The Silver Economy in China: Consumption trends of China’s aging population| Daxue Consulting

What is the state of China’s silver economy?

Often referred to as the seniors’ Market, the Silver Economy in China covers all products and services intended for people aged 60 and older. As stated in its name, the Silver Economy is not only a ”market” but also functions as an “economy”.

Senior citizens in China usually have stable lives and incomes with around 90% owning endowment insurance and property. Thus, elderly in China have a less stressful daily life. However, they grew up during a time with less security, having to experience events like the Cultural Revolution, resulting in more frugal consumption habits.

In urban areas, many Chinese senior citizens have only one child. Unlike the urban areas, Chinese senior citizens in rural areas have children who often move to cities for work. Seniors are emotionally dependent on their children, but the younger generation has less time to spend with their aging parents, so they are often lonely. Therefore, they have a strong demand for social entertainment and accompanying services.

The Silver economy in China is rapidly growing. With this growth, the Chinese senior citizens’ consumption is diversifying, while opinions from family can easily influence their consumption behaviors. International brands also benefit from the aging population, there is increasing awareness of health, fashion, and beauty, and e-commerce platforms are paving the way to make imported goods easily accessible for China’s elderly and caretakers. There is also room to develop in many segments.

China’s elderly population growth

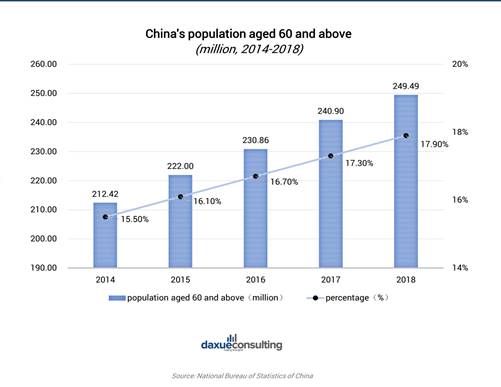

China’s elderly population is increasing. By the end of 2018, China had nearly 250 million people aged 60 and above, accounting for 17.9% of the total population. Every year, 8-10 million Chinese people turn 60 years old. By the end of 2025, there will be around 300 million Chinese senior citizens, accounting for one-fifth of the total population.

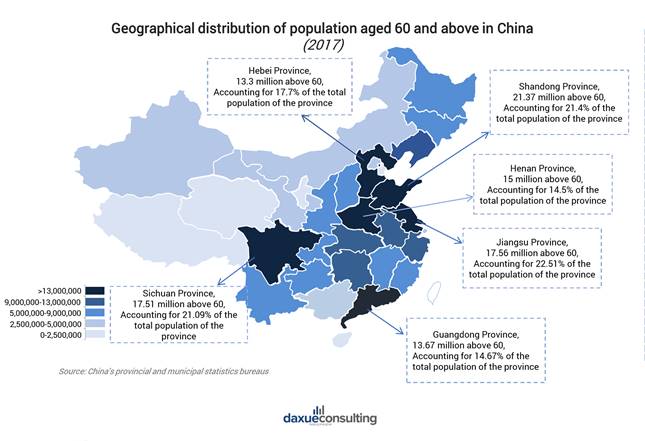

The senior population is mainly concentrated in the eastern and southern parts of China. These provinces usually have more developed economies and larger populations. This indicates that local economic development affects the aging degree of the region. In 2017, Shandong province had the largest senior population in China, mainly due to its high level of economic development and large population (the region ranked third in GDP and second in population in 2017).

Income level of China’s seniors

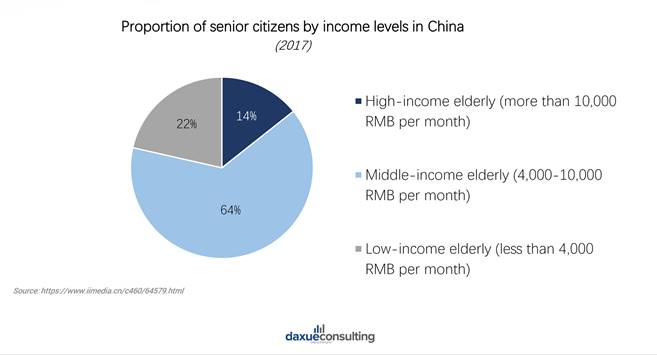

In 2017, there were more than 110 million senior citizens with a monthly household income of more than 4000 RMB, of who 20 million had a monthly income of more than 10000 RMB. Individuals with middle and high-income levels accounts for 78% of the senior population. In contrast to younger people, they have less busy lives, meaning they can spend more time and money on higher-level and hedonistic consumption such as leisure activities, tourism, and artwork.

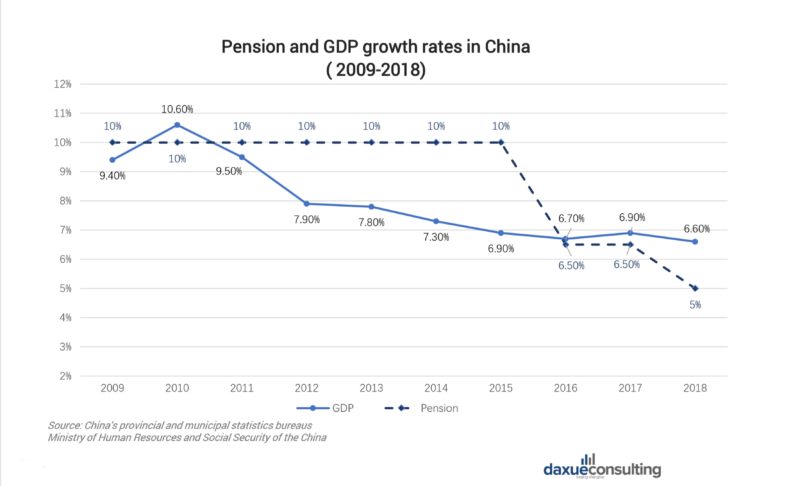

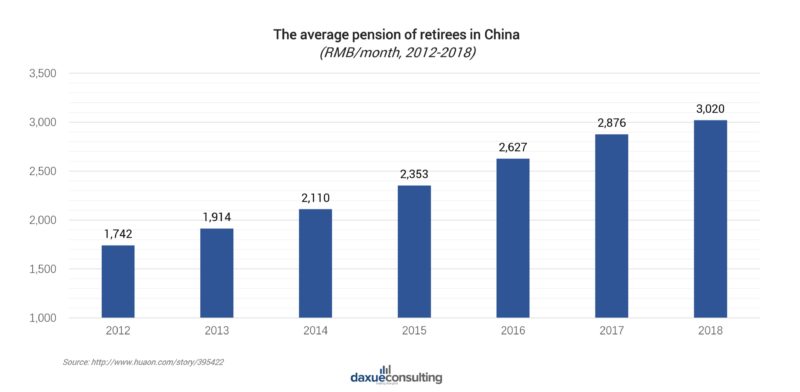

Over the last decade, the average growth rate of pensions for Chinese senior citizens exceeded the GDP growth rate, while pensions for the elderly maintained rapid growth. From 2009 to 2018, there has been immense growth in the income of China’s elderly, especially those who used to work in remote areas. Based on government policy, their pensions usually grow faster than average. With China’s pension system, senior citizens who paid accumulatively social endowment insurance for at least 15 years can get a pension every month in China after retirement. The amount of pensions that the elderly can receive monthly depends on qualifying years of personal social insurance contribution, social insurance contribution base, and social average wage.

From 2012 to 2018, the monthly pension of retirees over the age of 60 nearly doubled, and the disposable income of the Chinese aging population increased. The average monthly pensions in China for retired workers exceeded 3000RMB in 2018. Retirees in China’s eastern coastal provinces have a high pension income. These provinces tend to have a higher level of economic development due to the early reform and opening, as well as the advantageous regional geographical location. These regions have many more senior citizens than other provinces. Western provinces where ethnic minorities live in compact communities also have relatively high pension levels. Tibet has the highest pension in the country. State subsidiaries and fewer retirees are the main reasons for higher pension levels.

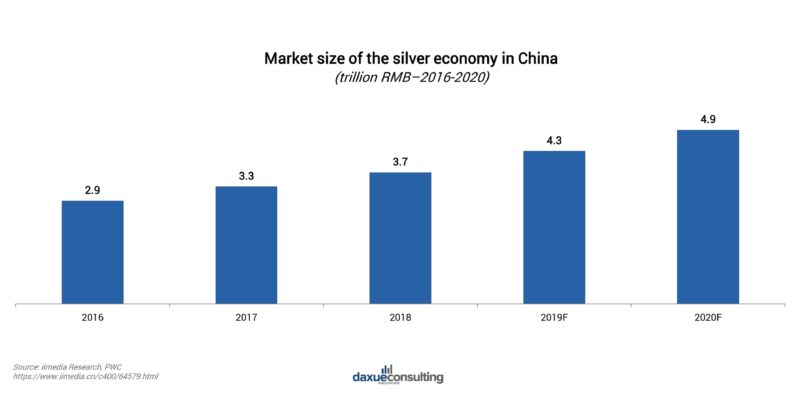

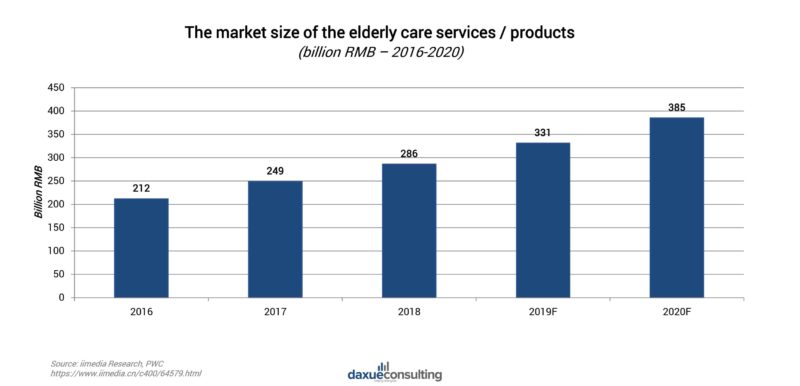

Behind the silver economy in China’s market growth

The market size of the Silver economy in China has been rising for several years. Along with the development of the elder service industry, it will sustain rapid growth for a few years.

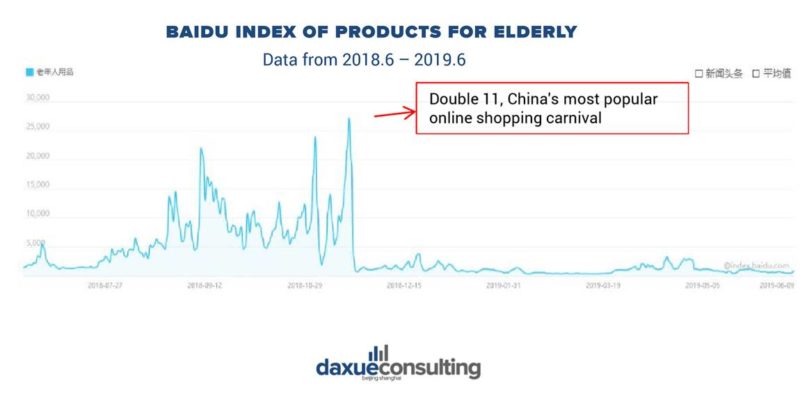

According to Baidu Index, the four major trends related to the silver economy: products for elderly, pension services, nursing homes, and elderly insurance.

Products for the elderly

The number of searches of products for the elderly remained high from May to November, with the biggest consumption day being Double 11, China’s most popular online shopping carnival, in 2018. When people search for products for the elderly on Baidu, they usually browse different types of products and e-commerce sites for senior citizens.

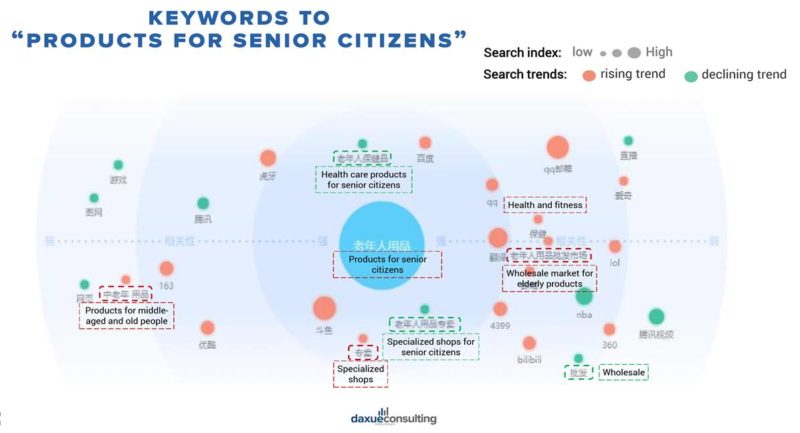

The most related keywords to “products for senior citizens” are “health care products for the elderly,” “specialized shops for senior citizens” and “health and fitness”.

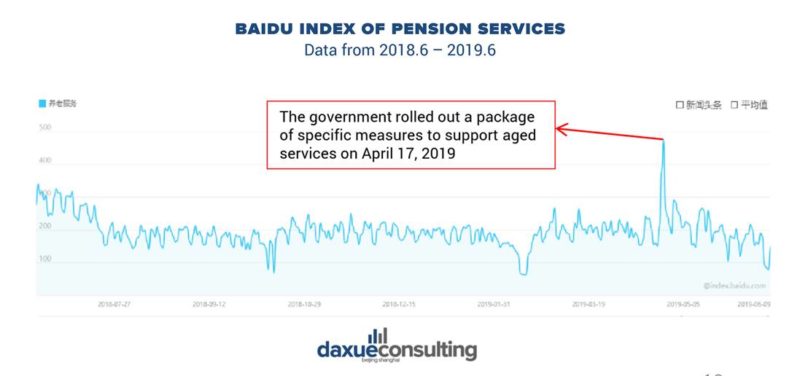

Pension services

The number of searches of pension services peaked on April 17, 2019, when the government released news about pushing forward the construction of pension service infrastructure. When people search for China’s pension services on Baidu, they usually browse the latest pension policies and websites providing pension services.

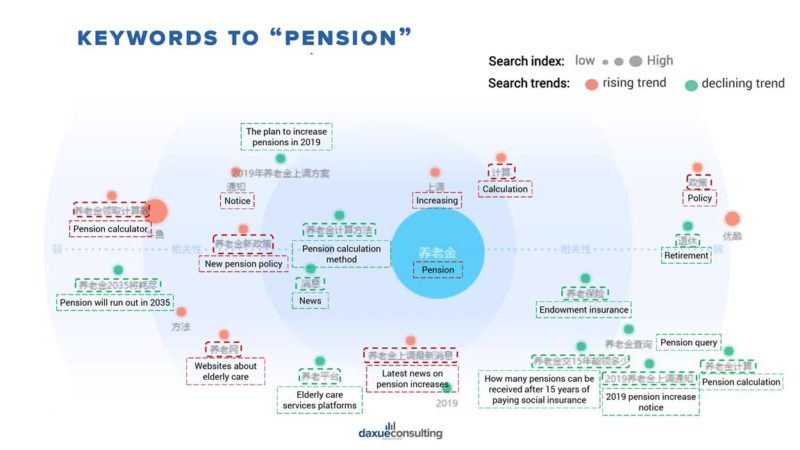

The most related keywords to “pension” are “increasing”, “pension calculation method”, and “latest news on pension increases”.

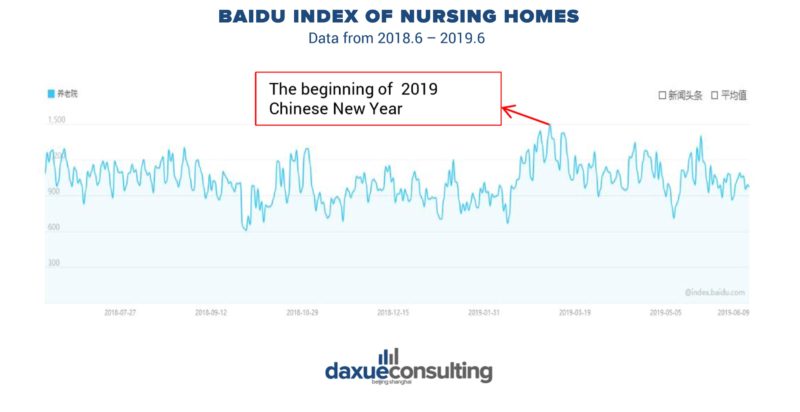

Nursing homes

The number of searches for nursing homes fluctuated around the average index, and the search number reached the highest point at the beginning of the Chinese New Year. Baidu searches with the keyword ‘nursing homes’ are usually related to the prices for nursing homes and how to run a nursing home.

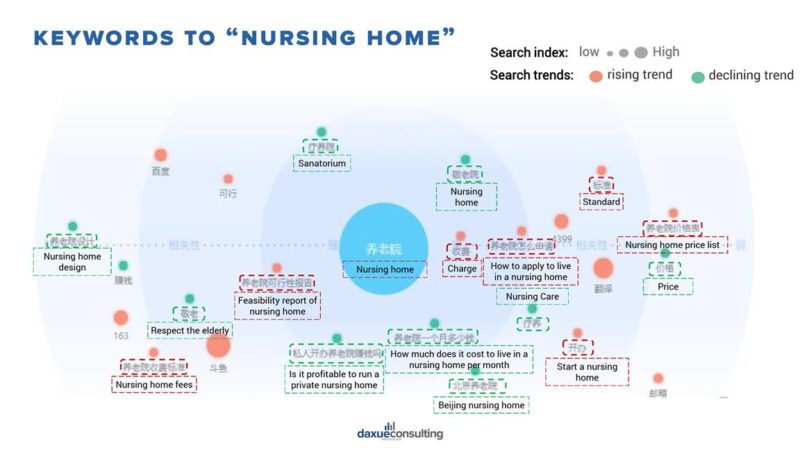

Related searches to “nursing homes” are “price,” “is it profitable to run a private nursing home,” and “how much is the nursing home per month.”

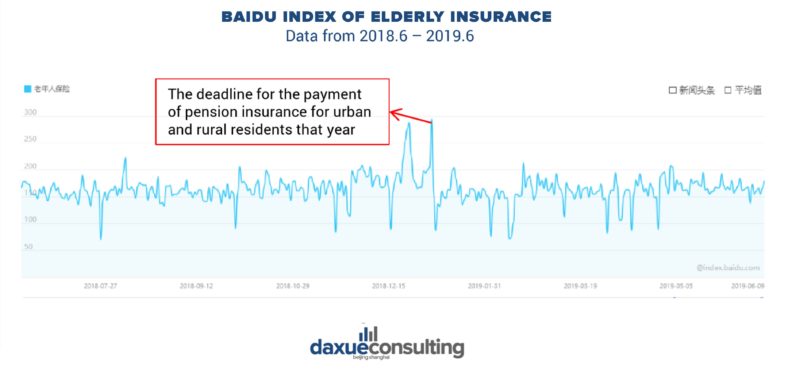

Elderly insurance

The number of searches of elderly insurance fluctuated greatly, reaching its peak in December of 2018 because December is the deadline for payment of pension insurance for urban and rural residents. When people search elderly insurance on Baidu, they usually browse insurance products and websites of insurance companies.

Senior citizens’ consumption

The consumption concept of China’s senior citizens is defined by the importance of health, family members’ opinions, practicality and frugality, and preference of in-store experience

Importance of health

For senior citizens, health is the major criteria of purchasing decisions, especially for daily-use products.

Accepting family members’ opinions

Senior citizens’ purchase decisions are easily influenced by the opinions of their family, especially by sons and daughters.

Practical and frugal

Senior citizens care about products’ practicality and price since they are more frugal than younger generations.

Preference of in-store experience

Many prefer offline shops because they can see and try the products/services.

Chinese senior citizens’ consumption can be segmented in many ways: by tier cities, income levels, and gender.

Different tier-cities

Senior citizens living in tier-1 cities showed a strong willingness to spend money on social lives and leisure. In contrast, senior citizens in tier-2 and tier-3 cities are more interested in goods related to health.

Different income levels

High-income senior citizens consume more healthcare and entertainment products/services. Low-income senior citizens’ daily expenses focus on daily-use and medical products.

Gender

Senior women spend more money than men do. Chinese women have a stronger demand of consumption entertainment, fashion, and beauty. Additionally, their spending on daily-use goods is also higher than men’s.

Products and services in the silver economy

The Silver economy in China generally covers daily use products, healthcare products, fashion, housekeeping services, nursing care services, exercise, etc. consumed by the Chinese aging population, particularly those aged 60 or older.

Shift in consumption

With a rising disposable income, China’s elderly’s consumption is shifting from traditional frugality to enjoyment. They are willing to spend money in four areas, leisure and exercise, fashion and beauty, healthcare products, care services/goods.

The silver economy’s consumer preferences

The Chinese aging populations’ preferences differ depending on the cities in which they live. In many major cities, there are specific goods and services that are their favorites. For example, Shanghai’s aging population likes buying clothes. Beijing’s aging population likes buying cosmetics. Shenzhen’s aging population likes buying cameras. Hangzhou’s aging population likes medical cosmetology. Chengdu’s aging population likes buying sports equipment. Suzhou’s aging population likes buying digital products. These favorite goods show that China’s elderly consumption habit has shifted to spending more on things for enjoyment.

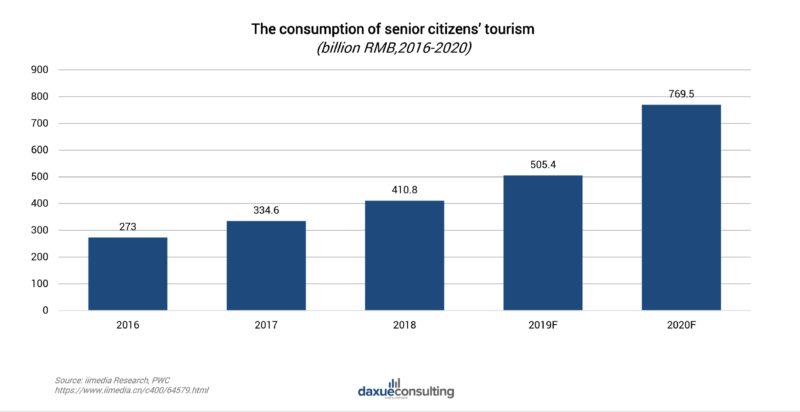

Tourism

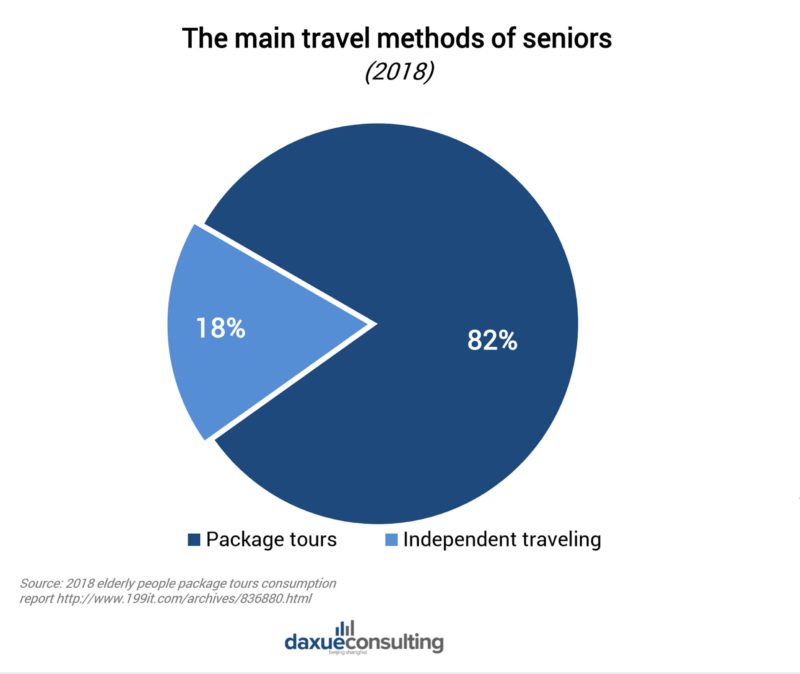

Leisure and exercise is one of the four areas where the aging population is willing to spend money. In this area, tourism is one of the most popular leisure activities. Seniors make up more than 20% of China’s tourists every year. In the next few years, senior citizens in China’s consumption on travel will keep rising along with the consumption upgrade.

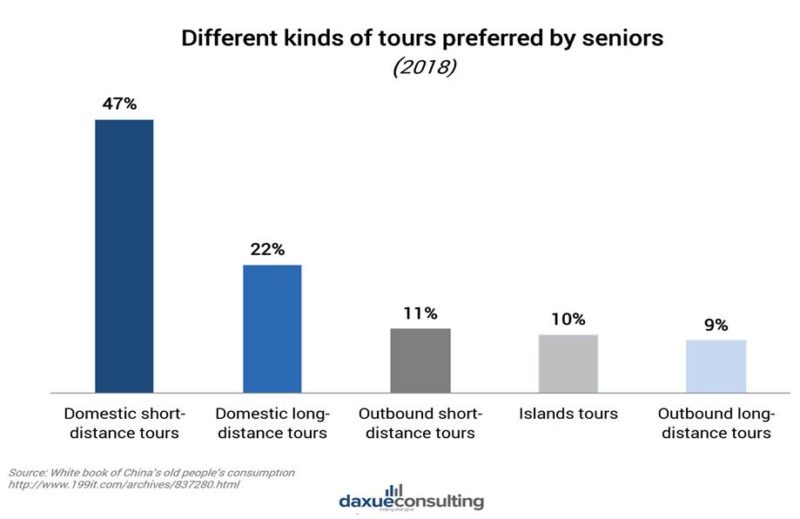

Most seniors like vacation packages and short-distance tours. The most popular destinations are Beijing, Guilin, Xiamen, Guiyang, and Urumqi. The most popular overseas destinations are Thailand, Japan, and Malaysia. When traveling, senior citizens demand beautiful landscapes, high-quality local goods, and safety.

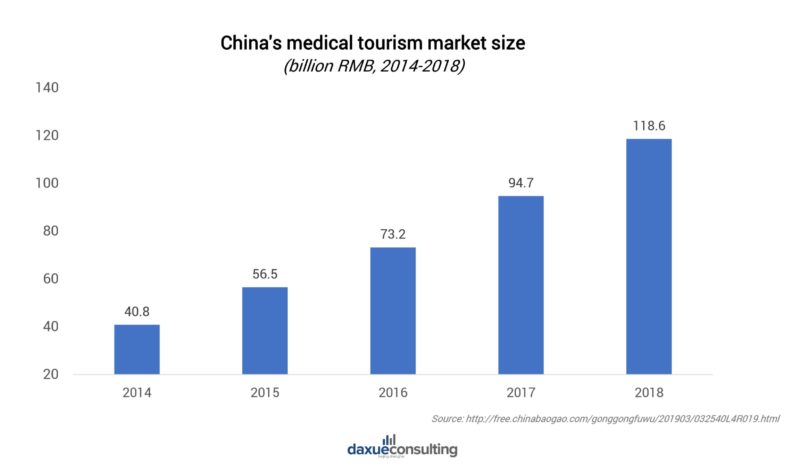

Medical Tourism

China’s growing elderly population provides huge potential for the developing medical tourism market. From 2014 to 2018, there was a rapid increase in China’s outbound medical tourism. The market size reached 118.6 billion RMB in 2018, with more than 30.5% GAGR. Participating in China’s medical tourism market are three main types of companies, which include online medical companies, overseas medical institutions, and online travel agencies. There is a complementary relationship among the three types of participants of China’s medical tourism, and they work together to provide services for medical tourism.

