As gardening gains popularity as a leisure activity, where do China’s gardening tools come from? | Daxue Consulting

China’s gardening tools market.

In China, the demand for landscaping and gardening activities has increased considerably in recent years. Aesthetics and environmentalism are the primary driving desire for this change in consumer preferences. As the economy is moving towards environmentally-friendly industries, the concept of gardening is also changing among Chinese consumers.

Market researches show that the CAGR for the global gardening tools market in 2017 was 1.6%. Persistence Market Research estimated the global sales of gardening tools in 2017 was 280 million units. This figure is expected to surpass 300 million by the end of the year 2025. Now, Asia-Pacific cultures incorporate gardening activities into their lifestyles as it becomes recognized as a leisure activity. In China, people are gradually accepting the idea of horticulture as a therapy for daily life getaways. Small gardening tasks are not only a hobby but a ‘medicine’ to reduce stress.

The increasing popularity of ‘Do It Yourself’ (DIY) in gardening also brings a fresh approach to Chinese middle-class consumers. Rising disposable income affects leisure choices, and small gardening and horticultural activities are being widely recognized as a relaxing and worth-trying way to maintain the peace of life.

The gardening tools manufacturing industry in China, however, is not developed to scale. So far, the main competitors in this market are all small-to-medium sized enterprises with fewer specialties and a broad range of products. Thought highly competitive, the market specification is not precise and there exist no major market players in the domestic production.

In short, the Chinese gardening tools market is growing, and the business potential is unrealized. An international brand can actively compete in this field as the market is not mature, while promotional strategies are the keys to successful expansion.

The gardening tool market composition – Overview

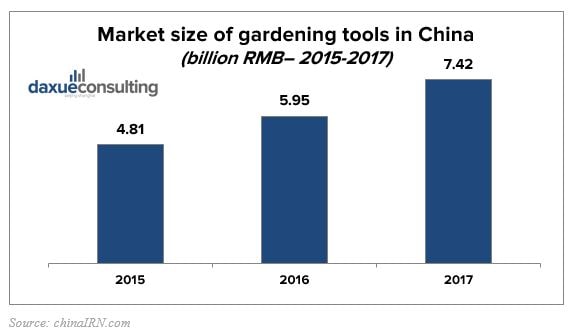

The gardening tools market in China is now experiencing a strong growth trend. In 2017, the estimated market size of gardening tools had reached 7.42 billion RMB with a CAGR at 24.71%

The increasing market size comes along a more specialized division of different market segment in China. There are mainly three segmented markets of the gardening tools market in China which are tools for public gardens, for family gardens and for maintaining forests. According to Daxue’s research, the leading consumer groups for gardening tools in China consist of three large groups: local government (public) gardening service providers (business) and families.

The gardening tool market composition – Consumption analysis

Consumption patterns are seasonally adjusted

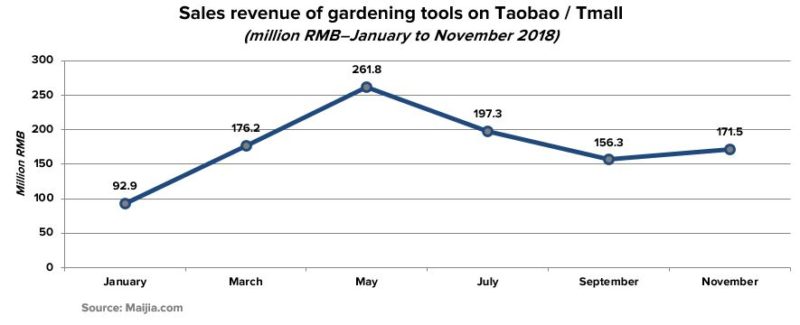

Consumption in the gardening tools market in China is showing a strong annual-seasonal pattern. According to the 2018 sales data from January to November on Tmall/Taobao, the largest online retail platform in China, the consumption pattern of gardening tools sales in China is seasonally adjusted with the peak sale happened in May and the lowest in January.

Also, in November there is a slight upward twist on sales volume, which may largely due to the Double 11 Shopping Carnival with huge discounts on every type of goods including gardening tools.

Keywords search intensity based on Baidu Index regarding specific gardening products such as ‘lawnmower,’ ‘bush cutter,’ ‘watering can,’ and ‘chainsaw’ also shows a clear seasonal pattern.

[Source: Daxue Consulting]

The search frequency of the keyword ‘bush cutter’ has stably fluctuated around a certain value. But its lowest also happened during the Spring Festival season.

[Source: Daxue Consulting]

Consumer preferences revealed by Social Media

Consumers of gardening tools in China utilize different social media platforms to ask, gather, evaluate and make decisions on different gardening tool products.

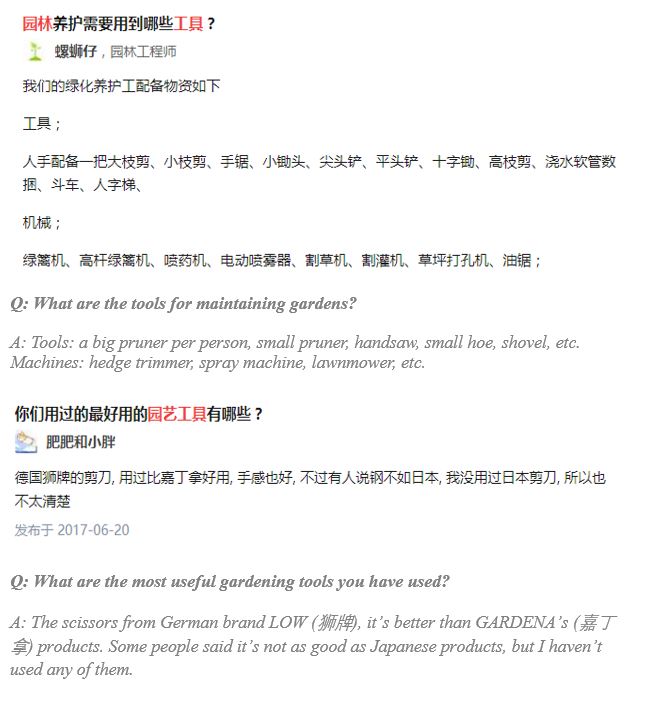

Zhihu.com is the most prominent Chinese online Q&A platforms with social media features. People ask questions about gardening tools on Zhihu.com to gather useful information:

Social Media as a way of sharing product experience

Weibo and Wechat are two major social media platforms in China. Many people have posted on gardening tools/machine.

According to the social media research done by Daxue, positive feedbacks on these products are mainly focusing on the following aspects:

- Easy to use/carry, saving the labor;

- Good quality;

- Long service life;

- Environmentally friendly.

[Source: Daxue Consulting]

[Source: Daxue Consulting]

- Engine noise and exhaust gas;

- Cannot do continuous work;

- Easy to be damaged;

- Cannot achieve expected outcomes.

On Weibo and Wechat, brands introductions and requests for product authentication are the main contents among the posts about gardening tools and machines in China.

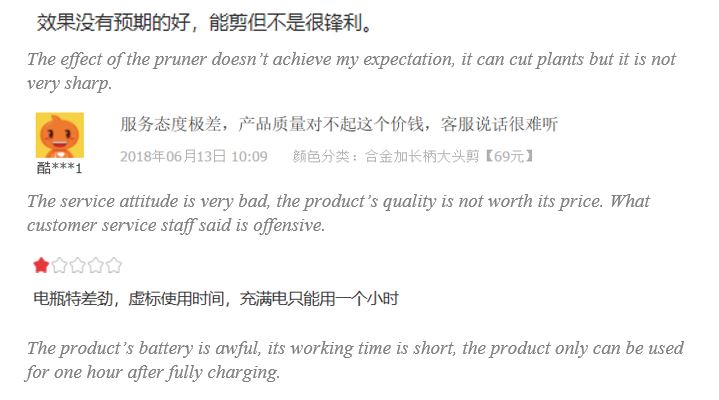

E-Commerce platform buyers concerns quality as a priority

Major e-commerce platforms such as Taobao/Tmall and JD.com all have functions for online customers to leave a review after purchase, whether positive or negative. Most discussions about gardening tools are focusing on products’ quality and prices. Consumers can post pictures of the real goods they receive in the review for others’ reference. Also, some sellers online offer a small amount of cash or gift card reward for those positive and detailed buyer’s reviews.

