The sports market in China

Although the Chinese have their favorite traditional sports like table tennis and badminton, the sports market in China is becoming in rich with a variety of activities.

[Source: La Croix, China’s team at Olympic Games in 2016]

The most influential sports in China

Some sports have a particularly high media profile and influence among the Chinese population. The West still very often associates China with martial arts, but some sports are today real political, identity and economic vectors. Among the most influential sports: tennis table and badminton are loved by Chinese and are regarded as national games. Additionally, China has a history of success in these sports during the Olympic Games. Traditionally western sports such as basketball and football are becoming more common in China.

Columbia, The north face, Camel, Toread: the outdoor kit brand market is booming

The sports market in China has evolved. With the growth of national income and increase of living standard, Chinese people started to turn to outdoor sports like hiking, camping, climbing, skiing and skating. According to a marketing survey, market share of outdoor sports increased dramatically. As of 2020, most foreign brands have entered China and occupied about 70% share of the Chinese outdoor gear market, but the homegrown brands have sprung up since 2014. The same year, the number of domestic Chinese brands rose by 46 to 504, including 354 core brands such as Toread, MobiGarden, Sanfo Outdoors, Camel and Kolumb. There are four specialized outdoor sport brands among top 20, they are respectively Columbia, The north face, Camel, Toread. On the other hand, local brands performed well and made good results on the outdoor sports, for instance, Toread’s market share has reached 8.7% in 2016 and was put into the top 3 brands.

[Source: Daxue Consulting, outdoor sports department at Decathlon in China]

A new enthusiasm for extreme sports in China

China’s urban youth are proving to be increasingly thrill-seeking. Extreme sports include skydiving, skateboarding, BMX including some disciplines that are considered an Olympic sport.

Unknown until recently, extreme sports are now seducing the middle class. Whereas leisure sports were previously reserved for the wealthy classes, who alone had the financial means to buy the right equipment – the Chinese middle class has access to them in turn with the increase in purchasing power. In order to meet consumer demand, China relies on major foreign brands Nike, Adidas, Puma for apparel, and Decathlon for mass distribution.

The sports market in China is supported by the Chinese government

China is investing heavily in sports infrastructure. For example, China aims to create nearly 500 ski resorts by 2022 and 600,000 football pitches by 2025. The government is also encouraging private investment, particularly in events, equipment and trade in products and services. Alibaba, the Chinese e-commerce giant, thus launched its subsidiary Alisport in 2015 to develop activities of broadcasting and organization of sports events and ticketing. After hosting the 2008 Olympic Games in Beijing, sports industrialists are ready to host the next Winter Games in 2022. And for good reason, with its ski resorts and 300 million potential skiers, China represents a gigantic market. The sports market in China in terms of economy is exploding and represents tremendous opportunities for international brands. China has the most potential sports market in the world for its huge consumer base.

[Source: Variety, Beijing to Host 2022 Winter Olympic Games]

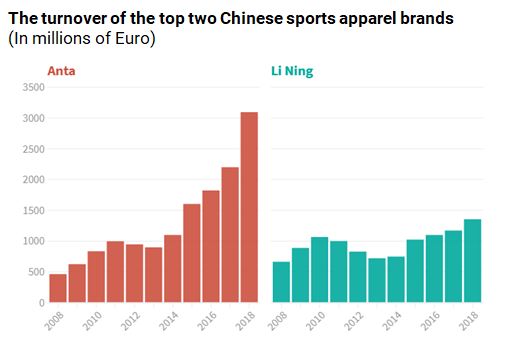

Local Chinese brands outperform European brands

Founded in the 1990s, the two Chinese brands Anta and Li-ning are benefiting from the popularity of sport in China and the renewed patriotism of Chinese consumers. After some difficult years, the sports equipment manufacturer Li-ning has bounced back to the point of being able to gain market shares. It also applies for Anta which reached the Top 3 of biggest manufacturers. Although these two brands are unknown worldwide and mainly sold in China, some specialists believe that Anta could overtake Nike in China within the next five years. With a 15% share of a Chinese market estimated at 43 billion dollars by Euromonitor, Anta is third on the podium behind Adidas (20%) and Nike (23%). Li Ning has a 6% share according to Bloomberg.

[Source: Bloomberg, Anta’s and Li-ning turnover evolution]

As the official partner of the 2022 Winter Olympic Games in China, Anta has just acquired the Finnish company, Amer Sports, for 5.2 million euros. The company specializes in mountain sports, with the brands Salomon, Atomic, Arc’teryx and Wilson tennis rackets. Thus Anta has become the eader in winter sports equipment in China and in the world. The brand sponsors the largest number of the most popular sportsmen and women in China. Anta’s sales, the strongest of the duo have grown by 80% in two and a half years and are expected to reach 32 billion yuan this year. Even if these results are not enough to counter Nike and Adidas, the brand is in the Top 5 of the biggest sports equipment manufacturers, alongside Puma.

The increase is not as similar for Li-ning but the brand managed to bounce back. After accumulating strategic errors (slogan change, bad pricing strategy, overcrowded stores…) and seeing its sales drop, the brand has taken a new turn. From now on, Li-ning sponsors Chinese sportsmen and women and participates to Fashion Weeks by mixing sport and fashion. The good economic health of local sports brands is the result of several factors: the increase in the number of consumers taking up sport, the rise in the quality of Chinese products, the boycott of American products due to the economic war and the organization of major international events at home as well.

Adidas, Nike, Puma: industry giants threatened by U.S. sanctions

The sports market in China is a key market for Adidas, Nike and Puma because the country accounts for a large chunk of the companies’ sales and also serves them as a major producer. Jordan brand, a secondary line of Nike, is devoted to developing basketball shoes. It not simply produces shoes but artworks and even souvenirs in the eyes of NBA basketball fans. It also applies for Adidas and Puma who are looking to establish themselves on the sports equipment market in China.

However, Puma’s performance in China market is not so outstanding compared with the previous two giants. Nevertheless, things have changed since the US-led trade war against China. President Trump’s trade war has increased tariffs by 25% on sport equipment in China and threatens to extend these duties to almost all Chinese products imported into the United States. Added to this the boycott of American products by Chinese consumers, which will result in a drop in sales. The sports market in China could be strongly impacted by these policy measures.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes