China’s baby care market: Why do Chinese parents love foreign products? | Daxue Consulting

China’s baby care industry is experiencing all-around growth

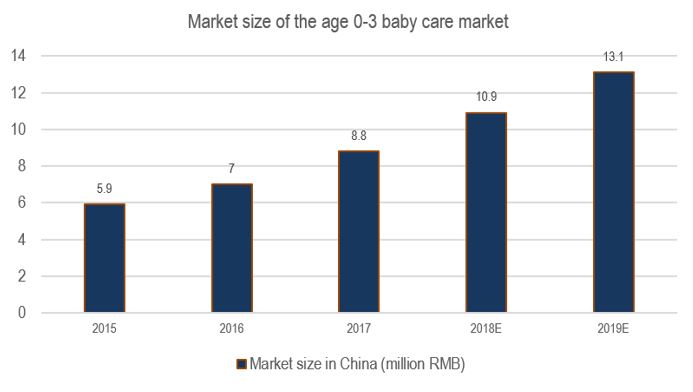

The size of the baby care industry in China growing with a high speed, with its compound annual growth rate expected to reach 14.5% by 2023, according to Mintel China. Considering China’s recent easing of the One Child Policy in 2016, accompanied by the growing household income of Chinese families, the baby care market has seen consistent growth through both online and offline distribution channels. While foreign brands are still favored, especially when considering baby milk formula, domestic competition in China’s baby care market has tightened in the recent years, including sales of other child care related products such as strollers, bottles, baby seats, cribs, and baby clothing. Although offline channels such as supermarkets and dedicated baby care stores are still the main distributors, the growing online presence of the industry both in e-commerce and social media seems to point to a promising future for the baby care market in China.

[Source: qianzhan statistics “Market size of the age 0-3 baby care market”]

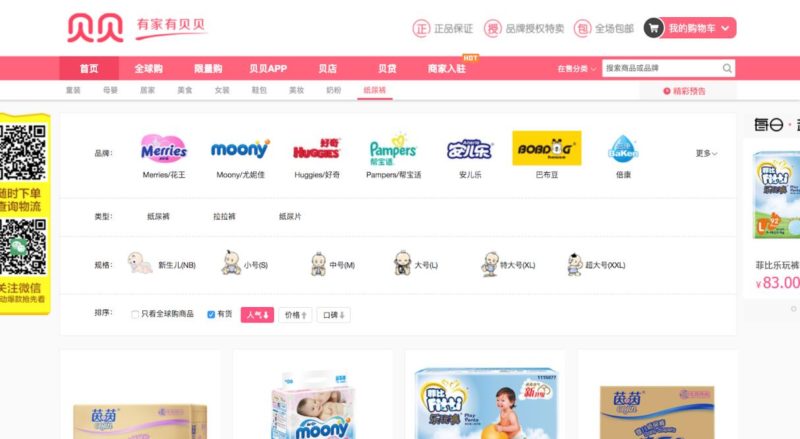

E-commerce enables more foreign baby care product purchases

Purchases of baby care products through e-commerce are a big source of growth for its market in China. Cross-border baby care related sales online are some of the most popular for Chinese consumers, in addition to beauty and food products. Consumer reports record a higher frequency in the usage of baby products, especially those relating to baby personal care, such as body powder, lotions and creams, baby insect repellent, and shower gels. The preference for baby care is still imported products, and the huge e-commerce platform in China enables consumers to purchase foreign brands through cross-border e-commerce.

Half of the baby-related products are being purchased through e-commerce

Online channels now represent 50% of mother and baby retail market value, increasingly competing with physical stores for consumer attention in the baby care distribution market in China. As of 2017, this half of the market is dominated by Tmall, with 47% of the gross online merchandise volume, followed by JD at 27%. Combined, JD and TMall held 37% of the total online sales of baby-related products.

There is a growing market for baby durables, such as a stroller and baby seats in China. Online sales of strollers have reached 2.6 billion RMB on Taobao/Tmall in 2017. During the same period, China produced 16.41 million safety seats for cars, a 10.97% rise compared to 2016 to meet the increasing demand. In the baby bed, cribs, and basket sectors, the total online sales of baby beds have reached 1.16 billion RMB on Taobao/Tmall in 2017. According to a consumer report study by Mintel, 41% of consumers have purchased baby durables (strollers, car seats, beds) through online websites such as TMall and JD. While the unit price of international brands in the baby safety seat and stroller segment is 2500-4000 RMB, nearly three times the price of domestic brands 800-2000 RMB, foreign international brands are still favored over domestic, with 47% of consumers preferring imported brands for safety reasons.

