The kaolin clay market in China sees major growth

Will foreign companies make a move on the kaolin clay market in China?

The kaolin clay market in China is expected to grow significantly in the following years, reaching a 6% to 7% annual growth rate. The latter is clearly higher than the 4.53% global compound annual growth rate expected until 2021. The main reason for this disparity lies in the growing demand for kaolin products in China, especially within the construction sector. Indeed, thanks to the surge in demand facing the kaolin clay market in China and Japan, the Asia Pacific region holds the largest combined share of the global kaolin clay market.

A significant number of overseas companies have therefore invested in the Chinese kaolin clay market. Imerys (益瑞石石墨和碳公司), a French company which accounts for 24% of the global production, is the leading investor, followed by its American challenger, Engelhard, which was purchased by the German group BASF (巴斯夫欧洲公司) after BASF had already entered into a Chinese partnership by acquiring companies such as Shanxi ShuozhouAnping Kaolin Company (山西朔州安平高岭土有限公司) in the early 2000s. The major role of established Chinese companies is also notable; two prominent domestic firms include Chinese Kaolin Company (中国高岭土有限公司) and Longyankaolin Company (龙岩高岭土公司). The market also boasts other key suppliers, such as Anhui Union Titanium Enterprise Company (安徽联钛供应链管理有限公司) and Shanghai Yuefang industry & Trade Development Company (上海悦方工贸发展有限公司), which both sell calcined kaolin. These players and others underscore the strong business potential offered by the kaolin clay market in China.

Since its establishment in 2009, Daxue Consulting has successfully led several projects focused on building products and dry mining in China. Daxue conducted thorough industry analysis in China and competitive benchmarking of the main foreign and Chinese actors in the kaolin clay market in China. According to Min Chun, senior project leader at Daxue Consulting, “Both our specialization on the Chinese market, our knowledge of contractors and builders, and our experience in the construction sector enabled us to develop credible insights that satisfied our previous clients”.

[ctt template=”2″ link=”nSc63″ via=”yes” ]Between 2011 and 2015, Chinese kaolin clay production rose from 6 to 7 million tons, representing about 15% of global production.[/ctt]Important growth trends for the kaolin clay market in China in ceramics and construction

Kaolin clay (or China Clay, 高岭土) is white clay mostly composed of kaolinite, which is a hydrated aluminium silicate. The kaolin geology process relies on chemical weathering, which transforms hard granite into soft granite (“kaolinisation”). Because of the numerous inherent properties of kaolin, kaolin uses are very diverse. After it is transformed by chemical plants in China, kaolin is used by various industries, such as paper, ceramics, rubber, pharmaceuticals and cosmetics.

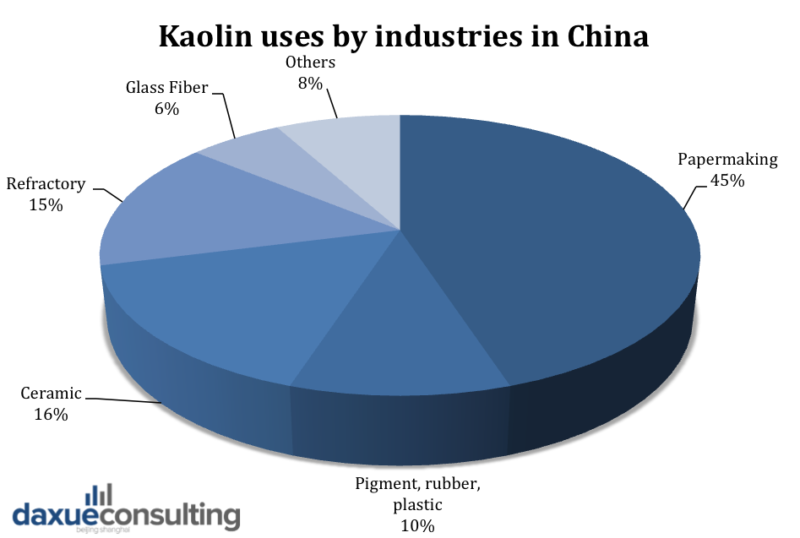

According to Chinese Powder (中国粉体网), a Chinese website specialized in the metal powder industry, the two segments with the most significant need for kaolin clay in China are the papermaking (45%) and the ceramics (16%) industries. Between 2011 and 2015, Chinese kaolin clay production rose from 6 to 7 million tons, representing about 15% of global production. By 2022, the demand for kaolin clay in China is expected to increase to 9 million tons. It is important to underline that 70% of the Chinese domestic kaolin clay production is used for ceramics and refractories, and only 20% is mobilized for the paper market in China.

In the following years, the percentage of kaolin clay used in the paper industry is likely to decrease because of the improvement of the papermaking process and the progressive use of calcium carbonate, hence leading to a decrease from 30% to 35% in kaolin clay demand for this industry. Apart from the significant demand for kaolin clay by the ceramics industry in China, there is a growing need for kaolin clay not only in the construction sector (especially cements, plastics, paints and coatings, etc.) but also in the pharmaceutical, agricultural and cosmetics industries.

The need for kaolin in paper making is likely to decrease because of the progressive use of calcium carbonate. Reproduced by Daxue Consulting with data from CnPowder.cn.

China’s production of high-quality kaolin clay frustrated by technological limitations

Despite its huge scale of kaolin clay production, China also imports significant quantities of this raw material. In fact, Chinese suppliers still don’t meet the technological requirements to produce large amounts of high-quality kaolin clay. High-quality kaolin clay is generally used by the paper industry because of the material’s purity and whiteness. Consequently, Chinese industries see large-scale importations of high-quality kaolin clay from overseas suppliers, and the bulk of Chinese kaolin exports consists of low-to-mid quality clay.

According to YouZhen Gen (尤振根), a kaolin industry insider working at China kaolin Co.,Ltd (中国高岭土有限公司), the export price of kaolin clay in China is $31.58 per ton and the import price is $218.50/ ton. The import price is 8.9 times higher than the export price because of the quality gap.

[ctt template=”2″ link=”cccNe” via=”yes” ]The export price of kaolin clay in China is $31.58 per ton and the import price is $218.50/ ton. [/ctt]Daxue provides market sizing and supply chain analysis for the kaolin clay market in China

Providing guidance for the future development of a supply process in China implies a comprehensive understanding of each step of the value chain to optimize the overall progression. If you are a company seeking to distribute kaolin or invest in the growing kaolin clay market in China, and want to review in-depth industrial research in China before you start, Daxue Consulting can support you. In particular, we conduct research methodologies such as market sizing in China, supply chain analysis, market analysis in China for industrial sectors.

If you have any question or inquiry, you can contact us by sending an email at dx@daxueconsulting.com