[Source: The picture has been from a buyer’s home and shared on JD as a review of a lawnmower from Tuochuan (拓川). The buyer gave positive reviews for its good quality]

[Source: The pictures have been taken from a buyer’s home and a garden, and shared on Taobao as reviews of a big pruner from JOUNFULL (京聚福)]

Positive Reviews:

[Source: Daxue Consulting]

[Source: Daxue Consulting]

The gardening tool market composition – Products analysis

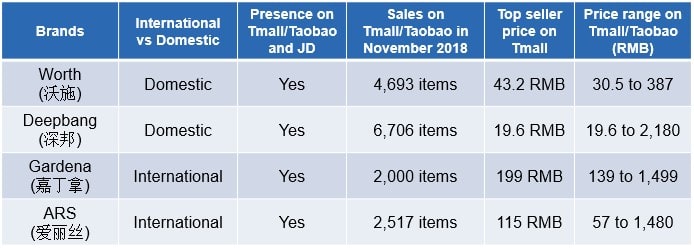

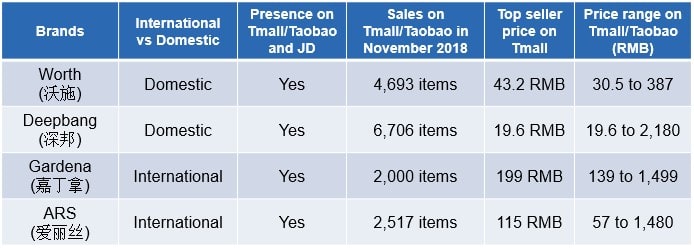

Gardening Shears

Gardening shears are one of the essential gardening tools in China. Data from online retailing platform Tmall/Taobao shows that domestic brands have potentially a higher monthly sale than their international counterparts. Domestic brands Deepbang (深邦) and Worth (沃施) ranked 1st and 2nd in November monthly sale in 2018. International brands Gardena (嘉丁拿) and ARS (爱丽丝) only reached 40%-50% of the sales of domestic brands at the same time. The top seller prices of the products are relatively low, and it is the main reason for their outstanding sales.

[Source: Daxue Consuling]

[Source: Daxue Consuling]

Shovels

Local brands Qinglin (青林) is undeniably the leader in sales for this product in November 2018 with more than 10,000 items sold. Zhuoshi (卓石), another domestic brand also sold more than 5,800 items. These two brands contributed significant sales volume in November 2018 for Shovels than their international counterparts. For global brands, Gardena (嘉丁拿)’s sale reaches a bit over than 10% of that of Qinglin (青林), making international brands’ sales insignificant compared with domestic brands.

[Source: Daxue Consuling]

[Source: Daxue Consuling]

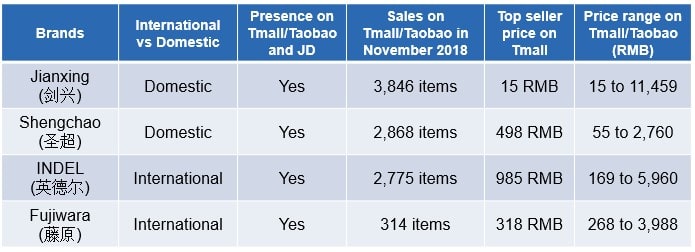

Lawnmower

Sales of a domestic branded lawnmowers are higher than international brands. Local top seller Jianxing (剑兴) has extremely low prices compared with the international top seller and have sold more than 1,000 items in November 2018. However, INDEL (英德尔), the global top seller does not trail behind too much compared with the second top domestic seller Shengchao (圣超). The difference in their sales is less than 100 items. Fujiwara (藤原), another international brand, did not perform well with only 314 items sold at the same time. Overall, domestic brands all play better than international brands at a lower price.

