How millenials and low-tier cities are shaping China’s jewelry market

China is on track to become a consumption-led economy and a prosperous society, which bodes well for the retail in China, especially the luxury sector in the long term. International business in China can take advantage of the blooming sector and catch the opportunity. The China’s jewelry market is still dominated by foreign brands. Corresponding to the growing demands, distinct and revolutionized consumers’ needs appear. Consumers appreciated customization and get involved to the design of the jewelry.

We also find that the smart and second-hand jewelry market has soared recently. China’s jewelry market can afford to approach a wider target market, men and children represent a flourishing consumer base. However, their demand have not been satisfied yet. In this fast-changing market, having insights on the latest trends would level up performance.

Jewelry sales are tied to GDP, so here is an overview of China’s GDP

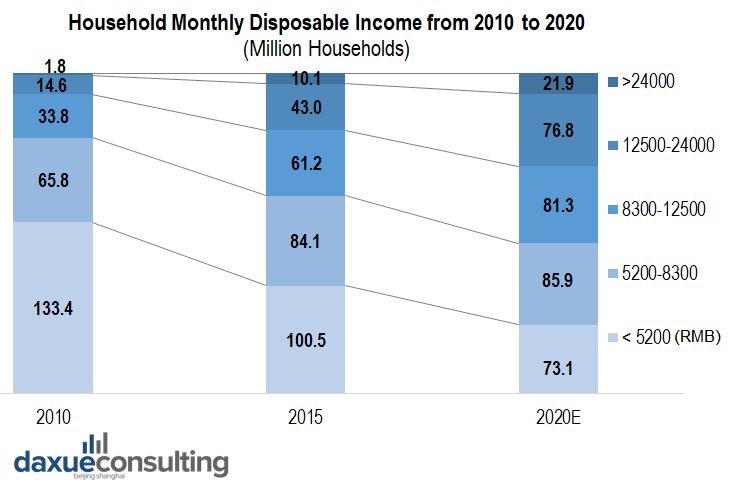

The Chinese GDP has seen an upwards trend from 2010 to 2019, maintaining a stable growth rate at around 10% from 2017 to 2019. The number of the wealthy class and the upper middle class in China are expected to rise, which is a sign to promote the consumption of jewelry. From 2015 to 2020, the number of the wealthiest class (more than 24,000 RMB monthly disposable income) has the highest growth rate, with a CAGR of 16.9%.

![China's GDP]](../wp-content/uploads/2020/06/daxue-consulting_Chinas-GDP.jpg)

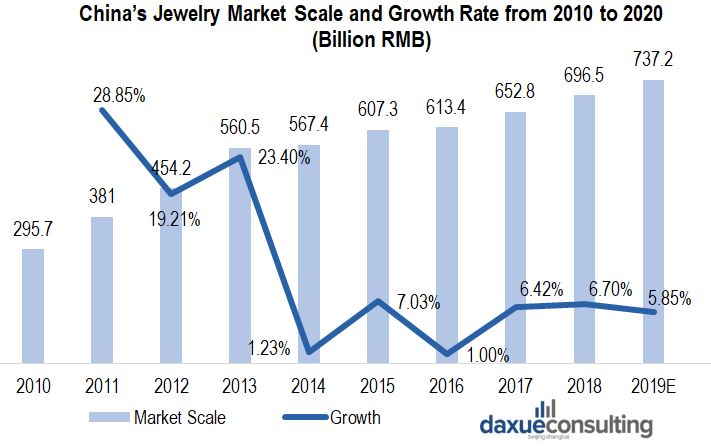

Correspondingly, from 2009 to 2015, China’s jewelry market saw an upward trend. However, in 2015, the industry revenue dropped by 9.12%, ending the six-year continuous growth. The downward trend in 2016 has eased in 2017, following a stable growing trend onward.

China’s fundamentals, including the growth of the middle and upper classes, and urbanization, remain strong and the government’s new fiscal policies, such as 13th Five-Year Plan, are expected to improve jewelry market conditions in the next few years.

These 8 trends shape China’s jewelry market

1. The luxury jewelry market is dominated by foreign brands

Players in China’s jewelry market could be divided into mainland companies, Hongkong-invested companies and foreign companies. Generally, products of foreign brands, such as Cartier, Van Cleef & Arpels, and Swarovski are priced higher than domestic brands. These luxury brands often have a longer history, and customers are willing to know the story behind the brand and each product series.

Chinese domestic jewelry companies are younger. Most of them have no more than a hundred-year history, and the price is more affordable. In recent years, with the Chinese economy’s recovery from the global recession, more young players, such as KEER, I DO, and Zbird have joined the market and expanded quickly.

Big companies such as Chow Tai Fook Group implement a multi-brands strategy, building high-end jewelry brand image. Jewelria, for example, is a brand of Chow Tai Fook group, targets high-income people, and only has stores in a few tier I cities, products of which are not accessible on the online shops.

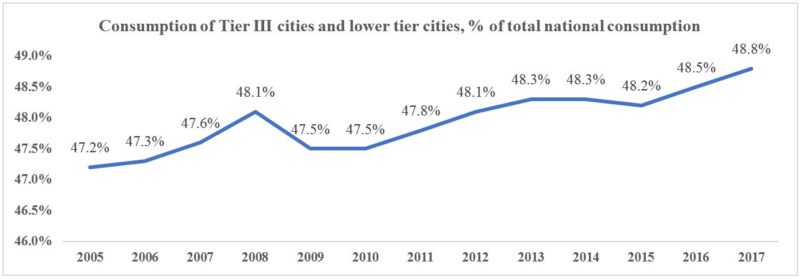

2. The geographic center of jewelry consumption is shifting downward

With demand in Tier 1 and Tier II cities reaching maturity, Tier III cities become a more important driver of growth and contributes the most value to China’s jewelry market.

The purchasing power of Tier II and III cities is increasing rapidly. Accordingly, the demand for jewelry is increasing, stimulating store expansion in lower-tier cities, especially for companies that implement both store franchising and self-operating models.

Source: China Industry Information

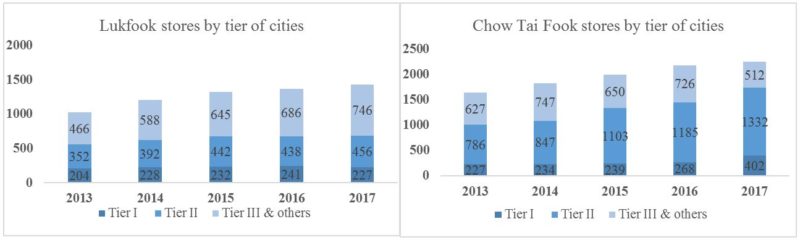

Lukfook and Chow Tai Fook are the two companies with the most stores in mainland China. In recent years, they focused more on expansion in Tier II, III and lower-tier cities in order to achieve a broader coverage, and accelerate authorizing franchise stores in these cities. These cities which experience higher economic growth are in general more resilient to global economic fluctuations and have seen rapid expansion in their jewelry markets. Cartier is also trying to expand carefully in Tier II cities, such as Chengdu and Nanjing.

However, the market in tier I cities is not shrinking, of course, so companies continued to upgrade the positioning and branding of Tier I and cities to cater to the sophisticated customers in these cities. Pandora, for example, retained all the operation of distributors in China to improve the purchase experience.

Demographically, population growth rate in tier III cities is higher than that in tier I and II and has doubled in recent 10 years. Population in tier III cities is 5 times more than that in Tier I. Because internet penetration rate of tier III and lower-tier cities is higher than before, people are more easily to be affected by KOLs when making a purchasing decision.

Source: Lukfook annual report, Chow Tai Fook annual report

3. Gold jewelry is the most popular, but tier I cities are reshaping the trend

China’s jewelry market can be segmented into three: gemstone jewelry, metal jewelry and other jewelry. Other jewelry could be made by Ceram, ivory, wood, etc. Although many jewelry companies have expanded their watch sectors, and watches are usually set diamond or other precious stones, watches are not considered a subcategory of jewelry.

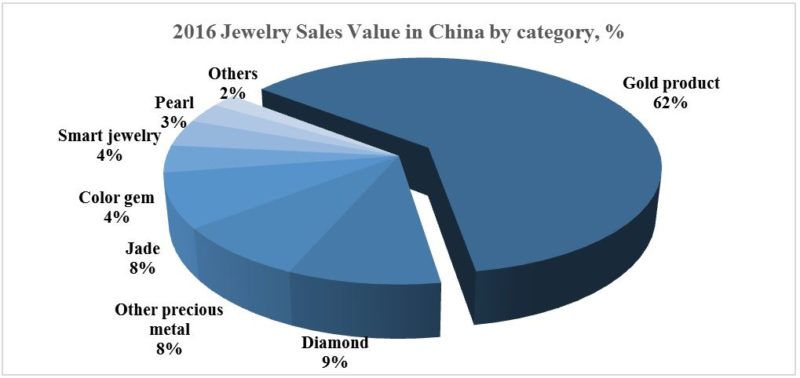

In the whole jewelry industry, gold products are the most popular category and accounts for more than a half of industry revenue, followed by diamond, jade, and other precious metal such as platinum and silver.

Source: Gems & Jewelry Trade Association of China

The revenue contribution proportion is the same in some companies. Chow Tai Fook, for example, gold products contribute the highest revenue of 57.4%.

Chow Tai Fook divided bridal jewelry into Chinese bridal and western bridal. Chinese bridal jewelry is usually made of 24-K gold. In northern China, there is a tradition that the bridegroom has to buy “three gold (三金)” for the bride, which contains a gold ring, gold necklace, and gold earrings.

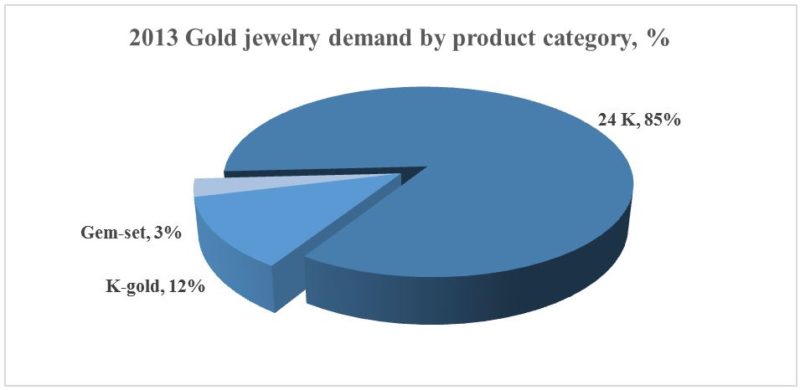

Image: Daxue Consulting

The Chinese market is dominated by plain, 24-carat products, which represent about 85% of the market by volume. This ‘pure gold’ jewelry (known as 足金 in Mandarin) is almost entirely sold by weight. Ships weigh the items chosen by their customers, multiply the fine weight in grams by the daily SGE spot price and then add a markup that incorporates the labor charge and a retail margin. The balance of the market is made up of 18 carat ( known as K金 in Mandarin) and gem-set products. A large share of the 18-carat market is for weddings bands, where ‘white gold’ provides strong competition for platinum.

Source: Precious Metals Insights

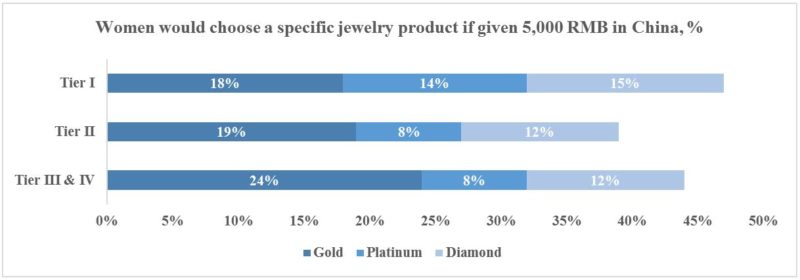

In recent years, gold jewelry has faced stiff competition from gem-set or other jewelry products in tier I cities. Only 18% of women in tier I cities would choose to buy gold jewelry when given 5,000 RMB, compared with 14% and 15% who would buy diamond or platinum jewelry respectively. However, this competition is not as fierce in lower-tier cities. Consumers in tier III and IV flock to buy high carat, heavy gold jewelry for wealth preservation purpose. Also, in tier I cities, there is a healthy market for 18-carat fashion jewelry, much of the upper end of which is imported Italian product.

Source: World Gold Council

Tier I cities are changing the shape of consumerism in China. Trends that start amongst these groups eventually filter through the consumer landscape.

4. Self-purchasing of non-bridal diamond jewelry pieces is growing

Bridal diamond jewelry may not be the foundation of the diamond jewelry industry

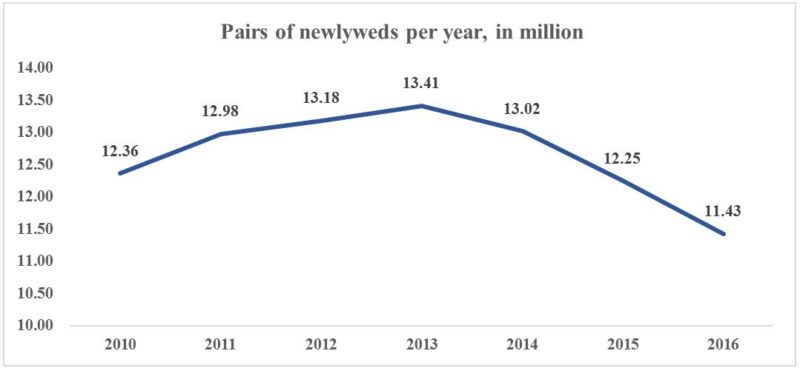

Wedding jewelry is traditionally the biggest part of jewelry consumption occasions, which contributes 32.1% and 39.2% total revenue of Chow Tai Fook in 2014 and 2015. Brands such as I DO and Darry Ring have always targeted in the bridal market.

However, in 2016, only 11.43 million Chinese couples registered for marriage, making it the third consecutive year the number has declined. Much of the marriage decline results from China’s one-child policy. Ended formally in January after 35 years, the policy accelerated a decline in the country’s birthrate. As a consequence, people between 20 and 29 – prime marrying age- make up a declining share of the population compared with two decades ago. Because families often preferred male babies, China has a surplus of men, further complicating marriage prospects.

Source: Ministry of Civil Affairs of PRC

With the decrease in demand for wedding jewelry, brands need to adjust the product line. Danish fashion jewelry manufacturer Pandora seems to quit this market. It has kept away from ‘love’ based promotion in China. Its advertisement has never shown the image of couples, which is thought to be old-fashioned and would discourage it from potential customers such as single women.

The Tmall store of Pandora presented many pictures with young ladies wearing its products. This differentiates this young jewelry brand from other traditional brands.

Image: Pandora Tmall flagship store

Products popular with Millennials and for female self-purchase are helping to spur growth.

While women’s desire to be given diamonds is still strong, women in China are more likely to buy diamonds for themselves. This is due to the growing number of working women. 25% of women in China are already earning more than their spouses, which is higher than that in the US.

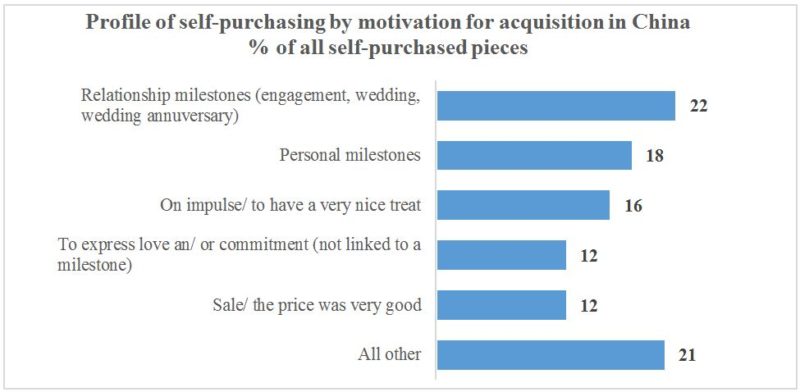

They often choose gifted jewelry themselves or have input into its selection. 26% of women receive diamonds for birthdays, with the exception of 18th and 20th birthdays when an even higher percentage of women receive diamonds. 27% of women buy diamond jewelry for no specific reason. Emotional drivers are particularly powerful in China, with the celebration of relationship and personal milestones topping the list, while this number in the US is among the last.

Source: De Beers Diamond Insight Report 2017

Millennials increasingly value everyday wear jewelry. Unlike wedding jewelry, jewelry for every day is a repeat purchasing opportunity. They also value experience over things, that’s why Pandora is so popular in China. Its Moment series bracelets provide over 600 different options in China for Chinese customers, launching new products in various celebrating days. Pandora remains a two-digit percent of annual revenue growth in mainland China since it entered China market officially in 2015.

Conventional domestic jewelry companies are also seeking to attract millennials. After-acquired Boston jewelry brand Hearts on Fire, Chow Tai Fook provides more products for young customers. Luk Fook provides gold jewelry in low purity, making the price more affordable.

People are trying jewelries on in Monologue shop, and most of them are young ladies. Monologue is another young brand of Chow Tai Fook, targeting millennials in a simple design and low price.

Image: Daxue Consulting

5. The digital market can’t be isolated from offline stores

Online shopping has effectively become a national pastime in China with approximately 77% of respondents picking it as their favorite leisure activity.

80% of consumers aged between 20 and 40 learned about gold and jewelry products through the internet and 60% of them had spent money on the internet. The proportion of spending on gold jewelry under RMB1,600 was 64%, while that on gold jewelry over 3,000RMB was 15% only. Currently, the products priced at around 1,000RMB are prevalent in the internet spending on gold jewelry, while the products priced under RMB2,000 are the major market for the internet spending on gem-set jewelry. Chow Tai Fook sets price range in their physical stores is 3,000-6,000RMB, whereas online it is 1,000-1,500RMB.

Almost all the main players in China have its own Tmall and JD stores. Besides, Wechat shop and Vip shop are the 2 platforms where people could reach jewelry products.

E-commerce player keeps rolling out offline stores

In the online market, jewelry companies’ biggest challenge is to inspire confidence in customers. Because of Chinese people purchasing preference, the business model of Blue Nile that provides diamond selections for customer online has no physical inventory and only procured from the supplier once a customer has made an online purchase will not succeed. Almost all the online shops of jewelry companies could locate the nearest offline shop for online visitors, inviting them to walk in and touch and feel jewelry. Even early e-commerce success players are rolling out offline shops these years.

One difference between e-commerce player and conventional players is the function of offline stores. For the former one, it has fewer offline stores: Kela (柯兰钻石) has 210 stores, and Zbird(钻石小鸟) has only 41 stores. These stores only have sample products and a few inventories. People can either place a digital order through in-store tablets or their own mobile device, or through the store directly, and they have to wait for products producing and shipping from Shenzhen, China’s biggest jewelry manufacturing and trading hub, where most jewelry manufactories are located in, including Kela and Zbird, for 5 to 20 days.

Zbird(钻石小鸟) successfully implements a B2C model into jewelry industry. Zbird is founded in 2002, before Alibaba had even launched Taobao, selling diamond rings and pendant on Eachnet, the first e-commerce platform in China, and only opened its first offline store in 2014.

Customers could select key components of diamond (i.e. Price, Cut, Color, Clarity, Carats)

Image: Zbird official website

However, for Zbird and Kela, most of their revenues come from offline stores: 80% for Zbird and 70% for Kela. Customers looking for engagement and wedding rings are more likely to actually buy the ring in the offline Store. Online customers tend to buy more personalized diamond jewelry like pendants, earrings, and other pieces that are less likely to require opinions from family members.

E-commerce and O2O interactions will continue to reshape the retail industry

Unlike e-commerce companies, conventional jewelry companies are trying to access customers as broad as possible. They focus on in-store experience and have more than one store in a city. Chow Tai Fook’s revenue from e-commerce platform accounts for 9.3% of the total. 11% for Lukfook, increased 97.4% from 2016, 77.7% of which comes from gold and platinum products

Chow Tai Fook levered on its extensive retail network paired with inventory unification system to collaborate with online platform partners and launched the online order distribution program in 2017, enabling its customers to enjoy jewelry deliveries directly from nearby POS in shorter delivery time.

WeChat is an efficient channel to communicate with customers

WeChat’s monthly active users sit at 1 billion as of Feb. 2018. Cartier was the first luxury jewelry brand to use WeChat moments ads. Relying on Tencent’s enormous database, the accurate delivery of the ads helped Cartier’s WeChat account gain a huge following.

From February sixth until Valentine’s Day of 2017, 150 limited editions “rose gold love bracelets” were available exclusively on Cartier’s WeChat online store. Each bracelet cost over RMB 30,000 and was on the more affordable end of its jewelry collection. The total 150 bracelets were sold out within a week on WeChat.

The purpose of this campaign was not to focus on the selling figures, but rather on showcasing Cartier’s premium-purchase experiences. Essentially, using hunger marketing resulted in raised brand awareness and increased desire from consumers.

Besides WeChat, Weibo and Douyin are also witness a joining of jewelry brands. Domestic jewelry brand I DO has 38 thousand fans on Douyin and is one of the most popular jewelry brands on it, compared with Chow Tai Fook’s mere 12 fans and KEER’s14 fans. The most popular videos of I DO are the promotional cuts off a group of celebrities, Nine Percent, that has presented its crossover perfume. The group member of this nine-member Chinses boy group formed by the survival show Idol Producer has at least 4 million fans on Weibo, 73 percent of which are young people aged under 23. Finally, this perfume contributes 4-million revenue to I DO. Recently, Chanel cooperated with Douyin, posting videos about its watch, gaining up to 73 thousand views.

Posters of I DO perfume presented by celebrities NINE PERCENT have covered the whole exit of Shanghai Xujiahui subway station.

Image: I DO Weibo account

Brands need an innovated form of advertising. The parent company of I DO, Hiersun Industrial Co., Ltd., founded its own film company, and plan to shoot a movie based on the idea of its I Do bridal jewelry. The same as Kela, whose parent company Gangtai Holding (Group) Co., Ltd has acquired an advertising company in 2015.

Without long history, domestic jewelry brands emphasize design and quality of raw material

Some high-end jewelry brands attract customers by telling brand stories, such as Cartier and Van Cleef & Arpels, and some young brand without such a long history could choose to endorse itself by strengthen its design, persist in social responsibility and others. Pandora strengthened its concern to Thailand workers, Shinning house (钻石世家) emphasizes donating to schools in rural areas.

Since Shanghai Diamond Exchange is the only transaction platform for import and export of diamonds in mainland China, most jewelry companies in China purchase processed diamond from it. However, some companies, such as Zbird, choose to sign purchase agreements with Antwerp Diamond Exchange and purchase processed diamonds from there.

Rather than purchasing processed and polished diamond, a few big players have ability to process diamond by themselves, vertically integrating their business model. Chow Tai Fook now purchases rough diamond from Alsora and Rio Tinto, and has 5 Jewelry Manufacturing Companies in mainland China, covering upstream raw material procurement, and rough diamond cutting and polishing, and midstream product development, manufacturing and quality assurance.

Cutting and polishing rough diamond allows Chow Tai Fook to secure the quality of diamond to be sold.

Image: GIA, Visit to Chow Tai Fook Diamond Cutting Factory in Foshan, China

6. There is still much room for jewelry for men and children

Limited male jewelry despite the strong demand, especially in tier I cities

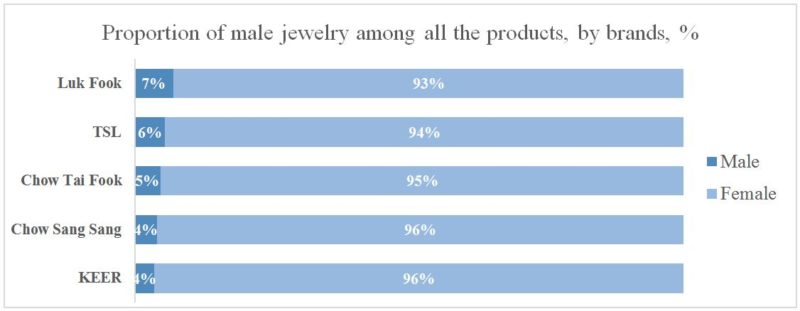

China’s jewelry market consumption is dominated by females. 63% of jewelry products are purchased by females, and this number would go up with an increase in unit price.

While the traditional women’s market is fiercely competitive, the male jewelry market is still in the early stage of its development. As well as traditional jewelry items, such as rings, the men’s market also includes such solely masculine items as tie clips, cufflinks, and belt buckles. The interest of mainland male consumers in jewelry products stems mainly from their taste for diamonds. Among Chinese males in the 30-44 age group, 67% wish to own diamonds. Compared with the relentless growth in overall demand, though, the development of the mainland male jewelry market is relatively slow.

Although jewelry brands more or less have some male jewelry products, the design is lack of innovation, and most of them are gold rings or bracelets. Diamond jewelry brands have only a couple of diamond rings for men.

Source: Data from brands’ Tmall flagship stores

Most male consumers bought jade and K-gold products, but the diversity of jewelry purchased would increase with the income of male. For high-income male consumers, they prefer amber, diamond, color stone and crystal, and are less interest in conventional jewelry such as jade and K-gold. Males in tier I and II cities contribute most of the revenues of jewelry for men.

Jewelry for children

In accordance with Chinese traditions, people give longevity locks, bracelets, and necklaces to children as goodwill tokes and as a way of wishing them a healthy and happy life. In particular, the kinds of gold jewelry items can be worn, but which also has an inflation-proof value, are the top choices among those parents who are skilled at managing finances.

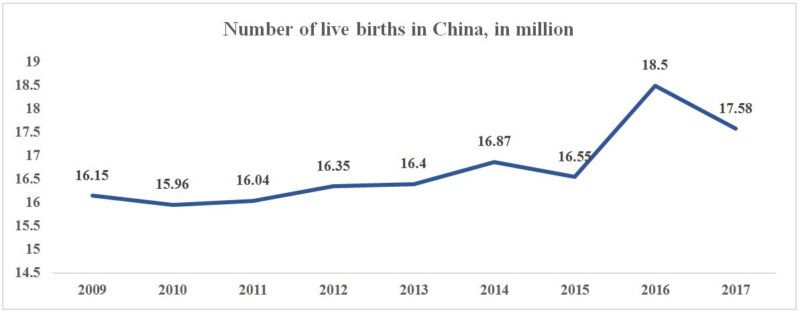

In December 2015, the two-child policy allowing Chinese couples to have two children was passed, and effective from January 2016.

Source: National Health and Family Planning Commission of the People’s Republic of China

In response to the implementation of this policy, many companies have introduced a variety of kids’ products. Lukfook, for example, launched an array of jewelry accessories featuring the Rilakkuma, a popular fictional character produced by a Japanese company, and the baby gift sets that came with the accessories invoking blessings for peace, safety and health as well as the exquisitely designed gift boxes. Chow Tai Fook also cooperated with Disney, Line, and Marvel, attracting parents to buy for their children.

Chow Tai Fook launched Minions series products, most of which are priced relatively low, compared with others, from 756 RMB to 948 RMB

Image: Chow Tai Fook e-shop

Besides images of cartoons, the twelve Chinese zodiac animals is also a theme of children jewelry. Parents believe that give children a gold or silver bracelet of their zodiac animal would keep bad luck away from their children.

7. Smart jewelry may be an opportunity

Totwoo, the first domestic smart jewelry company, has got 20-million series A round investment in 2016, used for developing new products and launching offline stores. It launched smart jewelry “We Bloom”, “We Bold”, and “Time Memory” in 2015. It has necklaces and bracelets, priced from 1,098 to 2,389RMB, and made of crystal set on silver or gold. The featured function is that two connected users can share their “virtual emotions” in real-time through the Totwoo APP to vibrate and light up, according to the reporter-turned Internet entrepreneur. Users can store their secret memories and receive alerts: “Take a break,” “Fitness Tracker” and “Incoming call.”

Conventional jewelry company Chow Tai Fook also invested in smart jewelry “Linklove”. It has vibrating, selfie shooting, and step tracking recording functions.

8. The second-hand jewelry market is at a beginning stage

Although the second-hand market is growing fast in China, especially for second-hand car, having over 10 e-platforms exclusively for the second-hand car business, second-hand jewelry seems to just at a beginning stage. Second-hand jewelry products could be traded in second-hand platforms that allows users sell things in various categories, such Xianyu, developed by Alibaba group, and Zhuanzhuan; or in platforms exclusively for luxury products, such as Zhier (只二) and Secoo (寺库).

Daxue Consulting can strategize your entry into China’s jewelry market

As a business intelligence authority in China, Daxue Consulting has a thorough understanding of China’s jewelry market and millennial spending habits and can help your company strategize a China market entry.

If you want to know more about China market strategy, do not hesitate to contact us at dx@daxueconsulting.com

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

![[Podcast] China Paradigm 45: Analyzing the market for colored gemstones in China](../wp-content/uploads/2019/06/gemstones-China-podcast-150x150.jpg)