What are the differences between Chinese and Western consumers for luxury goods?

A substantial growth in China’s luxyry goods market mainly thanks to young consumers

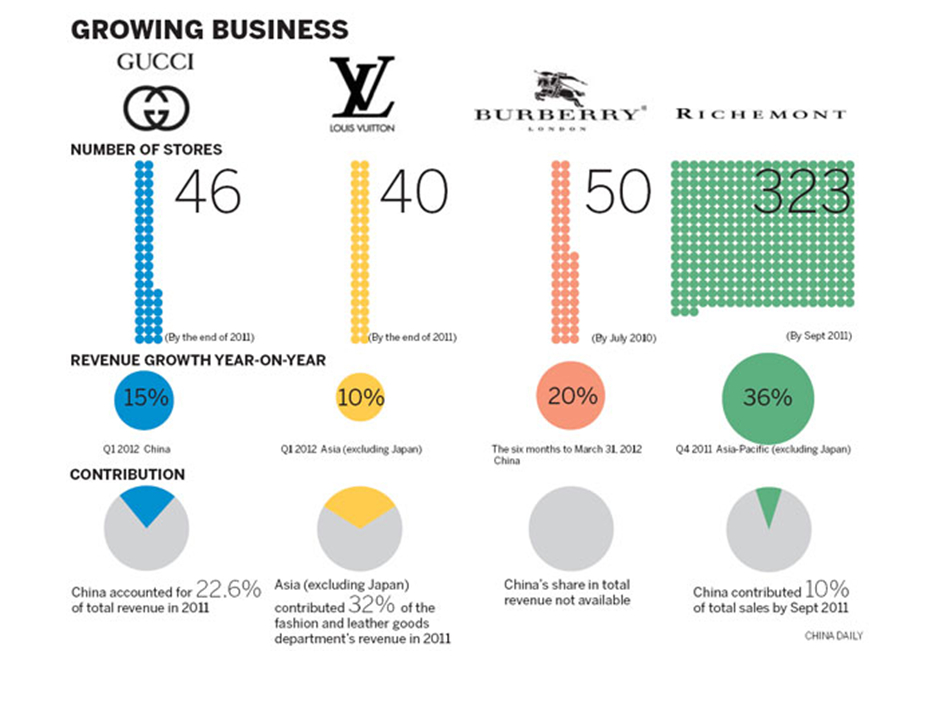

China is the second largest country in terms of luxury goods consumption after Japan. By March 2011, the total amount of its consumption has reached 107 billion U.S dollars, accounting for 27.5% of the global luxury goods market. It seems that the recent global economic recession has not affected the Chinese luxury goods market as it hit other Western countries. According the Economist, Andrew Keith of Lane Crawford, a high-end department store that first opened in Hong Kong in 1850, reports no slowdown at his stores there or in Beijing. Burberry, a British fashion brand, enjoyed sales growth in China of about 20% in the year of 2013 to March. Bain & Company estimates that “luxury sales in greater China (which includes Taiwan, Hong Kong and Macau) will grow by 6-8% this year, to exceed $35 billion, making it a luxury market second only to America”. Thus, it is vital to differentiate Chinese and Western consumers to profit from Chinese market.

Young people play an important role in the consumption of luxury goods in China. In China, around 75% of the luxury goods are purchased by people under 40. According to market research in China on luxury goods, respondents of age 21-30 were from first and second-tier Chinese cities as well as Hong Kong and Taiwan, more than half of them have annual income under 180,000 RMB (approximately $29,694). It is found that 92% of the mainlander group claimed that they intend to purchase luxury goods while only 20% of Taiwanese would do so. The young consumers used these expensive purchases as self award and they would rather save up two or three months’ salary for one piece of luxury goods. People of 20-30 also account for the first generation of “one-child policy”; this generation is arguably more self-indulged. They would rather dress up with flashy and logo-visible apparels and handbags than the globally popular high street brands such as Zara of H&M. On the contrary, Western luxury goods consumption centers on older age group. It is found out that the age group of German luxury good consumption is between 40 and 70, similarly to most Western countries. Meanwhile, Chinese of 50 and older do not have the habit of extravagant purchase. This young trend also indicates that the Internet is widely used to browse, research and purchase products. However, fewer than 20% of the established luxury goods consumers in Germany have shopped online.

Chinese consumers are more inclined to purchase luxury goods

Psychologically, there are quite a few fundamental differences among the Chinese and Western wealthy consumers. The history of consumerism and materialism is much shorter in China as the market was not opened until the 80s. Thus, the nouveau-riche in China is more of a new social class compared to the established upper-middle class in the West. This can explain the rather irrational consuming pattern of some Chinese consumers. On average, people are willing spend 4% of their “money” on luxury goods, while certain Chinese female would spend 40% or more.

The categories of luxurious consumption of Chinese and Western consumers are different. Chinese consumers are more material-oriented: their luxurious purchase is mostly on clothing, cars and watches that can show off their fortune and social status, whereas in Germany, the consumption on luxurious vacation and other life style services (spa, massage and/or even extreme sports) are more popular. The traditional concept of luxurious goods, such as champagne, restaurants, is less attractive in Germany. The once pioneer high-end brands such as Calvin Klein and Armani are back to cheaper pricing to appeal to German consumers.

Uniquely, the social implication of luxury goods in China is personal and beyond. Interpersonal relationship is highly valued and useful in China. It is argued that luxury goods are the best presents in China. According to a Bain& Company survey in 2010, more than 20% of luxury purchase was aimed at gifting; this has been a booming trend. Furthermore, the launch of gift cards of the department stores not only facilitates the gifting process but also broadens the choice of luxury goods consumers have. Banks also launch similar gift cards that allow foreign transactions. However, Western consumers are motivated by the exclusive personal experience: service and ambience are important factors that motivate their consumption.

Works quoted :

http://wenku.baidu.com/view/b936cf6aaf1ffc4ffe47ac15.html

“Beyond bling; Luxury goods in China.” The Economist 8 June 2013: 65(US). Academic OneFile. Web. 27 Dec. 2013.

“China: Post-80s Lap Up Luxury Goods.” Asia News Monitor Nov 30 2011. ProQuest. Web. 27 Dec. 2013 .