Is the beer market in China getting craftier? | Daxue Consulting

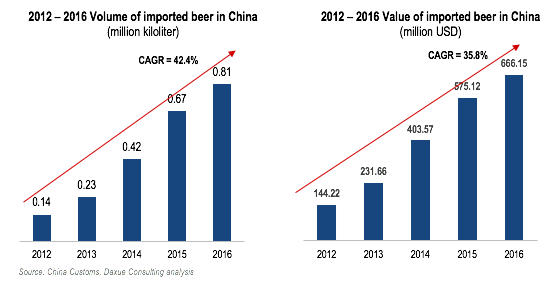

Beer imports in the last 5 years have risen with the Chinese market showing growth in both volume and value. In 2016 alone, 0.81 million kiloliters of imported beer were sold illustrating the progression from 2012 with a compound annual growth rate (CAGR) of 42.2%. Moreover, the imported beer market in China has reached 666.15 million US dollars increasing by 35.8% compared with 5 years ago. The fast development of the Chinese beer market is largely due to its small size, notwithstanding the increasing demand for this sector. In comparison to domestic beer, imported beer still remains a niche within the Chinese market. This is further illustrated with a slower CAGR in terms of volume suggesting that the price of beer has been going down in recent years making imported beer more competitive with local Chinese products.

Growing popularity and awareness of Craft beer in China

Craft beer has become more popular as Chinese consumers gain more awareness of foreign products. For craft beer alone, a couple of years ago the segment only made up 0.3% of the total beer consumption in China. Since then, however, this percentage has risen to about 5% with Darren Guo an organizer of the Craft Beer of China Exhibition expecting to see a 30% growth in the beer market until 2020 attributing it to the still developing beer culture. This growth is likely to due to millennial interest in searching online to find new products. This is seen as online searches of craft beer are mainly being done in the coastal cities with 50% of search volume coming from those between 20 to 40 years old. The main target for craft beer is often millennial Chinese consumers with this group being highly connected to the internet as they shop among several popular e-commerce platforms curious to discover new products. Moreover, this group is part of the burgeoning middle class which has made craft beer more popular with their willingness to pay more for premium experiences. Online platforms help better facilitate this with the separation of imported and local products making these products standout to consumers.

Further, despite the lower price gap between some foreign and local products, there are still international brands following premiumization trends. This is seen with many Chinese brands struggling with the shift to premium drinks with Snow, Tsingtao and Yanjing dropping in sales volume. This is as younger and more affluent consumers switch to more premium drinks over value for money in order to look more ‘unique’ and ‘cool’ to their peers. Particularly, Heineken has increased its strength with its more expensive offerings. This is along with Panda Brew whose sale of distinctly flavoured brews has tripled since its establishment in 2013 with his products in more than 60 cities. This need for brand recognition and products that provide social value is also driving the development of craft beer within China’s alcoholic beverage industry.

The beer market in China: Consumption habits

When consumers purchase beer to drink at home, the main channels are still grocery stores, shopping malls and supermarkets. This is as grocery stores take advantage of geographical location and tend to satisfy customer’s desire to impulse buy and consume beer. In comparison, supermarkets are mainly based on planned consumption and this trend is particularly seen in the northern regions. Dining channels also take up a large portion of the total consumption with family occasions being the exception to this. Further, data from Katar also states that those from first or second tier cities in China tend to purchase beer at KTV (Karaoke), cinemas, restaurants and convenience stores. This is with restaurants taking up to 50% of the total sales volume and with KTV and bars remaining the main channel for higher-end beer purchases.

Drinking culture in China: Taste preferences

The craft beer flavour is new and not largely spread across the Chinese population. This is as craft beers are stronger, with a higher volume of alcohol and a more bitter taste. The main Chinese consumers targeted by craft beer brands are those in urban growing middle to upper class. These consumers are more willing to try new products and don’t mind paying more in order to do so. However, most Chinese consumers traditionally prefer weak and sweeter flavoured beers which are refreshing and easily drunk during lunch and dinner. These beers are cheaper than their foreign counterparts and are easily consumed by Chinese across all income levels and all parts of China. The brands that are more popular tend to be lighter and closer to Chinese beer flavours, refreshing and easily drinkable. This is in order to match the mass-market taste as lighter beers are more popular in China with the brand Qingdao being an example of this. Brands with a strong identity and taste which differ to these mainstream beers also stand out in the niche market.

An example of this is Trappistes Rochefort, a Belgium brewing company, which offers a darker beer often sold in multi-brand shops with a higher volume of alcohol content at 11.3%. This brand is available in China and describes itself as a ‘brown ale’ and is appreciated by those with ‘more discerning palates’ further emphasizing its differences in the market.

Off and on-trade in the Chinese beer market

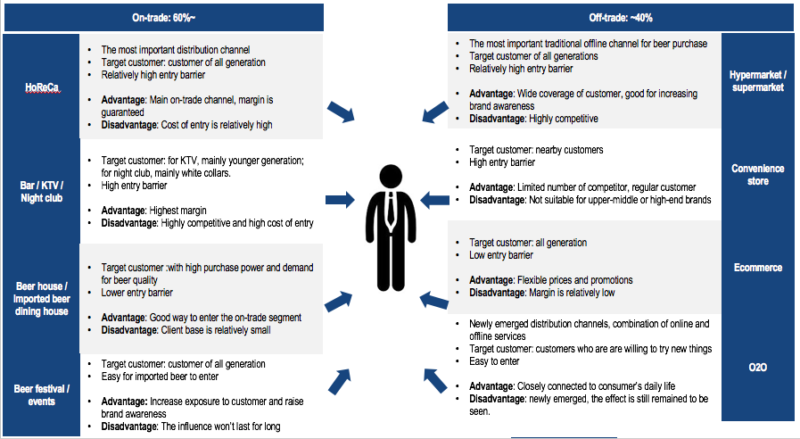

There are diverse possibilities available in order to sell craft beer in the Chinese market which includes methods that are both on-trade and off-trade. Particularly, online alcohol sales are forecasted to be promising in the future especially as the market share of online purchases is predicted to increasingly erode the proportion of offline sales in the Chinese market. However, sales in the off-trade market have grown swiftly over recent years, as the fast development of online sales and the trend of consumers enjoying their beer at home both individually and socially.

On-trade is worth 60% of imported beer distribution in China. The on-trade channel includes HoReCa, KTV, nightclubs, bars, beer houses and imported beer dining houses along with beer festivals and events. In comparison, off-trade deals with both on and offline channels including hypermarkets and supermarkets, convenience stores, E-commerce and 020.

Distribution channels for targeting those with interest in new products in the Chinese beer market

Recently imported beer has been deeply promoted in Chinese hypermarkets, supermarkets and e-commerce, with the average price dropping by 18% during the past three years. The price gap between imported and domestically produced beer is increasingly becoming smaller with foreign brands changing their price from 20RMB to 15RMB a liter. The direct competition between imported and domestically produced beer is unavoidable. However, a price should be considered less of an obstacle with the reduction bringing foreign brands closer to domestic competitors for the more common products. There still remains a greater price difference for higher quality products with those in the growing middle class in tier 1 and 2 cities willing to pay the fee for more premium products.

Imported beer consumption in China: E-commerce

E-commerce is very popular with Chinese consumers looking for imported beer products. Specifically, there are three types of shopping avenues that are more popular and targeted to consumers. Horizontal e-commerce platforms sell larger quantities of imported products in particular categories which allow Chinese to efficiently find what they need. Vertical platforms, in comparison, are usually niche and are dedicated to a more educated and targeted audience especially if the brand is more well known. Examples of horizontal platforms include Tmall, JD and Tmall Global, whereas vertical platforms include Jiuxian and ichinabeer.

Cross-border channels, which is a way of shopping online to buy foreign brands directly, are also another method for businesses in the Chinese market to use. This channel is especially beneficial for international companies when entering the market in order to test the market’s reaction to the products itself. Cross-border method also has tax advantages for foreign brands as sellers can sell products cheaper than some of the goods available in the domestic market. This bypasses the taxes that apply selling products physically thereby making this very desirable for international brands seeking to enter the Chinese market.

E-commerce can be utilized to reach all over China, but for craft beer, this channel is more effective when focusing specifically on urban areas. This is as most rural areas have a lower awareness of niche products. Targeting this way, as a result, better includes and hones in on Chinese millennial consumers who are living in urban areas of tier 1 to tier 3 cities.

