Understand the drinking culture in China

Drinking culture in China: What are the Chinese preferences for alcoholic beverages?

Drinking culture in China is omnipresent in the daily life, during the dinners at home with friends or family, celebrations, holidays, casual get together, nights out on the town, business meeting and that, for a long time. Drinking culture in China is quite different from the drinking culture in the western countries. When you come to China, for business, pleasure or whatever it is important to know the rules of Chinese drinking etiquette.

At this time, in China, Chinese millennials, called “post-80s” (八零后) for those born after the 80s and “post-90s” (九零后) for those born after the 90s, account for around 30% of the Chinese population and are becoming the most important consumer group for the global economy. Among young consumers aged between 20 and 29 years old, 33% said they would increase their alcohol consumption in the future. Chinese millennials are shaking up drinking culture in China and are interested by trying new things and changing alcohol habits.

This analysis will show tips about the drinking culture in China, and exhibits the great opportunity for international spirits in China.

Contact us for any question on the Chinese market

Tips about Chinese drinking culture

Drinking culture is omnipresent in China

Drinking in China is an pervasive social ritual. Toasting is a very important on-going ritual in China and it happens very regularly especially at a formal banquet; the honoured guest returns the toast to the host, the host or the eldest person is expected to make the first toast.

- When Chinese people toast together, the person of a lower status should have the glass slightly lower than the other person.

- In China, drinking Baijiu is usually done when toasting with another person and nether alone.

- During business lunches, most of the time Chinese people toast with a glass of Baijiu that is said to bring luck. Baijiu is one of the most popular drinks in China, and it is the drink of choice for business dinners.

- When Chinese people are drinking together, they said “cheers”. Cheers in Chinese is Ganbei (干杯) which literally means “dry the glass”. With each toast carried you must empty your glass.

In China home and restaurant represent together 80% of the consumption of alcohol in China. In term of drinking occasion, it seems there is a shift when we jump generation. For the Chinese consumers between 35 and 44 years old, 53.2% of them would consume alcohol in restaurants, which has a strong connection with their affordability as well as the purpose of consumption (for business occasions). Still, clubs and bars are becoming a good leverage to reach younger consumer as about ¼ of 18-24 years old consumers and nearly 1/5 of 25-34 years old consumers enjoy these venues for consuming especially new and appealing kind of alcohol beverages.

While still a significant part of the drinking occasion are following traditional context and rules, in recent years, drinking in China has shifting to more purpose of experiencing culture, cultivating friendship, relaxing, and having fun. It is especially true in Chinese tier-1 and -2 cities.

Chinese consumers alcohol habits are changing

Chinese consumers are interested for discovery and novelty. 86% of Chinese millennials could change their habit and are ready to buy a bottle of wine they have never tasted. 72% of baby boomers expressed the same intention.

Millennials tend to choose their alcoholic beverages to express their identity and their personality. They are willing to pay for more exotic tastes, more than baby boomers.

Recent years also exhibited a growing trend for healthy consumption in China, also impacting this industry. Consumption of alcohol is changing and Chinese people want low alcohol and healthier drinks. Consumers are mainly young women. In response for the Chinese who want healthier drinks, Luzhou Laojiao Health has launched a campaign for healthy liquor products, among which an active and healthy liquor-ginseng wine containing ginseng as its raw material.

The trend of low-alcohol beer is also growing. This has led beer companies to reduce the level of alcohol while also trying to develop non-alcoholic beer (especially foreign beer groups). For young women consumers, beer giants such as InBev have developed non-alcoholic beer to meet the needs of female consumers.

Chinese government’s anti-corruption campaign

How did the sales of international spirits evolved following the 2012/2013 drop

In 2012, China launched an anti-corruption campaign. New measures formulated by the government, have particularly affected sales of high-end wines and international spirits.

alcoholic beverage group and the world’s second largest wine and spirits group, both French firm announced sales decline by 10% at the end of 2013.

France’s exports to the Asian markets (Southeast Asia, China and Japan) decreased respectively by 9.8% and 3.8% in volume and quantity.

Since 2012, due to the Chinese government’s anti-corruption campaign sales of Scotch whisky and Cognac in China have fallen. However, in 2014 Cognac was for the second consecutive year number one of exports, surpassing Wines and Champagne. Since 2015, millennials alcohol consumption in China has increased, leading to a slow recovery of the Cognac market in China.

In response to the new market conditions, Cognac producers had to adapt by launching middle-range bottles like cognacs Club (人头马俱乐部) or 1738 Accord Royal (人头马皇家礼赞) from Rémy Martin. Sold between 74 to 100 US dollars, these new bottles are much more accessible than the usual premium Louis XIII bottles from Rémy Martin (人头马路易十三).

In 2017 the importation of Cognac has shown a significant increase in China and surpassed the volumes imported in 2012. This is a new record for importation of Cognac in China, which became the second largest market for Cognac, behind the United States. January 2018 shows a growth of imports of Cognac in China of nearly 65% compared to January 2017, which suggests a growth that should continue in 2018, in order to meet the increasing demand in China.

Chinese millennials are more interested in international spirits

Increasing consumer demand for foreign beverages in China

The post 80s and post 90s are the biggest consumers of alcoholic beverages. Young Chinese consumers are increasingly willing to drink alcohol. Chinese millennials are more often drinking beer (91%), followed by wine (57%) and Baijiu (31%). Whiskey is also very appreciated.

- Yellow beers, white beers, dark beers are the most popular among Chinese consumers; beer from Germany has the largest market share with 52%.

- In 2013, Scottish distillery sold 16.7 million bottles of whiskey in Mainland China.

- When the Chinese government finally opened its doors to in 2013, the development of the agave industry reached an unprecedented level in China.

Imported wines are particularly popular, especially red wines because red is synonymous with joy, luck, happiness, and wealth to Chinese consumers. In 2016, the total of imported red wine in China was approximately 638 million litters, an increase of 15% from the previous year; the total amount was approximately 2.364 billion dollars, an increase of 16.3% over the previous year; the average price was 3.71 dollar per liter. In China, imported beverages are particularly popular among young people aged between 18 and 22 years old.

Contact us for any question on the Chinese market

Decline in popularity of Baijiu among youth

Credit: Timeout Beijing

Domestic alcoholic drinks in China, include with Tsingtao (青岛) and Harbin (哈尔滨) which are popular Chinese beer brands, and various Chinese liquors such as Baijiu (白酒).

Baijiu is a traditional fermented alcoholic drink originating in China, normally made from barley, corn, rice, wheat and sorghum. The most popular brand of Baijiu in China is Baijiu have high alcohol content (about 50%) and is enjoyed during family celebrations, business negotiations, holidays, and is offered when a foreign guest is present. Baijiu over 50 degrees represents 80% of sales in China, following a belief of high-quality associated with high-degree of alcohol. More and more Chinese are becoming more health conscious, and therefore, start to reduce their consumption of the traditional Baijiu, viewed as bad for health.

Moreover, we expect a shift of the trend for Baijiu led by new generation of consumers. According to Daxue Consulting research, 60.3% believe that Baijiu is not for young people, 56.3% believe that Baijiu will lose market share and 42.6% are less likely to drink Baijiu (白酒) mainly because of its bad taste, limited occasion of drinking, and its old fashion image.

Insight into China’s beer market from one of Daxue Consulting’s experienced project leaders

Mike Vinkenborg has conducted many projects in the beer industry in China. Through his experiences, he has not only grasped China’s craving for craft beer and the opportunities it brings for foreign brands, but he has also pinpointed the barriers that brands face when importing beer to China.

Foreign wines still on the rise in China

Chinese people show a great interest in foreign red wines

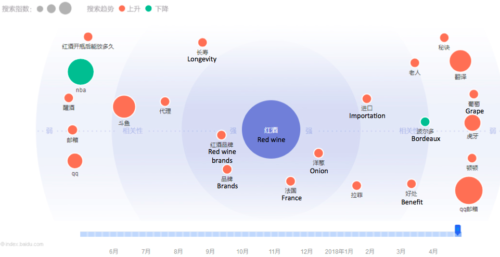

Main associated keywords: “Bordeaux” (波尔多), “Red wine brands” (红酒品牌), “France”(法国). Sourced from Baidu Index (百度指数) by Daxue Consulting.

The growing interest for red wine (红酒) can be observed on Baidu searching trends (Baidu is China’s Google). It can be noted that Chinese internet users have been searching red wine (红酒) more and more over the last 4 years. The main keywords associated for red wine are « Bordeaux » (« Red wine brands » (红酒品牌) and « France » (法国).

It shows that Chinese people are interest by foreign wines, and they would to know more about brands, and foreign wines. Wine companies pay more attention to Chinese Millennials under 28 years old which consume more and more foreign wines and try to promote their products according to their habits. Sales of imported wine are nearly six times higher than domestic wine.

Thibaud Andre, research project manager at Daxue Consulting, said « we know that the French wine brands are performing very well in China. France is the larger importer in term of volume for red wine. France is also mentioned as the first top-of-mind wine origin when it comes to quality of the production”. French wine has always been the first choice of Chinese consumers, but more and more people are starting to try wines from Italy, Germany, Australia or United States.

However, after years of development, domestic wines have been improving in terms of quality, showing a strong growth dynamic.

Italian sparkling wine had the largest share of volume imported to China

According to Daxue Consulting research, young Females users have significant more weight associated to sparkling wine (43%) than imported wine (30%), which prove a potential of growth for this market through this specific target segment.

Clubs and bars are becoming a good leverage to reach younger consumer as about ¼ of 18-24 years old consumers and nearly 1/5 of 25-34 years old consumers enjoy these venues for consuming, for instance, sparkling wine.

Italian sparkling wine had the largest share of volume imported to China with 6,065,019 litres and a total amount of sales of 16 million US dollar.

One of the mains trends of the results of the report shows that Chinese have a huge preference of international spirits and particularly Chinese millennials show a great interest in foreign wines.

Daxue Consulting has a robust background in the alcohol industry in China:

Our market research team has carried out projects for different clients overseas seeking to enter the Chinese wines market.

If you want to know more about wines industry in China or about drinking culture, do not hesitate to contact us at dx@daxueconsulting.com

Hi, I have been experimenting with baijiu for the last three months or so. Baijiu, pronounced “bye-joe” literally means “clear liquor,” is a category of at least a dozen Chinese liquors with a defining quality that is common to all premium baijiu is the ABV of 50% plus. Its a bit too strong and pungent for my palate. I have found it really is great as a cocktail mixer some brands more so than others. https://www.baijiublog.com/ has a good in-depth selection on cocktail recipes here https://www.baijiublog.com/baijiu-cocktails/#Baijiu-Cocktails-1

In my opinion it mixes better with citrus flavors but everyone has their own preferred taste. Enjoy!