New technology drives the Consumer Electronics Market in China

Consumer electronics refers to any electronic device that people use in everyday life. This includes televisions, cameras, headphones, tablets, smartphones and many other home products. The consumer electronics market in China is a huge sector of China’s e-commerce market, with Apple being one of the most popular foreign brands among Chinese millennials. According to GfK retail, the online share of computers, communications, and consumer electronics sales in China reached over 30 percent in the first half of 2018. With the growing middle class, the number of users in the consumer electronics market in China has increased significantly.

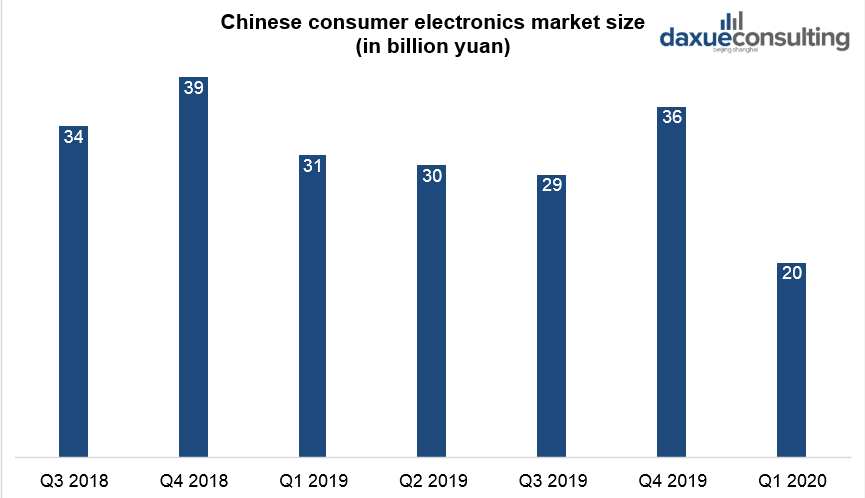

In 2018-2019 the quarterly market size of consumer electronics was around 30 billion yuan. However, in the first quarter of 2020 during the COVID-19 outbreak, Chinese consumer electronics market size dropped to approximately 20.9 billion yuan.

Data Source: Statista, Chinese consumer electronics market size

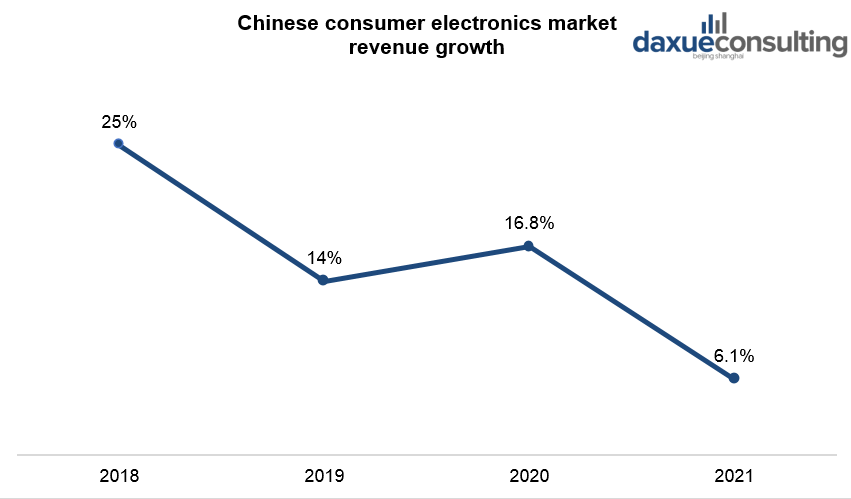

The COVID-19 outbreak in China had a great impact on the Chinese consumer electronics market in China. Forecast predicts it will see a decline in revenue growth from 16.8% in 2020 to 6.1% in 2021.

Data Source: Statista, Chinese consumer electronics market revenue growth

Smart technologies drive the growth of the consumer electronics market in China

The popularity of AI in China has brought new development opportunities to the consumer electronics market in China. In the next decade, smart homes and IoTs (Internet of Things) will be a huge development opportunity for manufacturers.

For example, the domestic smart connected room air-conditioner market in China is expected to grow from 4.1 million units in 2015 to 37.6 million units in 2020. Midea Group and Haier Group are leaders in domestic smart room air-conditioner market. Both these leaders are expanding product sectors of smart room air-conditioners this year.

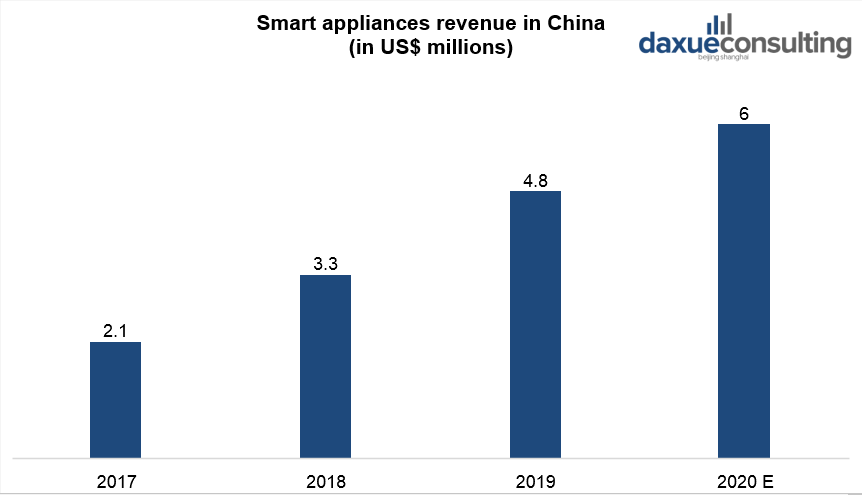

At the same time, the revenue of smart home appliances in China is growing. In 2017 it accounted for US$ 2 million, when in 2019 it increased twice to almost US$ 5 million.

Data Source: Statista, Smart appliances revenue in China

The growth of the consumer electronics market in China is partly due to government policies

It is quite unique that policies and regulations that the government promulgated play a critical role in the development of the consumer electronics market. As of 2011, China is the world’s largest market for personal computers. In 2013, the Chinese government issued 5G licenses, marking the beginning of a new era in China’s high-speed mobile network. China Telecom promised to create 300,000 5G base stations by the end of 2020. The operator, which is taking part in a 5G network share with China Unicom, deployed 40,000 of its own base stations by the end of 2019. That reflected a RMB 9.3 billion investment in 5G networks in 2019.

2019 was a booming year for e-commerce. China raised the limit on cross-border online purchases, as well as expanded its list of duty-free goods. The government raised the annual quota on cross-border e-commerce purchases for individual buyers from 20,000 to 26,000 yuan. The limit on a single transaction was raised from 2,000 to 5,000 yuan or $723 dollars.

Growing consumption of consumer electronics requires new technologies

The rise of domestic manufacturers: Huawei, the leading provider of consumer electronics

When it comes to the best domestic mobile phone brand, many people will think of Huawei. Since 2017, Huawei continues to maintain leading position in China’s smartphone market, with a year-on-year increase of 23.4%.

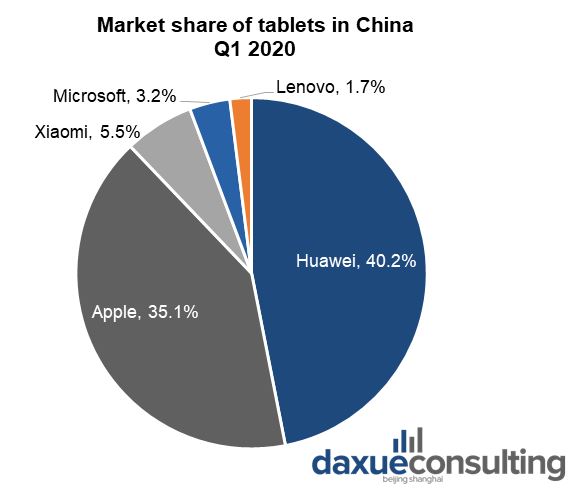

According to GfK, as of the end of February 2020, the market share of Huawei Tablets was approximately 46%. In addition, since 2019, Huawei has surpassed the Apple iPad for the first time in the Chinese tablet market. It has continued to expand the gap with the Apple iPad. In 2020 Huawei grabbed 40.2% of the domestic market, up from 33.9% a year earlier. Its overall unit shipments rose about 1% to 30.1 million.