Over half of consumers report to using general e-commerce websites for baby clothing, followed closely by malls/department stores, specialized mother and baby stores, and supermarkets. Consumer reports of increased frequency in online shopping indicate the growing potential and competition of online markets versus physical offline stores. Among all kinds of baby care products consumption on e-commerce platforms, baby toys sales lead with 55% bought through online sales, diapers at 52%, clothing at 50%, and durable goods at 41%.

Mother and baby dedicated stores dominate the distribution of baby care products, such as lotions, creams, and shampoos, while in general stores such as supermarkets, consumption mainly consists of baby diapers and other toiletries. Yet the online distribution of all products has steadily increased, especially in the sectors of baby toys and clothing, where they are already taking over physical stores as the main channel of distribution.

Therefore, online channels are essential to foreign brands

“For the baby food processors, foreign brands are still better perceived. For 10 to 20% of the customers, the country of origin is a crucial criterion (especially for offline customers). As a result, many brands label themselves as International brands but are manufactured in China.” – Tim Favre, Daxue consulting project leader

Due to consumer sensitivities regarding the safety of domestic baby products, the baby care industry is a highly competitive category for imported goods. Online distribution through websites like TMall and JD offer convenient access to foreign product brands. An insight into the growing e-commerce market for baby products, Daxue project leader Tim Favre offers that: “For the baby food processors, foreign brands are still better perceived. For 10 to 20% of the customers, the country of origin is a crucial criterion (especially for offline customers). As a result, many brands label themselves as International brands but are manufactured in China.”

On Zhihu, a Chinese community question-and-answer site, the most concerned questions relating to baby care is regarding the brand of baby care products. Two foreign dominate the baby care market competition. Johnson & Johnson is the leading company in the baby personal care market in China with a market share of 12.8% in 2017, followed by Pidgeon with 7.8%. German brand Sanosan is also in competition for market share with domestic brands Frog Prince, Giving, and Yumeijing. Consumers are willing to pay for baby care products to ensure quality and safety, and brand is one of the most important associated keywords in online baby-related item searches. Foreign companies also participate in strategic branding through name translation to portray a warm, protecting presence to the Chinese consumer. 贝亲beiqin(Pigeon)literally translated to “baby affection,” is strategically translated phonetically to create a semantic element.

帮宝适 bangbaoshi (Pampers) uses the same strategy meaning “help baby feel comfortable.” it displays a direct message of their products’ comfortable advantages and effective functions.

With increasing competition among Chinese companies, there is also a promising future for the growth of the domestic baby care market

Due to a history of national scandals relating to China’s baby care industry, most infamously regarding baby formula, the domestic sector of the baby care market is still under backlash. While foreign companies still dominate the Chinese baby care market, Chinese companies have slowly been climbing its way up in sales. New demands from a population of parents with higher income also pose future opportunities for Chinese companies. As more parents are willing to spend their income on pampering their children, there is a higher demand of child-specific products, thus offering one angle for domestic companies to enter the Chinese market.

[Source: Taobao “Frog Prince shower gel”]

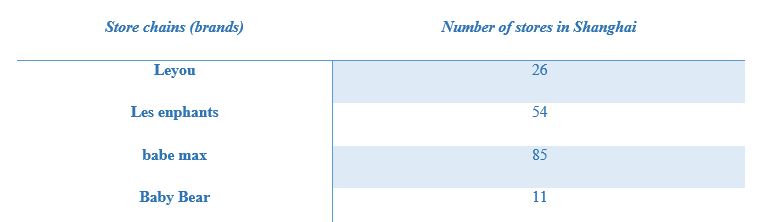

Baby-dedicated stores are prominent in China

“Most of the sales hold that offline store is still the dominant channel for baby care products and half of the sales consider it’s still growing.”—Yixiang Zhang, Daxue Consulting project manager

While online penetration is the main source of distribution for foreign brands and other segments of baby goods such as toys and diapers, offline distribution channels are still the dominant channel for the baby care market. Places such as supermarkets and dedicated baby stores are very attractive to consumers as they are able to set into the store and experience products for their children first hand.

[Source: Daxue Consulting]

Online Presence and Social Media Influence facilitates its popularity

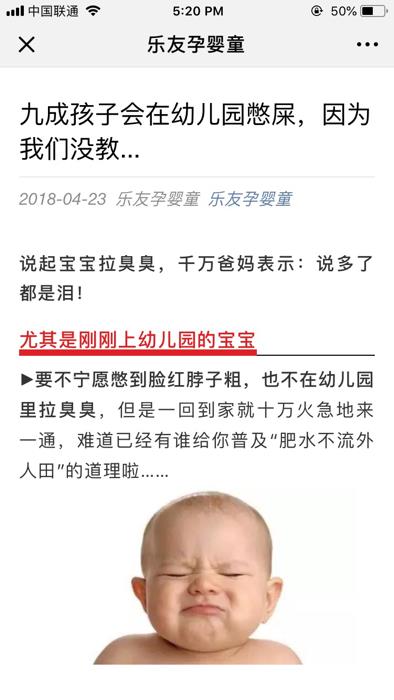

Like many brands hoping to win over the Chinese consumer, companies in the baby care industry are using WeChat as a marketing platform. In addition to allowing product selection and e-commerce to be easily accessible, WeChat allows users to establish a sense of intimacy with its users. Leyou, a popular Chinese baby care company, utilizes interesting and humorous blog articles offering knowledge and advice on taking care of your child. In one section of an article, Leyou discusses the “四要四不要” or “four wants four don’t want” to help your child get through the “可怕的两岁” or “frightening two years of age.” While the style of the article is rather personable and casual, it regardless offers serious advice, such as “Must be calm, don’t be violent.” In another article, Leyou provides an attention-grabbing headline- “child poops in Kindergarten, because we didn’t teach….” The article also utilizes a humorous subheading using colloquial language: “Speaking of baby pull a stink stink.…” Leyou’s entertaining yet informative strategy to attract consumers demonstrates how one company may utilize WeChat as an effective marketing platform for the baby care market.

[Source: Johnson&Johnson WeChat account]

[Source: Johnson & Johnson WeChat]

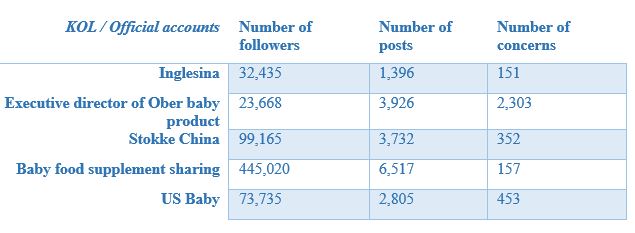

Baby-dedicated websites, WeChat Official accounts, Weibo KOL’s

Weibo, China’s most popular microblogging website, has also allowed baby care brands to utilize the Twitter-style blog site through blogging on relevant baby care industry related information, and reblogging posts from its followers. Some of the most popular Weibo accounts by baby care influencers include Stokke China and US Baby.

[Source: Weibo, StokkeChina]

[Source: Daxue Consutling]

[Source: mobile application, muyingzhijia]

[Source: homepage, beibei]

Increasing online searches on questions regarding baby care

Baby related questions have also gained attention on Zhihu, with the most inquiries on the brand of product to buy, as well as baby care and safety of baby care products. Community members have also written extensive articles on certain popular topics, such as “Baby Beds, What is the Safest Way to Buy Them?” Other articles include how to choose baby formula, and informative articles on the baby’s development of their senses during their first few years, amongst many others.

[Source: Zhihu “Baby cribs, how to make the safest purchase”]

Author: Julia Qi

Daxue Consulting is can help get your baby care products into the Chinese market

Daxue Consulting has carried out projects in the baby care industry and has experience with product launches and market entry procedures like brand naming and competitor analysis. To know more about the baby care industry in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.

Allison, thanks for the great article. According to the graph above, the size of the baby car market in China was forecast to reach 3.11 trillion RMB in 2018. Can you tell me the source of that figure?