Beer distribution in China: Hotels and restaurants

In terms of hotels and restaurants, there is a distinction between traditional Chinese channels and western premium channels. This is as traditional Chinese hotels and restaurants mostly serve mass-consumption beer, with big bottles of local brands generally about 600ml in volume. In comparison, western-style and premium luxury institutions serve high-end products including craft beer which can be an expensive drink. Examples of distribution channels for this category include international hotels with bars with business or high-end positioning or mid-range western restaurants in tier 1 cities. The targeted areas include mostly tier 1 and 2 cities with Chinese and foreigners as consumers from the ages of 20 to 50 years old in urban areas who have knowledge of and are interested in craft beer.

Chinese interested in craft beers: Bars and breweries

Bars and breweries with a large selection of imported beers are flourishing the past few years in the main tier 1 cities. With a larger audience of foreigners and Chinese interested in craft beers, the best way to attract them is to offer imported products that are difficult or are hardly found in other places. Dedicated imported beer bars such as beer89 in Beijing, Beer lady in Shanghai are examples of these. Breweries and sports bars such as the Great Leap Brewing are also an example of this, with a large selection of beers available. Those who usually go to these places are Chinese and foreigners between the ages of 20 to 40 years old in urban areas with beer interests.

China’s alcoholic beverage industry: Offline events

Source: That’s Qingdao

Beer festivals, food and beverage events, imported products fairs. There are plenty of small events to larger fairs where craft beer brands and producers promote and sell their products. Sponsoring events with high participation of the target market, here being mostly millennials from ages 20 to 35 years old, is also a good way to promote brands to consumers in tier 1 cities with an interest in social events. They are more likely to attend summer festivals or events such as the Qingdao beer festival as well as Oktoberfest which takes place in several tiers 1 cities.

2018 best sellers for craft beer in China

The top 4 results on Tmall from October 2018 for the volume of sales online under the category ‘craft beer transported products’ were Corona, Hoegaarden, a mix of Belgium craft beers as well as Trappistes Rochefort. On Tmall these top 4 results show a variety of imported products where consumers can purchase items either individually or in a group in order to try a greater variety of imported products.

Corona is the most popular craft beer imported product. This is with it selling a bottle at 20RMB for a 330ml bottle. It sells in a glass bottle with several sizes available and is imported from Mexico with a self-owned shop on Tmall. In October 2018 the number of sales on Tmall was 2216.

Hoegaarden was the second most popular based on the volume of sales online. It sells one product at 17.5 RMB for a 500ml can. The brands packaging comes in both cans and also glass bottles which are available for other products. The product is imported from South Korea which is the production place and has a self-owned shop on Tmall. In October 2018 the number of sales on Tmall was 1422.

A Mix of Belgium craft beers was the third most sold with 302 sales on Tmall in October 2018. These products sell at 14 RMB a bottle which can be from 330ml to 500ml in volume and are imported from Belgium. The online shop is a multi-brand craft imported beer shop on Tmall and often sell several bundles of different brands suggesting trials of different types of beers and brand packages.

The fourth most sold craft beer is Trappistes Rochefort selling which sold 265 products on Tmall in October 2018. The products sell for 17.5 RMB for 330ml bottles and are imported from Belgium. The online shop has multiple brands of craft imported beer products with several bundles of different brands also trying to get customers to try different types of beers and brand packages.

Beer preferences evident through Chinese consumer buying practices

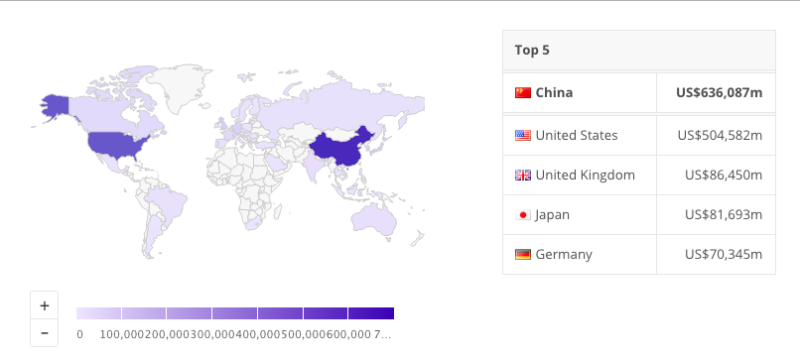

E-commerce has become increasingly more important in China with the market amount equaling $636,087 million US dollars. Chinese E-commerce is the largest in the world with it expecting to grow even further to a market volume of $1,086,111 million by 2023. Of this, Tmall is the largest E-commerce platform in China with 52% of the market share. When searching on Tmall for ‘craft beer’, an analysis of the first page ‘popular products’ provides insight into Chinese consumer preferences and trends.

Source: Statista

A trend that is evident is the prevalence of multi-brand stores. Multi-brand stores are a good opportunity for a new brand in China with limited cost and visibility thanks to packing offers. To do this, small craft beer brands are sold in multi-brand craft beer shops with the most popular products are bundles of different beers from the same or different brands. Further, this is beneficial as when gathering several brands, shops have more resources to promote themselves. In comparison, many famous international famous brands have their own self-owned shop with a large number of products being sold from this platform.

In terms of packaging, glass bottles tend to be more popular. For high-end products, this packaging is more suitable and is seen on more imported beer which is thought to be premium and higher quality. An analysis of 60 products showed that only 23% of products were offered in cans (14 out of 60).

To keep the premium image of products, small brands do not discount products while international brands which are already popular in China tend to give discounts. This applies especially on 11/11 which is one of the more important shopping festivals for China and is similar to Black Friday. In order to create awareness for craft beer brands, special packs for 6 or 12 different brands in order for consumers to try new products. It is especially good for smaller brands trying to create awareness.

Craft beer conferences in Mainland China

Conferences are also very useful for foreign organizations looking to enter the Chinese market. This is as foreign brands can collect useful contacts as well as get acquainted with the trends of the beer market in China. Particularly, the Craft Beer China Conference & Exhibition 2019 run by NürnbergMesse China along with the Beer Link and the China Light Industry Machinery Association provides insight into the craft beer market. This event includes experts talking about brewing technology, insights into operations, brand management methods, e-commerce platforms, investment institutions and marketing channels among other topics which are of interest to those in the craft beer industry.

Free Trade Zone Development in China helping international businesses

In China, the recent development of the Free Trade Zone Development (FTZ) has made doing business in China easier with favourable policies for cross-border trade. This is seen with the simplification of clearance procedures which shortens clearance time and lowers cost for importers. This is especially good news for international brands trying to enter the market. There are four provinces that have set up Free Trades Zones including Shanghai,Tianjin, Fujian and Guangdong which all have their own rules. In particular, Xiamen is especially of note with one of the largest beer ports due to its favourable policy towards importers which allows beer importers to save 2,000 RMB per cabinet.

Opportunities for foreign brands wanting to enter the Chinese beer market

Over the past 5 years, there has been fast growth in the imported beer market in terms of volume and value. The slowdown of the Chinese economy has had a limited impact on the imported beer market. Further, the consumption of imported beer in China is likely to grow due to the rise of the middle-class population and the correspondingly more westernized dietary habits and interest in beer culture. This is evident as these middle-class consumers situated in urban areas tend to demand higher quality and prestige beer. The number of consumers in the upper middle class in urban areas is expected to grow from 36 million to 192 million in 2022. Moreover, the overall demand for beer from in 2020 is expected to reach 49 million kilolitres. These consumers with higher incomes have higher living standards and a demand for higher-end products. Further, the development of simplified procedures through Free Trade Zones have further facilitated beer imports making it easier for those wanting to enter the Chinese market. As such, craft beer is likely to see an expansion in the future and provides a plethora of opportunity to those who want to enter China’s alcoholic beverage industry.

A blind tasting is a great test to check how customers react without knowing the brand. One of the main goals is getting objective data-collection and unbiased preferences. Daxue Consulting can help you to get precise of view where your beer brand stands from a user’s point of view.

![[Podcast] China Paradigm 41: How to start a trendy wine chain in China](../wp-content/uploads/2019/05/Podcast-wine-chain-China-150x150.jpg)