Data Source: Statista, Market share of tablets in China

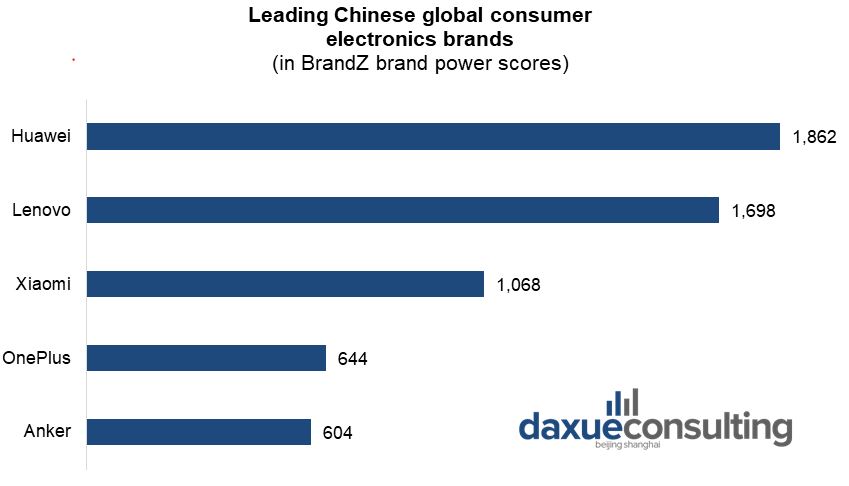

Lenovo, Huawei and Xiaomi go global

Consumer Electronics remains by far the best performing category in the electronics market in China, dominated by brands such as Lenovo, Huawei and Xiaomi in China.

David Roth, Chairman of BAV Group commented: “The companies behind China’s brands are taking a more active role on the world stage. They are increasingly shaping the conversation at a category level, as well as helping to support economic growth in developing markets in many ways, not least by investing in infrastructure”.

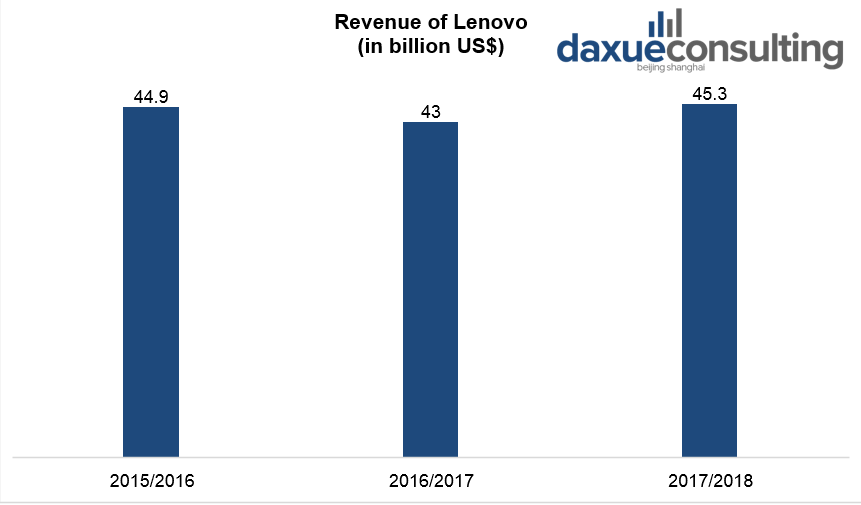

Lenovo

Lenovo holds 24.4 percent of the global PC market, sustaining its position as the worldwide #1 in PCs. Growth came from premium categories, including Workstations, Thin and Light PCs, Visuals and Gaming PCs. They all had double-digit sales volume growth year-on-year. In North America Lenovo moved up two places in the industry rankings from the previous quarter to number four. In addition, revenue continues to outgrow the market with profit continuing to improve. Going forward, Lenovo will continue its investment in its mobile business to drive future growth opportunities.

Data Source: Statista, Revenue of Lenovo

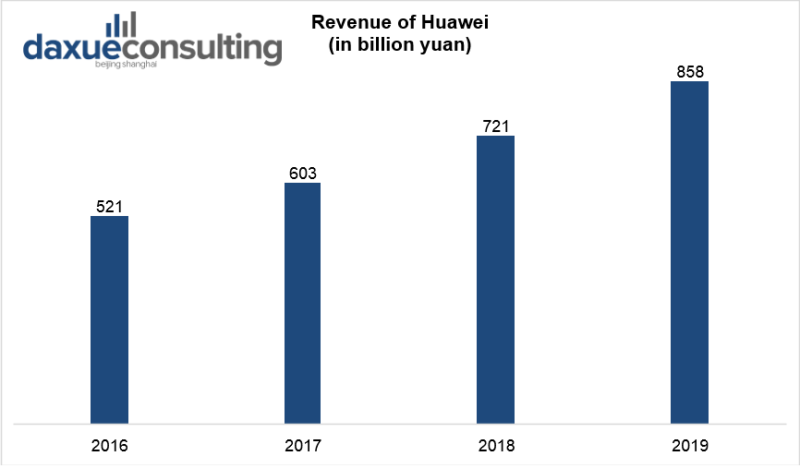

Huawei

Huawei, thanks to a whopping 16-17 percent annual growth, claimed the No. 2 global smartphone vendor spot in 2019, behind Samsung and ahead of Apple. Both firms have similar global market share numbers for 2019. Samsung had around 20 percent, Huawei at 16 percent, Apple at 13 percent, and Xiaomi and Oppo around eight percent each. Q4 2019 was Huawei’s first quarterly decline—down seven percent from Q3. It blames on the export ban. But this ban doesn’t affect Huawei’s marketability in its biggest market, China, where Google doesn’t do much business. Huawei has had its own software ecosystem in China for years, with the “Huawei AppGallery” store, cloud storage, a browser.

Data Source: Statista, Revenue of Huawei

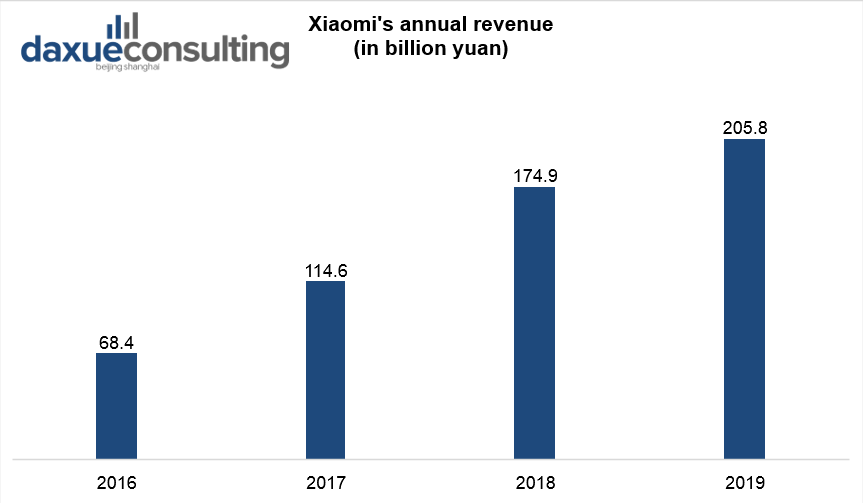

Xiaomi

As of 2018, Xiaomi’s international business grew by 150 percent and has successfully entered 82 foreign markets. Among these 82 markets the brand ranks among the top five in about 25 markets. Xiaomi beat its rival Samsung to be the leading smartphone brand with most shipments in the Indian market in the third quarter of this year. Xiaomi’s overall market share during Q3 2018 comes at 27 percent while Samsung managed to grab 23 percent on market share.

In Indonesia, Xiaomi became the second largest brand for the first time and is leading the sub-$150 segments. It holds 22 percent market share in Indonesia while the leading brand Samsung holds 25 percent market share.

The company continues to expand globally and Xiaomi’s global shipment numbers are also growing. The company reportedly shipped 9.7 percent of all smartphones shipped worldwide during third-quarter this year.

Data Source: Statista, Xiaomi’s annual revenue

Apple and Samsung struggle against domestic competition in the consumer electronics market in China

In 2018 the U.S. and South Korean firms had fourth and fifth place in the Asian giant’s smartphone market. Ahead of them came three Chinese firms: leader Huawei with a 16% share, then two companies little known elsewhere, Oppo and Xiaomi.

Data Source: Statista, Leading Chinese global consumer electronics brands as of 2019 (in BrandZ brand power scores, BrandZ is a brand power score based on analysis from Millward Brown)

Brand loyalty is not as strong in China as in other markets. It’s a very crowded, fragmented market and fiercely competitive, with rivals undercutting each other with price and design. Low-priced Chinese competitors have been “particularly troublesome” for Samsung, which has sought to offer phones across all price ranges.

Apple still benefits from its luxury image and the strong loyalty of its long-time users in China. But the California firm sometimes has to contend with the country’s Communist authorities. In 2017 Beijing blocked Apple’s iTunes Movies and iBooks services launched in China. Besides, the Chinese media has prominently reported about alleged security vulnerabilities on Apple devices.

The revolution of distribution channels has promotes sales in all areas

Nowadays, selling-commerce contributes to the diversity of the sales channel and avoids many problems like establishing an outlet in a rural place. Despite the relatively small base, continuously rising disposable incomes in rural areas, together with increasing education and interest in consumer electronic products has stimulated demand and continued to drive volume sales in rural areas. Meanwhile, the expansion and penetration of retailers such as Suning and Gome into the rural areas has also played an important role to boost volume sales in rural areas. However, urban sales still account for the majority of volume sales of consumer electronics products thanks to the higher acceptance of innovative technologies and disposable income levels in urban areas.

Other than large e-commerce platforms like JD, Tmall, and Taobao, many electronics brands sell directly to Chinese consumers through their own websites.

Source: Statista, Top 5 online stores by net sales in the consumer electronics segment in China

China’s overall online and offline consumer electronics market consumption upgrades intensified

In the future, the retail in China’s consumer electronics market will change, and the online plus offline model will dominate.

In China’s consumer electronics market, offline channels are the main channel for consumption upgrades. Taking traditional home appliances as an example, the proportion of retail sales in offline markets reached 70% in 2018. High-end consumer groups pay attention to product experience, so the offline market has an advantage over the online market.

The consumption upgrade trend has continued in the past few years, and the proportion of retail sales of high-end products has increased from 21% in 2012 to 23% today. All-channel retailers such as Suning, high-end products accounted for 27%, which is the driving force. E-commerce promotions have also become important, and consumers are becoming accustomed to it.

Smart home innovations will change the retail format

For offline channels, there will be new value revaluation opportunities due to the innate advantage of the consumer experience. Visionary vendors and retailers have focused on rebuilding their smart home retail prospects in the future. Retailers with online and offline advantages will have more imagination space in new retail.

Brick and mortar locations allow consumers to see a product in action before purchasing and gives them the ability to take a product home the same day. Offline direct-to-consumer tactics can help sell smart home products in China.

Beyond physical brand-owned retail stores, mall kiosks and other seasonal “pop up” stores can be effective at marketing complex smart home solutions.

COVID-19 impact on the consumer electronics consumption in China

The lockdown had a great impact on the companies in the consumer electronic market in China. China’s smartphone shipments will be 5% lower than expected. In total, China’s smartphone market shipments declined by more than 30% in the first quarter of 2020.

COVID-19 has caused severe challenges for leading Chinese manufacturers such as Huawei, OPPO and Xiaomi. Forecast predicts that in 2020, they will face the risk of declining demand in the Chinese domestic market. International brands such as Apple will also suffer from insufficient production capacity and the risk of declining demand in the Chinese market. As China slowed down and then stopped, supply chains were disrupted. It affected Apple as one key consumer electronics vendor. More than 90% of Apple’s products are made in China and the Chinese marketplace accounts for 18% of its revenues.

Slow recovery

Since April 2020, consumer electronics companies have started seeing a pickup in sales due to healthy domestic demand.

China shipped nearly 21 million smartphones in March, up 240 percent on a monthly basis. In particular, over 24 new 5G smartphone models hit the market in April. The domestic shipments of 5G smartphones exceeded 6.21 million units, representing a 160 percent growth from February.

Wu Qiang, vice-president of smartphone maker Oppo, said the company’s smartphone sales have been recovering rapidly.

Huawei Technologies Co said its sales revenue rose by 1.4 percent on a yearly basis to 182.2 billion yuan ($25.7 billion) during the first three months of 2020, despite challenges from the COVID-19 pandemic. Huawei said revenue from consumer business group (smartphones, personal computers and tablets) will see rapid growth in China this year.

Lenovo said as more people stay at home for work and study, the demand for PCs and tablets will increase. The growing demand for mobile games, remote consultations and video conferencing tools also provides tons of opportunities.

More on the AI ecosystem in China

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

![[Podcast] China paradigm #20: How to get the most out of XiaoHongShu](../wp-content/uploads/2019/04/China-paradigm-China-business-podcast-20-150x150.jpg)