The increasing level of cleanliness: The household cleaning market in China | Daxue Consulting

The Chinese household cleaning products market is growing rapidly. According to STATISTA, revenue in the Chinese household cleaners segment amounts to USD 3,552 million in 2018 and the market is expected to grow annually by 4.1% (CAGR 2018-2021). The rising disposable income and improving quality of life result in Chinese consumers’ higher requirement of household hygiene. Meanwhile, to keep up with a faster pace of life, especially in the urban areas, Chinese consumers are also looking for more efficient household cleaning products, no matter if it is a kitchen cleaner or a household electrical appliance like a vacuum cleaner.

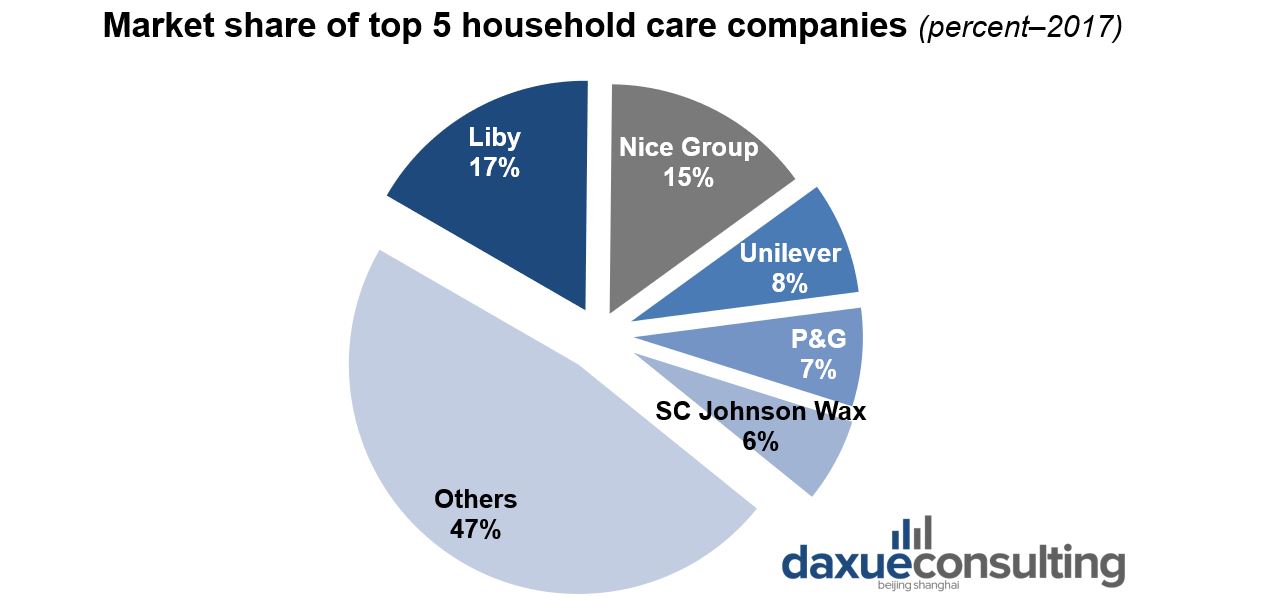

Although the Chinese household cleaning market for basic merchandise is quite saturated and a couple of oligopolies occupy a majority of the market share. However, there is still plenty of room on the Chinese market for diverse international brands of cleaning products. Since many Chinese families are used to doing daily cleaning tasks manually, the market penetration of many electrical appliances is still relatively low compared to the western market – e.g. vacuum cleaner.

Chinese household-care-products market is an oligopoly market: Liby (立白), Nice Group (纳爱斯集团), Unilever (联合利华), SC Johnson (庄臣) and P&G (宝洁) contribute over 50% of whole market share.

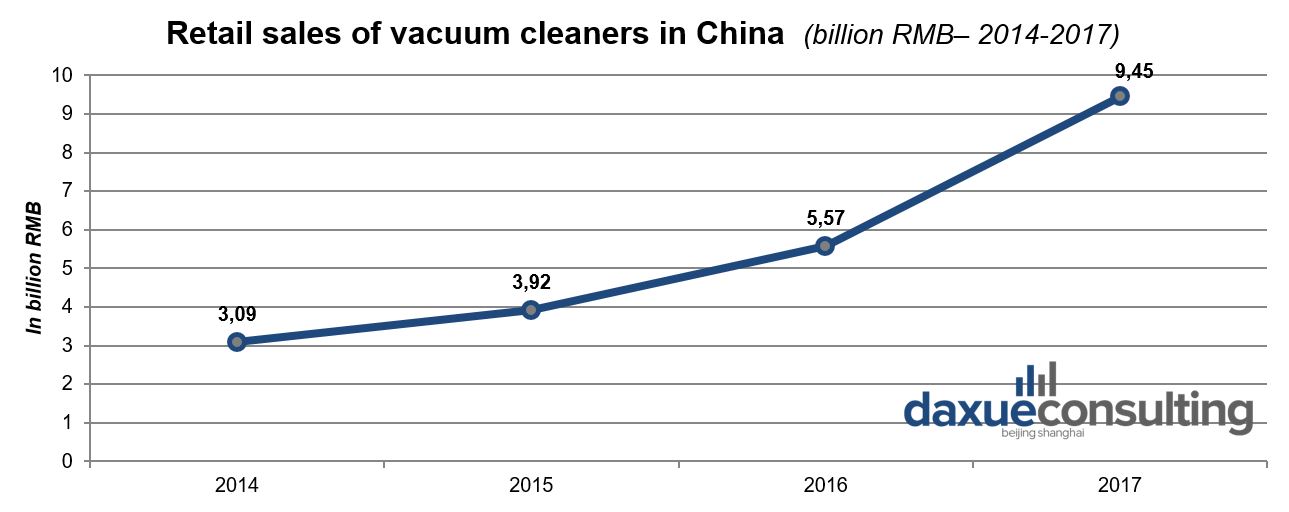

The retail sales volume of vacuum cleaners on the Chinese market is increasing and the market demands will keep growing in the next few years.

Lower-tier cities in China still have room for market growth

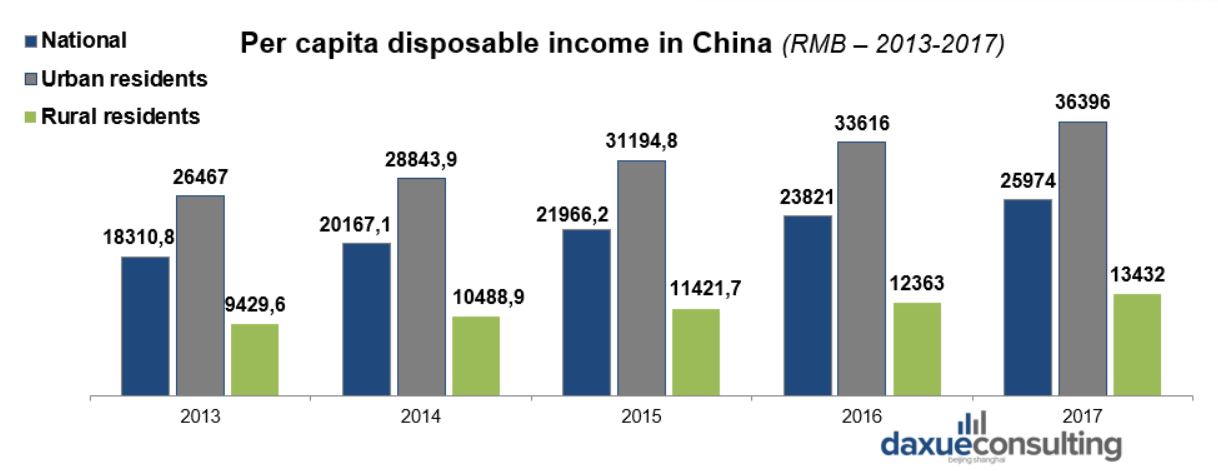

“The main difference between tier-1 and lower-tier cities’ cleaning products consumption is the fragmented usage for different household cleaning tasks in most urbanized areas, while in more rural areas, consumers tend to utilize one dedicated product in a multi-purpose way.” Says Thibaud Andre, research director of Daxue Consulting. The income gap is still huge in China, while consumers living in tier-1 cities are keeping up with the pace of international cleaning products market, consumers from lower-tier cities are still at a primary stage of household cleaning. Although the per capita disposable income of Chinese rural residents is still low, it has increased around 40% from 2013 to 2017. With the household earnings going upwards, consumers from lower-tier cities will also hold stronger purchasing power for expanded household cleaning products. That makes them a huge potential consumer base for international household cleaning brands.

Chinese consumers are getting more health-aware: Health~ and Eco-friendliness trends

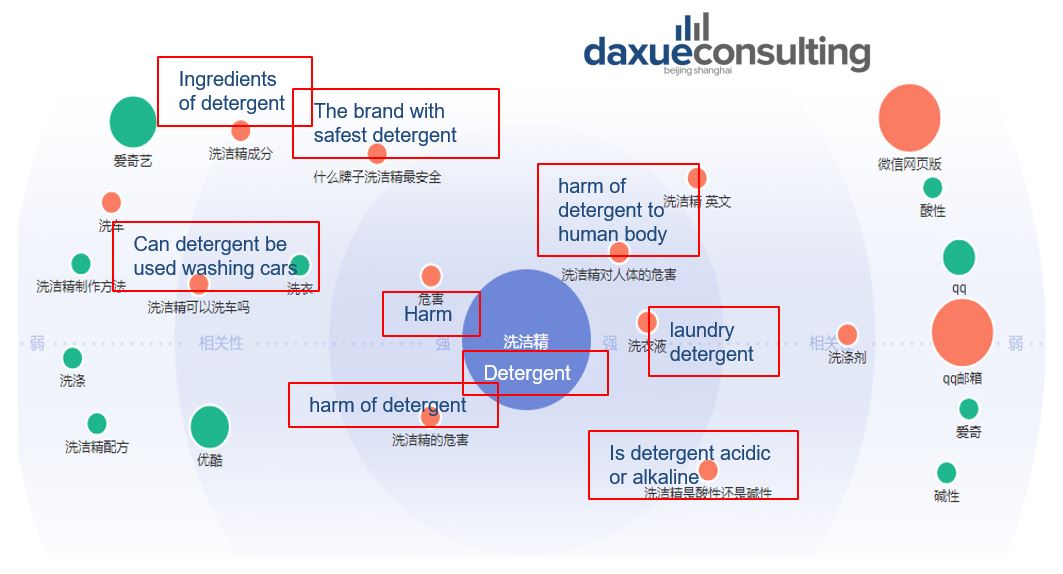

Product-safety awareness among Chinese consumers is getting higher. Concerns about daily chemical products, like cleaning detergents are especially prominent. As we can see on Baidu index, almost all highly related terms of searching phrase “dishwasher detergent” are about safety issues like: “Harm” and “Harms of detergent to the human body”. Other related terms are e.g. “ingredients of detergent” and “brands with the safest detergent”.

There is also a higher demand for a child (baby)-specific cleaning products, e.g. bottle cleanser, as more parents are willing to spend their income on taking care of later generations.

Household cleaning appliances market still has huge potential for international brands

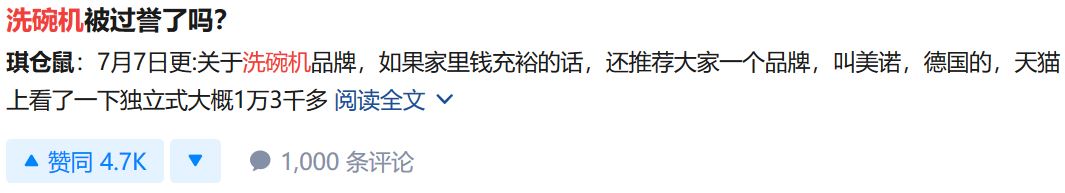

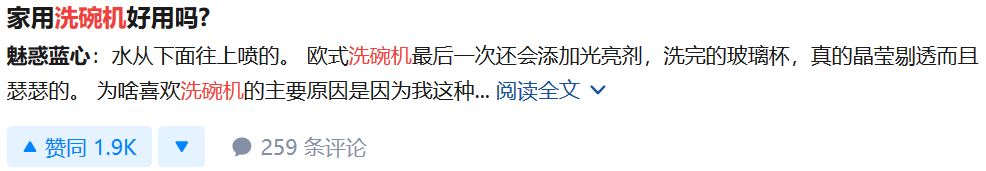

Home electrical appliances like ovens and dishwashers were not visible in normal Chinese households until a recent couple of years. As the quality of life increasing, more and more Chinese consumers are searching for labor-saving devices to relief them from chores. But appliance like a dishwasher, which is standard in western households, are still not common in China. What is holding this back? From the questions on Zhihu, China’s biggest question-answer platform, we can see that the interest is high. However, Chinese consumers are still determining if it’s useful for their households.

On Zhihu, the question was: “Are dishwashers overrated?” This answer on Zhihu got much attention (4.7K thumbs up and 1K comments). In the answer, a German brand has been recommended.

Several similar questions on Zhihu: “Is household dishwasher helpful?”, “Is dishwasher useful and suitable for Chinese family?”

Expected Sales of Dishwasher on Chinese Market 2017-2020

Along with the increasing sales revenue of dishwashers on the Chinese market, related products like cleansing tabs and cleansing powder also offer a huge opportunity for international household cleaning brands.

The same applies to products like oven cleaners, as ovens are becoming more popular in China, the demand for cleaning products for the oven will also be on an upward climb. Yet there are not many domestic brands on the Chinese market for oven cleaners. On Tmall most dedicated oven cleaner products are from western brands.

Chinese households are using high-end/automated cleaning appliances

Growing hygiene and health concerns coupled with automated and quick cleaning solutions have driven the household cleaning appliances industry. For example, improved standards of living and rising urban population in China is supporting the growth of household vacuum cleaners market. At the same time, Chinese consumers have driven the demand for technologically advanced products.

Looking at the high-end household electrical appliance like Dyson vacuum cleaner on Baidu index, the searching frequency of last three years has grown approximately five-fold.

Dyson vacuum cleaner

Dyson V10 wireless vacuum cleaner on Tmall

Dyson, Haier, Bissell, and Panasonic are some of the big players on the Chinese market. However, Chinese consumers are constantly searching for high-performance and more cost-effective products. Different brands are responding to consumers by incorporating new features such as robotic operation and bag-less technology. Xiaomi is a prominent competitor on the Chinese market, whose household vacuum cleaner robot has got huge success with its high performance-cost-ratio.

Xiaomi vacuum cleaner robot

E-reputation plays a crucial role in the brands’ development in China: Using Chinese social media to engage with consumers

“Brand reputation has a stronger impact on household cleaning category purchase in China than in European markets. The word-of-mouth and e-reputation play crucial roles in the development of a brand.” Says Thibaud Andre. On the most popular social media platforms in China (Weibo and WeChat), posts about household cleaner mainly consist of brand/product recommendations and their usage. Among those posts, international brands are more popular than domestic ones. For example, the following post recommended Italian brand Chante Clair’s and its degreaser cleaner by a Chinese lifestyle KOL, who owns 94,910 followers on Weibo. On this post, she described how she utilized the cleaner and successfully removed the stain on the floor, which never came off no matter what products she used in the past.