[Source: Daxue Consuling]

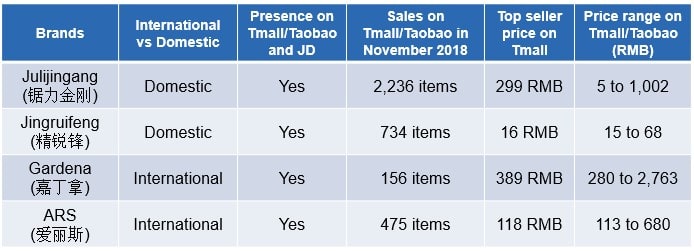

Handsaw

Most handsaw brands have built their official stores on the leading e-commerce platforms such as Tmall/Taobao and JD.com in China. International brands usually have higher prices. As a result, their sales are much lower than those of domestic brands. In November 2018, local leading brand Juli Jin’gang (锯力金刚) sold more than 2,200 items, and this is more than four times the sale of which the top international brand ARS sold at the same time.

[Source: Daxue Consuling]

The gardening tool market composition – Manufacturer analysis

Worth (沃施)

Worth is one of the major gardening tools providers in China. It has built an official website for showing brand stories, product catalog, and news/events updates. Worth has three major product series: power tools, petrol tools, and hand tools. Among these series, hand tools are primarily sold online on different e-commerce platforms including Taobao/Tmall, JD.com, and others. Worth consider its products have long product life, making those tools handy with high qualities. The significant sales points including long product life, easiness of use, efficiency, low maintenance costs, and environmentally friendly designs.

Worth has a digital presence on major e-commerce platforms with no existence on newly inducted e-commerce operators such as Kaola and Pinduoduo. This means Worth is still operating in a conventional online retailing pattern as Kaola and Pinduoduo are based on an entirely different rationale for e-commerce.

Customer view this brand as high quality guaranteed. Aftermarket services and excellent craftsmanship are also praised among all customer review posts online. The only drawback pointed out is that its products are selling at relatively higher prices among the entire product category.

Worth has its Weibo account with 69,564 followers and 11 posts till November 2018. But it has no Wechat presence at all. Its entire social media profile is not active.

Gardena (嘉丁拿)

Gardena is a favorite gardening tool brand based in Germany. Its official Chinese website contains different product types (series), updates on company news, service information and customer support. In China, Gardena primarily sells four kinds of products: watering tools, lawn care, grass shears, soil and ground, and smart system solutions for gardening. To further promote its products, Gardena describes its products as having good quality with long product life, effective and efficient while very handy and easy to use.

Gardena has a digital presence on both Taobao/Tmall and JD.com, which offers a convenient way of e-commerce in China. In new e-commerce platforms such as Kaola and Pinduoduo, Gardena has no active presence. Its conventional e-commerce presence is as strong as Worth (沃施), which make these two brands the major gardening tools providers in the Chinese market.

Customers consider this brand as a representative for high quality and great designs. Easy to use and useful application is also being praised on significant e-commerce platforms. Similar to Worth, Gardena’s product is relatively pricey. In addition, online customers think their products, through effective and user-friendly, are having insufficient sizes.

Gardena maintains both presences on Weibo and Wechat with 9,580 and 319 followers respectively. However, they did not show active status and remained inactive during Daxue’s research period.

STIHL (斯蒂尔)

The official website of STHIL China contains three subsites for its trading company in Taicang, Jiangsu, its manufacturing factory in Qingdao, Shandong, and its official German website in Germany. The primary body of these websites is related to the company news and events updates as well as the product series. These websites also provide detailed knowledge of equipment caring and handbooks for different types of power tools. STIHL mainly sell power tools in China including chainsaws, hedge trimmers, and brush cutters.

STIHL has a digital presence on both Tmall/Taobao and JD.com. Compared with Gardena and Worth, STHIL’s sale is not significant. This is mainly due to the nature of its products being power tools which incorporate more technologies than the other two brands. One surprising fact about STHIL is that this brand has a presence on Pinduoduo, and have a relatively high sales volume per day when Daxue was conducting the research.

Customer view STIHL as a brand with good quality and user productivity. STIHL’s chainsaw is especially being regarded as an enduring tool with great value. Some negative feedbacks indicate the product is on a mediocre level of quality with bad aftermarket services. These are only the minority. Most of the feedbacks praise STIHL for its high quality and long product life. Some suggest the product is ‘worth to buy.’

STIHL has an active presence on both Wechat and Weibo with 47,418 and 8,385 followers respectively. It has maintained an active status on Weibo for it has posted 21 posts during November 2018.

CONTACT US NOW TO ANSWER YOUR QUESTIONS ABOUT BUSINESS IN CHINA

The gardening tool market composition – Promotion

Advertising is prominent

Advertising is considered an essential promotional tool for all types of products in China including gardening tools. Greenworks (格力博) released an online advertising video to promote its new arrivals for public green spaces. This brand is focusing on medium and large size gardening machines.

The video highlighted the fact that all products are electrically powered gardening machines. This means they are all environmentally friendly. And these products meet the need for environmental protection restrictions in the Chinese market.

[ Souce: https://v.youku.com/v_show/id_XMzYyMTMxMjE0MA==.html?spm=a2h0k.11417342.soresults.dtitle ]

The video’s main scenes are divided into several gardening machines of Greenworks: pole saw, blower, string trimmer, top handle saw, hedge trimmer and lawn mower.

The video implied the excellent effects and quality of those gardening machines; it also highlighted those machines are all new energy (electricity) products.

Brand Naming

Choosing an appropriate Chinese name for your brand not only conveys the ideologies and doctrines embedded in your brand but is also a way for people to keep your brand in mind. Several gardening tool brands have made good examples. These names connect with the concept of gardening and create the image of gardeners and plant growth.

Worth – ‘沃施’ The Chinese name consisted of the two Chinese characters: ‘沃’, meaning ‘to irrigate’, and ‘施’ meaning ‘to spread manure.’ Together the Chinese name implies the brand is related to growing plants, such as gardening tools and farming tools.

Gardena – ‘嘉丁拿’ The Chinese name consisted of three Chinese characters. ‘嘉’ means ‘good or wonderful,’ ‘丁’ implies the concept of a gardener, and ‘拿’ means ‘hold.’ This Chinese name implies that the products are of high quality and are the best matches for gardeners.

STIHL – ‘斯蒂尔’ The Chinese name based on the pronunciation of its original name. The Chinese name accommodates the pronunciation and uses Chinese characters.

The gardening tool market composition – Distribution channels

Online retailing coverage in China

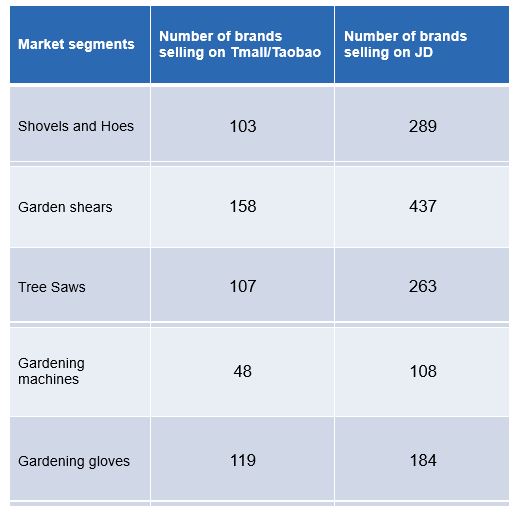

JD.com has far more presence of brands in gardening tools. This phenomenon may due to the higher security deposit Tmall/Taobao require for registering and opening up an official store on its platform. The online promotional activities mainly happen during double 12 shopping festival (following the success of double 11 shopping carnival created by Taobao, double 12 shopping festival was also created several years ago to stimulate the consumption potential of online retailing further).

[Source: Daxue Consulting]

Offline retailing coverage: case in Shanghai

Major offline retailing points for gardening tools are specialized stores and wholesale markets. The number of those offline retailing points are limited, and most of them are located outside the residential areas and business districts. The possible location for those stores is in the surrounding suburbs of a city.

Searching keywords ‘gardening tools’ renders 16 results of stores on Baidu Map and 14 results of stores on Dianping.com. Among those, 16 are specialized gardening tool store, and only 5 of them are wholesale markets.

[Source: Daxue Consulting]

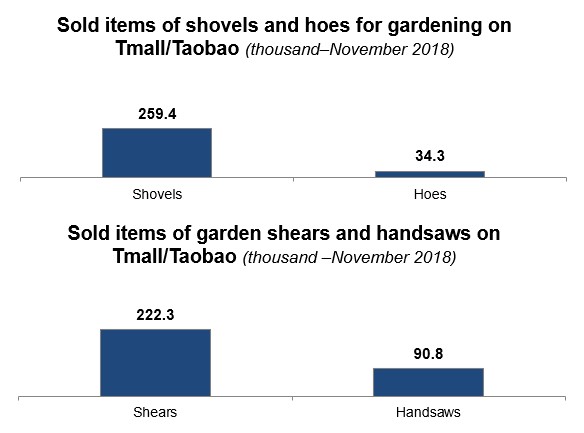

Shovels, hoes, garden shears, and handsaws are widespread gardening tools in China. On Taobao/Tmall, the sales of shovels (for gardening) were far more than hoes (for gardening) in November 2018. The sales of garden shears were also more than handsaws during the same period.

[Source: Daxue Consulting]

Gardening tools market trends and promotional solutions

The Chinese market for gardening tools is changing and growing. Daxue identified the three key market trends that will shape the future of the Chinese gardening tools market.

- Environment protection

Many gardening machines are petrol products, which causes air pollution. Thus, many brands have started to use electricity as new energy of gardening machines for environment protection.

- Chinese independent brands

By learning from international gardening tools brands, many domestic manufacturers have now created independent brands and developed better technologies to enter the high-end market (both the Chinese market and the global market).

- Appearance is becoming important

Since the living conditions of Chinese consumers has been improved rapidly, many people have started to pick their gardening tools with a nice appearance (quality, effects, and price are still important). Therefore, some brands began to offer gardening tools with better designs.

To further support the promotional purposes, brands who want to enter the competitive Chinese market should fully utilize the promotional channels including specific websites, specialized magazines and social media key opinion leaders (KOLs).

Additionally, there are now specialized websites as promotional channels waiting to be fully exploited.

- Chinagardentools.net (中国园林工具交易平台) at Chinagardentools.net

- Gardentools.cc (园艺工具网) at gardentools.cc

- CSC86.com (华南商城) at csc86.com

Specialized magazines as a purposeful promotional channel:

- Xiandai Yuanyi (现代园艺)

Xiandai Yuanyi (现代园艺) is a well-known professional magazine about gardening in China. The magazine offers technologies, plant knowledge, and sales information. The gardening tool is a part of the magazine’s content.

KOLs are important in Chinese social media life. For international brands, KOLs are a huge part of modern Chinese product promotions activities. Users of gardening tools are influenced by KOL’s shared opinions and introductions. KOLs, who post information about gardening tools, mainly consist of gardening/machine KOLs, photographers, goods designers, and brand founders.

[Source: A Weibo account of a photography KOL, writer and editor of a Chinese magazine 《IFIORI》. Her account has 422,035 followers. One of her posts about gardening tools received 100 likes and 55 comments]

[Source: This is Internet news and info KOL; the KOL mainly posts info about daily use goods and hot internet topics. The KOL has 65,876 followers. Gardening tools are part of his posts]

The Chinese gardening tool market takeaways

The Chinese gardening tool market is growing rapidly with huge unrealized potential. Gardening and horticultural activities are now popular among middle-class Chinese. With a rising disposable income, people are now willing to spend more on high-quality gardening tools with outstanding design and craftsmanship. E-commerce platforms are a major battleground for the market competition of local and global brands, and brand promotion in China is essential to gain extra market share.

As the gardening tool market in China is still amateur but highly competitive, international entrants are advised to carefully design their marketing strategies and promotional methods before the entrance. Social media existence is essential, as Chinese consumers heavily rely on online product reviews and feedbacks to help with their purchasing decisions. Also, brand naming and advertising are crucial for people to remember your brand.

China is now turning into an environmentally friendly economy with eco-friendly industries booming. Gardening tools sold and used in China are also coping with this trend. To successfully launch a business in the gardening tool market in China, it is important to keep the products and brands up to the current trends. Again, social media is a great platform for both gathering consumer feedbacks and promoting your own products for brand recognition.

Author: Jiameng Hu

Daxue Consulting helps you get the best of the Chinese market

Do not hesitate to reach out to our project managers at dx@daxueconsulting.com to get all answers to your questions.