Car ownership vs hailing in China: substitutes are gaining traction in China mobility market

Considering growing number of population and wide adoption of disruptive perceptions, China’s car market has entered a brand-new phase where it has achieved a great number of car ownership and new car registrations. The market rapidly emerges into boutique sectors like renting, leasing, new energy vehicles and car-hailing. Now fewer consumers think of cars as necessities or status symbol, having practicality in mind, the market of used cars and sharing applications will expand. Consumers will have a higher incentive to purchase vehicles with better services and unique configurations or new energy vehicles. With the policy support from the government, the change of the consumer willingness and technology advancements, Chinese car market presents more opportunities than ever.

Chinese car market is still on the rise and diversifies into new sectors

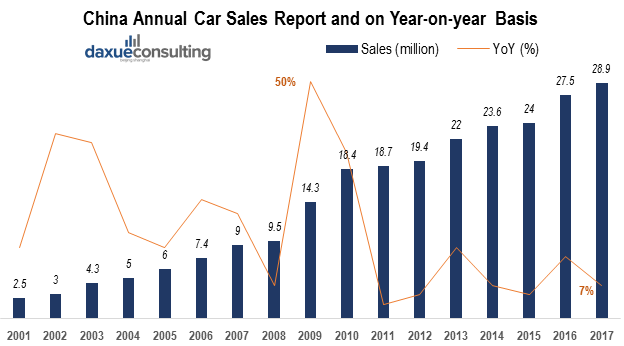

After years of development, China’s economy has entered brand new phases with Chinese’ per capita disposable income stood at 25,974 yuan in 2017, according to Xinhuanet, increasing up to 7.3 percent year-on-year in real terms. 20 years ago, very few Chinese households had cars, and even the motorbike was perceived as a high-value items for mass-market consumers but now China Car Parc has reached 300 million in 2017. Car registration number also soars to 6.83 million in the first quarter of 2017. The annual car sales in China are still on the rise starting from 2001, China now has reached 28.9 million car sales in 2017 and the number is forecasted to grow until 2030. A recent report shows that China’s annual car sales is still growing every year, but the speed gradually slows down, lower than few years before. The China’s car market’s growth slows down but the market actually offers more opportunities. Thanks to the government policy support, consumers’ perceptions changes, technology advancement, the new energy vehicle market is selling on the market, second-hand car market becomes bigger and car-hailing takes over the market.

(China Annual Car Sales Report and on Year-on-year Basis, Graph made by Daxue Consulting and data gathered from chinabaogao.com)

China’s tax reduction plan and ecological policy stimulates new energy vehicle market

Since 2011, China has been experiencing an extensively slow growth of car sales for more than five years. To maintain the sales increase, China has published diversified intense favorable policies to add purchasing incentives. For example, China has issued consumption tax reduction for low emission cars, given out free license plates and 30 thousand to 50 thousand subsidies to new energy vehicles, and reduced electricity prices. These policies have significantly promoted the sales in tier1 and tier2 cities, especially for cities like Shanghai, where there is strict license plate restriction.

China has long been desired to develop new energy car market due to environment protection, energy security and achieving competitive advantage. Starting from 2010, China has been considering developing new energy car market, but due to technology limitation, consumer acceptance, infrastructure and cost, this idea has not been brought into life until 2015. In 2015, the sales volume of new energy car increased from 0.33 million to 0.5 million. The market is growing and the market still has huge potentials. According to PWC’s law of technology industry development, after years of promotion, new energy automobile’s market share has reached 1% now, with the network effect of the new energy automobiles, the consumption will be further boosted.

For electric vehicles, a low-cost battery is essential to the wholesome cost of the vehicle. Achieving economies of scale, firms can lower their battery cost and attain better car configurations. China has built enough infrastructure for the rising of new energy vehicle market. For every new energy vehicles, one charging pole is required, however, in 2016, there are only 160,000 charging poles being built. The number is way less than expected, approximately 4 new energy vehicles share one charging pole. With the support from high position Chinese government officers, new energy vehicles, which include fuel cell vehicles, plug-in hybrids and battery electric cars, are going to sell more in China in the following years. According to Bloomberg, the China’s government has set targets for each year’s new energy vehicles sales, hoping to reach 2.1 million sales in 2020. According to Zhihu.com (知乎), Chinese people are optimistic with the development of new energy vehicles’ future. One of the user comment showing the optimistic perspective of Chinese netizens on the future of electronic cars.

(Translation: Overall, I believe electric vehicles are good products. Some people say ultimately, using electric power is also consuming energy, but the electric power can be generated from wider range of resources, from water, to wind and also to nuclear power. The reason for China to promote the electric vehicles is to lose its sole dependence on petroleum. One user in Zhihu commented on the topic of electric vehicles, Screenshot by Daxue Consulting.)

However, now, the construction of infrastructure and the battery technology have not reached a point where an industrial breakthrough can exist. While now, with massive production scale of new energy vehicles, regulated battery charging standards and increasing investment in the industry equip China with ability to develop further.

Chinese consumers care less about car ownership and go thrifty on purchasing

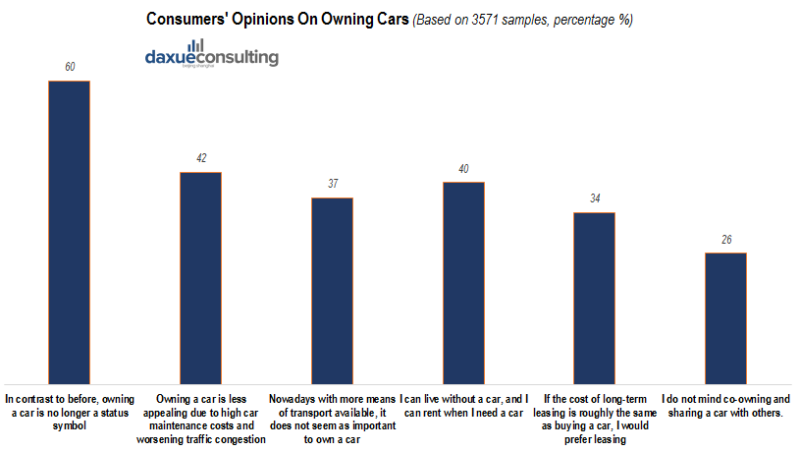

In the past decades, the ratio of owing a car has increased dramatically with the process of economic recovery, contributing to urban congestion and pollution emission. Owning a car in modern cities means to tolerate transportation pressure and experience inconvenience to find a parking area. According to an extensive survey done by McKinsey conducting over 3,500 samples, consumers now open to different options like renting, leasing, sharing or co-owning a car rather than buying cars.

The young generation of consumers now emphasize more on the actual value of the car. Five years ago, according to McKinsey’s survey of China’s premium-car owners, budget was the fourth-most important factor in buying a car. While, now, consumers rank budget the second-most important factor, after brand, for both new and used premium cars. In China, luxury car buyers should pay extra consumption tax plus the original premium price. China increased the consumption tax for premium car that priced higher than 1.3 million RMB by 10% in 2016. People’s negative expectation on future economy contributes to the thrifty lifestyle. Consumers now will also consider used cars rather than buying new ones. According to People’s daily, the second-hand market has a quick growth, it is forecasted in 2017, second-hand cars sales will exceed 12 million, a 20% increase comparing to last year. New energy car sales increased 53.5% comparing to last year’s sales, China’s domestic car brand has increased its market share by 0.7%. The data suggest that Chinese have huge purchasing power on new energy vehicles and are willing to spend money on the industry. The domestic car brand’s rise identifies the trend that consumers begin to care less about the car brand and focus more on the practicality.

(Consumers’ opinions on owning cars, the data gathered from 3571 samples, statistics displayed on the chart in percentage. Graph made by Daxue Consulting and data gathered from McKinsey’s report.)

McKinsey’s report also identifies the trend that car ownership is losing its appeal to customers. Sixty percent of consumers in this research say cars no longer function as status symbols. Owning a car is less important now, because other kinds of transport are available, providing more flexible and convenient ways for daily transportation. There is an opinion shift from owning a car to using a car among customers. Customers nowadays pay more attention on the service they received from using luxury car instead of owning a luxury car to show their social status. Services added on the value chain become critical.

Consumers now also want better deals and more information about their desired cars. Before they go to the car store to purchase, they will tend to search information online and conduct a thorough research on the car. Car stores became a place for them to test drive and make final deals. Thanks to the Internet, consumers gain more channels to compare the car prices and make sure they get a better deal.

Overall, due to the changes of market and consumers’ preference and perceptions, China’s economy and government policy has made car sales growth possible and the market has diversified into different mature sectors, such as leasing, renting and online car-hailing services.

