A look at China’s aircraft industry after COVID-19

COVID-19 has dealt a long-term blow to China’s aircraft industry. Responding to Chinese government’s strict measures to constrain the propagation of the epidemic, Chinese citizens became conservative on travelling. Hence, the loss of China’s aircraft companies for Q1 of 2020 was approximately 73 billion RMB, which compelled them to find self-rescue plans. In March, the epidemic gradually disappeared in China, the aircraft industry thus resumed domestic operations. Despite the hard hit of COVID-19, China had officially become the largest aviation market in the world in April 2020.

How COVID-19 impacted China’s aircraft industry

The darkest period of China’s aircraft industry

The epidemic has frozen China’s aircraft industry. Chinese domestic residents were scared of the contamination during travel. As for expatriates and Chinese students who study abroad, it was nearly impossible for them to fly back to China as Chinese authorities closed their borders and implemented the ‘Five One policy’. Hence, the sudden drop in passengers cut off China’s aircraft companies’ cash flow and exposed them to the risk of bankruptcy.

Source: daxue consulting, China’s five-one airline policy during the COVID-19 pandemic

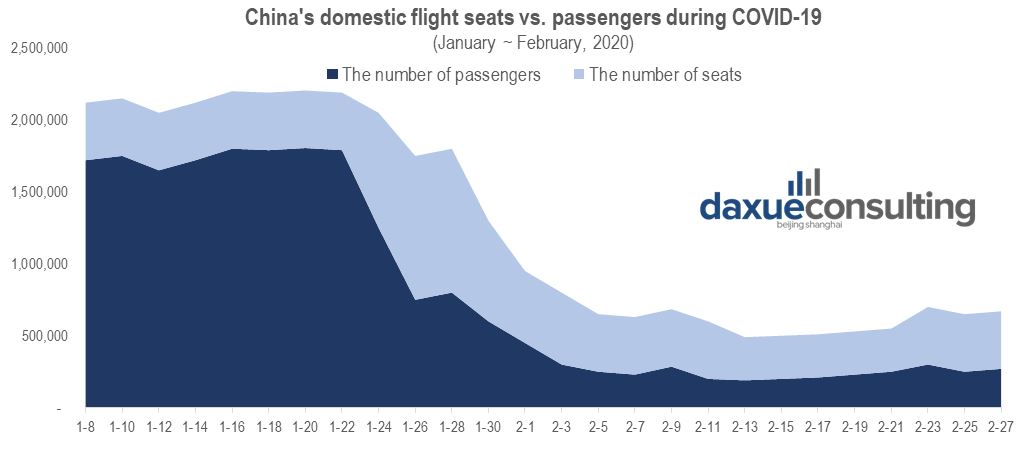

During the Chinese New Year holiday, the occupation rate of flight seats was about 80%, which however decreased to under 60%, and even 40% after the outbreak . In February, China’s aircraft industry lost about 1.2 billion RMB in the domestic market and 300 million RMB in international market every day. If we have a look at the medium-term impact of COVID-19 on the sector, the escalating loss totaled more than 100 billion RMB until May. Thus, there is no doubt that the Coronavirus caused long-term impact on China’s economy and it will need three to five years for China’s aircraft industry to tide over this dark period.

Source: cannews, immediately following the announcement of COVID-19, the domestic flights on January 24th to 28th experienced a major gap in supply and demand.

The self-rescue plans of China’s aircraft companies

It was urgent for China’s aircraft companies to take measures to stop the bleeding of resources. Many companies called their jets to an emergency halt to reduce the cost of staff and fuels due to the poor occupancy rate and complicated isolation regulations. Thus, the risk of bankruptcy forced Chinese aircraft companies to implemented technical and organizational transformation. Many of them targeted live webcast to sell discounted tickets, headrests and some special products. It is surprising that the self-rescue plans worked, and they got money to compensate the loss and maintain normal operations.

The outbreak of COVID-19 boosted China’s online shopping market, and the live-streaming is the key to open the door towards Chinese netizens. Therefore, many China’s aircraft companies sold tickets by using Chinese KOLs or creating their own livestreaming rooms. For example, during China’s 6.18 shopping carnival, China eastern airlines promoted a new weekend ticket, which is valued 3,322 RMB and allows passengers to fly to any mainland city until 2021. This promotion piqued Chinese consumers’ traveling desire, and they sold more than 100,000 tickets in one single day! Through these successful self-rescue activities, China eastern airlines not only raised about 300 million RMB cash, but also increased the number of travelers.