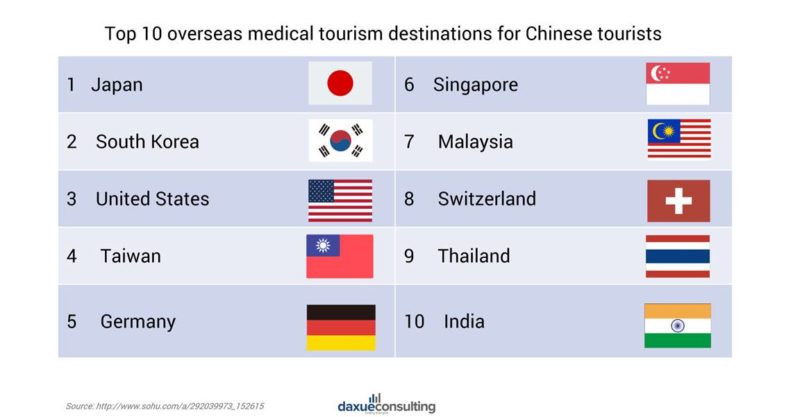

East and South Asia are the top destinations for Chinese medical tourism. The United States and Western Europe are popular destinations as well. Distance and medical technology become important factors for Chinese medical tourists to choose destinations. The top 10 overseas medical tourism destinations for Chinese tourists rank as follows:

Exercise

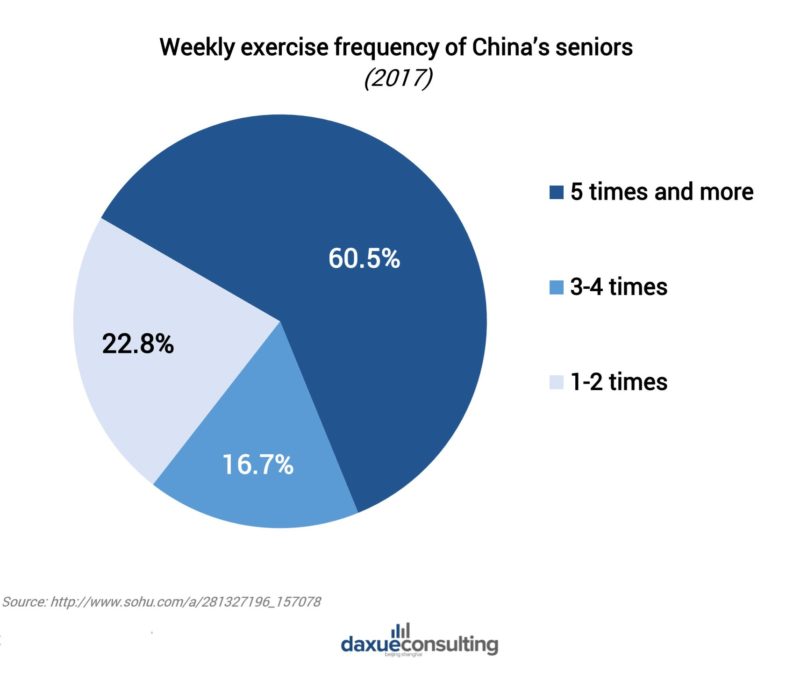

The main forms of exercise for China’s elderly people are walking and jogging, Tai Chi, and dance. Among them, square dancing is the most popular activity for the elderly. Walking and jogging are both common exercises among seniors for its low intensity. Tai Chi is a traditional Chinese martial art and generally needs professional training. Dancing in public squares and parks is very popular among China’s seniors. More than half of the aging population exercises at least five times per week, usually in the morning and at night.

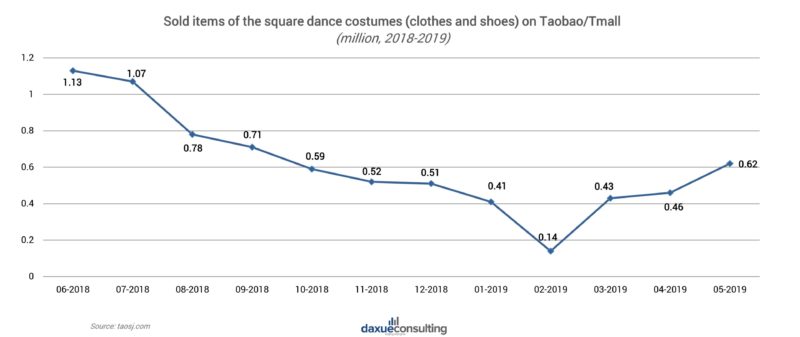

As the most popular physical activity for the Chinese elderly (especially women), dancing already showed a large market potential in recent years, In the evenings and mornings, seniors gather in parks and public squares to dance. In 2017, there were 100 million participants in China. On average, they spent 300-500 RMB per month on dance clothes and shoes. On Taobao/Tmall, the highest sales of dance apparel were in June and July. After that, the sales continually declined before March 2019. This means that summer is the most popular time for dancing.

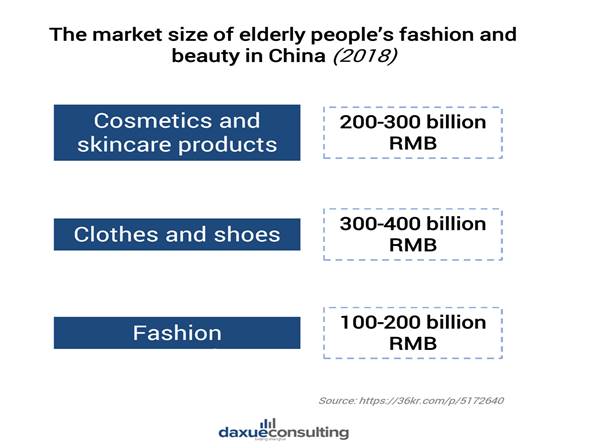

Fashion and beauty

On Taobao/Tmall, around 60% of Chinese senior women buy cosmetics six times per year. In 2018, the average Chinese senior spent 1500RMB on new clothes. China senior citizens’ spending on medical cosmetics increased 4.4 times from 2017 to 2018.

