The expanding Chinese lighters market provides diverse opportunities for international entrants | Daxue Consulting

China is now the largest producer and exporter in the world, with an enormous population of smokers, and thus a huge domestic demand for lighters. In addition, some luxurious and innovative types of lighters are now considered as new gift options and hence broaden the demanding spectrum of lighters in the domestic market. The continuously growing means of purchasing online and offline retailing give Chinese consumers a wider range of choices on how and when to purchase a lighter. The wider demand spectrum of different types of lighters further differentiates the products – for daily usage and gift purposes. Chinese consumers now heavily rely on social media to pick their own lighters and localized branding strategies can lead to outstanding sales performances for those international brands operating in the Chinese market. Overall, the Chinese lighters market is huge enough for international brands to compete with local producers. However, without clear brand position and localized branding strategies, there is limited chance for new international entrants to further expand their market share in China, as most Chinese consumers are now demanding not just a brand with an international background.

China is producing and consuming the largest amount of lighters in the world

Lighter production in China

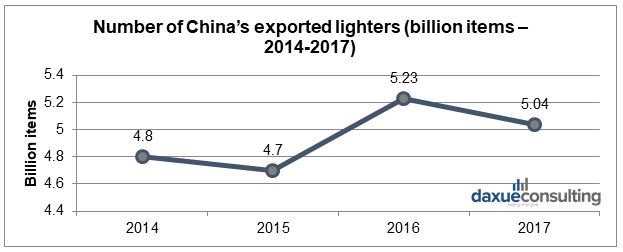

China is now the largest lighter producer in the world. The annual production of lighters has exceeded 15 billion items in 2017. Almost 70% of the world’s annual lighter production is contributed by Chinese producers from 2014-2017. Chinese-produced lighters also occupy 67% of the number of lighters sold globally. Since 2016, with this large production volume, China exports more than 6 billion lighters per year worth 165 million US dollars and it now shares the world’s 45% lighters market with the global market demands for lighters ranging around 20 billion items annually.

Number of China’s exported lighter from 2014-2017

China has an enormous consumption of lighters

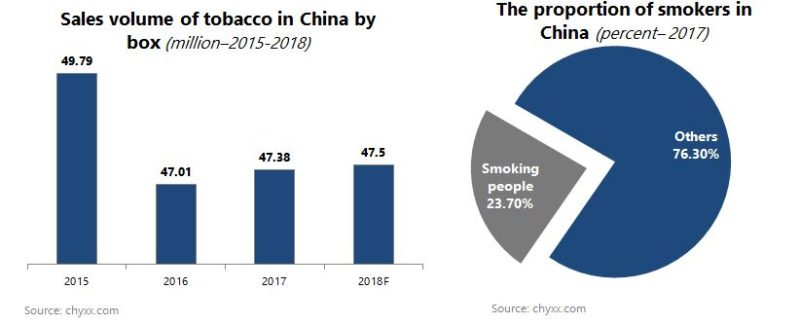

Smoking is still the major purpose of lighters in China. Smokers are the main consumers of lighters in the Chinese market. China is the largest tobacco producer and consumer around the globe and it has 300 million tobacco users. tobacco users, known as the ‘smoking population’, occupy 23.70% of the total population in China. In 2017, China has witnessed a resurgence in tobacco consumption, with a 7.36% increase in normal cigarettes and 16.76% in luxurious tobacco products. Though China has published a series of regulations to reduce the smoking behavior and smoking population and witnessed a sharp decrease in tobacco sales during 2015-2016.

Chinese Tobacco sales from 2015-2018 and the smoking population in China 2017

The tobacco sales have restarted its increase since 2018 and continue this growing trend into 2018 with estimated sales around 47.5 billion boxes of tobacco products. As a result, large tobacco consumption leads to large lighters demand in China.

Lighters for daily usage (normally the low-end kerosene plastic-made lighters) are one of the major types of lighters consumed by regular tobacco users.

Chinese consumers use lighters as gifts

Other than being used for daily smoking, consumers also consider lighters as precious gifts, these mostly happen when purchasing luxurious imported lighters such as Dunhill or Zippo lighters. These international brands are regarded as more suitable as presents rather than daily usage.

Baidu Index shows that the search intensity of ‘lighters’ reaches its highest point in February 2018 when it was the Spring festival in the Chinese lunar calendar, which means the beginning of a new Chinese lunar year. More people (including non-smokers) consider lighters as festival gifts other than its main function as daily used equipment. Another Baidu Index keyword analysis shows that the search intensity of ‘lighter brand’ reached its peak during the Chinese Valentine’s Day. Branded lighters (mostly luxurious or more-costly than normal plastic-made kerosene lighters)are now being considered as a new gift option for women’s beloved husbands and boyfriends no matter those men are smokers or not.

Baidu Index on keywords ‘lighters’ and ‘lighter brands’ shows that lighters may be one of the festival gift choices in China now

Branded lighters vs Non branded lighters in the Chinese market

Chinese consumers now separate lighters by their function. Daily usage lighters are normally made of plastic and using electronic means or kerosene as the main lighting technique. While high-end branded lighters such as Zippo can be seen as a gift during festival seasons, mainly due to its high added value from better design, craftsmanship, quality and original lighting experience by using the flint as the lighting technique.

Baidu Index keyword search intensity on words that represent normal plastic-made lighters for daily usages shows a totally opposite pattern with branded lighters during non-festival and festival days.

Baidu Index keyword ‘kerosene lighter’ and ‘electronic lighter’ shows low search intensities during festival seasons

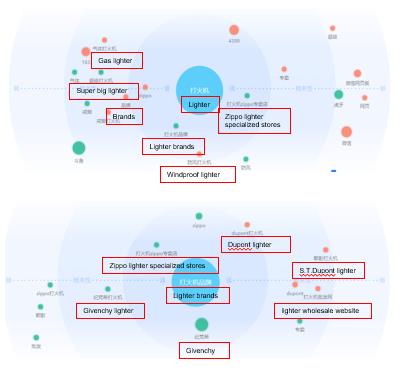

Semantic analysis showing the searching trends lead by different keywords – ‘lighter’ for normal lighters and ‘lighter brands’ for branded lighters

The search intensity for keyword ‘kerosene lighters’, which stands for normal plastic-made kerosene lighters reached its lowest during the week of Chinese Spring Festival. The search intensity for keyword ‘electronic lighters’, which stands for another type of low-end daily using lighters also reached its lowest during the Spring Festival season as well as the Chinese National Day holiday season at the beginning of October 2018.

Further semantic analysis from Baidu Index of different keywords related to lighters shows a segmented trend towards different positioned lighter products and brands. A normal keyword ‘lighter’ is highly related to different types of normal lighters such as gas lighters and windproof lighters. While the special keyword ‘lighter brands’ related to differently branded lighters which have higher retailing prices with an international background such as Zippo and S.T Dupont.

Consumption trends in Chinese lighters market

Social Media Content analysis:

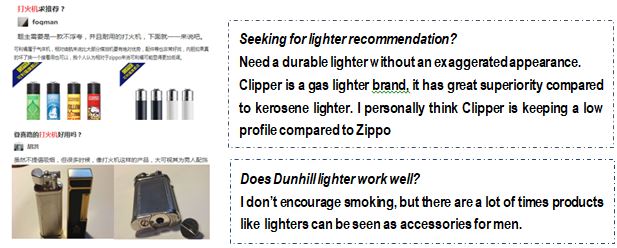

Chinese consumers now rely heavily on domestic social media when picking their own lighters. Zhihu, Weibo and Wechat are the major sources for opinions sharing and brand introduction.

Zhihu.com

Zhihu, as a Q&A social media, has gathered more than 100 million topics under numerous topics. Under the topic of choosing lighters, answers focus more on lighter brands introduction and recommendation. Mostly international brands are being recommended and picked such as Clippers, Zippo and Dunhill.

Weibo is another major social media primarily for opinion sharing, businesses do marketing campaign on Weibo to attract followers and hence the brand recognition and reputation among Chinese Internet user population. Key opinion leaders (KOLs) are the major methods of promoting one brand.

‘I have dreamed to have a Zippo lighter since I was a kid. Because it’s cool and has a strong personality. Thanks to Zippo China for offering me a surprise today. Mazzi, who is a master of art from Italy, designed this lighter for me.’ by Yu Han, Famous Chinese pop dancer promoting Zippo lighters on his personal Weibo account. This post has 8,416 likes and 28,317 shares

Weibo lottery is another popular mean for a marketing campaign on Chinese social media. Domestic brand Zengaz teamed up with Ziyannet.com (an entertainment media) together held an online Weibo lottery and this post received 107 likes and 315 reposts.

Don’t let your lighter expose you as having bad taste. Whether you smoke or not, a lighter is the alternative on men’s gifts list. After all, it has a special position among men’s fashion accessories. Men buy lighters for themselves and as gifts, not only for their practicability and value but also to show their styles and taste.

This article has 7,700 views and 20 likes.

Wechat, the biggest online communication tool has its own social media function. Wechat articles are published by public accounts that users can follow. These articles can be on various topics including lighters. Articles on lighters mainly focus on how to pick your own lighters that fit your tastes and introduction and recommendations of differently branded lighters.

‘\and Ziyannet.com wake your football dream. Now follow @ZENGAZ and @Ziyannet.com and share with 1 friend, forecasting the champion of the world cup! On 14th, 21st, 28th of June and 5th, 12th of July, we will pick 1 person each day to receive a gift about World cup for free

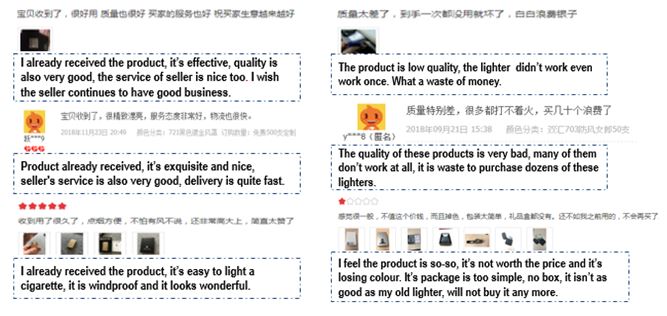

Products authentication and validation, lighter brands (mainly international brands) introduction and promotion, these are topics mostly seen from the analysis of social media contents. On the other hand, e-commerce platforms customers praise for the good quality and great craftsmanship incorporated in those products. Hence a comprehensive analysis of the lighter products sold online is another convenient way to verify the consumer trends on lighter in China.

Customers from e-commerce platforms praise for good qualities and great good design while criticizing poorly manufactured products.

The international brands are facing strong competition from local brands, or even local manufacturers not branding their product and pricing at a low-level not matchable and exhibiting strong ties with their local distribution networks – Thibaud Andre, Research Director of Daxue Consulting

Competition landscape by product types and brands’ e-commerce presence

Analyzing the sales performances of different brands within different types of lighters is a major way to see through the chaotic lighters market phenomenon and to discover the true competition landscape and consumption trends hidden behind the scenes. Also, the e-commerce presence of different brands can be seen as if the brands’ holders are adapting relatively cutting-edge sales strategies within the Chinese market. After all, e-commerce is now the largest and most straightforward retail channel for almost all the products, especially for daily consumer goods such as lighters.

Products Analysis: Kerosene lighters in the Chinese market

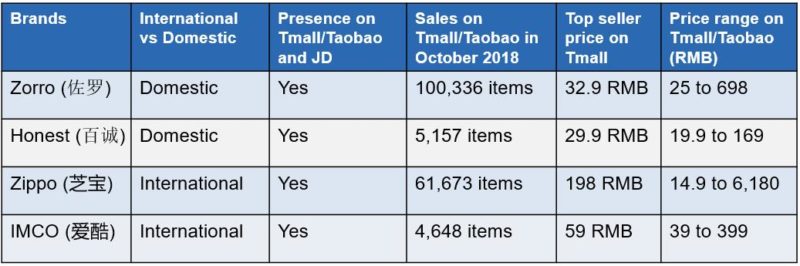

October 2018, among all kerosene lighters brands on Taobao/Tmall, Domestic brand Zorro was the sales Champion of the month, followed by international giants Zippo. Other domestic and international brands such as Honest and IMCO are also among the top sellers. Zorro captured the monthly sales champion for two reasons: low prices and classic Zippo design. Its top-selling product type was only 32.9 RMB compared with the similar Zippo one at 198 RMB. However, it is obvious that Zippo had reached a much higher revenue for a higher price with a considerable amount sold.

Kerosene lighter sales performances by brands on major e-commerce platforms in China

Consumers choose Zorro mainly for its classic Zippo design with much lower prices, but while this is true, the original Zippo brands do not lack much on the sales and its products can be sold at a much higher price. Authenticity may also exert some of its weights when consumer picking their own lighters.

Products Analysis: Flint lighters in the Chinese market

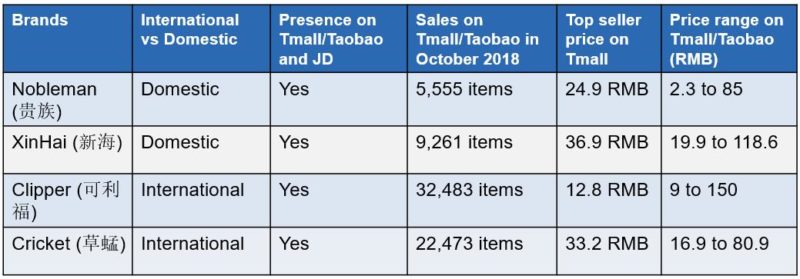

Among all flint lighter brands on Taobao/Tmall, Clipper is no doubt the dominant market player in this segment. There is no large price difference between domestic and international brands (they are all very low, Clipper even has the lowest price among all), and it is obvious that all starting at low prices, international brands are undoubtedly the most popular one among all market players for the good qualities and brands reputations.

Flint lighter sales performances by brands on major e-commerce platforms in China

Other brands include Nobleman, XinHai and Cricket (international). Domestic brands are not competent to their international counterparts and even the second top seller Cricket sold way more lighters than the domestic third XinHai for more than 10,000 thousand lighters.

Products Analysis: Electronic lighters in the Chinese market

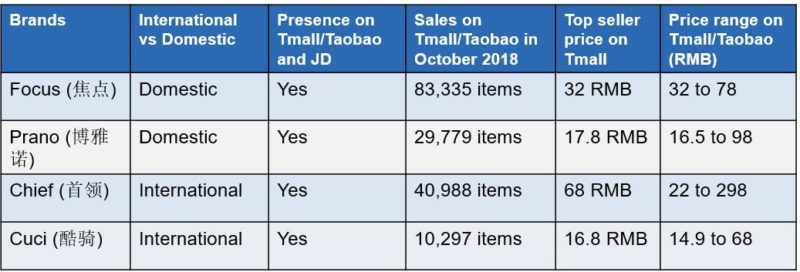

Domestic brand Focus led the Taobao/Tmall sales in October 2018 with its items sold doubled those sold by the second-best seller international brand Chief. The major reason is that domestic electronic lighter producers developed their technology of production independently and the lower costs lead to a lower retail price. While international brands still tag their prices ranging above medium prices, the domestic electronic lighter brands have realized low prices with reliable qualities, thus a better market performance among all the market players.

Electronic lighter sales performances by brands on major e-commerce platforms in China

The analysis of different types of lighters shows that the price range of lighters is large on e-commerce platforms such as Tmall and JD. And prices are the major criteria for the consumer to decide what, where and when to purchase. Many Chinese brands can provide extremely cheap products with similar functions since they have a lower all-scope cost structure. International firms can effectively compete with them through quality and design if the prices are not an advantage that can be grasped by foreign competitors.

Brand analysis

Zippo:

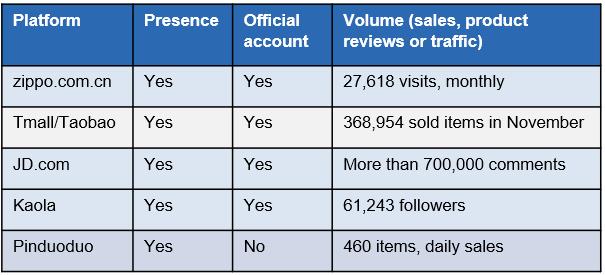

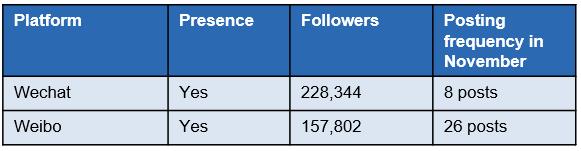

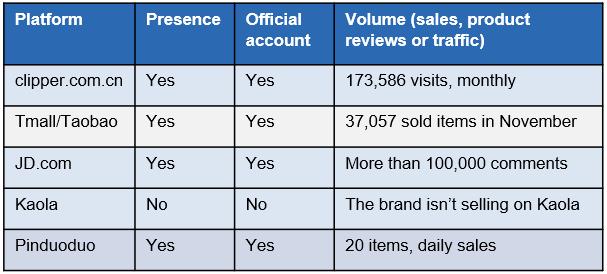

Zippo is one of the most important lighter brands in China and its strong presence on the Internet is reflected by its well-maintained official Chinese website and other official flagship e-commerce stores on different platforms. According to the research by Daxue, the official Chinese Zippo website is the major information distribution channel for Zippo news such as new arrivals and new designs, as well as those promotional activities during Chinese events such as double 11 shopping festival, the largest annual e-commerce sales events in China. Besides its Chinese official website, Zippo also has its presence on all major e-commerce stores including Taobao/Tmall, JD.com, Kaola and Pinduoduo.

Zippo’s presence on different major Chinese e-commerce platforms

Zippo’s brand reputation mainly comes from its understanding of and respect towards Chinese culture. Based on its classic design, Zippo has incorporated the Chinese cultural elements into its products for Chinese consumers. The localized branding strategy has made Zippo the most welcomed lighter brand in China.

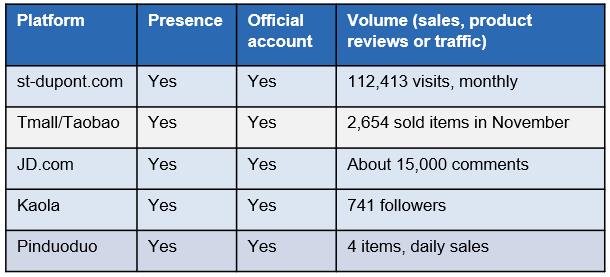

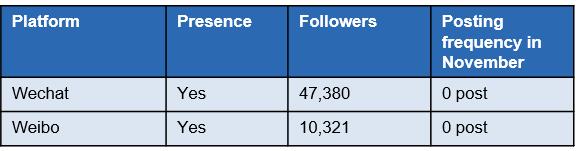

The presence of e-commerce leads to an important marketing role played by social media. In China, Wechat and Weibo are two major social media platforms penetrate heavily on consumers’ daily life. Zippo has an active official presence on both platforms with a considerable number of active followers.

Zippo’s Chinese social media presence – Weibo and Wechat

S.T.Dupont:

S.T.Dupont, the famous luxurious lighter brand from France, is another major lighter competitor in the high-end lighters market in China. This brand only sells high-end lighters with luxurious and delicate design, as well as the expensive price tags. S.T.Dupont has official presences on all major e-commerce platforms including an official website for releasing new arrivals and updating news about the brand. Due to its nature of being the luxury brand, its sales are relatively low on e-commerce platforms.

S.T.Dupont’s presence on different major Chinese e-commerce platforms

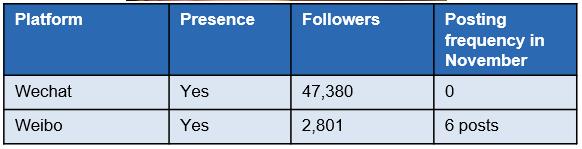

S.T.Dupont’s official Chinese social media presence is limited. Though official accounts both exist on Wechat and Weibo, they do not maintain the active status and compared with Zippo, the follower numbers are small with few posts.

S.T.Dupont’s Chinese social media presence – Weibo and Wechat

The delicacy in its product designs means the lighters from this brand are only suitable for collective purposes, for those who are truly lighter collectors, S.T.Dupont lighters exhibit high collective value while it is not suitable for ordinary consumers to purchase these types of lighters only for its brand value of being luxurious.

Clipper:

Clipper is a trendy brand in the international lighters market. Its trendy and lively design attracts younger consumers and thus being recognized as a fast-fashion related lighters brand. The official websites mainly update the new product designs for Chinese consumers while it has an official presence among most major e-commerce platforms except Kaola. Compared with the trendiest one Zippo, the monthly (November 2018) sales of Clipper is way lower.

Clipper’s presence on different major Chinese e-commerce platforms

Clipper’s social media presence is very weak, its official accounts on Wechat and Weibo have low activities and its followers are limited to a small number.

Clipper’s Chinese social media presence – Weibo and Wechat

Though not very active on social media, Clipper’s designs are very localized and personalized, which creates chances for reaching young customers as the new generation of consumers are more likely to purchase products with distinguishable individual styles. The localized cultural branding strategy also applies to Clipper’s products as it frequently uses elements of China such as the Great Wall and Pandas.

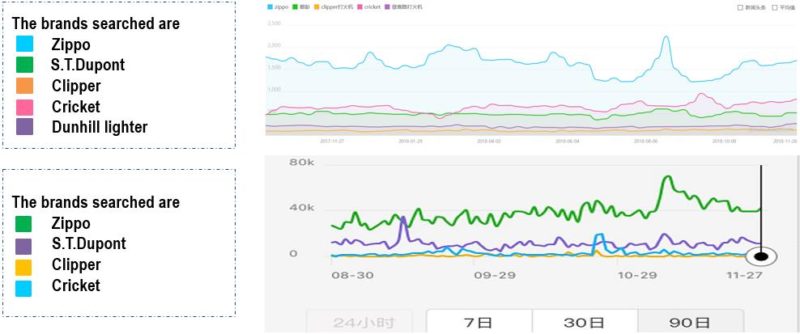

Baidu Index shows Zippo is still dominating the searching keywords, meaning Zippo is the dominating name of the lighters market in China. Other brands are incomparable to the name of Zippo. Wechat Index shows a similar pattern of intensity that Zippo has more than 5-fold search intensity than the second place holder S.T.Dupont.

Zippo is still the dominant brand by Baidu Index and Wechat Index

Facts about Zippo focuses on both high-end and low-end market may be the major reason why it is the biggest market player yet. Other brands do not have a matching product spectrum to compete with.

Localized branding strategy gives Clipper and Zippo a great advantage on sales volume. While Clipper only targets younger consumers, Zippos products are suitable for all age groups, therefore, giving it the best potential customer population in China. Metallic quality also gives Zippo great advantage compared with Clipper, of which most of the products are made of plastic. Overall speaking, Zippo offers the best lighters deal in the market with good quality and acceptable prices.

How important is a brand strategy in the Chinese market?

Successful branding strategies can bring huge success. Zippo utilized a unique China-only advertisement to promote its products in China on Valentine’s Day 2017. This advertisement did not sell the products themselves but the sense of romance connected to Zippo lighters. The purpose of the advertisement is to relate romantic feelings with Zippo thus enlarge the potential customers from the targeted audiences – young lovers in China.

Branding strategies also include naming the brands in Chinese name. Zippo has named some of its products as ‘Zimo自摸’, the words indicating a Mahjong player winning the game by getting the key tile himself. ‘Zimo’ has a potential meaning of being the luckiest and winning the wealth from others. Zippo’s ‘Zimo’ lighter is therefore associated with similar ideas.

S.T.Dupont named a series of its products as James Bond 007 series. ‘James Bond 詹姆斯·邦德’ is the major character from 007 series movies and has a great sense of taste, this name indicates the products and the owners also have great personal tastes.

Clipper uses ‘Suerte 好运连连’ as its products name, this name means the ‘ongoing good fortune’ and Clipper want to exhibit a sense of continuous luckiness for the potential users of clippers.

Thus, the ways of naming a lighter come from three major aspects. First, the names use words with Chinese culture background to express the meaning of good luck, wealth and best wishes. Second, buy using some names of well-known movie characters, products may give similar impressions of those movie stars. Last but not least, the direct use of patterns and images on lighters to express the meaning of product designs.

How important are offline sales for luxury lighter brands in China?[The retail distribution benefits from the great network of convenient stores in urbanized areas. Getting access to store chain assortment is the key challenge for international brands’ distribution – Thibaud Andre, Research Director of Daxue Consulting]

Take Zippo for example

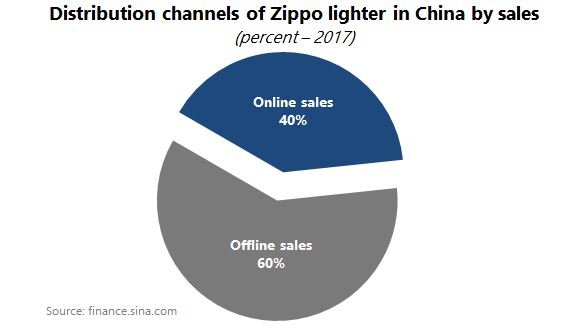

By the time of 2017, Zippo had more than 1,700 authorized offline retail stores in China. It also announced the establishment of its online official flagship stores on Tmall and JD.com. In China, Zippo’s offline sales (60%) is still the major distribution channel, while its online distribution methods (40%) are the getting up quickly in recent years.

Offline retailing – Case in Shanghai

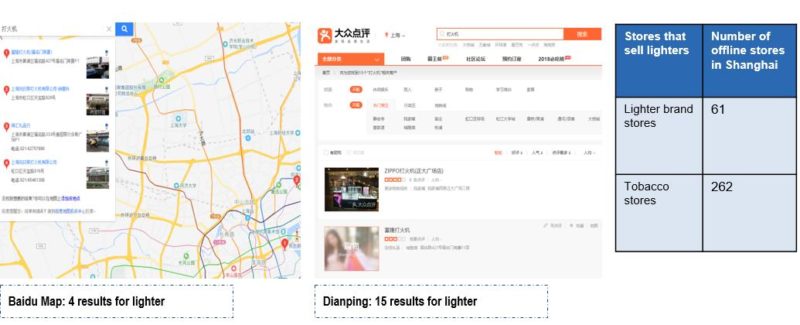

The offline retailing is still a major chain for lighter distribution. Case analysis on Shanghai shows that the offline geographical coverage of stores that sell lighters is large. Normal tobacconists and convenient stores only sell ordinary lighters for daily usage while branded lighter stores sell international brands such as Zippo and Dunhill. Research from Baidu Map and Dianping.com shows that major sales places include a shopping mall, supermarket, convenient stores and brand specialize stores.

Geographical analysis of offline lighter sales points in Shanghai

Different in-store representation

The sales places for different lighters are drastically different and their in-store representation is also distinguished.

For high-end branded lighters such as Zippo, these products are sold in specialized and authorized retailers in shopping malls and department stores with showcases containing and displaying different types and designs for customers to choose from. These products emphasize their design and quality offline.

High-end lighters are displayed in window showcases |

Low-end lighters are placed at the cashiers of convenient stores |

For low-end products sold in tobacconists, supermarkets and convenience stores, they can always be found near the cashier, positioned as an impulse or quick purchase.

The main advantage of the online retailing of lighters in China

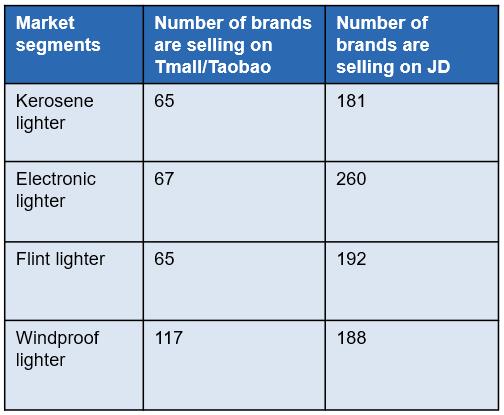

Our research shows that, though Tmall/Taobao is larger than JD.com, the presence of different lighter brands on JD.com is way more than those on Tmall. The major reason for this is that Tmall has stricter rules for official stores opening-up with a higher deposit taken. One big advantage for online retailing is that many lighter brands do not have to have a large and effective network of offline distributors to start their business operations in China.

Number of brands presence on Tmall/Taobao and JD.com

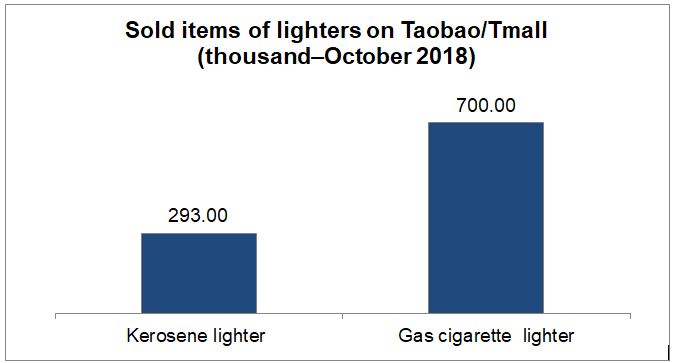

Lighters sales by types in China

The most common type of lighters used by Chinese is gas lighters. In October 2018, only on Taobao/Tmall, the sales volume of gas lighters is twice as much as that of Kerosene lighters, makes it the largest and most popular lighter type in China.

Implications for International lighter Brands

For those international lighters brands, who want to explore the consumption potential within the Chinese market, localized branding and marketing strategies are their necessities.

First of all, international brands can utilize those cross-border e-commerce platforms such as Tmall, JD.com and Kaola mean to penetrate China’s domestic lighters market. E-commerce presence of those brands mentioned is evident when considering the best market entry opportunities for those yet to come to China.

To better understand Chinese consumers, Chinese social media such as Weibo and Wechat (perhaps Tieba) are the major channel to gather customers’ feedbacks as well as holding PR activities such as Weibo lotteries. It is also important to use individual or organizational KOLs including fashion magazines and Internet icons to elevate the sense of the presence of the brand on Chinese Internet communities.

Specialized lighters online retailer is another way to open up new distribution channels when seeking ways to penetrate the Chinese market. Online retailing is the future for lighters sales in China. Zctx.com, Tlaoda.com, Vipbinghu.com, 67a.cn and 67a.cn apps are all specialized online retailers for smoking equipment including lighters. Cooperation with these retailers can bring loyal smoking population at your doorstep and once the new lighter is accepted by the most loyal and picky customer, it is easy for you to reach others with no significant brand loyalty.

Last but not least, it is important to localize especially on the product design. Zippo and Clipper adopt successful product design just for Chinese consumers. And Zippo even made a unique advertisement only for China. Evidently, the strong online and offline market presence of Zippo lighters and its enormous annual sales are all consequences of successful localization. For those yet to enter the Chinese market, it is the best to suit consumers’ tastes in China.

Author: Jiameng Hu

Daxue Consulting can help get your lighter brand into the Chinese market

Daxue Consulting has carried out enormous projects with premium products (can be your luxury lighters brand) as well as FMCG and has experience with product launches and market entry procedures like brand naming and competitor analysis. To meet answers to all your questions do not hesitate to contact our project managers at dx@daxueconsulting.com.