A clear vision of the Eyeglasses Market in China | daxue consulting

Size of the eyeglasses market in China

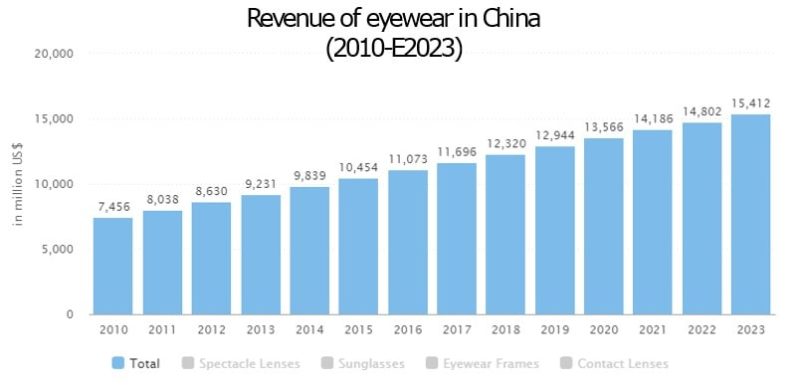

The spectacle market in China generated 63.8 Billion US dollars in 2018, increasing by 6% since 2017. With a population of 1.4 billion people by mid 2019, China has an enormous demand for eyeglasses and other vision correction products. China not only has the largest potential in the eyewear market, but is also the leading manufacturer of eyeglasses.

Highest rates of myopia in the world, fuelling demand in the eyeglasses market in China

Around half of the people in China are affected by myopia, which is significantly higher than world average of 30%. A survey from the National Health Commission reported 53.6% of mainland children and adolescents in 2018 suffered from myopia. This include 14.5% of children aged six, 36% of primary school students, 71.6% of junior high school students and 81% of senior high school students. With the high myopia affected rate, the eyeglasses market in China is only going to expand. As young children are diagnosed with myopia, parents are willing to pay for high-quality eyeglasses for their kids. As electronic devices and smartphones are becoming more prominent, 67% of children aged six or under are exposed to blue lights on a daily basis due to increasing smart phone use. Blue light-blocking spectacles are becoming increasing popular with parents who want to protect their children’s eyes.

However, huge demand does guarantee success in the eyeglasses market in China. Foreign eyeglasses companies looking to enter China should still create a strategic market plan based off data and research.

Leading Competitors in China’s optical lenses: international and local brands

Market share in China for optical brands is quite diffused. The top 10 brands commanded a combined market share of just 15.4% in 2018. This means that there is no clear leader in the eyeglasses market in China, but there are a lot of competitors who have very innovative technology and accurately cater to Chinese consumer demands.

International competitors in the eyewear market in China: ZEISS, Essilor, Nikon, Hoya, Chem

Good quality, high technology content and complete product lines are the major strengths of these imported brands.

Zeiss: Experiencing rapid growth in China

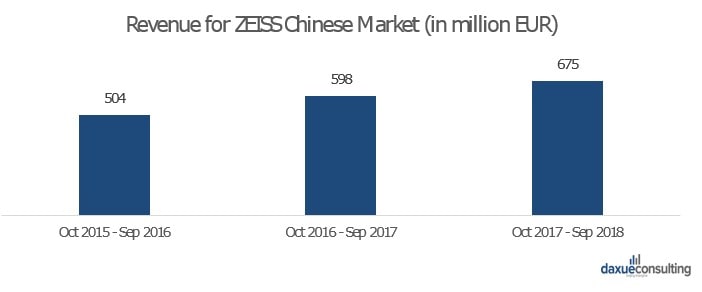

Zeiss Greater China established in China in 1957. The Zeiss group covers multiple industries including semiconductors manufacturing, industrials quality solutions, research microscope solutions, medical technology, and vision care and consumer optics in Greater China. Zeiss is considered as a high-end product that target for white-collar workers and wealthier class as ‘ZEISS’ itself represents high quality.

ZEISS’ revenue in the eyewear market in China has increased each fiscal year a 13% growth was achieved in China for the fiscal year ended on Sep 30th 2018.

Zeiss has developed several specialized products such as Full UV protection clear lenses: provide full UV protection while maintain high transparency of the lens, DuraVision® Premium Coatings, PhotoFusion®. As one of the leading brand in optical lens market, Zeiss is continuously creating excellence with a unique powerhouse and providing holistic offering with market leading innovations, and a global network.

Hoya: Customised for the Chinese market

Hoya is another international brand that is doing well in China. Hoya is a Japan based premier provider of optical glasses such as photo masks, photo mask blanks and hard disk drive platters, contact lenses and eyeglass lenses using wave front technology for the health-care market, medical photonics, lasers, photographic filters, and software.

Hoya is famous for its quality, unique design and aesthetics as well as latest functional improvements and innovations. Hoya also markets itself as a brand that more suitable for Asians. Hoya has developed a Defocus Incorporated Multiple Segments (DIMS) spectacle lenses that is specially customized for the Chinese market. DIMS was developed in association with Hong Kong Polytechnic University and is known to be able to slow down myopia progression. Besides, Hoya provide a reasonable price compared to other brands of the same level despite lower brand awareness than Zeiss and Essilor.

Local competitors: Mingyue, Wanxin, MUJOSH

Mingyue (明月) Optical is one of leading professional eyeglass manufacturers in China with strong R&D and manufacturing ability. Its distribution network has exceeded 20,000 store locations and it has been exported to about 50 countries and regions.

Mingyue’s Sales revenue in 2018 has realized over 20% year-on-year growth. According to Euromonitor, the domestic market sales of Mingyue optical has occupied the first place for three years.

Mingyue marketed itself as a national brand from the beginning, focus on users, and winning partners. This makes Mingyue become the first choice for partners and therefore become the first choice to consumers. In 2019, it is estimated that nearly 150 million RMB is invested in brand promotion, terminal construction, training, services, etc.

Besides marketing, Mingyue also emphasis on the optical lens technology innovation. It has developed A6 coating, which provide better waterproof, dustproof, antistatic, oil resistant and wear resistant capability. Mingyue also launched first experiential retail terminal in the industry called SI system, and fast expanded in national area.

To Chinese eyewear consumers, Mingyue is a local brand that is more suitable for Chinese. It is also a national sales lead with assured quality.

Key Success Factor in the eyewear market in China: Quality

It is not hard to realize that quality is the top key success factors that shares among these successful brands in China. It is important for companies that want to enter Chinese market to provide a high quality products and services. Meanwhile, marketing as a high quality optical lens provider is also an important factor to success. A strong R&D manufacturing and strive to provide a more suitable products to Chinese customers is another factor that help to win more Chinese customers.

Current Eyewear Trends: Necessity VS Fashion accessory

A fashion symbol: Raising demand of the sunglasses market in China

Sunglasses are becoming increasing popular in China as a fashion accessory and the number of people buying sunglasses is growing year by year. Moreover, many sunglasses brands and luxury brands are expands series to stimulate sales further. According to Euromonitor, sunglasses sales in China reached RMB10.77 billion in 2018, an increase of 7.3% from the previous year. Increasing numbers of people are buying sunglasses as fashion accessories. The sunglasses market in China has also recorded a growth of healthy and stable value in real terms in recent years. The residents of lower tier cities buy new glasses once every three or four years while those in tier 1-2 cities change approximately every two years. Starting on this basis, the annual demand in the central market pairs of sunglasses is about 50 million of pairs.

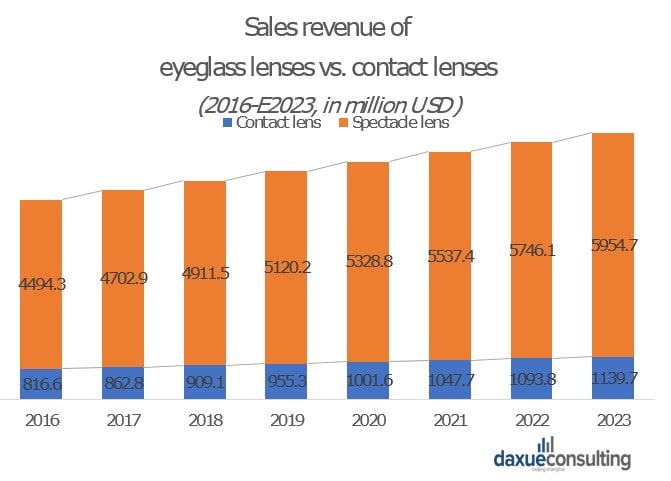

Contact lenses market in China: An important cosmetic product

According to Euromonitor, retail sales of contact lenses in China amounted to RMB8.77 billion in 2018, up 7.5% from the previous year. This figure is expected to rise by an average 6.7% annually over the next five years, to reach RMB12.13 billion by 2023. Many people choose contact lenses because they are more convenient, and carry less risk of injury specially when performing physical activities such as sports. Among all types of contact lenses, sales of disposable one-day contact lenses are likely to grow even faster than sales of traditional lenses. Thanks to the thriving cosmetic industry in China, sales of contacts lens continue to increase as it transform from a functional lens to a cosmetic product. However, while the contact lenses market in China witnessed higher growth rate in recent years, eyeglass lenses still account for the major market at present.

Grasping the high demand in the eyewear market in China

There is no doubt that the eyeglasses market in China is expanding with the increasing rate of myopia. However, it was not easy to win Chinese consumers without marketing your brands strategically. According to the common success factors of current top spectacle lens brands, the key is to provide quality optical lenses to Chinese consumers and market your brand as high-quality. Moreover, the current trend shows sunglasses and contact lenses have a huge potential as Chinese consumers are becoming more aware of their styles. Therefore, staying trendy could be the next key success factors for all optical lens providers.

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes