The tea market in China: Analysis of the largest tea market in the world

There are 7 types of tea leaves in China: green tea, yellow tea, white tea, oolong tea, black tea, dark tea, and floral tea. Since 2014 the new style tea is becoming popular in China. The new style tea (新式茶饮) consists of fresh tea leaves and milk or cream. It also includes tea’s with toppings like jellies, tapioca pearls, and fruit. The tea market in China is the largest in the world, and it is not folding to competing products like coffee or soda, rather it is strengthening with premiumization.

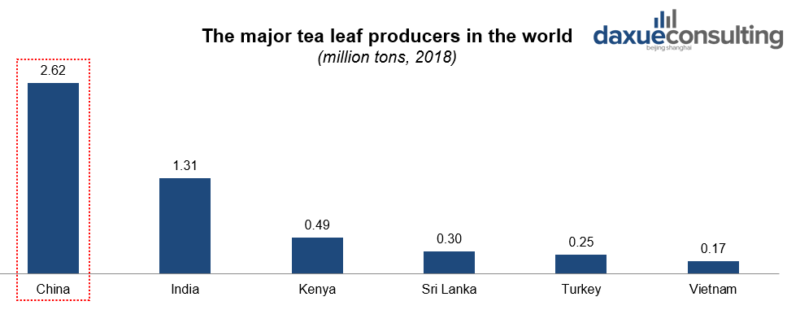

China is the largest tea producer in the world

The total global tea output in 2018 was 5.9 million tons, China contributed 2.6 million tons of them (44.7%). China is the largest tea producer in the world, but it still has a huge market demand for tea leaves. Hence, the output of major tea producing countries will continue to grow. In particular, the increased awareness of Chinese consumers on health will drive the global tea market to further increase.

Data Source: iimedia, Tea market in China report by daxue consulting. China is the major tea leaf producer in the world

The tea industry chain in China includes tea planting, picking, use of fertilizers, processing, and packaging. Also, different kinds of tea are rolled, dried, and oxidized. The sales channels are supermarkets, tea shops, restaurants, and e-commerce platforms in China.

China’s tea production market

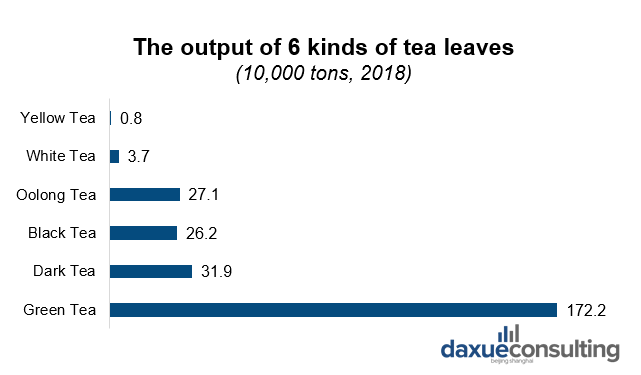

Green tea leaves make most of the China’s tea production. Considering China’s huge market demand, green tea will continue to maintain its output advantage for a considerable period. Besides, drinking tea is an important part of the Chinese culture and living customs.

Data Source: iimedia, Tea market in China report by daxue consulting. Green tea has the biggest output in the Chinese market

China’s tea sales will maintain an upward trend. With the increase of income of Chinese residents, quality will become an important factor in the sales of tea.

Data Source: Qianzhan, Tea market in China report by daxue consulting. The tea sales revenue in China

China’s demand for tea is rising steadily

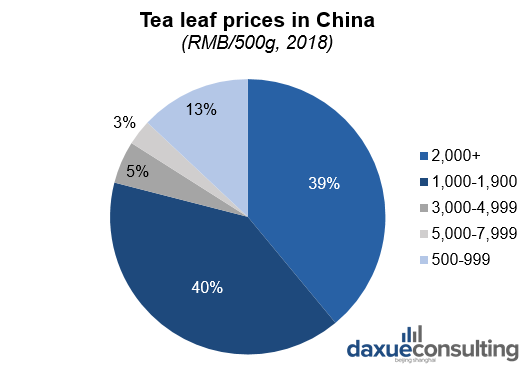

China’s 1.4 billion people already drink nearly 40 percent of the world’s tea, and they are thirsty for more. Chinese consumers prefer higher quality tea products, they often rely certification for assurance the tea is organic and sustainably grown. Besides, they agree to pay much more per serving than Western tea consumers. The best tea in China can be up to US$1,000 for 500 grams.

Data Source: Chyxx, Tea market in China report by daxue consulting. Tea leaf prices in China

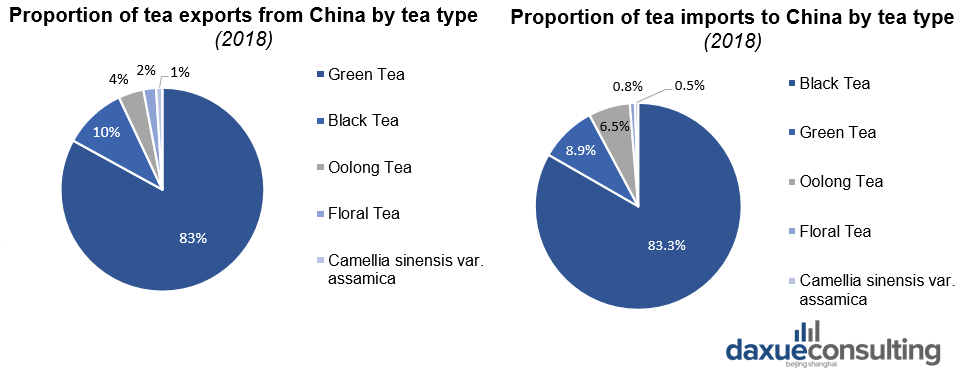

China exports green tea and imports black tea

Green tea accounts for 83% of the total tea exports. Exports of black tea, green tea, and flower tea all increased by more than 6%. Black tea accounts for 83.3% of tea imports. The rise of new tea drinks such as milk tea in China has further increased the demand for black tea.

Data Source: Chyxx, Proportion of tea exports/imports by tea type

Key characteristics of tea consumers

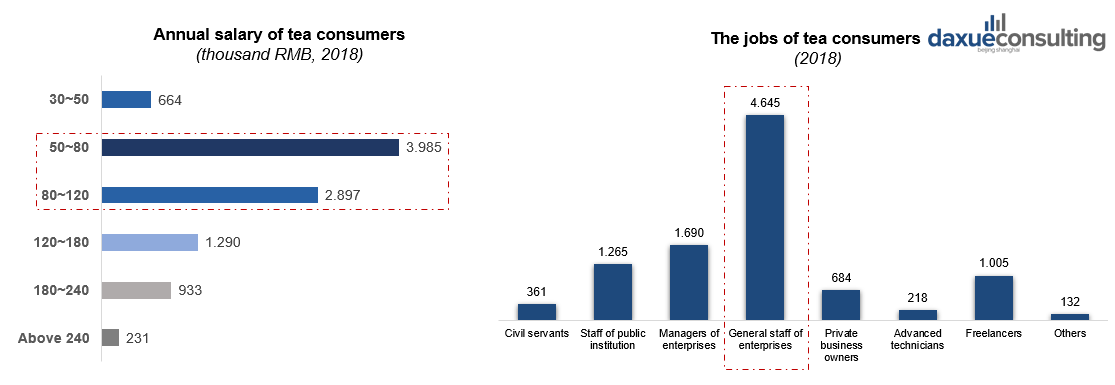

According to the survey of China Tea Industry Research, tea consumers are mainly enterprise employees with 50,000-120,000 RMB annual salary. They usually have decent spending power and pursue a high-quality life. Hence, office places are a common place to consume tea.

Data Source: China Tea Industry Economic Research, Tea market in China report by daxue consulting. Characteristics of tea consumers in China

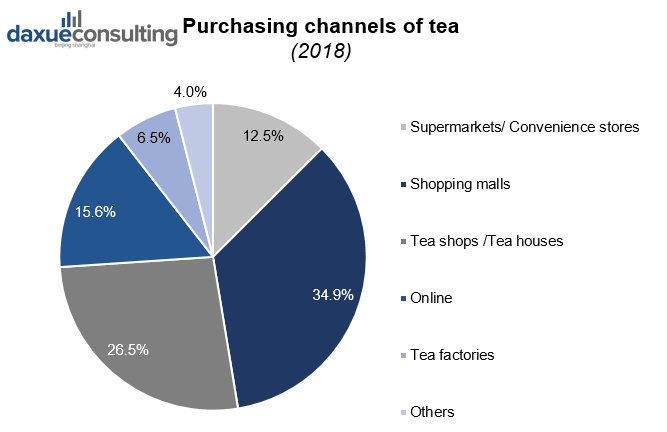

Where do Chinese consumers buy tea

Chinese consumers still mainly rely on offline channels such as exclusive stores or large supermarkets in China. Tea enterprises should broaden their channels and combine online & offline to find new ways to attract customers. Quality assurance, convenient purchase, good experience and low price are the focus of consumers attention. Tea companies must consider them when doing channel construction.

Data Source: China Tea Industry Economic Research, Tea market in China report by daxue consulting. Purchasing channels of tea

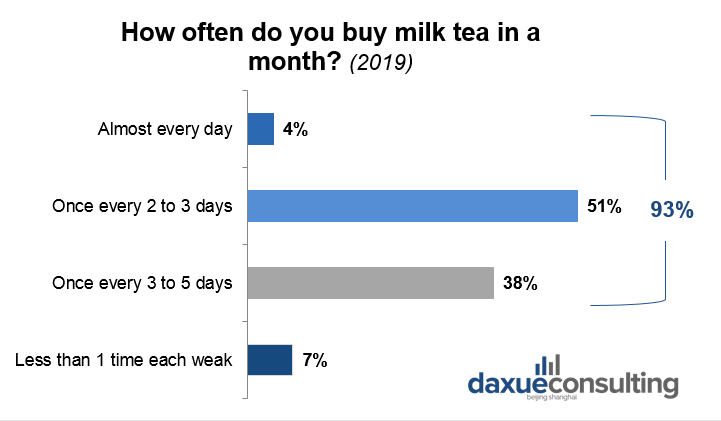

Drinking milk tea is a daily habit for many Chinese people, and a huge driver of the market

According to the survey of 36Kr Research, milk tea is becoming a part of daily lives for many Chinese people. Around 93% consumers buy milk tea at least once every week. Milk tea consumers are usually repeat customers. That is why it is essential for milk tea brands to improve customers loyalty leading to repeat business.

Data Source: 36Kr research, Tea market in China report by daxue consulting. Milk tea consumption in China

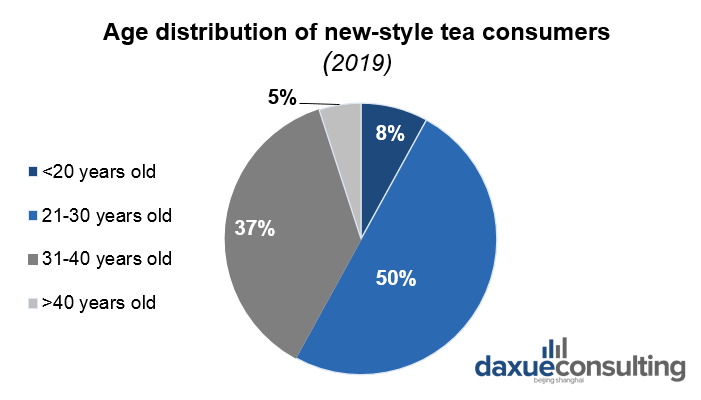

New-style tea consumers are mostly young women in tier-1 cities

Women under 40 years old are the main consumer group. Urban white-collar women in China are particularly keen to milk tea and fruit tea. Only 30% of consumers are male. The male consumer market still has a large space to develop. More research on male flavor and aesthetic preferences of new-style tea may help to further penetrate the market. This is consistent with the fact that many stores are in first tier cities. Tier-1 cities are saturated markets, but second and third tier cities have a lot of room to grow. However, lower tier city consumers are more concerned with price.

Data Source: 36Kr research, Tea market in China report by daxue consulting. Age distribution of new-style tea consumers

The leading brands in China’s new-style tea market

Most of the direct-sale shops are high-end brands. They are more concentrated in the first-tier cities with higher prices but less offline stores. It means franchises are helpful for expansion but not for a high-end image. There is little variation in store menus, which means there is a trend of product homogeneity in the market.

Case studies of tea brands in China: path to success

Lipton (立顿) – The most successful tea bag brand

Lipton is the largest foreign tea brand in China. It is a black tea brand from England. It mainly focuses on black tea, green tea, jasmine tea, and oolong tea. Its advertising slogan is: “Direct from tea garden to the tea pot”. In 1992, Lipton officially entered China and started to sell black tea and green tea.

Due to the high quality and clear target market, Lipton in China achieved very large sales and market share. Lipton’s owner Unilever invested 50 million USD in Anhui (安徽) province to build one of the biggest tea factories in the world at that time. In 2008, the total annual output value of Lipton was about 23 billion RMB, which was almost the 2/3 of the output value of the China’s tea bag industry.

How Lipton built itself as a mainstream tea brand

Lipton brought its standardized design and production of tea products when the brand entered China. They helped Lipton reach every corner of the market while also building brand awareness among Chinese consumers. Many foreign tea brands sell tea products from abroad using Chinese distributors. However, Lipton invested in building a local factory and hiring local employees. With this strategy, Lipton greatly reduced the costs and localized the brand. It helped the brand to act quickly to meet the needs of Chinese consumers. In 2008, Lipton was one of the first international brands advertising on mobile Internet in China. The brand was also one of the first to use e-commerce in China.

Lipton targets Chinese white-collar workers and young adults with its tea bags

Tea is traditionally a leisure product. Therefore, many Chinese brands target middle age and elderly people, who have more leisure time. Most Chinese tea brands sell loose leaf tea, which can make people enjoy the process of brewing tea. Lipton mainly targets on white-collar workers in China and young adults in urban areas. The brand uses its tea bag as a competitive difference in China’s tea market, because it is convenient and safer. It also greatly simplified the steps of drinking tea in China.

Lipton is facing great challenges in China

According to the annual report of Unilever in 2019, Lipton’s profits decreased. The brand is facing many challenges in China. Lipton’s tea usually is very cheap, which means it must keep high sales to get enough revenue. Besides, most Chinese young adults (21-30 years old) crave creativity and novelty. Lipton is losing this huge consumer group. Now, competition in China’s tea market is tighter and consumers preferences have changed. But Lipton has not innovated its package and products, it’s less exciting for Chinese consumers. More Chinese competitors are rising, they have better understanding of consumers, more creative package, and advanced marketing (such as KOLs in China).

Xiao Guan Tea (小罐茶)

Xiao Guan Tea is a high-end Chinese tea brand launched in 2014. It covers six categories: green tea, black tea, oolong tea, dark tea, white tea, and reprocessed tea. The brand targets young adults with strong consumption power and pursue the quality of life. By the end of November 2018, Xiao Guan Tea’s sales revenue reached 2 billion RMB in China’s market. It has around 650 offline shopsin the nation.

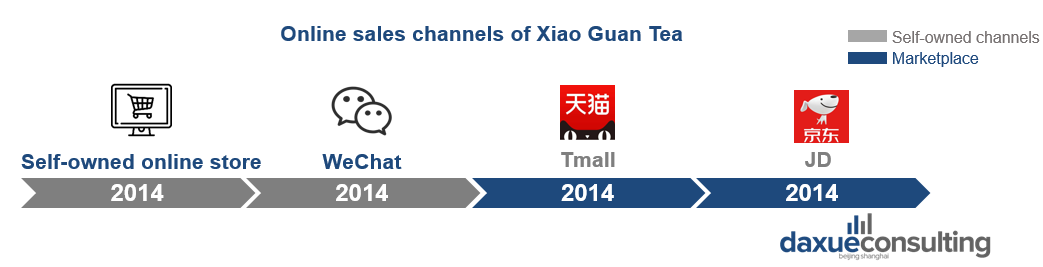

Data Source: Xiaoguantea.com, Sohu.com, Tea market in China report by daxue consulting. Online sales channels of Xiao Guan Tea

Positioning itself as a high-end brand

Xiao Guan Tea positions its products as high-end. The brand built its high-end image using well-designed packages and offline stores. It can create the distinct sense of modern luxury for consumers. Xiao Guan Tea uses aluminum cans and high-end gift box as packages, which make the tea healthy, and easy to conserve. Hence, Xiao Guan Tea products are now popular gifts during some Chinese holidays.

Xiao Guan Tea is upgrading its tea manufacturing by developing and using AI

In cooperation with IBM, they developed a robot that can scan and pick out the impurities of tea leaves. One robot can finish 50-60 human workers’ job every day. The technology can reduce labor expenses and improve processing efficiency. Xiao Guan Tea and Siemens launched a cooperation at the end of 2018 to build a new smart tea production facility in Huangshan (黄山). The factory will use AI technology in China to achieve the intelligence of the job-shop, optimizing the production process.

The impact of COVID-19

With the coronavirus outbreak in China, exporting became slower and more expensive. The epidemic also has complicated international logistics. Thus, China’s tea export progress is much slower and export costs increased. The main tea import countries strengthened their customs inspections and some countries reduced or stopped importing China’s tea. Offline retail channels had the biggest impact due to coronavirus in China. More than 60% of tea shops had no sales revenue during February 2020. Online orders for tea decreased and some products had delays in delivery because of the lack of employees in logistics. Therefore, online tea sales also declined.

Long-term impact

The economic impact of the coronavirus in China on tea distribution channels is temporary. The main impact on tea retails was mainly in February and March. The online and offline sales both will quickly recover when the epidemic is over.

Increased focus on health and social

After the COVID-19 outbreak, there is no doubt that everyone will pay more attention to personal health than before. Although tea leaves are not medicine, they are still health-related products, and have health benefits. The proper promotion of the knowledge about tea leaves will help facilitate everyone’s tea consumption. Chinese people’s enthusiasm for social networking is still growing, tea brands need put more emphasis on packaging and appearance design.

Because the COVID-19 outbreak, Chinese consumers have stronger health awareness. Many consumers choose to buy milk tea with little or no sugar. Fruit tea is also popular for due to having less added sugar and more health benefits. For milk tea brands, it’s essential to add the concept of health into their promotion and advertising.

Socializing is more and more important for today’s young people. Tea is not only a kind of drink, but also a sense of fashion and ceremony for them. Thus, milk tea shops now focus more on appearance. Therefore, if traditional tea brands want to increase sales, appearance is as important as quality and taste.

![[Podcast] China Paradigm #27: How to succeed in China’s tea market while starting from scratch](../wp-content/uploads/2019/04/China-marketing-podcast-27-150x150.jpg)