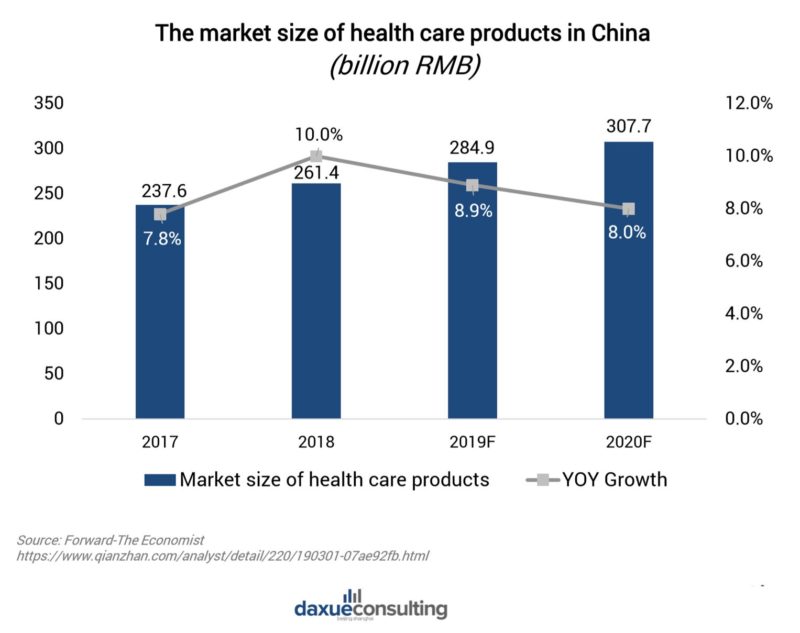

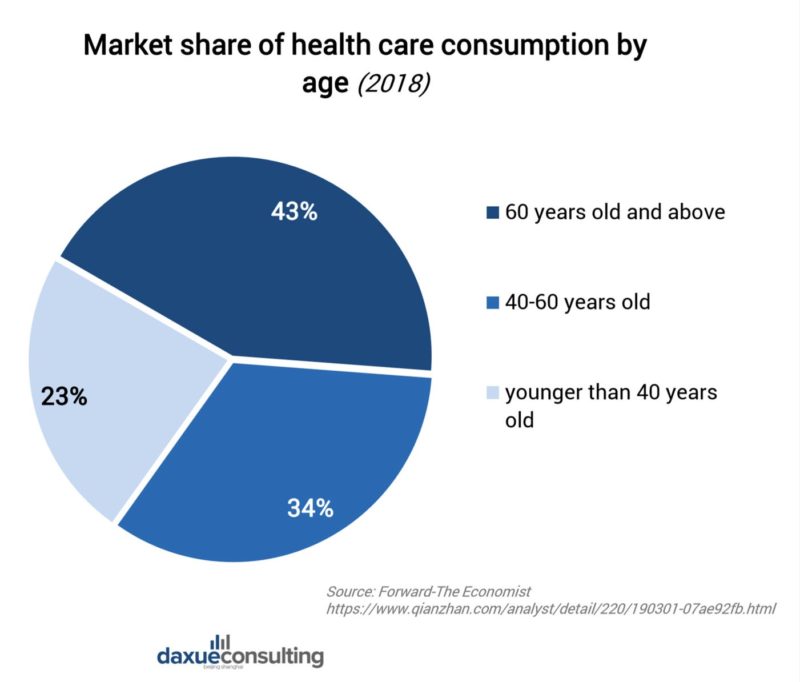

Healthcare products

The healthcare products market in China is steadily growing, almost half of the market share comes from seniors. This means that aging people are the most important consumers of China’s healthcare market.

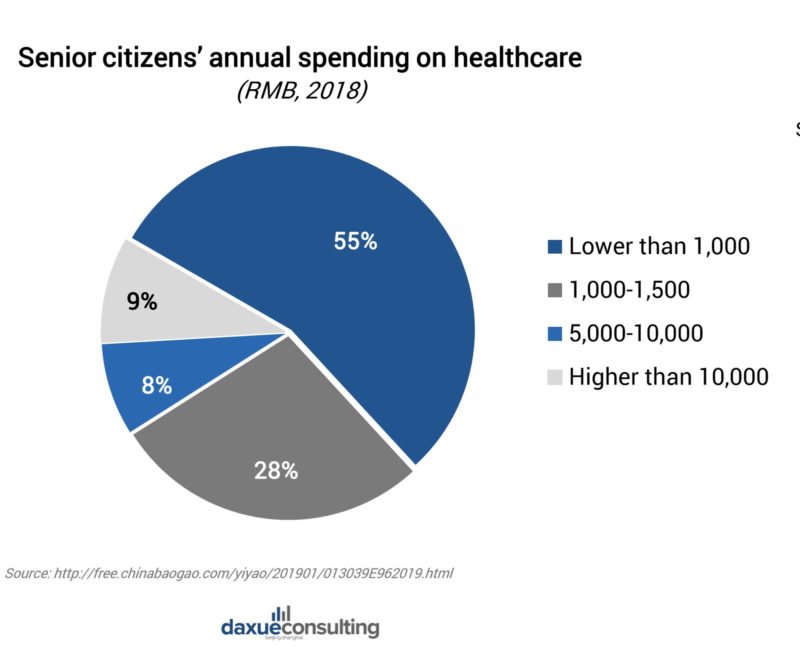

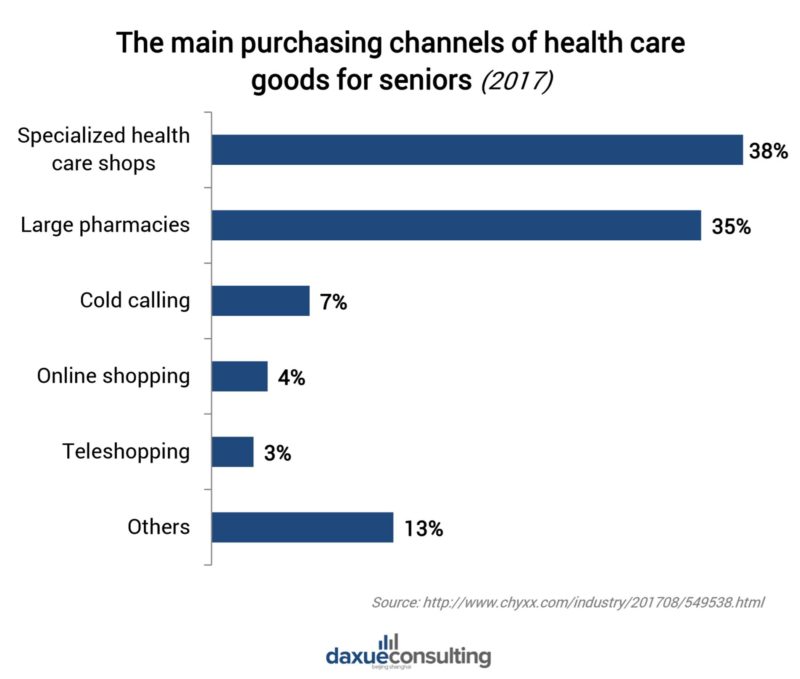

Despite more than half of seniors spending less than

1000RMB on healthcare goods in 2018, almost 20% of them were willing to pay more than 5000RMB a year on healthcare products. Offline shops are still the main purchasing channels for elderly people, as many of them have a lack of trust in the healthcare products from the internet.

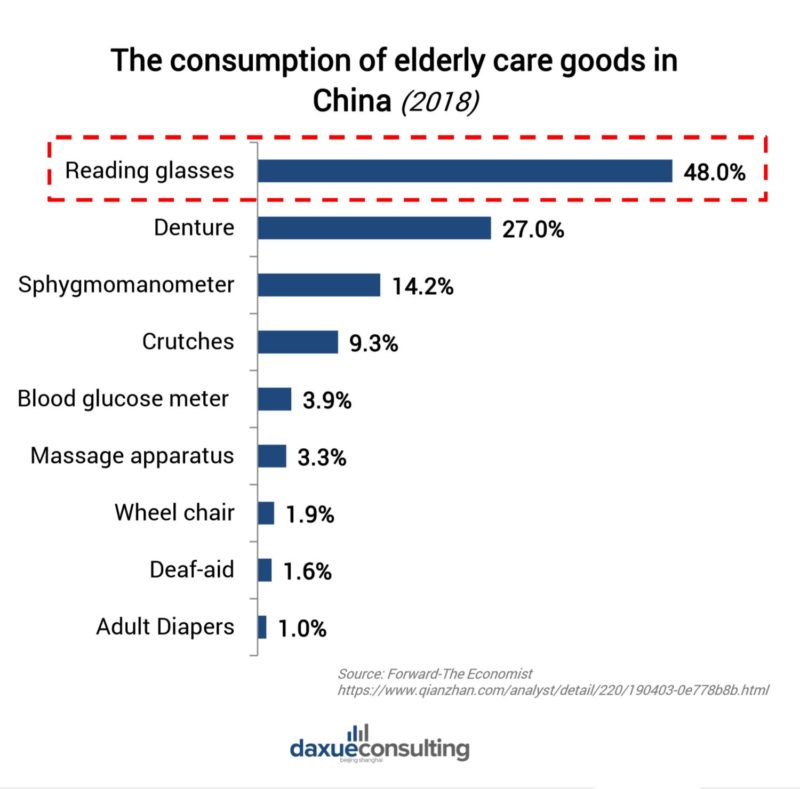

Consumption of elderly care products

Reading glasses are the most popular goods since they are essential in senior citizens’ daily lives. However, many of them are cheap and lack high-quality brands. The average price of reading glasses is less than 20 RMB.

Online shopping

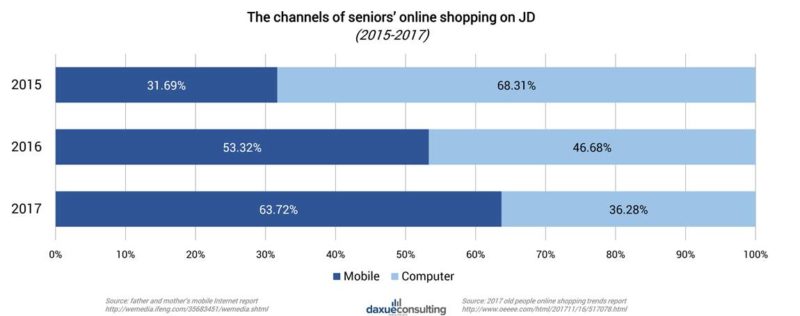

China has had more than 30 million middle-aged and elderly individuals (above 50 years old) who shop online. Senior citizens show a huge market potential as online consumers. More and more senior citizens in China are starting to use mobile apps for their online shopping.

By June 2018, China had more than 50 million internet users over the age of 60, which mean one of five senior citizens are netizens. In 2018, the registered users on Tmall.com among senior citizens exceeded 7.5 million. On JD.com, the main products purchased by senior citizens were fashion products, healthcare goods, home appliances, cosmetics and personal care, and food.

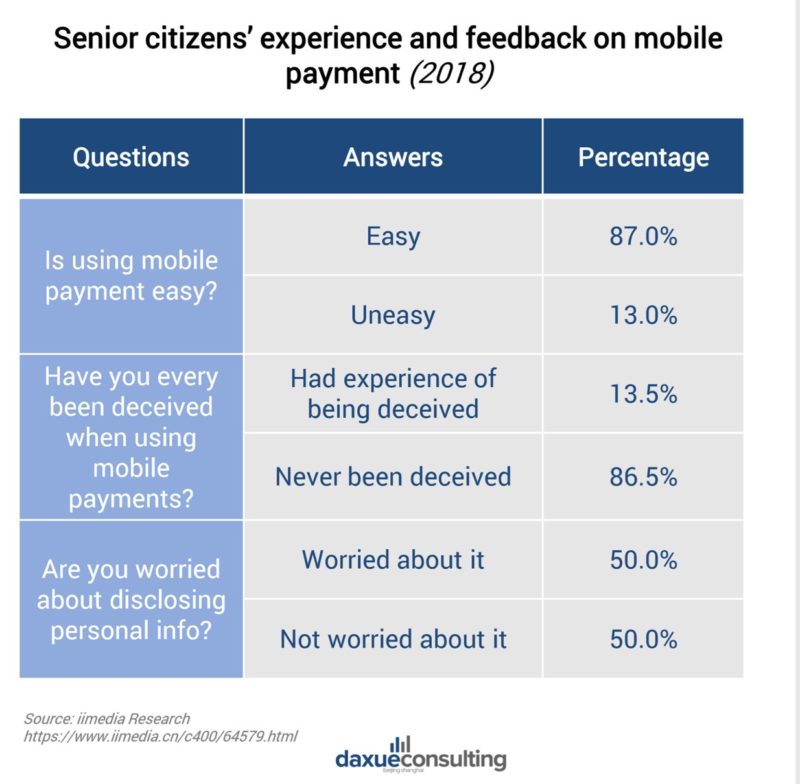

Most aging individuals are willing to use mobile payment methods with personal information disclosure being the main issue for them. Compared to 2017, the number of senior citizens who used mobile payment doubled in 2018. Senior citizens who used face scan and fingerprints payment increased 20% and senior citizens who used QR code payment increased 2.5 fold in 2018.

