Battle of the Bakeries: How the macaron brands in China reach the customer

What Are the Prospects for Premium Macaron Brands in China Like?

French pastries in China have become a hit. The demand for western food and French bakeries in China has been increasing in recent years. At Daxue Consulting, we observe that as the average Chinese income per capita increases rapidly, from mere 4,560 USD to over 8,000 USD between 2010 and 2015 according to The World Bank, so is the demand for Western-style goods rising, especially among the millennials.

One of the many industries to benefit from this trend is the baked goods and confectionery market in China. In particular, small baked goods like macarons (马卡龙) are becoming a luxury product. According to our research, the soaring search ratings of macarons on Taobao (淘宝) and Tmall’s (天猫) indexes reach the coveted number 1 ranking in the dessert category early this year for the first time ever. However, the total sales of macarons on Taobao and Tmall only ranked 9th in the dessert category in May 2017 with a volume of approximately 3 billion RMB. In this case, the future still holds massive potential for macaron brands in China.

Rapidly developing bakery market in China

The consumption of bakery products in China has been quickly increasing as western food is becoming quite popular among China’s younger generations.

According to Euromonitor, China alone accounted for 43% of the growth in volume in this market in 2013. Moreover, China’s bakery industry currently boasts the world’s largest CGAR at 11.93% between 2011-2016, which is much higher than the 2.17% figure for the world’s number one bakery products market, the USA.

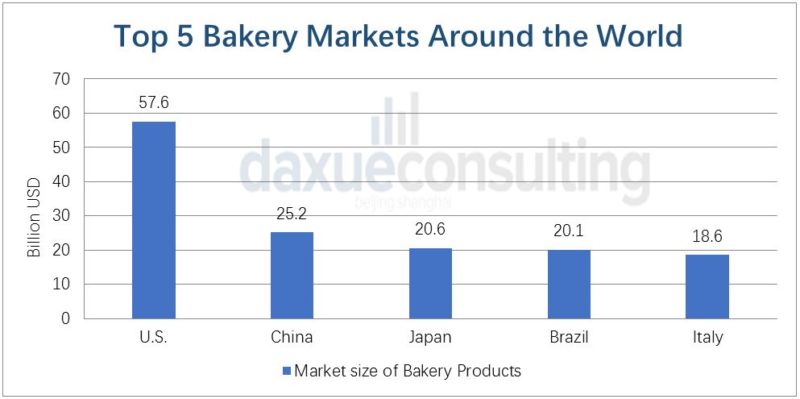

China has become the second largest market for the baked goods industry with a 25.2 billion market scale, second only to the US as of 2016. Source: Reproduced by Daxue Consulting with data from Euromonitor; Zhongtai securities.

Along with the development of common baked goods, premium bakery products have also become more popular. Premium bakery goods have become a high priority item for many Chinese people. “Unlike Europe, China did not have a large number of small, traditional bakeries in the past; instead they have always relied on big brands to drive the market forward. Therefore, Chinese consumers were historically used to buying high-end products from famous brands.” states Thibaud André, senior consultant at Daxue Consulting.

In the traditional Chinese-style of cooking, bakery products are not commonly consumed in everyday meals, so the value of sweet baked goods can be up to three times that of typical confections. Apart from the price, more and more Chinese consumers are now concerned with taste and appearance of baked goods.

Macarons are still a niche product in China. They are sold in few stores and at a quite expensive price. Source: Daxue Consulting.

In 2012, there was a shift in consumer preferences. Premium foreign bakeries took advantage of the opportunity and have been coming to China ever since. According to Dazhong Dianping (大众点评), a leading food and restaurant recommendation app in China, bakery shops with reported consumption of over 200 RMB per person are mostly run by international brands. Such restaurants and stores sell chocolates, cakes, sandwiches, macarons, egg-tarts, and other popular Western treats.

Compared with the Western premium bakery brands, Chinese brands usually boast a larger network of stores. For example, Ganso (元祖), a Taiwanese premium bakery brand, entered China in 1993. Now, it has over 600 stores across Southern and Western China. However, Daxue Consulting found that the average number of locations for Western brands is usually less than five stores.

The geographical distribution of the Taiwanese premium bakery brand Ganso (元祖), showing its large network of stores around China, particularly around the coastal provinces and the Southeast. Source: Ganso.

For most of the Western brands, their struggle to expand is partially due to their lack of, or poorly managed, online presence. BlackSwan Cake (黑天鹅蛋糕), a luxury sub-brand under the Chinese mass market bakery brand Holiland (好利来), has a well-designed official Chinese website that provides cake booking and online payment services for customers.

According to user comments on Dazhong Dianping, many Chinese consumers frequent these high-end bakeries for an afternoon tea and snack. Macarons are an especially popular Western dessert during an afternoon tea. For example, Pierre Marcolini and Salon de Thé de Joël Robuchon, two Western premium bakery brands in Shanghai, have both included macarons on their afternoon tea menu.

A macaron decoration in Pierre Marcolini, Shanghai. The bakery has creatively added macarons to a cake. Source: Dazhong Dianping

Niches among Macaron Brands in China

The Top Brands

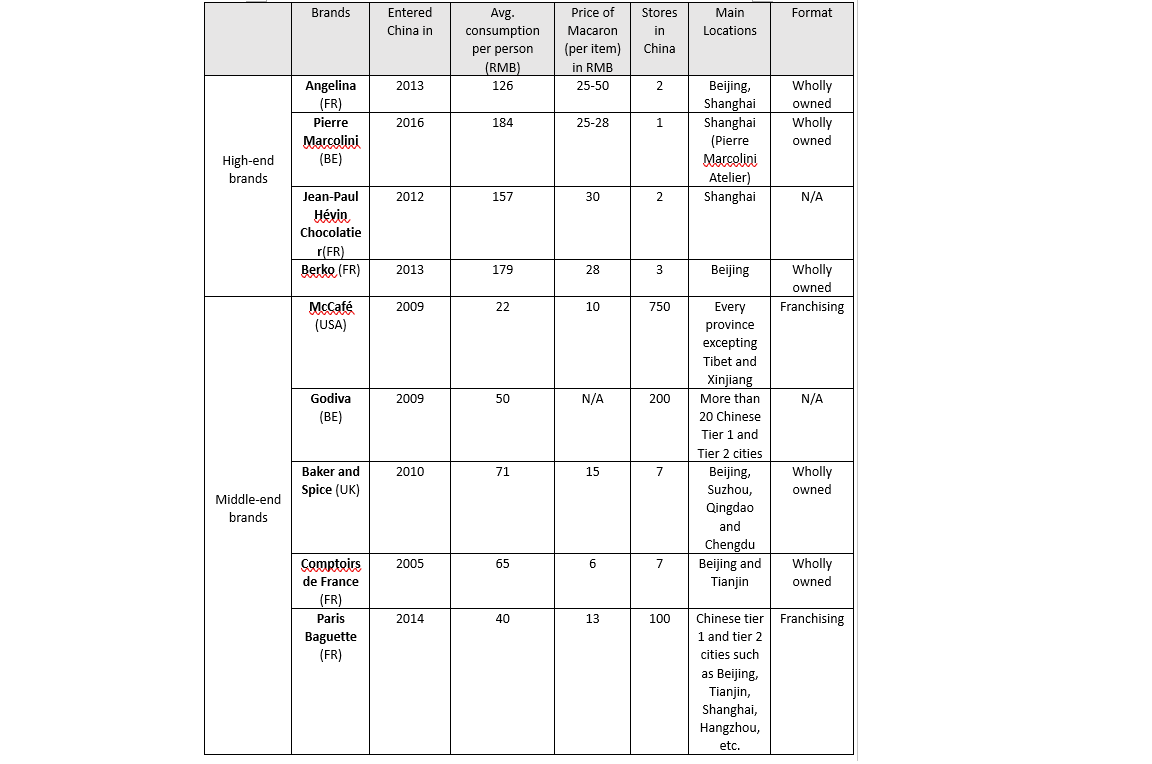

The high-end market is dominated by foreign brands, with the prices ranging between 25 to 30 RMB.

Angelina, Pierre Marcolini and Jean-Paul Hévin Chocolatier—three popular premium brands in the Chinese market carefully distributed their wholly-owned stores in Beijing and Shanghai. While most brands only operate a handful of stores around China at best, each of these stores is widely frequented by customers because they offer many perks and unique experiences.

French culture in China has influence on food and dining. By utilizing classical yet appealing French design in their stores, combined with spectacular looking products, Western brands can successfully sell a variety of goods and services. Many consumers spend a long time sitting in the store, not only to eat or to chat with friends, but also to take photos of desserts with artistic appearances to later publish on Chinese social networks to increase their own social status.

[ctt template=”2″ link=”x8QE9″ via=”yes” ]China Loves #Macarons: Ranked 3 Most Searched Word in the Desserts Category on the Chinese Internet Earlier This Year.[/ctt]

The Mid-Level

Middle-end brands such as Godiva (歌帝梵), McCafé (麦咖啡), Baker and Spice, Comptoirs de France (法派1855) and Paris Baguette (巴黎贝甜), occupy another part of Chinese macaron market, with prices from 10 to 15 RMB for one piece. These brands are most prevalent in the Tier 1 and Tier 2 cities through franchising, with most of locations in large cities along the coast, particularly so in the Southern and Southeastern provinces, such as Shanghai (上海), Zhejiang (浙江), Fujian (福建), etc.

Their primary demographic is Chinese white-collar women who have higher requirements on the quality of food. Based on our sensory research in China, consumers want the food to not only be healthy, but also look appealing; with one reason for this being that the macaron is considered an “exotic” and luxury confection, and the experience of eating it can be shared with friends online.

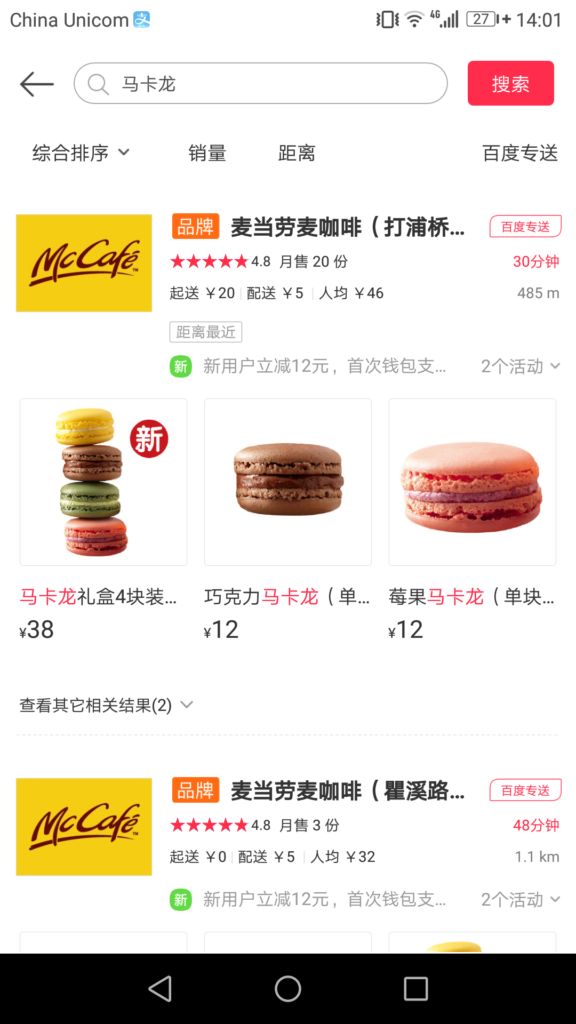

McCafé China is selling its macarons at a price of 12 RMB per piece, and one box of four macarons at a price of 38 RMB. Source: 百度外卖 (Baidu Takeaway mobile app), November 2017.

As opposed to luxury brands, middle-end brands make themselves competitive by guaranteeing that the store is easily accessible, with a high quality-to-price ratio and standardized products across stores. For example, McCafé has more than 700 locations all over China, excluding Tibet (西藏) and Xinjiang (新疆). Godiva and Paris Baguette’s number of locations is in the low hundreds.

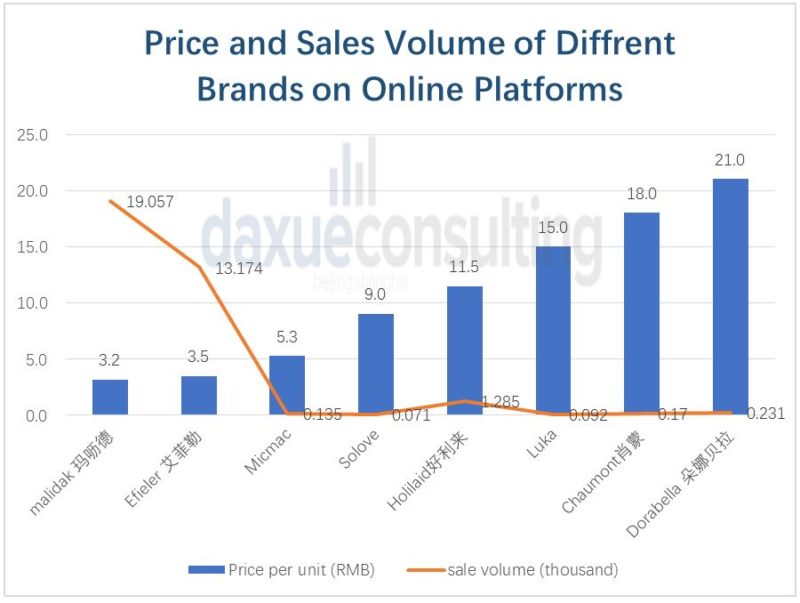

The usual sale volume of middle-end brands with an average price over 10 RMB per unit is lower than 1,000 pieces per month.

An Overview of Chinese Macaron Market

Affordable Brands

The low end of the market is mainly occupied by brands such as Malidak (玛呖德) and Efieler (艾菲勒) both domestic brands. The average price is 3-4 RMB per unit and sales reached over 10,000 pieces in May 2017.

Our research found that consumers who buy macarons from these affordable brands through e-commerce channels are mainly located in the following areas: Fujian (福建), Jiangsu (江苏), Guangxi (广西), Henan (河南), and Shanghai (上海).

The macaron sale volume on Taobao and Tmall deceases sharply as the price is increasing. Source: Daxue Consulting.

Which Macarons Do the Chinese Really Spend Money on?

Food Safety Considerations

After a series of food hygiene and safety incidents across China, many consumers are warier of food quality and are thus turning to more expensive and trustworthy brands whenever possible. Particularly, the Chinese are very concerned about the statements on non-additives and preservatives.

According to a 2016 study, no additives and anticorrosive claims among bakery brands have nearly doubled in the recent years to attract more customers and improve brand image.

The color of macaron was the 10th hottest keyword on Baidu Search Index in June 2017, which reflects an uptick in consumer awareness of product quality. As a result, macaron brands in China need to clearly state that the color of their macarons is not derived from unsafe ingredients.

Celebrities in Marketing Campaigns Matter

With the rising impact of Chinese celebrities (网红) on consumer goods, we found that macaron brands in China that cooperated with Chinese celebrities have successfully attracted more attention.

Berko, a young American-style French bakery, specializing in selling cupcakes and cheesecakes, launched a pink macaron gift package called “Berko X Grace Macaron”(手绘马卡龙礼盒), featuring the renowned Chinese beauty blogger Grace Chow (周扬青), (3.5 million followers on Weibo), who is the famous girlfriend of LuoZhixiang (罗志祥), a popular Taiwanese singer with 51 million followers on Weibo.

“Berko X Grace Macaron”(手绘马卡龙礼盒), by Berko, featuring the renowned Chinese beauty blogger Grace Chow (周扬青). Photo source: Berko China official Weibo account.

“Berko X Grace hand drawn macaron gift package” was launched on Valentine’s Day in 2017 and sold out in the first two days of launching, according to Grace’s Weibo post.

The success of the first promotion led to another cooperation between the two parties. Berko and Grace launched another gift package titled “Berko X Grace Hi Babe” (Berko X Grace的两款夏季联名礼盒) in late June 2017. The newest launch included supplementary products with the same theme, such as T-shirts and detox water. The company also invited other Chinese celebrities, like Qinlan (秦岚), a Chinese actress with 7 million followers on Weibo, to advertise the new collection.

Beauty blogger Grace Chow appearing in Berko’s promotion of its Valentine’s edition of macarons. Source: Weibo.

Tying Up the Knot with Macarons

According to “Chinese Wedding Status Survey in 2017” (2017中国人婚礼状况调研报告), conducted by the Chinese matchmaking agency Baihe Website (百合网), western-style weddings and birthday ceremonies are also very popular in China.

63.8% Chinese women prefer western-style or a Chinese-Western mixed style of weddings. Since becoming a symbol of premium western desserts, macarons also play an important role in these ceremonies. A macaron display table could not only provide sweet food to guests, but also act as avenue decoration. Additionally, the sweet taste of macarons plays into some of the most central themes of Chinese ceremonies, conveying wishes of good fortune and appreciation.

Daxue Consulting: An Experienced Advisor

Should you consider entering the bakery market in China, our experts at Daxue Consulting will help you do it in the most effective and efficient way. Our experience in doing rigorous research in the food industry gives us the ability to provide you with the most thorough understanding of macaron brands in China as possible. We will help you figure out where your brand fits in and how successful it can be.

Our existing clients had various requirements related to both market entry as well as the expansion in this industry. Let’s consider one major player in the bakery market that was planning on operating in China. They reached out to Daxue Consulting to provide assistance with market research, focusing on market size, market segmentation, competition analysis, and consumer preferences, among other factors.

Taking advantage of Big Data analysis as well as first-hand data collected through our network of local insiders, our researchers measured the market potential. Then, relying on a wide network of respondents, we were able to carry out a combined online-offline survey that included several hundreds of people. Store-checking and price comparisons for different products helped to measure up the competition. In the end, our client had a strong understanding of the market environment and ample information on how to further proceed with the market entry. All of this was done in a time- and cost-effective manner.

Our team has done much more extensive research on the pastry industry because of its high potential for foreign brands, particularly from Western Europe. We will be glad to share our findings with you to help your company succeed in China as well. Reach out to us by phone or email to learn more.