The red wine market in China: Production plummets, imports fill demand

China has become the first market for red wine in 2013. According to the survey from Jiuyejia, the top five countries by volume remain unchanged, with the US leading the way with 318 million cases, followed by Italy (266 million cases), France (250 million cases), Germany (244 million cases) and China (156 million cases). Germany is the world’s largest wine importer, importing 126m cases, but overall imports fell 1.7 per cent between 2012 and 2017. The UK was second with 114m cases, followed by the US (799bn cases) and China (610bn cases). From 2012 to 2017, The Chinese market grew by 15.7 percent and became the country with the fastest growth in import volume. China and Russia are expected to lead the import market.

Moving to 2020, there are several changes such as government policies hindered the growth of the red wine market in China.

Red wine market in China from 2016 onwards

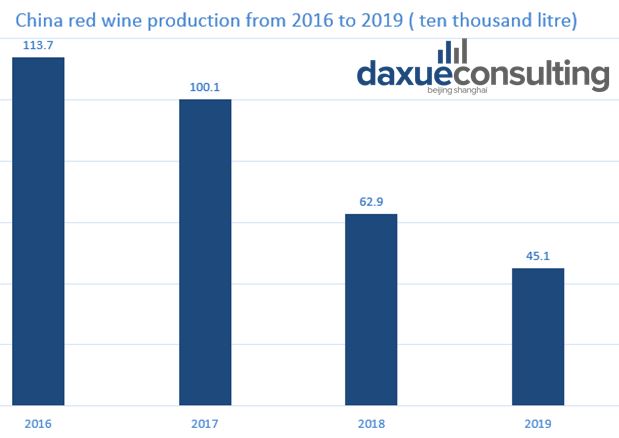

The domestic production has been declined since 2016 as well as the imported red wine market in China. While the global consumption of red wine grew at a rate of only 0.4% the output of domestic red wine has a negative growth since 2013 and has been continued to 2019. The national wine output in December 2019 was 79,000 kl, up 1.3% compared with the same period last year, and 451,000 kl from January to December 2019, down 10.2% in total.

Data source: China Jiu Ye, China cbn & drinks business, red wine production in China is plummeting

The general decline in production of red wine in China are largely due to the new tax policy and shifts in consumers group. More and more customer tends to buy red wine from imported red wine retailers. Because of the “Zero tariff” policy, red wine from places such as New Zealand, Chile and Australia can enjoy the tariff relief. This policy boosts the Australia’s export of red wine to China. From 2017 to September 2018, Australian wine exports to the Chinese mainland exceeded 1 billion Australian dollars for the first time, up 66% year-on-year, or about 4.9 billion yuan. Mainland China became its biggest wine export market, with sales surging by 221% in five years. Second reason is the Chinese government’s implementation of anti-corruption policy. This not only reduced consumption of Baijiu but also red wine. For instance, public servants are no longer allowed to drink during their lunch breaks on work days.

Red wine imports have fluctuated

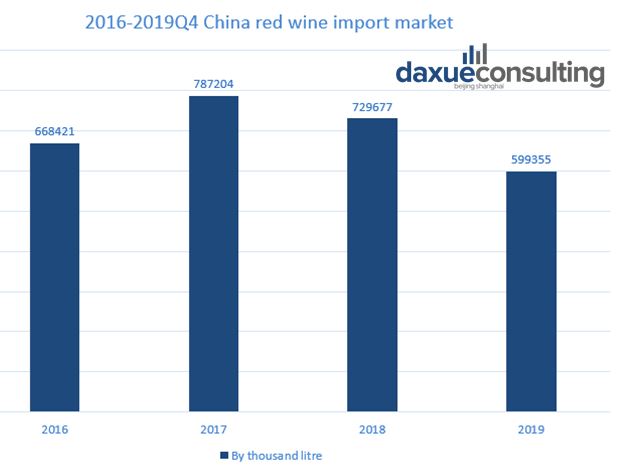

Although the China import red wine market benefits from the low tariff policy, the imported volume of red wine has been fluctuated since 2016. This is because the red wine market in China has entered the restructuring period.

Data source: Ifeng, China’s red wine imports

As the Chinese red wine market is gradually maturing, more and more imported wines are flooding into the Chinese market. There are more than 5,000 wine importers and distributors in China, with Shanghai, Beijing, Shenzhen and Guangzhou having the largest number of distributors and more competition. In addition, with the gradual deepening of Australian wine export business to the red wine market in China Chinese market, imported wine is also facing the difficulties of distributing its retail channel from online to offline. In the future, while the development space of the industry is expanding, the market share will be difficult to increase.

Looking at the future, many articles suggests that although the growth rate of red wine consumption is low and steady during recent years, the imported wine is continued to increase its market share in China while the domestic red wine will decrease the share of the market. The top 5 importing countries will remain unchanged: France, Australia, Chile, Spain and Italy however, the rate of growth might look very different. Chile will likely to become the country with fasting growing imported containers. Despite the red wine, the Chinese consumer is also welcome to other types of wine. Champagne and sparkling wine will gradually increase its market share. Additionally, China’s liquor consumption will also increase because of the development of the drinking culture in China.

![[Podcast] China Paradigm 41: How to start a trendy wine chain in China](../wp-content/uploads/2019/05/Podcast-wine-chain-China-150x150.jpg)