Embracing China’s silver generation: how brands market to seniors in China | daxue consulting

China’s silver generation

China’s silver economy is full of potential for brands who know how to market to seniors in China

What does China’s aging population mean for brands

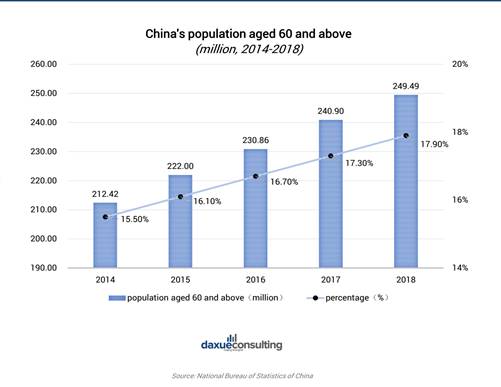

Often referred to as the seniors’ market, the Silver Economy in China covers all products and services intended for people aged 60 and older. China has gradually transferred into an aging society as the byproduct of the one-child policy. The graph below shows the rapid growth of the senior population in China. With elderly taking up a larger portion of the population, the question for brands is how to market to elderly in China.

By the end of 2018, China had nearly 250 million people aged 60 and above, accounting for 17.9% of the total population. Every year, 8-10 million Chinese people turn 60 years old. By the end of 2025, there will be around 300 million Chinese senior citizens, accounting for one-fifth of the total population.

By 2035, China is one track to become a hyper aged city as predicted. Contrary to the popular belief, the silver generation in China is an underrated group of consumers. They are eager to spend money in different areas, from elderly care service to luxury tour packages. 40 percent of Chinese retirees have the ability to go on luxury holidays. Additionally, in 2013, among 2.5 million people whose income is more than 130,000 yuan, 51 percent of that group were 40 to 49 and 21 percent were older than 50 years old. That being said, businesses in China should not ignore the emerging silver market as the silver generation market in China is larger than expected.

With a retirement age of 60 for men and 55 for women, Chinese pensioners are among the youngest in the world. For mass-market companies in industries such as leisure, health, banking and insurance, this population of people, aged 60 or more, is a very attractive target. Not only are they younger than previous generations, but they enjoy more free time than the active population. They are also experiencing a growth in purchase power and account for around 10 million more people every year. In 2050, seniors are estimated to be around 500 million in China, up from the current 220 million today. Thus marketers are working on adapting their products towards this new and high potential market. However, targeting Chinese seniors is not as easy as it seems.

Great opportunities ahead on the senior market

First of all, the purchasing power of Chinese seniors remains largely under-exploited by companies. According to Wang Jiyong, vice-chairman of the Chinese Senior Industry Association (CSIA), “the senior market is worth more than 170 billion renminbi (around 28 billion dollars in 2015), but the products that are addressing this market today are only worth 120 billion”, which represented, in 2015, an untapped opportunity of around 8 billion dollars.

Some studies, such as one by the National Committee on Aging, estimate the senior market at 594 billion euros, which represents 8% of China’s GDP. This estimation is far above the CSIA’s, but the findings remain the same: companies have still not been able to fully take advantage of China’s senior market.

The elderly feel neglected by advertisers

In 2013, the wide majority of the 3,600 Chinese people older than 60 who were asked to share their thoughts on this subject revealed that they felt ignored by marketers. Only 8% of the seniors thought that marketing and advertising were addressed to them in a relevant way, the Wall Street Journal reported.

Another study realised through qualitative interviews by the group HKTDC, proved even more so how the absence of marketing specifically targeting seniors generates a feeling of marginalisation. According to respondents, if there were products designed for seniors, especially in the apparel sector, those items would be highlighted, neither through advertising nor regarding distribution since they can only be found in second-tier malls.

What marketing strategy could be adopted?

However, the Chinese elderly don’t expect marketing that would directly target them, because it would be another form of marginalisation. Regarding the apparel industry, where the offer for seniors consists essentially of low-quality products, the elderly interviewed by HKTDC prefer to see middle-aged models in ads for quality products addressed to the mass market.

Volkswagen is one of the few Western brands that was able to efficiently target seniors with a commercial for its Beetle, showing elderlies imitating teenagers. Moreover, marketers should not hesitate to use the Internet and social networks to engage with the older generations, since these days, they are more and more connected.

Chinese senior citizens’ consumption habits

Chinese senior citizen’s consumption is distinctly different from the consumption of the younger generation. Most of the senior population in China hold the traditional opinion that it is important not to spend frivolously. They are more careful about their purchase decision. Thus, marketing to the seniors in China is different from marketing to the younger generation.

However, even though senior citizens care about products’ practicality and price since they are more frugal than the young generation, with a rising disposable income and improved economy, the spending pattern of the elderly generation changed from traditional frugality to enjoyment. China’s senior population are more likely to spend money on these four areas:

- Leisure and exercise

- Fashion and beauty

- Healthcare products

- Care services/goods

How tourism packages are tailored for seniors in China

“Mom and Dad Relaxation Tour”: huge demand, tailored design for elderly in China

The silver generation in China is one specific market in the tourism agency industry in China. China’s senior citizen travelers make up 46 percent of China’s outbound tourists. Compared to younger generation, they have plenty of free time as they are retired and have accumulated wealth to travel. “Senior travelers currently contribute around 20 percent of China’s total tourism market value,” says Zhang Qi, a manager at Ctrip, China’s biggest online travel agency.

Different from the young consumers, when the silver generation in China plans to travel, they have more concerns about travel details like travel insurance and less energy to research on their travel plans. As a result, in Ctrip’s report, 82 percent of the silver generation in China are willing to travel with a travel agency. Despite that, the silver generation in China usually have special needs when choosing a travel agency.

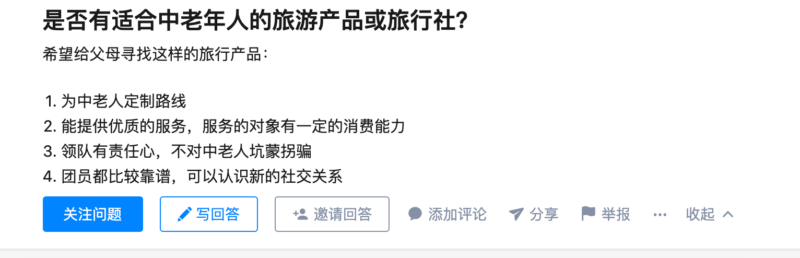

Screenshot of a zhihu question “Is there any suitable travel agency products for the senior citizens in China?” In the description, it mentions the author wants to find a travel product for his/her elderly parents: 1) Customized itinerary for senior citizens 2) Quality customer service 3) The tour guide needs to be responsible for the elderly people and not allow them to get scammed 4) Similar aged tour mates.

Facing the current market, the travel agency industry provides more tailored travel packages targeting senior citizens. In 2016, the Ministry of Tourism in China announced the related guidelines about the elderly and tourism agency. The guidelines aim to ensure the rights for the elderly people to travel and includes, for example, that transportation and sightseeing schedules should not be too heavy, out of health concerns for senior tourists. Therefore, big travel agencies like Ctrip offer tours like “Mom and Dad Relaxation Tours” to market to senior citizens in China.

Marketing to seniors in China: not for Weibo and Little Red book

Finding the appropriate marketing strategies for marketing to seniors in China is complex. Compared to the younger generation, the silver generation in China prefers to use offline travel agents as their choice because the senior citizens are relatively less active in social media. While the younger generation tends to do their research about tour agencies on social media or websites, the silver generation tends to trust brands they are familiar with. In this case, marketing to seniors in China needs offline stores and physical advertisements, including flyers, brochures, etc. For example, Spring Tour travel agency which has been operating in Shanghai for 30 years has 50 branches across Shanghai, and has succeeded at marketing to China’s ageing population.

While the senior citizens have less internet literacy, with the development of technology the senior generation in China has been more active on the internet. According to a Ctrip report, 51 percent of the silver generation in China use APPs to order travel agency tour online in 2018, an increase of 16 percent from 2016. Thus, different travel agencies should also not ignore online marketing channel.

Optimizing senior citizens’ online shopping experience in China

The silver generation in China enjoys online shopping. It has become the new favorite past time of China’s old generation when 92 percent of them prefer to shop online, as research indicates. Apparently, Taobao, the Alibaba-backed online retailer. has realized the large potential of the senior citizen market in online shopping. In year 2017, Taobao has 6 million users aged 60 to 69, spending possibly at around $200 billion a year.

However, the senior generation in China experience some difficulties in online shopping. For example, they still have concerns about E-payment security. Online payment has become a new trend in China, as in 2017, China saw $15 trillion in mobile payments. Secondly, the seniors in China are behind in the cashless society. The reasons behind that are plenty, including the seniors’ poor eye sights to see every detail on the screen and poor memories to remember how to use payment app, and simply not being native users of technology.

Taobao applies a series of strategies for marketing to the seniors in China. In 2018, Taobao launched an elderly-friendly version of its App to market to Chinese senior consumers. Compared to the original APP, this version is designed to be easier for older shoppers to use by simplifying the online payment process with a function called “pay for me” for the elderly to send the payment link to their children.

Because the senior generation’s purchase decisions are usually influenced by the opinions of their family, the customized app also displays their children’s account on every page so users can easily share products or start a conversation online. It also has a larger, less crowded interface, and simpler platform layout. Alibaba recruited a pair of “Senior Experience Officers,” for providing user feedback of the “elderly-friendly version” app and exploring the possibilities for improvement in order to marketing to the seniors in China better.

Additionally, Taobao started a program called “Taobao College For Seniors” in Hangzhou, teaching the senior generation about shopping experience online.

Targeting Chinese seniors: Careful analysis of the market is crucial

In order to understand the specific needs of seniors in China, it is crucial to deeply study their consumption habits, recommended Kunal Sinha, principal at Ogilvy & Mather China, when interviewed by the Wall Street Journal. For instance, only 7% of the budget of urban people aged 55 to 65 is dedicated to garments, while most expenses are related to food.

Deeply analyzing this kind of data appears to have been one of the keys to success for brands that were able to thrive in the senior market. For instance, Pinetree Senior Care Services, a company providing home-based care for elderly people, spent three years observing consumption habits and expectations of Chinese seniors before understanding that they disliked the model of nursing homes. The study clearly benefited the company as it has grown by 55% (year-on-year) since 2012.

Thus, the Singaporean company was able to bypass one of the main obstacles that numerous local and international groups are confronted with regarding the nursing home market: the price of the service. For Joseph Christian, a member of the Harvard Kennedy School interviewed by CKGSB Knowledge, the current financial resources of a majority of retired Chinese people are still too low to pay the price wanted by nursing homes. If there were any advice to give to marketing teams that are interested in marketing to seniors in China, it is, to begin with, a careful analysis of elderly peoples’ main expenditures.

Designing your own strategy to market to seniors in China: Daxue consulting & the silver generation in China

Having previously done research and analysis for a variety of clients targeting the Chinese silver generation, daxue consulting is an expert in providing quality reports and data for those aiming to get into this unique market. Our previous works for clients included a thorough assessment and localization of nursing homes within China, as well as conducting a survey to gain information regarding the use of the internet for online purchases by Chinese seniors. Daxue is no stranger to China’s older population and with our ever-expanding research; Contact us today to learn about your company strategy in marketing to seniors in China.

Our report on Silver Economy in China:

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes

![[Podcast] China Paradigm 38: How to start a dream driven elderly care business in China](../wp-content/uploads/2019/05/China-podcast-Elderly-care-business-China-150x150.jpg)