Elderly care service market in China

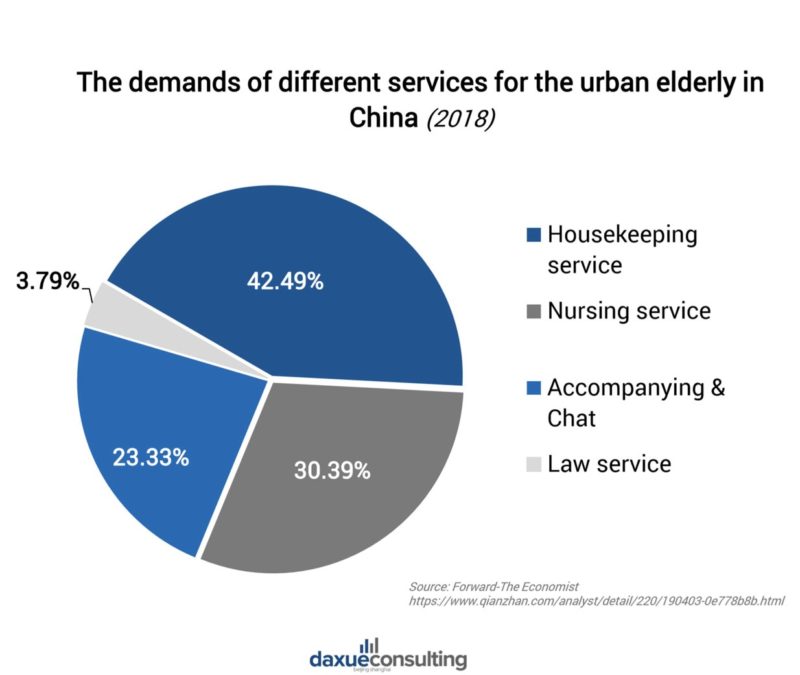

The market size of elderly care service is booming due to the dramatically aging population in China. In 2018, more than 20 million senior citizens lived alone, some of them were disabled. Many of them are in need of professional care. The most important services for the urban elderly are housekeeping and nursing care. The market of housekeeping services for senior citizens has been rising for several years, since the increase in the number of empty nesters in China.

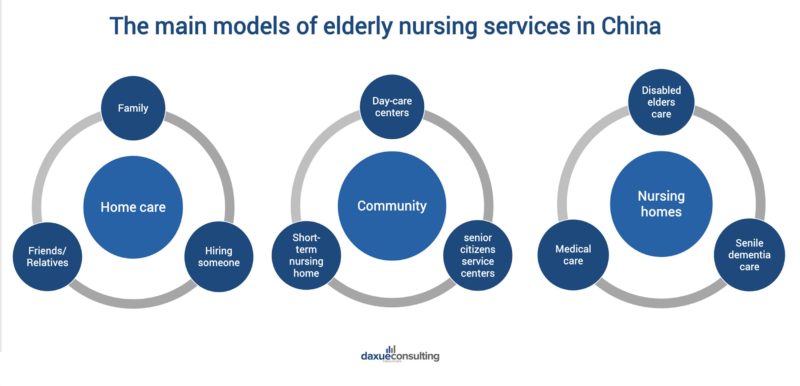

In China, there are three different methods of elderly care services, in-home care, community care, and nursing homes. Nursing homes are becoming more important since it offers knowledgeable and professional nurses and medical care.

Chinese consumer perceptions of nursing homes

When it comes to nursing homes, consumers’ most common questions and posts on Zhihu include:

- Why are Chinese people unwilling to send their parents to a nursing home?

- Is there and premium nursing homes that offer high-quality services?

- What the elderly should know when choosing a nursing home?

On WeChat and Weibo, consumers display positive perceptions:

- Availability of professional medical services in the nursing home.

- The nursing home has companionship and nursing care for the elderly.

- Nursing homes usually have a clean and healthy environment.

Chinese consumer concerns about nursing homes include:

- Some violent incidents in nursing homes reduced people’s trust.

- The lifeless ambiance in some nursing homes.

- Some staff lack professional training about taking care of senior citizens.

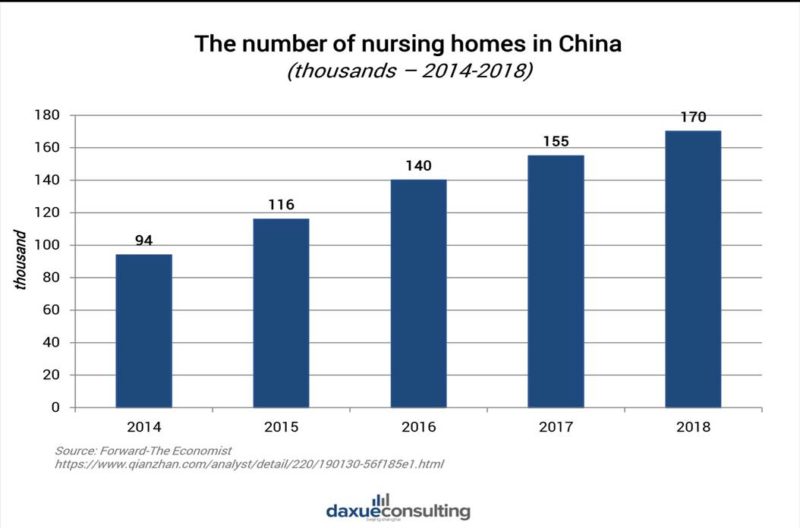

The nursing home market is growing very fast in China with the increasing demand for eldercare. The Chinese government is leading to the development of nursing homes. However, the government encourages more private enterprises and investors to enter the market.

China has a huge demand for nursing homes, yet the demand exceeds the supply. In 2018, the aging population exceeded 249 million in China. Many of whom need nursing services. Among those senior citizens, about 10% of them are willing to live in the nursing home, increasing the demand to about 25 million. However, the total number of nursing homes’ beds cannot meet the demand. There is more than a 9 million supply gap.

Drivers for the nursing home market in China include safety and service guarantee and the lack of ability and time to care for elderly parents. It is affirming for family members to know that nursing home has a safety system, which includes the facilities and staff. In addition, the nursing home can offer professional care that a family cannot. Younger generations are moving away from their hometowns for opportunities, therefore they have less time to take care of their elderly parents. Thus, the nursing home is a good option.

Obstacles to China’s nursing home market include traditional culture and negative perceptions. The nursing home goes against Chinese tradition. It is difficult for both the elderly and family members to accept the elderly living in the nursing home, as their children believe it is their responsibility to take care of their parents. Some family members generally have negative perceptions of nursing homes, such as the smell of medicine, no privacy, etc. therefore, they prefer their elderly family members to stay at home.

Market trend analysis

The silver economy in China follows the national consumption upgrade trend with diversifying channels of consumption, and rapid development in elderly nursing and healthcare. Except for cheap daily-use products, middle and high-income Chinese senior citizens consume more on leisure, fashion, and beauty, such as tourism and cosmetics. Senior citizens are slowly embracing mobile payment and are using online shopping apps. Due to the Chinese aging population, there are many market opportunities in nursing home and healthcare industries. Nursing homes are increasingly accepted by Chinese families.

Author: Shayaiah Mitchell

Make the new economic China Paradigm positive leverage for your business

Listen to China Paradigm in iTunes

![[Podcast] China Paradigm 38: How to start a dream driven elderly care business in China](../wp-content/uploads/2019/05/China-podcast-Elderly-care-business-China-150x150.jpg)