Comparison of market research in China vs the West: what you may not know about market research in China | daxue consulting

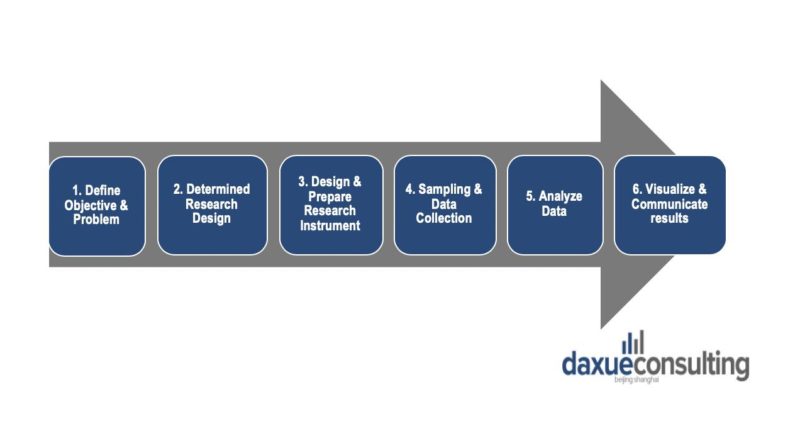

The common Framework of Market research

Market research is important in helping organizations to make informed business decision by collecting insights and using data. Through market research, a company could identify the potential growth possibilities and risk factors by learning about the consumer market, the local cultural and the unique challenges of the industry.

Market research follows a systematic methodology which can be categorized into the six steps below:

Defining an objective and problem is the first step to make a focused and relevant research, while sampling and analyzing data could help the researchers to identify the following:

- General market and industry knowledge

- Competition analysis

- Pricing strategies

- Search and evaluation of merchants/suppliersConsumer segmentation

- Consumer perception, satisfaction and loyalty

China and the west often see different purposes in market research

First and foremost, although growing rapidly, most Chinese markets are still maturing and a portion of market research projects are for new entrants. In contrast to the west where market research often focuses on consumer loyalty, branding and consumer satisfaction. The aim of market research in China is often geared towards market entry and making an initial strategy. Meaning that there is more emphasis on pricing strategies, naming strategy, market sizing, feasibility analysis and other market assessment strategies.

Why it is necessary to adjust your approach when doing market research in China

It’s crucial for business operators and market researchers to consider the distinct features of a particular country or region. The distinct features of China are a rapidly growing economy, increasing competition, vast regional and socio-economic differences, and the ever-present government regulations.

According to the Ministry of Commerce, foreign direct investment (FDI) into the Chinese mainland increased 7.3 percent year-on-year to 533.14 billion yuan in the January-July period of 2019. China has a growing economy structure and a promising trade market. Thus, the Chinese market is very competitive. Utilizing market research in China to obtain a clear understanding of Chinese consumers and the Chinese way of purchase is vital to any consumer-facing companies to decide the market strategies and practices.

“Market research in China is a lot about getting the most updated data and market intelligence, as things are moving so fast. For instance, getting 2018 data about e-commerce, mobile payment or any digital landscape will prove to be already extremely obsolete on the Chinese market. That is the kind of requirements (always have month- or week-old data) that we need to give to ourselves when conducting research in China”, say Thibaud Andre, research director for Daxue Consulting.

However, collecting information in China’s market could also meet some problems, from the diverse groups of potential consumers in China to different business customs between China and the west. When entering the Chinese market, adjusting the approach when doing market research in China is necessary because of the difference between Chinese and western markets.

Understanding the demographically complex consumer base in China

The Chinese market is bigger and more dispersed, bringing unique challenges to market sizing in China

First, China is the world’s most populous country. China has a population twice as large as the combined developed world and is comprised both developed and poor regions, both affluent and destitute cities, and is home to entirely 56 different ethnic groups.

