China Research: uncertain future of VIEs

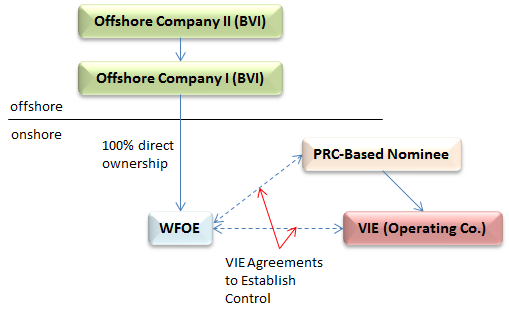

Certain industries in China are technically off limits to foreign investors, yet foreign companies have managed to invest indirectly in several Chinese companies within these sectors for over a decade. Using V.I.E.s (variable interest entities), foreign investors replace direct ownership of a company through contractual agreements with holding companies that invest in these restricted companies for them. This allows these restricted Chinese companies to acquire financing from outside of the country, while also allowing foreign investors to evade any restrictions on foreign ownership of companies within restricted industries.

Risks for foreign investors

Although investing through V.I.E.s can be extremely lucrative, it also comes with a risk to foreign investors. Because V.I.E.s evade Chinese regulatory supervision, they lack official approval from Chinese authorities. Normally, for a foreign company to invest in a Chinese company, the Ministry of Commerce of the People’s Republic of China (MOFCOM) must approve the equity transfer, but gaining approval is very difficult to acquire. V.I.E.s circumvent this approval process and Chinese authorities might view it as a foreign investment in a restricted industry without proper MOFCOM approval. As a result, these foreign investors risk the chance of Chinese authorities invalidating the V.I.E. contracts. Additionally, Chinese shareholders of the V.I.E. and Chinese courts may refuse to uphold the contractual agreements made through these V.I.E.s and cause investors to lose their holdings. Companies may also struggle to find trustworthy Chinese shareholder nominees for their operating companies unless they already have trustworthy connections in China.

Recent developments of VIE in China

Our research shows that recent developments and rulings by Chinese courts have made V.I.E. contracts seem even riskier than before. In 2011, Alibaba terminated its V.I.E. contracts, dramatically hurting the shares of Yahoo, who held a 40% stake in the company. Then in October of 2012, China’s Supreme People’s Court’s ruling invalidated certain contracts that concealed illegal intentions. Although these recent developments undoubtedly increase the risk of investing in these Chinese companies, the Chinese government does not want to cause the over 200 Chinese companies using V.I.E.s to panic by eliminating all U.S. listed stocks. Investors may continue to experience difficulties with Chinese authorities, but V.I.E.s are unlikely to be completely unwound in the country.

Sources:

K&L Gates