How can international brands successfully use Live-Stream Shopping to advertise in China? | daxue consulting

Live-stream shopping is currently the biggest craze in China’s e-commerce industry, but what is it? Live-stream shopping has been compared to TV shopping on American QVC channels, but it is live, spontaneous, interactive, and sometimes gamified. Hosts broadcast in real time, videoing themselves modeling clothes or other goods, and viewers can then immediately purchase that item from an embedded link. Live-stream shopping channels and short videos are the perfect medium to engage those with a “see now, buy now” mentality. From a revenue-generating perspective, Alibaba reports a 32% conversion rate on its Taobao live-streaming platform alone.

Viewer numbers for major broadcasts can rise into the tens of millions. In March 2018, a fashion week shopping stream from Tmall and Labelhood attracted almost 90 million views.

China is the world’s largest market for online broadcasts. According to a Deloitte report, live-streaming viewers in 2018 reached 456 million. Live-streaming activity, from platform development to advertising and events, is destined to be worth almost US$16 billion by 2020. Within live-streaming, shopping-specific streams in China are an exciting new platform for brands to engage with.

Producing a live-stream shopping show in the Chinese market is a perfect way for international brands to increase brand awareness, gauge consumer interest in various products, and generate revenue.

Why does live-stream shopping appeal to Chinese consumers?

Tmall organizers describe live-stream shopping as “shortening the fashion consumption chain.” The immediate interaction between brands, fashion insiders, and the consumer enables the everyday shopper access to a catwalk show and as such to feel a part of the fashion process.

Within just a few minutes of watching a live-stream the viewer can look at the product, learn how to use it, see how it works in combination with other items, watch the test user’s reaction to it, and more. Chinese live-broadcasting provides an authentic experience that other online shopping platforms cannot—there is no editing or photoshopping. Crucial to live-stream shopping in China is seeing the host or performers test the products. Live-streaming is about real people telling a real story about a real product. This basis on authenticity is why live-streaming is statistically more likely to motivate a purchase among Chinese consumers.

History of live-stream shopping in China

Live-stream shopping grew out of the larger live-streaming movement in China. In 2015 there were 45.7 million monthly active users for all live-streaming apps, but by July 2016 that number had grown by 182.7% to 129.2 million monthly active users. Now, there are nearly a billion active live-stream viewers in China.

People’s Daily reported in 2016 that the average live-stream watcher views streamed content for up to 135 minutes a day. However, not all of this live-streamed content in China is shopping-based, with many live-stream hosts simply singing or performing in other ways for their fans.

The live-stream shopping phenomenon in China is entirely a product of the internet age. Smartphones have lowered technical barriers to live-streaming, making it easier for KOLs to create aesthetic videos for fans to watch from anywhere. High-resolution front cameras and in-app beautification features make the live-stream shopping in China medium accessible for KOLs to stream on.

Live-stream shopping in China first appeared in 2013, but its popularity exploded in 2016 after Alibaba launched live-stream shopping on Taobao. Now, live-stream shopping is a formidable industry in and of itself, distinct from general live-streaming.

What are the major live-stream platforms?

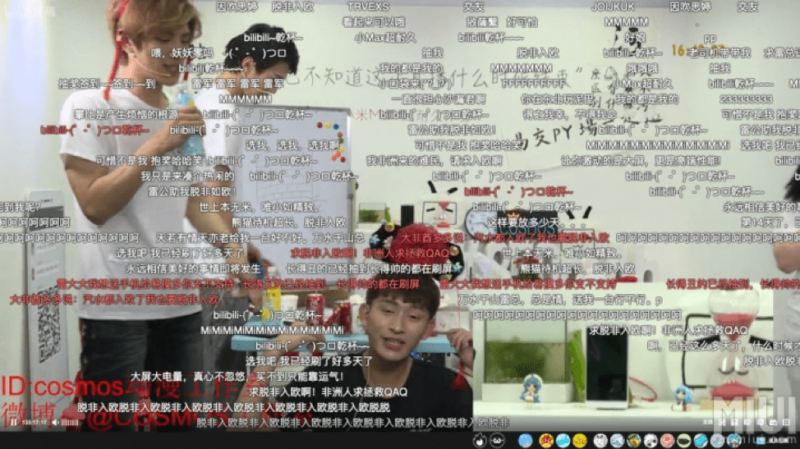

Taobao is a massive live-stream shopping broadcaster, and other major live-stream platform players are Tmall, Sina Weibo, JD.com, and Muogujie.com. Smaller but still significant live-stream players include Inke, Douyu, Vip.com, Bilibili, and Panda TV. In August 2016 the Chinese app market had at least 140 live video apps, and that number has now risen to over 200.

On single’s day in 2016, TMall established its prominence in the live-stream shopping industry by streaming an 8-hour show with luxury brands like Burberry, La Perla, and Paul Smith, as well as appearances by well-known industry insiders, with fashion advice directing the viewer to more products.

“See now buy now” was projected on a massive screen behind the runway, and viewers could immediately purchase products being modeled. Viewers took the saying to heart, and the 11.11 shopping festival made a record 920 million RMB in a 24-hour period.

The single’s day fashion show was so successful that Alibaba invested $100 million in Tmall’s new “luxury” live-stream channel. The high-end channel is managed by Mei.com, and features flash sales with brands that have opted to be on the platform. Brands sold include Fendi, Dior, and Marc Jacobs, Chloe, YSL, Karl Lagerfeld, Moschino, Burberry, and more. The new platform dramatically expands the presence of major international luxury brands on Tmall.

Who are live-stream shopping’s viewers and consumers in the Chinese market?

Live-streamed videos in general are most popular among men, but 80% of shopping specific live-stream viewers are female. Viewers are mainly from second-tier cities, according to Alibaba. They shop after work hours, largely between 8 pm and 10 pm.

Half of all live-stream shopping viewers in China are Generation Z – post-millennial – putting most watchers between 20 and 35 years old. Considering that most live-stream shopping hosts and models are also in this age range, it makes sense that the audience draws from the same age range.

According to a recent study by Accenture, more than 70% of Chinese Gen Z consumers (born after 1995) prefer buying products directly via social media than through other channels, compared with the global average of 44%.

“Gen Zs tend to dominate in daily live-streaming use. But for content that is unique, one-off, and targeted, the audience can be more in the millennial/Gen Y category, too,” says industry expert Elise Harca, “The latter are more picky about what they sit and watch.”

Brands should target specific age groups by choosing live-stream shopping hosts popular among youths or catering their products and stream activities to younger generations.

With live-stream shopping so ubiquitous, how can a new brand reach a large number of customers in the Chinese market?

The use of KOLs is the most important indicator that a live-stream shopping event will be successful. A KOL is a “key opinion leader,” commonly known as an “influencer” in the West. KOLs are famous on social media and shopping apps because of their high follower counts, which range from thousands to millions of fans. This reach makes them highly desirable partners for brands looking to advertise their goods to Chinese consumers.

When famed Chinese KOL Mr. Bags did a one-hour Cambridge Satchel live-stream in Beijing, it reportedly resulted in significant Weibo fan growth and Tmall page subscriber growth for Cambridge Satchel, as well as generated high sales on Tmall. In June 2018 Mr. Bags collaborated with luxury brand Tod’s, and sold 3.24 million RMB worth of handbags in just six minutes.

As Mr. Bags shows, Chinese consumers are incredibly reception to online influencers. According to consultancy A.T. Kearney, 60% of Chinese consumers would consider purchasing a product marketed by a KOL they follow, compared with 49% in the US and 38% in Japan. One reason is that KOL recommendations provide a sense of security in an e-commerce ecosystem riddled with scams, fake companies, and knockoff products. A trusted KOL can assay concerns that consumers would have about purchasing from a brand they’ve never heard of or bought from.

Furthermore, Chinese consumers find sales pitches more engaging when they are from KOLs they already adore. In live-stream shopping, shopping is the entertainment and that entertainment drives sales. Thus, a KOL’s persona is key to their success in growing follower numbers for themselves and creating sales for the brand.

Brands who promote with KOLs see a significant increase in sales and brand awareness. Lane Crawford live-streamed an in-store designer event with leading fashion KOL Fil White and saw viewings more than triple compared to their previous event without a celebrity element.

KOLs and live-stream shopping in the Chinese market: a how-to

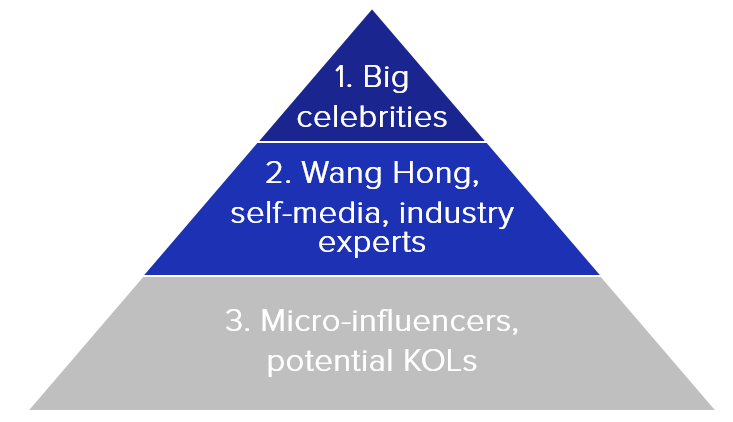

When choosing KOLs to partner with, brands should decide carefully. There are many KOLs to select from, but only those with a proven history of converting content into sales are worth the investment. The KOL search engine and monitoring platform, Robin8, divided Chinese KOLs into three segments 1) big celebrities, 2) Wang Hong, self-media, and industry experts, and 3) micro-influencers and potential KOLs to be uncovered. The total combined market value of the three segments is expected to reach 52.2 billion RMB by 2021.

The top segment of KOLs is made up of well-established celebrities. This segment of KOLs charges the highest fees, ranging up to the tens of millions RMB for a single endorsement. The average fee of these large celebrities in 2016 was 5 million RMB and is expected to reach 10 million RMB by 2021.

The middle KOL segment includes Wang Hong and industry-specific influencers who make about RMB 1 million a year on average. The term “Wang Hong” (网红), which means internet celebrity in Mandarin, referred initially to young, good-looking men and women working as hosts on social media and live-streaming platforms. Now, Wang Hong has a broader meaning and includes niche industry gurus such as professional gamers, entertainment content creators, and beauty/fashion bloggers. Another type of Wang Hong is e-commerce-driven: they own e-commerce stores and post their styles of fashion and beauty to aggregate fans and promote their business.

The bottom segment of KOLs consists of about one million micro-influencers. Although micro-influencers have fewer followers (a few thousand to tens of thousands), they can reach niche groups of people, interact with more fans, and build closer relationships. In 2021, micro-influencers are expected to generate 41.2 billion RMB of revenue.

The most popular, highest-tier KOLs don’t come cheap, but the investment pays off in increased brand to consumer engagement. Generally, the more impressions a KOL can generate, the more the promotion will cost the partner brand. KOLs who sell products will often earn commission, taking a 20% – 30% cut on each item bought by their live-stream viewers. Alternatively, companies can pay KOLs in gifts or with a flat fee.

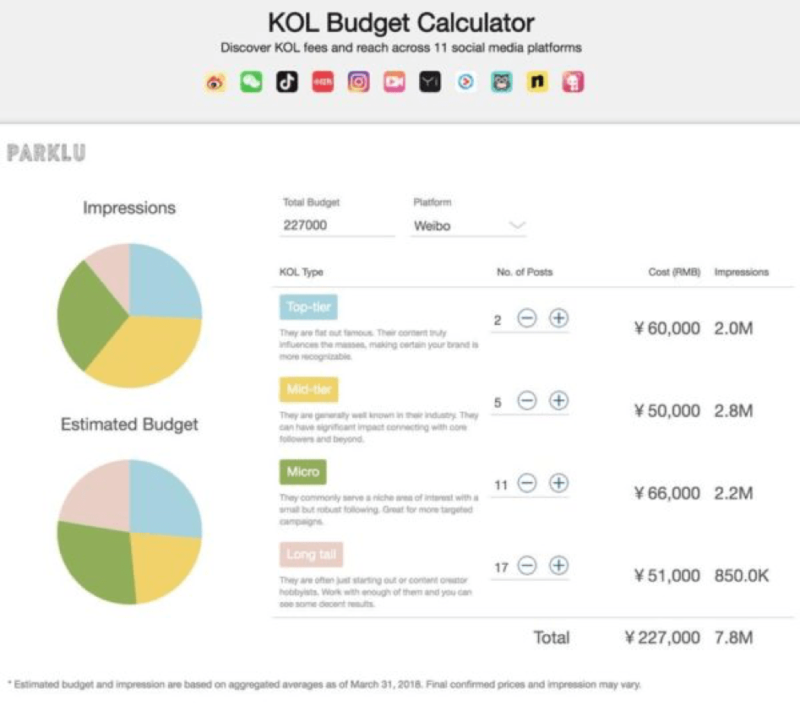

Brands can use software or KOL websites to assess the value and influence of KOLs they are considering, as well as reach out to and hire these KOLs. Some KOL search engines and monitoring platforms include PARKLU, KOL Store, MyPrad, and Robin8.

PARKLU is China’s premier influencer marketing platform in China with over 20,000 influencers for hire across 11 social media platforms. It has centralized China’s top content creators and added comprehensive, real-time campaign tracking software.

KOLStore has built a self-media value index called KolRank. It analyzes data from over 200,000 KOL accounts to detail their communication, brand, and investment value.

MyPrad is an online platform for marketers to communicate with KOLs directly, without intermediary agents. The platform is currently only open for PR officials, brands, and KOLs. MyPrad aims to improve efficiency and reduce the cost for marketers by solving problems like information asymmetry, slow response times, and high prices.

Robin8 utilizes AI and big data to profile and rank influencers, as well as match brands to KOLs. Robin8 has profiled over 23 million KOLs and executed over 900 influencer campaigns.

Which industries can benefit from the live-stream shopping module in China?

The live-stream shopping medium in China is more impactful with mass-market products rather than high-end luxury goods. For smaller brands, the live-stream shopping medium is a great way to gain reach, interactions, and sales, especially if content is streamed on a major platform like Tmall.

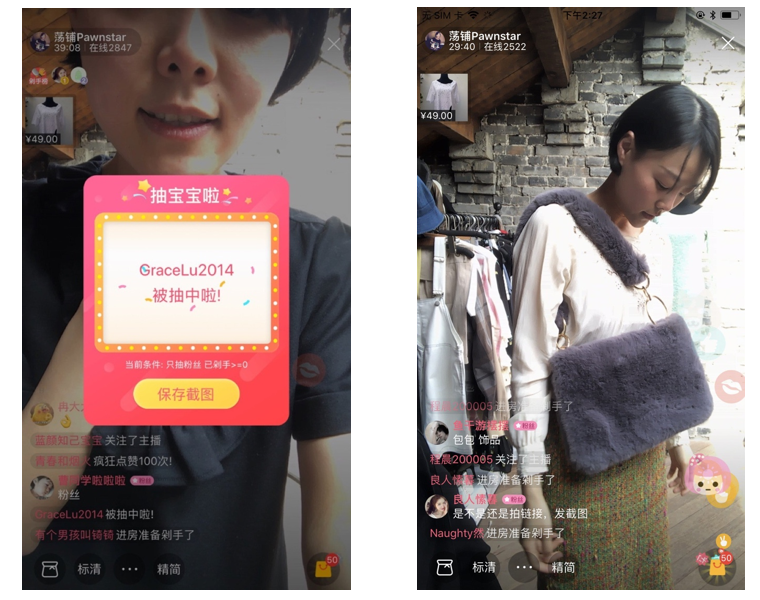

Small Chinese brand Pawnstar uses a WeChat mini-program, supported by Muogujie.com, to live-stream to about 20,000 to 30,000 people a session, four times a week. The broadcasts bring in 30% of the business’s total revenue. To engage the audience and add to the entertainment factor, Pawnstar will often add playful elements such as viewer raffles.

Even though live-stream shopping is most impactful with more affordable goods, luxury brands can still capitalize on live-stream shopping in China. From live-streaming luxury brands get the unique opportunity to control their brand image in the Chinese market, instead of relying on exposure from traditional media sources like Vogue or Elle. In 2018 Lane Crawford launched a Weibo live-stream that focused more on brand awareness, news, and experience rather than direct sales. For example, they included a segment where a Feng Shui master advised viewers on what colors to wear. In addition, live-streaming gives international brands the opportunity to grow their Weibo, WeChat, etc. communities in China.

During the 2018 Fashion Weeks in New York, Milan, London, and Paris, live-streaming was ubiquitous. It has become an effective channel for luxury fashion brands, press, influencers, and others to take runway shows and showroom hype to an eager global audience. Luxury brands such as Louis Vuitton, Bottega Veneta, Gucci, Dior, and many more offered live-streams of their fashion shows to Chinese consumers across their main social media platforms. Some decided to work with domestic celebrities to promote their sessions, while others collaborated with mainstream fashion magazines, including Vogue, Elle,andHarper’s Bazaar, to tap into their existing customer base.

Even more niche industries, like travel marketing, can reap the benefits of live-streaming in China. Live-streaming is a step up from more traditional forms of travel marketing because it gives consumers the chance to experience a tourism destination through more immersive means than just seeing pictures on a travel website. Brands can sway potential holiday-goers by giving them a taste of the location from their mobile devices.

In October 2016 Hilton Hotels and Resorts launched a major travel campaign in China via live-streaming. The hotel group teamed up with Chinese KOLs during Golden Week and asked them to film themselves and their families enjoying Hilton hotels across the country. To engage the audience, Hilton offered draws to followers for free stays and discounts.

How to broadcast a successful live-stream shopping show in China

1. Plan for everything

As with all live-streamed content, there is no editing and nowhere to hide mishaps. Once the cameras start rolling and the feed is live, what happens is, to a large extent, out of the brand’s control. Luxury brands who like to control their image tightly might find this prospect too much to bear.

Kanye West is one designer who learned the perils of live-streaming the hard way. During the 2016 New York Fashion Week, the celebrity broadcasted a live-show promoting his Yeezy 4 shoes. Several models in his show struggled to remain upright as they tried to remain completely still under direct sun in the 30-degree Celsius/85-degree Fahrenheit heat, while some models hobbled down the runway in malfunctioning footwear. There were reports of models “dropping like flies,” as several fainted or gave up and sat in the grass.

Risk can be mitigated by planning every possible element of the event. This means assessing the risk of the tiniest details, from weather predictions to what else might be scheduled viewing for that day, and having a backup plan for every eventuality. It’s also important to choose the right platform – creative projects should be broadcast on sites like Bilibili, while Tmall and Taobao are geared for people who want to “see now, buy now.”

2. Go all out

Live-streaming is one medium where less is not more. Brands should go all out, not only in their content but also in video length. In live-streaming long-form content works better than shorter videos. Building up anticipation brings the audience to the virtual arena: if the build-up has been handled properly, then live-stream viewers who have already invested time and effort are unlikely to quit easily. It’s “like going to a gig or performance—if it’s happening live, the audience wants to be there for it all,” according to industry expert Elise Harca.

Famously, smartphone brand Xiaomi live-streamed for 19 days in 2016 to showcase the battery on their new Mi Max phablet. It was touted as ‘boring’ by the company and viewers, but 39.5 million people still tuned in and the phablet’s sales numbers boomed.

3. Get the audience involved

Interactivity in live-streams is incredibly important to Chinese consumers. Brands can answer audience questions immediatley or show viewers’ live tweets, making the event significantly more exciting for the audience. Platforms should also include fun or gamified elements, such as holding raffles or competitions, giving out awards, or presenting hong bao’s to viewers.

Adidas is one brand that perfectly combined fun with interactivity. In their ZX Flux live-stream, they showcased a graffiti artist who changed his patterns and designs based on viewer requests.

4. Follow the government’s rules

Live-streamers in China must abide by PRC rules and regulations. In January 2017 the State Press and Publication Administration released a set of regulations regarding live-streaming. The rules stipulate that hosts of live-streaming shows need a license, and all live-streaming hosts must register details of their identity cards or business licenses. The 10th article specifies hosts from outside of China should first apply to the Ministry of Culture before opening a live-stream channel. Rules also require online broadcasts to “be beneficial to the promotion of socialist core values,” but this specific edict has no enforcement mechanism. Platforms carrying out interactive sessions must employ censors to manage their live comment sections. Most important of the government’s rules are that all live-streams must be “safe,” essentially that they do not include graphic, sexually explicit, or politically sensitive content.

Although some accounts and platforms have been shut down by the government in the past two years, this was mostly because of illegal activity or the broadcast of sexually explicit content. Regular commerce remains largely unaffected, industry insiders say. As long as companies generally abide by the rules, they have nothing to fear.

Live-stream shopping in China: a must do

Live-stream shopping opens a new route into the Chinese market for foreign brands, proving that brands can monetize in China without having a physical store. Even if a brand is already successful in China, live-stream shopping is a powerful way to generate fast sales and pique brand awareness. However, brands must remember to engage their audience, work with the right KOLs on the right platforms, and make waves without breaking any governmental rules.

Author: Alison Bogy

PR and Advertisement business in China requires strong and reliable knowledge of the overall market and on the culture and custom of its customers. Daxue Consulting conducts all the market research and consulting services you might need to develop your PR and advertisement business in China.

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.

![[Podcast] China Paradigm #24: How brands can master Chinese social media, livestreaming, and KOL marketing](../wp-content/uploads/2019/04/China-business-podcast-Livestreaming-Kols-150x150.jpg)