Car-hailing takes over the market

The car market has been shifted from focusing on manufacturing to customer servicing since Uber made it big worldwide. China has taken a huge leap in this industry by having the largest customer base in the world. Chinese people are widely adopting the “sharing attitude”, and the idea has contributed to the rise of mobility platforms. Major metropolis in China all have regulations concerning car licensing plates, for example, in Shanghai, nonlocal licensing plates cars are not allowed to drive on week days, and new licensing plates should be acquired by auctions or drawing lots. Cities in China has long been suffering from traffic congestions and population explosions, new transport solutions are always needed to solve the problems. Thanks to the fast development of Smart City, numerous new mobility solutions are introduced to the Chinese market. China’s mobility dominator, Didi, takes over more than 80% market share. According to Zhang Wensong, senior vice president of Didi Beijing, Didi is the best platform that provides 20 million trips every day to its users and has a huge number of data generated by the user themselves. Didi’s competitive advantage is its possession of user data. Although Uber has displayed its competitiveness in global market, it has struggled in Chinese market and abandoned Chinese market by being taken over by Didi in 2016 with $35000 million worth. Chinese car-sharing market is booming all over the country, it is predicted that the annual growth rates will be 45% until 2025.

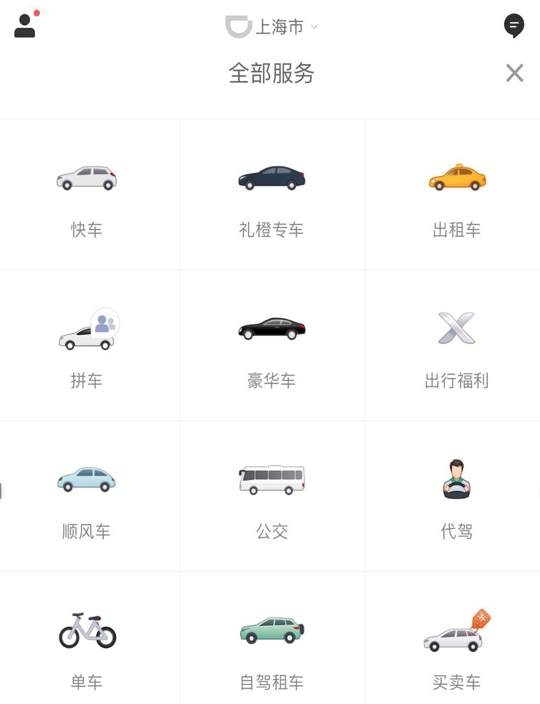

The expansion of Didi are unstoppable in China and it is looking for more growth in the future. The Chinese market still has a lot of potential to offer based on three reasons. Firstly, Chinese are looking for more transport solutions than those already offered like taxi. Secondly, car-hailing services now offer more diversified options and reach more client segments. For instance, Didi, the largest car-hailing company in China, offers a variety of services including providing exclusive chauffeurs to drive luxury vehicles for clients. Didi also provide luxury brand car ride containing premium beverages and exclusive driving services. Didi’s expansion largely depends on the Chinese government support, the regulations that government imposes help the car-hailing market to boost. China as a whole, including the government and people, is promoting the “sharing economy” together to benefit the economy.

Didi has also expanded its scope of business vertically and also horizontally by integrating other companies’ services into one platform. Didi has cooperated with multiple companies to provide services like second-hand car selling and buying, car renting services, maintenance and repair. Didi has also announced to brand out beyond its current services to offer insurance and financing solutions and also step into the vehicle production industry.

(Services provided by Didi Chuxing application, including ride-hailing, exclusive car, taxi, limo ordering, bus, bike sharing, renting, reselling and buying and finding exclusive drivers. Screenshot by Daxue Consulting.)

With the development of technology, Didi in the future will go deep into researching about new energy vehicles, self-driving vehicles to cast out the driver as it has already raised around $4000 million to fund the project. If this strategy became a success in the market, Didi can save up about two-thirds of its cost.

Overall, although China’s future car market is probably growing on a slower speed, it still provides a promising future for the consumers, automakers, dealers and emerging market innovators. Consumers now begin to change their perspectives on purchasing vehicles, automakers are finding new options to lean on new business trends, government is posing policies to regulate the new market and support the business. In the future, the key to succeed in this new car market is definitely meet quick changes of consumer needs.While value of car ownership and usage is rethought among Chinese urbanized, alternatives are emerging. Yet one model appeals more than the others: the car-hailing service of Didi Chuxing and Uber.

By 2021, about 600,000 vehicles in China will generate 80 billion yuan (USD12.34 billion) of added value. Will car owners use their vehicle more? No, but they will make it more useful for those who don’t own one. Today, among Daxue Consulting’s panel of Chinese consumers, non-owners of car and car-hailing services users felt “no need for a private car”. Moreover, according to reports, private car owners are considering selling their only car. There is a trend of rethinking the value of car ownership and usage in Chinese urbanized area.

By 2021, about 600,000 vehicles in China will generate 80 billion yuan (USD12.34 billion) of added value. Will car owners use their vehicle more? No, but they will make it more useful for those who don’t own one. Today, among Daxue Consulting’s panel of Chinese consumers, non-owners of car and car-hailing services users felt “no need for a private car”. Moreover, according to reports, private car owners are considering selling their only car. There is a trend of rethinking the value of car ownership and usage in Chinese urbanized area.

Why is car ownership becoming less appealing for young urban residents of top tier cities, though? The pollution generated, the difficulties to get a car license given strict vehicle restrictions, the climbing gasoline price, parking fees, and most of all, the endless traffic jams are the main reasons for this shift. The fast penetration of alternative tech solutions to improve and simplify urbanized mobility is another criterion.

Alternatives

Besides public transports, numerous solutions of mobility involving cars without owning them are popping out, from long- or short-term rental to carpooling and rides with private drivers.

Booking a ride or a car is made easier thanks to mobile apps, and the different models that exist enable customers to choose the right service for different needs: a short-term car rental for a round trip, a ride shared to go to work or a private ride to go back at night. When it comes to mobility, Chinese citizens are indeed paying much attention to flexibility, personal safety, and reliability of the arrival time. However, in this young and multiple market, some models are more successful than others. The car-hailing market, in particular, is booming. During an investor presentation in June 2015, the domestic leader of this segment Didi Chuxing estimated its market to reach 50 billion dollars value by 2020, reports the Financial Times. According to reports and Daxue Consulting’s panel, while car-hailing is still,for obvious reasons, far behind taxi hailing, the service is largely favoured compared to car rental and carpooling.

Can Uber take the definitive lead on this market?

Chinese car-hailing users often have different applications for the same service on their phone. In this case, the first to be consulted is often the proven market leader Didi Chuxing. As a result of the merger of Didi Dache and Kuaidi Dache a year ago,the 1.4 billion ride providers backed by Alibaba and Tencent now corners nearly 80% of the Chinese market.

But Didi Chuxing’s leadership is challenged by the Baidu (in Chinese百度) backed Uber. Then follow smaller market players like Yongche, Zuche or AAzuche…: the potential of ride-hailing and private drivers services did not fall on deaf ears.

To stay on track with this highly competitive market led by domestic Internet giants with a unique base of users, companies must therefore differentiate. While Didi Chuxing’s private ride service addresses the middle-end segment, Uber entered China with UberBlack for premium cars and UberX for medium-level vehicles, giving customers the choice to select the car model they prefer.

The Californian based company also enables its clients to set themselves the pickup destination and hides the final destination to the driver, an important feature for Yu Ling, 23-year-old Beijinger who quickly made up her mind between the two companies: “Didi is not that professional compared to Uber. The fact that Uber arranges the fare on behalf of the driver means that he cannot refuse a client for traffic or other reasons, whereas Didi’s drivers can.”

Building the most convenient service to attract more customers in this fierce competition has indeed led the two companies to compete further on services quality rather than pricing. Uber China thus disclosed its plans to expand coverage in 55 Chinese cities (Didi was present in 400 cities as of December 2015) and its goal to reach profitability within two years. But both enterprises have another imperative: diversification. In order to more effectively address the various mobility needs of Chinese consumers, the local leader launched a ride-sharing service in June, followed three months later by its American rival.

Building the most convenient service to attract more customers in this fierce competition has indeed led the two companies to compete further on services quality rather than pricing. Uber China thus disclosed its plans to expand coverage in 55 Chinese cities (Didi was present in 400 cities as of December 2015) and its goal to reach profitability within two years. But both enterprises have another imperative: diversification. In order to more effectively address the various mobility needs of Chinese consumers, the local leader launched a ride-sharing service in June, followed three months later by its American rival.

Daxue Consulting offer further analysis of industry evolution in China

Daxue Consulting has extensive experience in research project and strategic consulting related to the markets with constant and fast evolution. Our team offers a forward-thinking approach to topics such as digitization, high-tech implementation, artificial intelligence and many others.

To know more about the Car-Hailing Market in China, contact us!

See also:

- Uber Expansion in China

- Follow us on Twitter to keep posted, see our latest post about the automotive industry in China

#Chinese #automotive industry has outperformed its counterparts for seven years now. https://t.co/0APQawCqeF pic.twitter.com/PvsJuIa81D

— Daxue Consulting (@DaxueConsulting) April 19, 2016

![[Podcast] China paradigm #8: How can businesses keep up with China’s changing mobile scene?](../wp-content/uploads/2018/11/Thomas-Meyer-Youtube-Cover-150x150.jpg)