Italian brand Chante Clair’s was recommended by a Chinese lifestyle KOL on Weibo

Combination of Online and Offline is becoming the main purchasing method

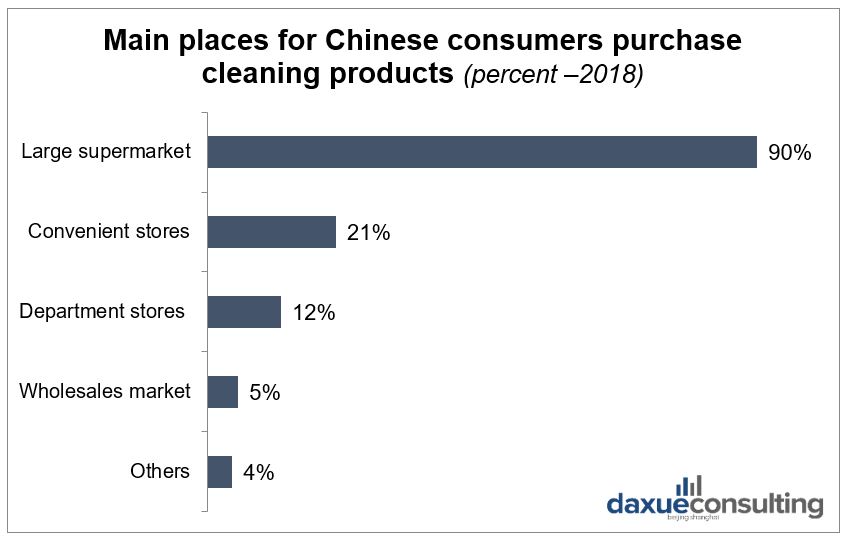

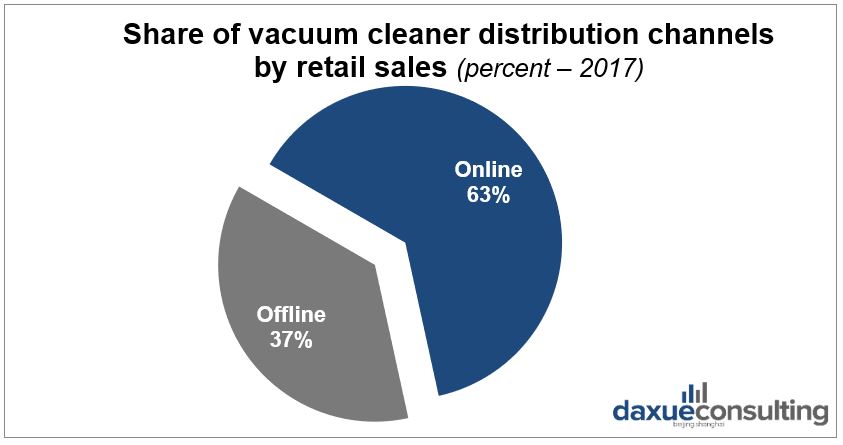

In China, offline shops are still crucial for most traditional household cleaning products. Over 90% of consumers choose supermarkets as one of their offline channels to purchase household cleaning products in 2018. Convenient stores and department stores are also important purchasing locations for Chinese consumers. Yet things are a little bit different when it comes to some household electrical appliance like the vacuum cleaner. In 2017, online channels have exceeded offline stores for vacuum cleaners in China by far (63% purchased online vs. 37% offline).

E-commerce platforms like Tmall and JD are important distribution channels for most household cleaning brands (international and domestic). While Tmall is primarily for building official online shops and has a better price, JD is famous for its more competitive logistic which promises next-day delivery even for remote areas in China like Qinghai and Gansu. DJ also offers fixed-time delivery which Tmall does not. Yet dedicated website hasn’t been considered as an online retail distribution channel for most household cleaning brands.

| Market Segments | Number of brands are selling on Tmall | Number of brands are selling on JD |

| Kitchen oil cleaner | 198 | 389 |

| Detergent (dish, fruit, and vegetables) | 199 | 233 |

| Bathroom/toilet cleaner | 75 | 325 |

| Floor cleaner | 129 | 273 |

“The setup and allocation of investment in their distribution network will probably be crucial for cleaning brands in the years to come. They should especially remain aware of new channels changing the market, such as Pinduoduo a few months ago in lower-tier cities.” Says Thibaud Andre, research director of Daxue consulting. Besides the most popular platforms like Taobao and Jingdong (JD), there are many other less-known e-commerce platforms ones which international players can leverage.

Chinese household cleaning market provides the chance for international companies to develop their brands

The Chinese household cleaning products market has a rapid growth pace and has plenty room for international companies to develop their brands for following reasons: 1) The improving living standard and fast pace of life in urban areas make Chinese consumers demanding more efficient and more convenient cleaning products. 2) Consumers from lower-tier cities are still at a primary stage of household cleaning while their per capita disposable income has significantly increased and will hold stronger purchasing power for expanded household cleaning products. 3) Many kinds of household cleaning appliances still have relatively low market penetration in China, thus have huge potential for international brands. 4) Chinese consumers are demanding more and more high-end cleaning products, according to Euromonitor International: Premium-positioned products claim a faster pace of growth over mass offerings in China.

What international cleaning products companies should pay attention to is first of all: e-reputation plays a more crucial role in the development of a brand in China than in the West. International brands have to use Chinese social media to reach and engage with consumers. Another important point to keep in mind for entering Chinese market is that both online and offline distribution channels are not to be neglected: while big supermarkets are still the most common location to purchase traditional cleaning products for Chinese consumers, some products like vacuum cleaner have a much bigger sales revenue share through online channels.

Author: Chencen Zhu

Daxue Consulting can help with the analysis of any market in China, including the household cleaning products market

Daxue Consulting, as a market research company, provides the adapted data in one of the most challenging markets in the world, China. We have a wide range of services to deliver a competitive market research. To know more about the household cleaning market in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.