“As not only market researcher but strategic consultant, we often have to remind our client that the segmentation in the West is not applicable to China. In our research, we will often distribute the consumer insights, but also the market sizing and the competition data, between city-tiers for instance. The level of urbanization is often a more relevant aspect to consider than the geographical areas, as Shanghai and Beijing might be closer in term of consumer behavior than Shanghai and Nantong (a tier-3/4 city few kilometers aways from Shanghai) for various markets”.

A demographically diverse consumer structure

As the third or fourth-largest country by total area, China’s economic and social development status is different from region to region. Consumption habits and income levels vary between tier 1 cities like Shanghai and Beijing and lower-tier cities. Similarly, there are also huge difference in regional patterns between eastern regions and inland regions. While someone is Beijing is more likely to purchase craft beer on Tmall.com, their counterpart in Weihai would opp to drink local Tsingtao beer and purchase through Pinduoduo. Thus, insight gained from market research conducted in a tier-1 city might be applicable to a tier-3 city.

The difference of the economic and sub-cultural factors from region to region in China leads to the different regional consumer preferences. Tier-1 cities are more economically developed and international because of the disparity in opening-up policy in China. However, inland regions and low tier cities are becoming increasingly important markets for foreign brands in China as their consumption power strengthens.

Thus, regional consumer segmentation is important in designing China’s market research plan for companies entering in Chinese market.

Business customs in the Chinese market

Bureaucracy: Barriers of data collection for Chinese market

In the process of conducting market research in China, the step of sampling and data collection is challenging because of the shortage of reliable information the lack of accuracy of the information. Chinese data agencies are less likely to be impartial. For example, while American data agencies are staffed by members who are independent from politics, Chinese data agencies are under the direct control of the Party and State Council.

Data related to traffic on social media or e-commerce may be fake, and like tech-savvy Chinese consumers, researchers also must observe qualitative data, like authenticity of reviews, to validate quantitative data like the amounts of likes or traffic on a product. Additionally, alternative data can be used to provide insight where direct data might not be easily found.

Be-aware of other cultural differences between China and the west

A good example of the cultural difference is guanxi. Compared with the western society, in China Guanxi refers one set of social connections that can be used for personal or professional purposes. At the same time, western countries are more focused on individualism while China is an interdependent society.

Guanxi could be occasionally needed in conducting market research in China. In China’s society, trustworthy and credible are two important traits for people to gather information from his/her sources. Guanxi creates the possibility of establishing a trusted relationship with your business partner in China. That being said, if a westerner wants to do a primary market research in China, they need to contact an intermediary as a mutual connection to engage a conversation with the third person. Without social connections, it would be hard for you to gain any first-handed information.

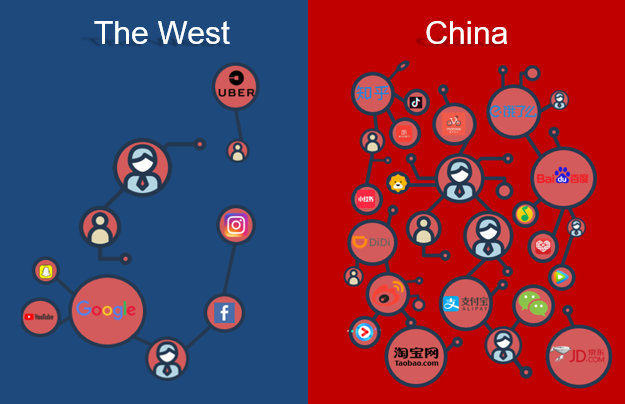

Navigating an unfamiliar APP and online ecosystem

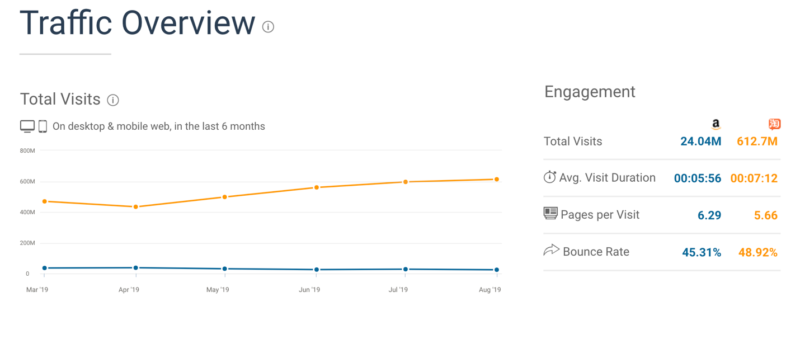

Comparison: Taobao vs Amazon

Chinese consumers are huge fans of online shopping. According to the National Bureau of Statistics in China, a government agency, online retail sales in China has reached 1.33 trillion dollars in 2018, an increase of 23.9 percent from year 2017. E-commerce in China is a part you should not ignore when you want to enter the Chinese market and do your market research about Chinese market. While 35.3 percent of China’s retail sales occur online, the United State’s E-commerce sector only represent 10.9 of its total sales. Due to the important place of e-commerce and digital activity in China, market research in China must take it into account.

Taobao, one of the leading consumer to consumer (C2C) marketplaces in China, is not China’s amazon. Compared to Amazon in America, Taobao is featured for these traits:

- Low costs for sellers and buyers.

- Competing through customer service, including rapid fast deliver and immediate messages replies from sellers.

- Business strategies are catered to different consumer groups

Entering the Chinese market, western companies have a lot to learn about Taobao and other Chinese e-commerce platforms.

In the last 6 months, Taobao has 612.7M visitors per month, way outscoring the number of visits to amazon.cn.

Xiaohongshu: Chinese online ecommerce APP shaping consumer purchase decisions

The idea of combining social media with ecommerce, now known as social commerce, has been popular since 2012; 2016, 52% of marketers predicting that it would be one of the biggest trends of the year. Xiaohongshu, as a mobile app, is a lifestyle sharing platform and a hybrid of social media and in commerce. Compared with Instagram, Xiaohongshu is more focused on driving direct sales and localized to the Chinese market.

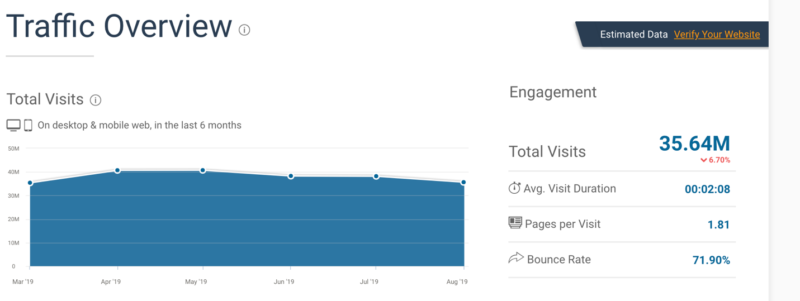

xiaohongshu.com attracts 35.64M visitors in the past six months. In late 2018, Xiaohongshu also opened a platform to connect brand with influencers or KOLs to create paid content. Foreign brands use Xiaohongshu to improve brand exposure and interact with some potential consumers as one of the strategies entering the Chinese market. When conducting market research in China, foreign companies should not underestimate the effect that how social media leads consumers to make a decision. Hence, the emphasis on a strong KOL strategy may surprise a new China market entrant.

China’s APP ecosystem and high tech savviness can be used as a research tool

Because of openness to technology and high digital fluency, even among older generations, this opens up doors to use research tools. For example, diary research in China, also known as in-vivo research, can be done through apps to quickly collect authentic qualitative data without burdening the research participants. Additionally, consumer surveys can also be integrated into China’s digital ecosystem, specifically WeChat mini programs. In combination with AI technology, the distribution of surveys can be automated based off relevant purchasing decisions.

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes