The impact of the Covid-19 pandemic on the organization and HR of foreign companies in China

Daxue consulting has teamed up with Dragonfly group HR Consulting to initiate this study, aimed at analyzing the impact of Covid-19 on organization and intercultural human resources of foreign companies in China. From this study, we can conclude the necessary push towards technological and organizational transformations that have made it possible to monitor and manage this epidemic like never before. Beyond a purely local vision of sharing the experience of each actor, this topic has global repercussions. We were delighted by the participation rate in this research: more than a hundred business leaders engaged in French companies and companies from French-speaking countries operating in China.

Download Full Report

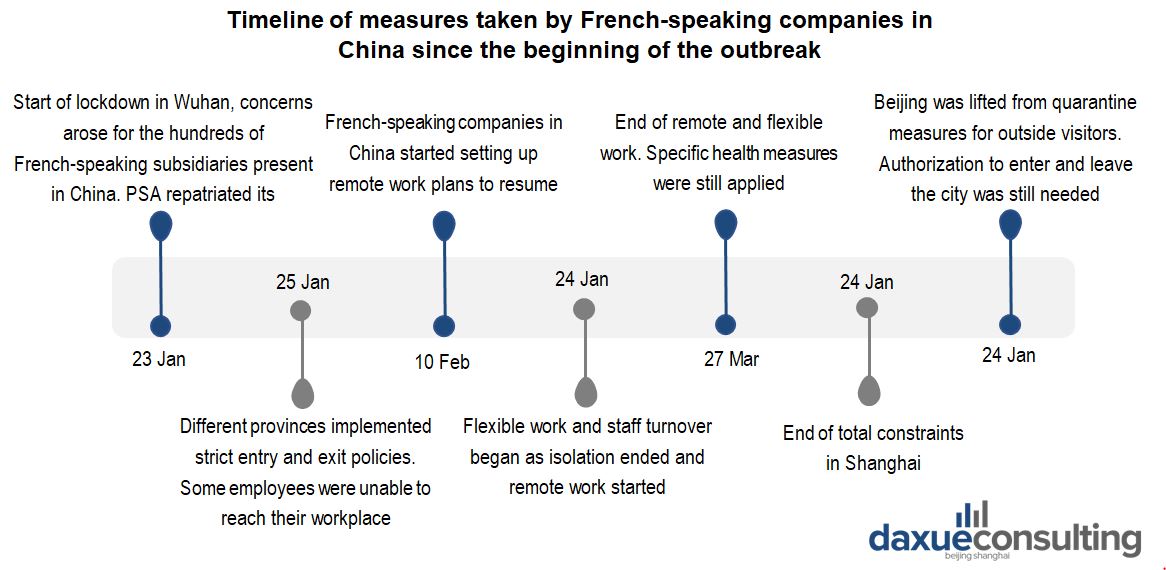

Measures taken by foreign companies since the beginning of the outbreak

Remote work

95% of the surveyed companies set up remote work tools to ensure the continuity of their operations as soon as the Chinese New Year holidays ended, in early February 2020. However, they encountered several challenges like inability to work from home for employees of factories, workshops and construction sites. Furthermore, support functions working remotely also need the necessary IT tools. Thus, relative solutions are sending tools and components to assemble at home, providing VPN access, sending new computers through the IT team and adopting software to facilitate remote work. Moreover, during the pandemic, the top 3 used collaborative tools are WeChat, DingTalk and Zoom.

Flexible work and more flexible hours

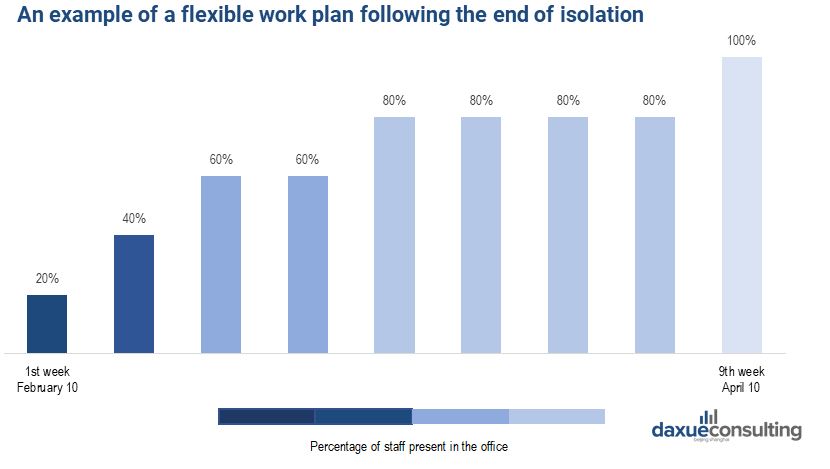

49% of the companies surveyed decided to implement a staff turnover policy to reduce the risk of contamination at work, and it was used more often in medium-sized enterprises and large enterprises, whose payroll increased the risks significantly. For these companies, staff turnover took effect at the end of the remote work period, allowing a smoother and safer return to work. Hence, it generally started from the end of February until the end of March. Most chose a system of two teams (A and B), which shared a week each.

Source: daxue consulting, The impact of Covid-19 on the organization and HR of foreign companies in China.

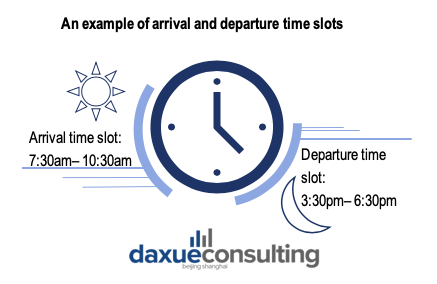

In order to avoid peak hours in public transit, companies reorganized working hours. Employees had departure and arrival time slots, based on their preferences in a 3-hours slot. Furthermore, 5 companies mentioned the provision of rental cars and Didi 滴滴for employees who had to use public transit.

Specific measures to avoid the risk of contamination at work

100% of LEs, MSEs and SEs, and 75% of MEs implemented specific health measures by the end of the Chinese New Year holidays in early February. In factories, the sanitary measures became stricter: reorganization of the changing rooms, footbath at the entrance, more masks supplied per day, and a quicker pace of staff turnover. Additionally, in order to avoid physical contact as much as possible, canteens and meeting rooms were prohibited or fitted to respect the principle of social distancing.

The digital health passport (suishenma 随申码) has been deployed on the Alipay 支付宝 mobile payment app across China since late January. It tracks the movement history of individuals, coupled with the geographic data of the pandemic. Sequentially, it delivers its conclusions in three colors as illustrated below.

Employees’ temperature was regularly checked by digital infrared thermometer at the entrance of the buildings. Furthermore, nominative cards at the entrances were distributed to employees to enter the buildings, and employees were required to keep a physical distance of at least 1 meter in access lines. Beyond these, enterprises distributed masks and hydroalcoholic gel to employees in the office and implemented disinfection protocol every 2 hours.

Undoubtedly, China’s measures to suppress the spread of the Covid-19 have achieved significant success. Meanwhile, these technological and organizational transformations enabled developments in working remotely, tracking population movements and establishing QR tracking

Operations resumption

The companies surveyed had largely resumed their operations by February 10th. Authorizations to restart the activity were issued for 88% of small and micro enterprises, compared to 75% of large and medium-sized enterprises.

According to the company’s activity sector, the full recovery is very contrasted, mainly assessed on a case-by-case basis by local authorities. Thus, companies whose areas are considered strategic, such as health or chemicals, have not encountered any difficulty. On the contrary, business sectors based on physical stores suffered a slower recovery, especially those in physical retail.

Check out our pages about how China is recovering from the Coronavirus outbreak and the Coronavirus China economic impact report by Daxue Consulting.

Main HR challenges met by French-speaking companies in China after the outbreak of the Covid-19

Employee motivation and involvement

In early February, the motivation of employees was divided between the desire to resume normal work and the risk posed by contamination in the office. At the end of February, employees’ motivation was affected by the remote work, emphasing the importance of “social work ties” over time. However, the comments of the respondents remained appreciative towards the state of mind of their employees during the crisis and 80% of surveyed companies considered their employees motivated during the crisis.

Assuming that most of the respondents believed that their employees were motivated, the comments showed that it is more the respondent’s state of mind that prevailed in answering this question. Thus, a respondent who is somewhat optimistic about the evolution of the situation will tend to say that his employees were motivated.

To successfully identify the feelings of employees during the crisis and determine their needs, several companies conducted internal surveys at different times during the crisis.

Employee’s feelings

70% of companies surveyed find their employees concerned, especially during the month of February. Fears were mostly fueled by the following causes:

- Staff were worried about potential issues around salaries and job security.

- Fear of contamination during transportation to work and at work.

- Concerns about the return of other employees from high-risk areas.

- Fears on current activities and projects.

Additionally, employees were also curious about following questions:

- What was the financial impact for the company?

- What were the legal and economic repercussions on employment?

- How would the recovery be organized?

Thus, knowing how to assess the mental wellbeing of employees during Covid-19 disruption became nonnegligible for companies. It is notable that short- and medium-term business fears were not necessarily correlated with the size of the business on its pre-crisis financial health. Similarly, subsidiaries of large groups and midcaps in China were not spared from these concerns.

Crisis communication and leadership

While facing these different challenges, leaders and managers insisted on their role in the communication process to answer the questions concerning the business’s economic future, job security, and organizational changes. Regular crisis communication brought visibility and transparency to employees. These methods were necessary to reassure and reduce feelings of anxiety among the employees.

Some comments highlighted the importance of leadership in helping employees get through the crisis. Companies cited decision-making and responsibility as essential leverage for organizing remote work and resuming activities.

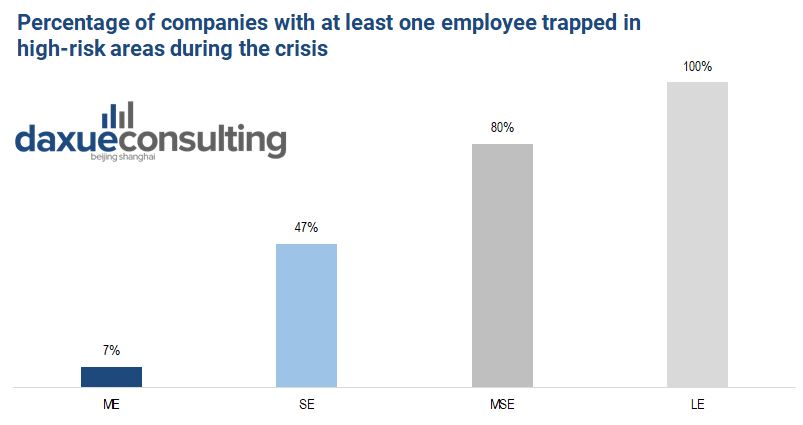

Many employees were stranded in high-risk areas and the bottlenecks were long-term since they were unable to reach their workplace from January to April. Some workers were denied entry to their dorms, or were no longer travelling between provinces, according to local regulations. As for the solutions to overcome these issues, remote work remained the leading one.

Source: daxue consulting, Covid-19 impact on the organization and HR of foreign companies in China. Many companies had employees stuck in high-risk regions like Wuhan.

With the global expansion of the pandemic in March that forced the Chinese authorities to close their borders, some expatriates were stranded outside of China. Thus, French-speaking companies in China expected difficulties, particularly for visa renewals and expatriate family life.

Work-life balance

Isolation impacted the work-life balance, which was becoming increasingly difficult to maintain, causing more fatigue and burn-out among employees. Concentration difficulties were sometimes linked to the lack of peace at home, the presence of young children, or the absence of a formal working environment. In fact, 45% of companies believed that children’s education from home has had an impact on the availability of employees. Hence, for some employees, the home work environment resulted in a lower level of productivity.

HR policies implemented by French-speaking companies in China to ride out the crisis

Salaries

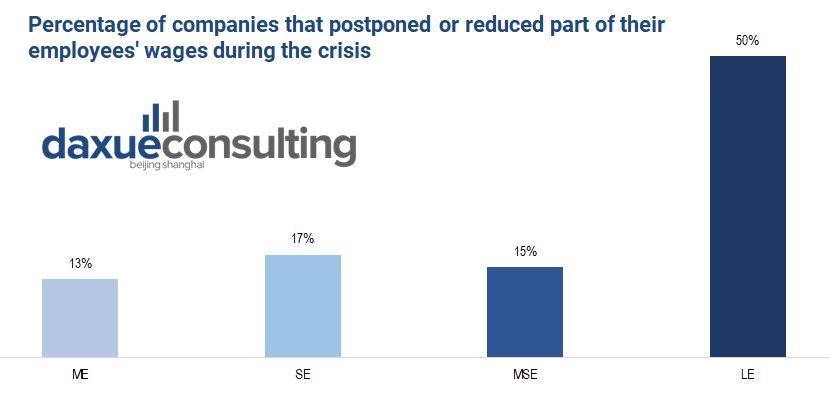

Overall, there have been several cases of wage cuts or deferrals during the crisis. However, we observed a clear cap between companies of more than 5,000 employees in China and the rest of the landscape of French-speaking companies interviewed. 50% of LE s decided to act immediately on employee salaries, compared to 17% of SEs. Generally, the wage cuts targeted the executives and the companies’ highest wages. Otherwise, they were linked to a significant impact of Covid-19 on foreign company’s activity area.

35% of the companies surveyed were likely to freeze or cut wages in the short-term, no matter the size of their workforce. Besides, comments showed that future freezes or reductions would be subject to many uncertainties, and linked to the difficulty of anticipating a return to normal activity. Again, some comments indicated that these freezes or cuts would generally affect the highest salaries.

Source: daxue consulting, Covid-19 impact on the organization and HR of foreign companies in China. Large enterprises were more likely to reduce wages during COVID-19 in China.

Layoffs and recruitment freezing

9% of the companies surveyed carried out at least one layoff during the crisis. In the sample surveyed, theses layoffs affected small enterprises. With less financing than subsidiaries of medium-sized companies and large groups in China, small enterprises were hit hardest by the crisis, and were sometimes forced to fire employees. However, it was unclear whether the 9% of layoffs were all directly related to the crisis or not since several comments referred to restructuring plans implemented before the crisis to justify the layoffs.

On the other hand, recruitment was frozen. Overall, there were fewer recruitments during the crisis, except for strategic positions. Store sales, support of customer service positions, directly affected by the crisis, were impacted by the freeze. As for strategic positions maintained, were mainly digital ones, directly related to the good performance of online services during the crisis. Comments showed that IT and social media positions were strategic during the crisis. Here is more information on how the e-commerce industry in China is changing during Covid-19.

New recruitment methods and organizational adjustments

Several French-speaking companies in China added that they encountered difficulties in the process of recruiting new candidates in China during the epidemic. These challenges stemmed from the inability of recruiters to meet candidates in person. As a result, interviews by videoconference were mentioned to facilitate the process, as well as the use of psychometric tests as additional decision support.

Also, companies wondered about a potential change in the professional aspirations of candidates: “Will the epidemic push some candidates to look for work closer to their homes?” and thus never leave their province of origin…

As for organizational adjustments, a few companies reported using the “zero-based budgeting” method to adapt their HR policies during the crisis. The zero-based budgeting (ZBB) is a method of budgeting in which all expenses must be justified for each new period to focus on cost containment. This budgeting method is contrary to incremental budgeting, which applies additions or deductions to the last period’s actuals.

Future prospects of French-speaking companies in China after the Covid-19

Forecasting the recovery

Most of the French-speaking companies in China do not forecast a full recovery until Q4 2020 or Q1 2021. Indeed, the epidemic still impacting Europe and North America and will affect the visibility of the companies whose operations are globalized. According to them, three indicators need to be closely monitored: order book, cash and the working capital requirement (WCR). Conversely, French-speaking companies in China whose operations are based exclusively on the Chinese domestic market have seen their activities restart at a quick, sometimes surprising pace.

An example of a respondent’s foresight of his operations’ recovery: From April to May, in the short term, slight impact of Q1 very easily absorb-able on Q2; From June to December, in the medium term, a possible violent reversal; On January 2021, in the long term, operation recovery will depend on the possible relocation of customers, the US election results and the international situation as a whole (political, economic and financial).

Some strategic changes and experience from the Chinese subsidiaries

To cope with the impact of the Covid-19 on foreign companies in China, decision makers are taking advantage of the momentum of online services to develop their digital activities. Others have made complete strategic changes to survive the crisis.

The French-speaking subsidiaries in China, whose headquarters are located abroad, transferred the experience in China. The questions are mainly related to the necessary protective measures to be taken for the work resumption and the end of isolation. Main tips are the followings:

- The Chinese team in support of the group’s crisis unit.

- Implementation of China’s best practices for the French headquarters.

- Toolbox for the crisis management experience sent to headquarters and global teams.

- Online webinar with the subsidiary: The impact of Coronavirus on the Chinese markets and its innovations.

We are still far from having drawn all the conclusions from the health crisis since the world has switched to an economic one. This study initiated by daxue consulting and Dragonfly Group provides a solid outline to understand the operational and organizational transformation in which the international companies have engaged in China. We are grateful to those companies which agreed to participate in this survey and their contributions are definitely significant. If you have any question, please feel free to contact us.

See how companies in China responded to the COVID-19 crisis in our Crisis Management Report

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

![[Podcast] China paradigm #16: How an APP can improve employee training in China](../wp-content/uploads/2019/03/China-business-podcast-16-training-in-China-150x150.jpg)

![[Podcast] China paradigm #28: Using thought leadership and social media to accelerate your business in China](../wp-content/uploads/2019/04/China-business-podcast-28-Ashley-Galina-150x150.jpg)

![[Podcast] China paradigm #18: How to take western digital marketing success into China](../wp-content/uploads/2019/04/China-business-podcast-China-paradigm-18-150x150.jpg)

![[Podcast] China Paradigm 36: How to run a headhunting company in China](../wp-content/uploads/2019/05/podcast-headhunting-company-China-150x150.jpg)