Rising Trend for the New World Wine in China

To know more about the New World Wine in China, contact us at dx@daxueconsulting.com

New World Wine in China

For the last 2 years the wine market has known a decreased in terms of volume due to the anti-corruption campaign, it is just recently that the wine market is slowly recovering, indeed, in 2015 the sales volume was at 4,365 million liters a little higher compared to 2014 with 4,108.2 million liters, mainly due to the dynamic growth of household consumption. Young consumers and middle-aged consumers, which are the key purchasers of wine, are more curious and are willing to discover a new variety of wine such as the New World Wine.

Old World Wine versus New World Wine

The wine critics often talk about Old World Wine and New World Wine. What is the real distinction between those two styles?

- The geography: The Old World Wine refers to wine from France, Italy, Spain, Austria, mainly located in Europe and some in the Middle East. New World Wine refers to wine from the United States, Argentina, Chili, Australia and New Zealand. In general, the Old World Wine has been produced since the Antiquity, whereas the New World Wine is much more recent.

- The style: Old World Wines are renowned for being lower in alcohol with a lighter bodied, while New World Wines are well structured with rich fruit flavor and a higher degree of alcohol, which are due to the weather of the regions. Indeed, a hot weather gives full-bodied and fruity wines, which is also related to the technique of vinification.

- The label: Old World Wines are labeled by area while New World Wines are labeled by grape variety. But just recently, some winemakers of the Old World Wine have also started to put the grape variety name on their labels.

- Vinification technique: In Old World Wine, the wine making process is rooted in the tradition and the history, with a number of law and rules, if the winemakers do not follow the rules, they are not allowed to put the name of the area on the label. In the new world, winemakers are encouraged to experience test grape variety and other different methods to find what works for their vineyard.

New World Wine in China: An alternative from the Old World Wine

According to Euromonitor, French wines is still dominating the market in terms of volume with 130 million liters in 2014, however with the rising cost of the Old World Wine, the important tariffs in China and with the 2012 anti-corruption campaign, Chinese wine imports have known a significant decline from 394.5 million liters in 2012 to 377.4 million liters in 2013. It is only recently that the tendency shows a slow recovery with an increased at 385.1 million liters. With all those barrier and criteria, Old World Wines are becoming a high-end product in the mainland.

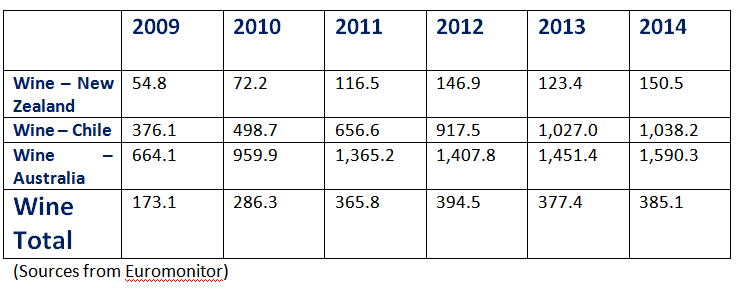

This is one of the main reason China’s growing middle class has found a new way to fill their glasses, the trend is turning to the new world wine bottles. Moreover, the Chinese middle class is more opened to try a new selection of products and are highly interested in tasting different wine products. Indeed, today, China imports a high quantity of wine from the New World such as Australia, Chili, and New Zealand, which represent in terms of value 1,590.3 CNY million, 1,038.2 CNY million and 150.2 CNY million respectively. Regarding the Chinese young generation, they are buying wines for their own consumption, most of which are imported wines under 100 Yuan. The best records for the sales in supermarkets are imported wines from RMB60-180 price range.

This is one of the main reason China’s growing middle class has found a new way to fill their glasses, the trend is turning to the new world wine bottles. Moreover, the Chinese middle class is more opened to try a new selection of products and are highly interested in tasting different wine products. Indeed, today, China imports a high quantity of wine from the New World such as Australia, Chili, and New Zealand, which represent in terms of value 1,590.3 CNY million, 1,038.2 CNY million and 150.2 CNY million respectively. Regarding the Chinese young generation, they are buying wines for their own consumption, most of which are imported wines under 100 Yuan. The best records for the sales in supermarkets are imported wines from RMB60-180 price range.

Some New World Wine areas have benefited from the free trade agreement allowing the exemption from tariffs of imported grape, a region such as Chile, New Zealand, and Australia. According to Euromonitor, China wine imports from New Zealand, Australia, and Chile are still increasing. (See table below).

Imports of Wine: Total Value 2009-2014 (CNY million)

It is important to notice the whole process behind the sales, before selling imported wine in China. Indeed, wine importers must present a Health Certificate and a Certificate of Origin from the exporting country in order to clear the inspection. The imported wine also need a Chinese Label in accordance with the general Standards for Food Labeling. After having approved by all these controls. The Customs will collect duties and other taxes.

Importing in China

The tariff rates for imports into China are divided into two categories: the general tariff and the preferential tariff.

- The general tariff rates are applied to the imports, which has not signed Most Favored Nation trade agreement with the People’s Republic of China. The general tariff rate for importation range is between 0% to 270%.

- The preferential tariff rate is applied to imports, which has signed Most Favored Nation trade agreement. The preferential tariff rate for importation range is between 0% to 121%.

Imported wines into China are subject to 10% consumption tax and 17% value-added tax. The total tax payable is calculated as follows:

Total Import Duty = Import tariff rate + Consumption tax rate + Value-added tax rate + (Import tariff rate x Value-added tax rate) (1- Consumption tax rate)

The total sales volume of imported wine slowed down in China in 2012-2014. However, Chile and Australia has known a favorable increase thanks to zero tariff imports (Free Trade Agreement) signed with the Chinese government. Both New World wines and Old World wines have notable differences, but that does not necessarily make one superior to the other. New World Wine generally places less emphasis on making wine the same way it has been made for centuries, and emphasis more on making wine with modern technology advances.

Case Study: Wine Industry

One of Daxue’s clients wanted to better understand the Chinese wine market, to prepare the launch of his wines from the New world into China. The objectives were to understand the competitive environment for the industry in first tier cities and understand the Chinese consumer’s preferences, as well as issue design recommendations. Daxue Consulting answered the objectives in 3 steps:

- A benchmarking of competitors through store checking

- Qualitative survey with clients

- Qualitative interviews with market experts in the wine industry that were directly dealing with the industry to find out the market know-how on distribution/design/consumers preferences.

We were able to organize competitors’ information based on our researches to tailor a detailed entrance strategy for our client that enables him to have a clear understanding on how to prepare and execute his product’s entrance into China.

See also:

Follow us on our Twitter, to stay up to date on China’s market. See our latest post on the beverage industry in China:

The #beverage market in #China is one of the fastest growing markets. Read our full report: https://t.co/35hCKveclH #ChineseConsumers

— Daxue Consulting (@DaxueConsulting) September 8, 2015

![[Podcast] China Paradigm 41: How to start a trendy wine chain in China](../wp-content/uploads/2019/05/Podcast-wine-chain-China-150x150.jpg)