The private jet market has soared in China

After the epidemic has paralyzed China’s general aviation, more flexible and safer private jet has become the first or even the only option for many people, creating the busiest quarter in the history of China’s private jet market. Many wealthy Chinese students who were stuck abroad during COVID-19 chose private jets to come back to China and the price of private jet charter rose dramatically. For instance, the number of foreign private jets flying to China increased 227% during Q1 2020, compared with Q1 2019. Additionally, the price of chartering a private jet with 14 seats rocketed by 30% from 1.35 million RMB to 1.74 million RMB in March. Some student even paid an astonishing 180,000 RMB for a ticket home.

More and more Chinese wealthy choose private jet as their transport tool since it is more convenient and shows a sample of status at the same time. After the outbreak of COVID-19, private jet charter users increased by 300%, and 80% of them were newcomers. Apart from the soaring of private jet market, Chinese billionaires also squandered money on private jet purchasing. Among 466 business jets in greater China, there were 163 private jets owned by 113 Chinese billionaires, which increased by 34 from the year before. Therefore, the vice president of OHFLYER, Haiyang Wang, said that the demand of private jet in China will definitely be higher than before COVID-19.

The development of China’s aircraft manufacturing

The Chinese plane-makers’ fight back against western manufacturers’ grip on the sector

For the past decade China, has been developing its own planes to cast off western manufacturers’ cord on the sector. But the planes made by Commercial Aircraft Corporation of China (Comac), the ARJ21and the C919, have been plenty criticized. It is believed that Chinese-made jets will not rival those of Boeing and Airbus in the short-term. With only 90 seats, the ARJ21 has been rejected by the aircraft industry as inferior to planes from other aircraft manufacturers due to frequent delays and loud noise. On the other hand, the C919, Comac showed bigger ambitions. Carrying up to 168 passengers, the C919 is designed as China’s first large aircraft to compete with Boeing’s 737 Max and Airbus’s A320neo. Furthermore, Comac is developing a third plane, the CR929, cooperating with Russia, and it is scheduled to be delivered in 2021. However, there still are some risks that Boeing and Airbus will also roll out their new high-performance planes when the CR929 entered the market.

Despite criticism, as a state-backed company, Comac is full in potential with high-tech aircraft manufacturing. It is not strategically correct to underestimate Chinese ability to penetrate the aircraft market. “The aircraft landscape is likely to shift from a European-Us manufacturing duopoly to accommodate a third part, and that’s probably the Chinese.” Shukor Yosof, founder of aviation advisory firm Endau Analytics originally told BBC.

Which markets are China’s plane-makers targeting?

As of now, Comac has received about 815 commitments for the C919 from 28 Chinese airlines and domestic leasing firms. Besides, its main partners are China’s three major airlines, Air China, China Southern and China Eastern.

Right now, only China’s aviation regulator has certified its jets to fly. As for foreign market, its jets may also operate in parts of Asia, Africa and South America that recognize Chinese certification. Then the permission from the US Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) are necessary for it to expand beyond those markets. However, western countries’ green light is still far from certain. Hence, turning around from international market, Comac mainly targets the greater China and foreign zones certificated with fly permission.

Challenges encountered by China’s aircraft manufactures

The main challenges of China’s national aircraft manufacturing companies, like Comac, are technological problems and high cost of components. Taking the C919 as an example, the development of the plane stemmed from 2007, cooperated with more than 200 companies and involved more than 20,000 people. Yet the engine of the C919 is manufactured by French SNEMAC and American GE. Thus, the mismatch of high-cost and low-performance makes China’s plane-makers lack of competitiveness. At the same time, getting the green light of foreign aviation regulators is also a big puzzle, which takes a long time and is full of uncertain.

As for small and private aircraft manufacturing companies in China, their biggest challenge is not about aircraft-related technology, “but getting the license from Civil Aviation Administration of China (CAAC),” Deng Chunpeng, general manager of a private aircraft producing company says. It won’t take a long time for them to solve technical problems like airframe design, the development of engine and components packaging. But the licenses including Production Certificate (PC) and Type Certificate (TC) will take years to get.

The expansion of China’s airport infrastructure

The gap between China’s economic development and airport construction

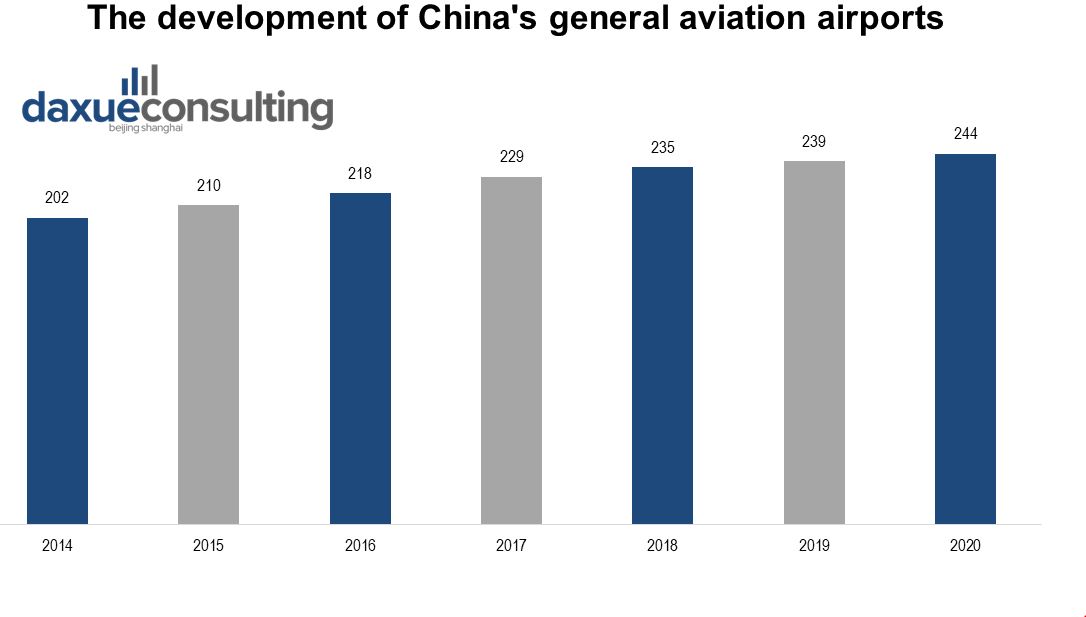

The U.S, Australia, and Canada have 20,000, 2,000, 1,200 general aviation airports respectively, but there were only 235 in mainland China in 2018. As of 2020, China has programmed and built 244 airports, with a 3.7% annual growth rate. Obviously, the development of China’s general aviation industry is not keeping pace with its overall economic advancement. As for long-term prospects, until 2025, China is planning to strengthen the air transport hub effects of Beijing, Guangzhou and Shanghai airports, and connect 93.2% cities of China.

Source : chyxx.com, The development of China’s general aviation airports

The construction of Beijing Daxing International Airport is aimed to stuff the gap between China’s economic soaring and airport infrastructure. As China’s air transport pivot, Beijing Capital International Airport had become the second airport annually receiving more than 100 million tourists, behind the United States’Atlanta International Airport. However, this airport was built in 1958, which means obsolete facilities cannot support such enormous pedestrian flow anymore.

The Beijing Daxing airport

Occupying 1.4 square kilometers and invested 80 billion RMB, Beijing Daxing International Airport has been dubbed “the 7th wonder of the world” by the Guardian. Owning such a laurel is not merely because of its immense terminal, but also advanced facilities and user-friendly designs. It is able to annually receive 100 million passengers with four runways for large aircrafts.

As for the interior, passengers just need 8 minutes to arrive at the furthest boarding gate after passing the security check. Besides, Daxing airport’s creative layout largely reduces travelers’ transfer time: 30 minutes for domestic transfer, 45 minutes for international transfer and 60 minutes for domestic-international transfer. So far new airport subway line has been in operation, commuting from south center city in 40 minutes. Therefore, the completion of Beijing Daxing International Airport has eased the air traffic pressure of Beijing, and symbolized China’s efforts on airport construction.

The distribution of China’s aviation network

Beijing-Tianjin-Hebei, Yangtze River Delta and Pearl River Delta are the hubs of China’s aviation network. In recent years, relying on Chinese government’s strategic supports and rapid economic development, Chengdu-Chongqing and Xian account for increasing proportions. In China’s airports passenger flow rank of 2019, the top 5 were Beijing Capital International Airport (100 million passengers), Shanghai Pudong International Airport (76.1 million), Guangzhou Baiyun International Airport (73.4 million), Chengdu Shuangliu International Airport (55.8 million), and Shenzhen Baoan International Airport (52.9 million).

Although the Chinese government suspended all flights to Beijing due to the second outbreak of COVID-19 in mid-June, China’s aviation network won’t change noticeably for the long-term.

Takeaways of China’s aircraft industry post COVID-19

The COVID-19 outbreak is the bust of the century for the global aircraft industry, and China, of course, cannot escape from the misfortune. The shock caused by the epidemic on the sector will need three to five years to adjust. On the positive side, the huge potential market will definitely boost China’s aircraft industry recovery. Besides, thanks to their successful self-rescue plans, many Chinese airlines maintained their cash flow’s normal operation and stimulated people’s traveling desire.

However, China’s aircraft manufacturing and airport infrastructure didn’t follow the pace of economic advancement. China’s plane-makers need to implement technological transformation to improve their aircrafts’ competitiveness, and Chinese government need to speed up the airport construction. If you want to get more information about China’s market, please email dx@daxueconsulting.com

Author: Olivier Liu

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast