The Chinese luxury market after COVID-19 survives through online channels

This decade, the Chinese luxury market growth was around 6% per year. However, it is now weakened by the coronavirus. The pandemic affects both demand and offer of the luxury industry. Some recent changes of the industry as digitalization help it to hold market share. Still, the important growth might come to an end. Is the Coronavirus just a short term crisis or a keystone for a new Chinese luxury market? It might be the opportunity for Chinese luxury brands to rise, whereas the European industry is down. First, we will take a look at the ups and downs of demand. Then we will discuss the opportunities in the Chinese luxury market after COVID-19

How COVID-19 is jeopardizing the Chinese luxury demand

Stores, missing parts of the luxury experience

Luxury companies closed their Chinese stores during the outbreak. Hence, it was nearly impossible to fulfill offline Chinese luxury demand. Buying online is not really an alternative to solve the situation because Chinese luxury consumers are not used to buy online according to the ROPO model. Bruno Pavlovsky, president of Chanel’s fashion activities stated: “You have to be able to touch the creations, it’s part of the experience.”. Even if consumers do a lot of research online to find luxury products, they ultimately purchase in offline stores. It is an experience to be in a magnificent flagship store to buy a product with the help of assistants. Also, it creates a desired prestigious image to exit shops with a luxury item in hand. COVID-19 forced luxury stores to close which impeded the fulfillment of Chinese luxury demand.

Will revenge purchase be enough?

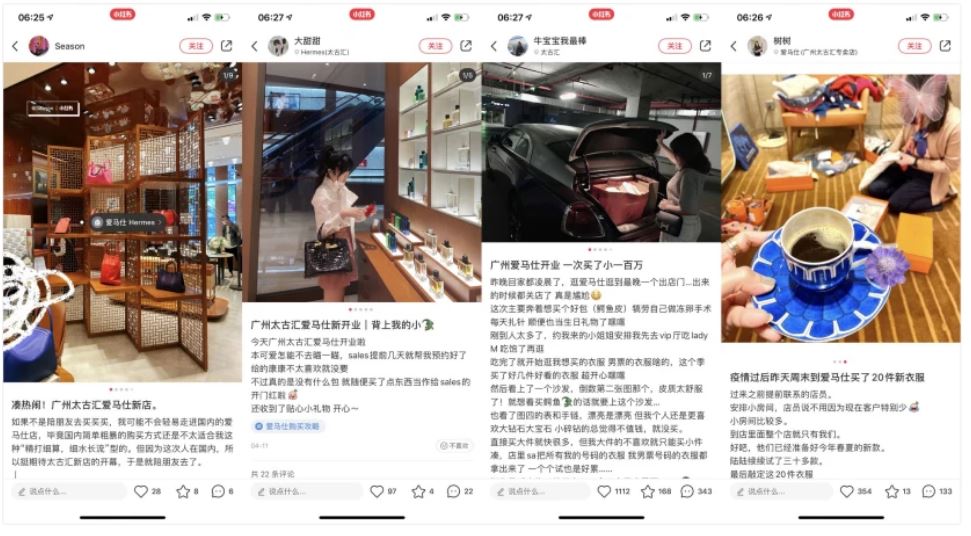

On Saturday April 11th 2020, the flagship store of Hermès in Guangzhou reopened. Within the day, the shop made 2.8 million USD of profit. Then, buyers post on social media their purchase. This phenomenon is call “revenge purchase” where purchasing provides happiness to consumers after a long period of quarantine.

Even if this example highlights a more positive situation for the Chinese luxury market after COVID-19, it is difficult to measure the impact of revenge purchase. Will it be enough to make up for lost profit? According to the consulting group Ruderfinnasia, Chinese luxury consumers will spend less on automobiles, watches, handbags and electronics in 2020. More than just a short period of closing for shops, COVID-19 might change the entire luxury consumption in the long term. Luxury brands should readjust their forecasts for 2020, even more if China is a vital area for them.

[Source: wwd.com – some revenge purchases quickly posted on social media]

The increasing weakness of Western luxury companies

The entire luxury industry has shut down

One of the main factors which impede the Chinese luxury market is having to shut down factories in Europe. Hermès had to close its factories to protect its employees. Coronavirus is impeding companies. Moreover, the virus affects subcontractors of the companies. For instance, China is producing sapphire crystal for the Swiss luxury watch industry. The entire production line is jeopardized. Even on the supply chain, trade exchanges had been slightly decreasing since February. The entire luxury offer is affected and is no longer able to fulfill the Chinese luxury demand.

Cancellation of useful marketing strategies

Luxury brands are hosting different events to improve their brand image or to present a new collection. For instance, Longines is the main sponsor of the horse grand prix “Longines masters” had been postponed. Prada and Chanel had also to cancel their fashion show. The coronavirus impacts the communication of luxury brand in China. They cannot anymore host events which increase their brand image or highlights their new collections. Still, the increasing digitalization in China gives alternatives in the Chinese luxury market after COVID-19.

Coronavirus brings more online opportunities

The rise of Chinese luxury brands

In April 2019, Chinese industry is recovering, whereas European production is still shut down. It might be the right moment for Chinese luxury brands to rise. Since they produce directly in the country, they can fulfill the Chinese luxury demand quickly. Icicle, a Chinese brand producing clothes created in 1997, has environmental compliance is one of their key-values. Another example, the brand Herborist which specializes in skincare. Created in the beginning of the 20th century, the brand recently made a shift in its brand image to appear more modern. We are brought to a new are of the Chinese luxury market after COVID-19, where the top brands are domestic.

Digitalization, dodging the deficiencies of reality

Even if luxury brands had to cancel some marketing strategies, digitalization allows them to continue mass communication upon customers. According to Bain consulting, digitalization is the new keystone of luxury brands. Companies doubled their digital marketing budget from 35% in 2015 to 70% in 2018. They work more and more with influencers (key opinion leaders) on social media. For instance, Cartier worked with Chinese movie star Lu Han in 2016. The brand launched a communication campaign to increase the masculine jewelry. Influencers have a real influence upon Chinese luxury consumers. They work online which is an asset during the coronavirus, everyone even at home can watch their contents.

Moreover, luxury companies still continue to present their products with digital events. In April 2020, the event watch and wonders took place online. Luxury watch brands were able to present new products. Cartier launches a new version of its famous tank watch.

Even if the Coronavirus forced brands to cancel some events, the digitalization allows luxury companies to communicate with their consumers and continue their marketing strategies on the Chinese luxury market.

[Source: Watches and wonders website – Brands new products on the main page]

Thus, despite the decreased demand, some opportunities appeared on the Chinese luxury market both for digital events and for Chinese luxury brands. European luxury brand will face a difficult year and revenge purchase will not be enough to recover. Still, they remain highly popular in China and hold a strong brand image which appeal consumers in the country.

Author: Enzio Cacciotto

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast