China’s new parents consumption report: Influences of the maternal and children product market in China

New parents in China habits on social media

In November 2019, Tencent Ads and Tencent Marketing Insights (TMI) released a report called Tencent Maternal and Baby Industry Consumer Insights 2019 (腾讯2019母婴行业人群洞察, hereinafter called the ‘report’), which revealed information and trends on China’s maternal and baby products market. Moreover, it offered us much insight into the activities and content consumption preferences of new parents in China on social media, such as WeChat. The Data were collected between July 2018 to June 2019, Tencent marketing big data were used. The samples covered tier-1 to tier-6 cities, observing parents with children under three.

The digital ecosystem brings many opportunities for the expansion of China’s maternal and baby products market

As the first generation of internet aborigines, new parents in China are used to using the internet daily, especially social media. Online social platforms such as WeChat have already infiltrated into the various daily parenting situations, from gathering parenting knowledge to spending leisure time with their children, from collecting baby care product information to even purchasing them directly on those platforms. The digital ecosystem definitely brings many opportunities for the expansion of China’s maternal and baby products market.

China’s maternal and baby products market

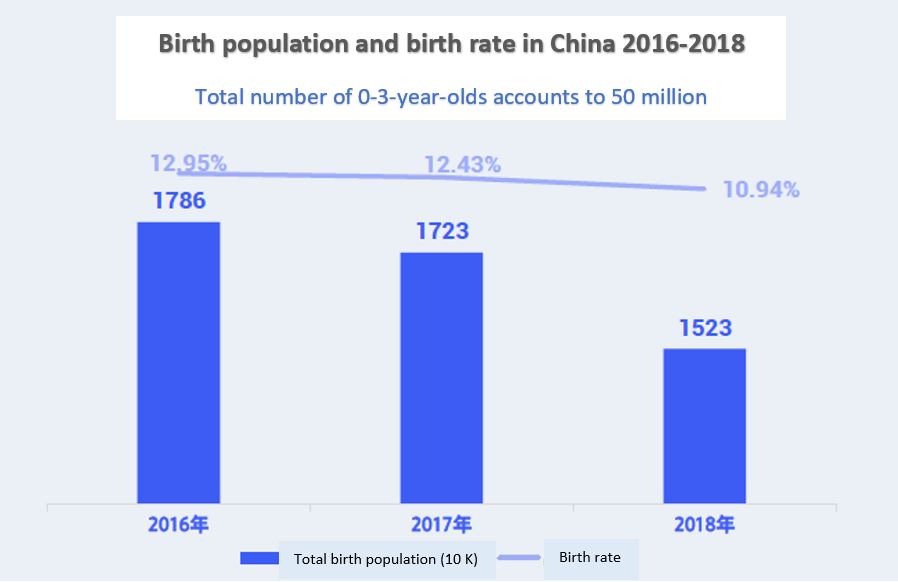

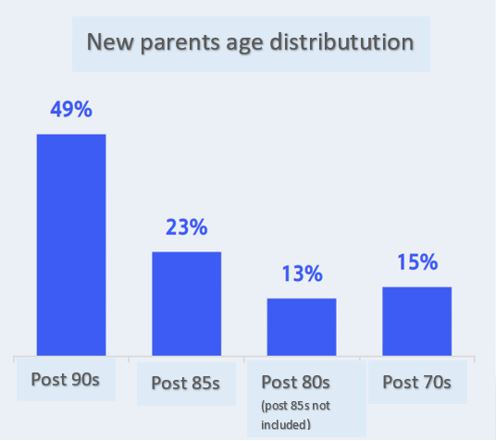

The total number of 0-3-year-olds in China from 2016 to 2018 is 50 million. The annual birth rate has kept over 10% in the last 3 years. Along with the post-90s and post-85s, post-95s have also joined the Chinese new parent group. According to the big data from Tencent marketing, people born after 1990 account for almost half of the new parents with 0-3-year-old(s) at home.

As these young millennials are becoming consumers in China’s maternal and baby products market, many new opportunities are gradually emerging. From parenting concepts to childcare consumption, new parents in China are showing an attitude that is completely different from their previous generations.

Chinese new parents possess not only affection for their children but also themselves. They want both quality time with the baby and alone time for themselves. New moms care more and more about skincare, body figure management and postpartum repair. Also, new parents in China are more educated and empowered to make their own judgments when it comes to good parenting and good life. As a generation that grew up with material abundance, these new parents have a higher and more diverse demand for maternal and baby products.

China’s new parents on WeChat

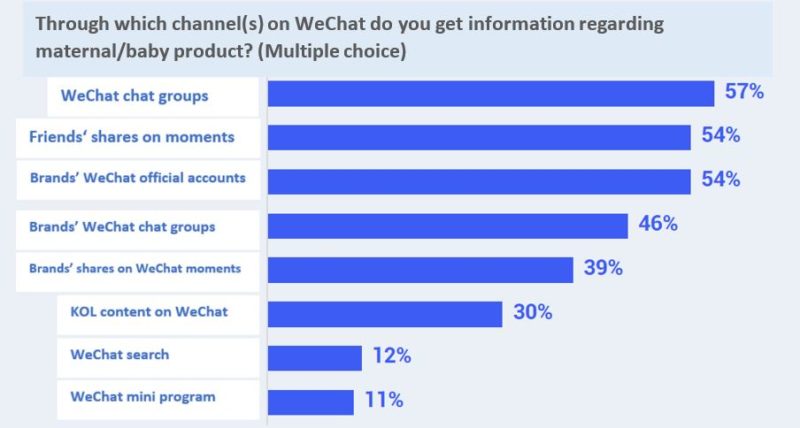

As the number one social media platform, WeChat plays a significant role in Chinese new parents’ buying decision process. The following chart shows the channel(s) on WeChat, through which new parents learn about information regarding maternal and baby products. As we can see, more than half learn about product information from chat groups, shares from friends on moments and brands’ official accounts on WeChat. Also, almost half of new parents in China get product information in brands’ own chat groups. In addition, brands’ shares on moments and KOL content are also important maternal/baby products information sources for them.

According to the report, group chats are the most important source for new parents to share and gain information about parenting knowledge as well as maternal/baby products. The report revealed that a new parent is in 3 WeChat parents-chat-groups on average, with new moms in 5 groups. Post 95s are more likely to join the brand’s fan chat groups (36%).

New parents from higher-tier cities like to join parenting lecture groups or online parenting course groups. On the other hand, new parents from lower-tier cities are more into maternal/baby product shopping groups (52%), where products discount information is shared and draw activities are held.

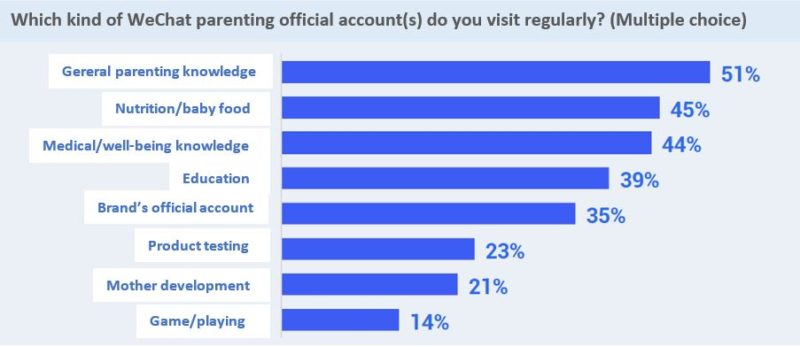

As we can see from the chart, when it comes to the question: “What kind of maternal/baby related official account(s) on WeChat do you follow and visit regularly?” More than half of the new parents in China are consuming content about general parenting knowledge; quite a lot of them follow nutrition/baby food related account (45%), medical/well-being knowledge sharing account (44%), education-related account (39%) and brand’s official account (35%).

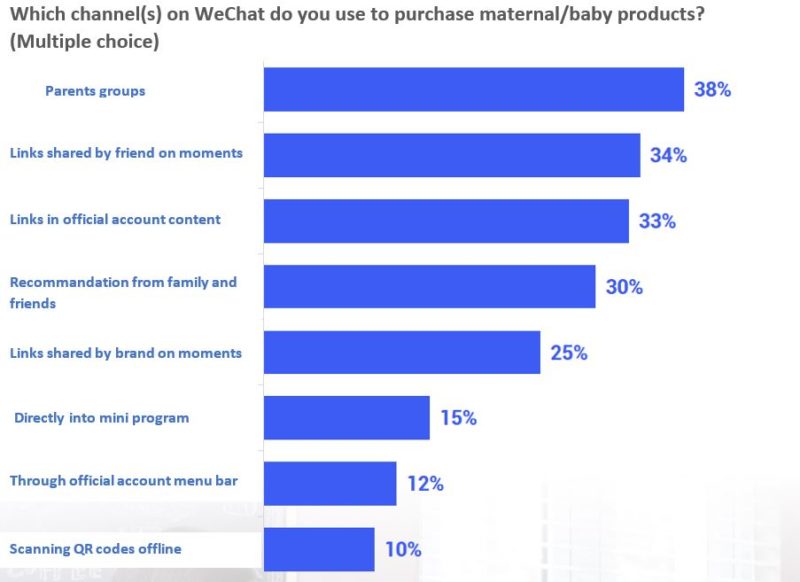

When they purchase maternal/baby products (or service) using WeChat, which channel(s) do they use? The chard below shows: patents groups (38%), links shared by friends on moments (34%) and links within WeChat official account content (33%) become the most used maternal/baby products purchasing channels for new parents in China on WeChat. Safety and product quality are the most important concerns in all maternal and baby product categories (baby food, baby clothing, toys, etc.).

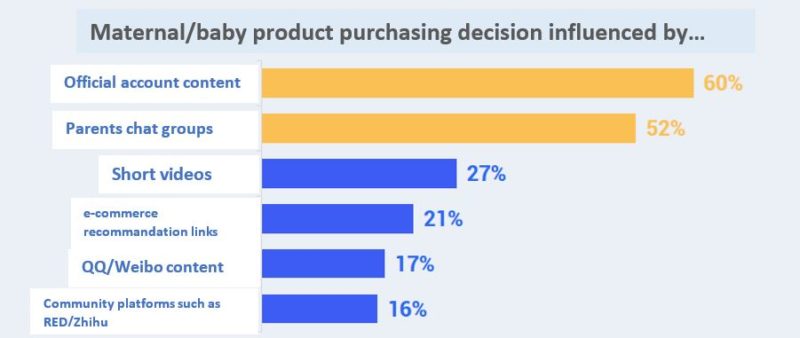

The report also revealed that, compared to new parents from other age groups, post 95s used the menu bar of WeChat official accounts much more frequently (22% compared to 12%). Post 80s and post 90s are more likely to purchase maternal/baby products recommended by WeChat official accounts. On the contrary, Tencent QQ / Weibo and short video platforms have a stronger influence on post 95s decision-making.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes