Why China Market Research must Examine Culture

China has enormous geographical disparities and socioeconomic variations across its regions. Consumer preferences evolve rapidly and sometimes even erratically. These cultural considerations should be taken into account when conducting China market research. It poses unique challenges to dominant and maintain dominance in the Chinese market.

For instance, Uber, the senior leaders of Uber did their research to avoid the mistakes that had derailed many other multinational firms before entering China. Uber partnered with China’s leading digital company, Baidu, whichcommitted significant investment of $600 million from it in 2014.

Despite these efforts, Uber retreated from the Chinese ride-sharing market. Because of a competitor in mainland China, Didi Chuxing had a large cash reserve and focused exclusively on China at that time. Uber later sold its China operation to Didi Chuxing. This case indicates a major short-fall in estimating the challenge of local competition. . More timely and specific research is needed to determine the potential competitors in the Chinese market.

[Source: finance.sina.com, Uber and Didi Chuxing in China]

Research Chinese consumers’ tastes

As salaries increase and the demand for quality goods and services strengthens, China presents significant opportunities for a growing number of retailers. However, some western brands have fallen short in their understanding of Chinese consumers’ preferences.

Mark & Spencer, a British fashion brand, exited China’s market in 2016. One of the problems was that they were targeting middle-class consumers by creating middle-class brand positioning. They failed to notice that the consumer tastes were not aligned with their brand pursuits. Mark & Spencer’s products were considered “suburban,” “UK housewife” from the viewpoints of Chinese consumers, which is simply not how they see themselves. Instead, the middle class Chinese consumers at that time preferred more youthful and more on-trend styles. Another factor for M&S is the misunderstanding of how Chinese buyers perceive value. The items in a medium price range did not bring prestige for the brand. Such things have limited appeal to Chinese shoppers because they are neither cheap nor have high brand value.

Brands cannot make assumptions about Chinese consumers’ preferences and values. Common knowledge of what the middle class likes to wear in the west does not apply in China. Market research could have been used to analyze consumer preferences and more fit pricing strategies.

[Source: retailinasia.com, “M&S in China with store closures”]

Globalized vs. localized: the adaption in the Chinese market

Any foreign brand that enters China contains both localized adaptations and the aspects from the original brand identity. However, each brand meets different market standards in China, and some find success through their original identity, and some brands find success with more localization.

Re-branding in China: “Chinese-American” chain restaurants

As the top fast-food chain in China, KFC is a typical example for its localized adaptions. The key to KFC’s success is catering to Chinese tastes, with maintaining its American brand identity. This chicken purveyor also serves pork chops, curry, congee, youtiao, a Chinese breakfast staple. On July 15, 2019, KFC announced the launch of its new Sichuan-spice Chinese pot-stews. It is aimed to target the midnight snack market, which is emerging among young Chinese generation.

[Source: Weibo, KFC, and its new midnight snack in China]

Likewise, chains like McDonald’s and Pizza Hut in China have been continuously updating their menus to cater to Chinese taste. Compared with the US, Pizza Hut in China is much more focused on the dining experience, with a full wine list and a three-course menu complete with dessert. Pizza toppings include local adaptations like Beijing roast duck and seafood. Apart from a partner with local investors, McDonald’s in China offers options like rice bowls and bubble tea. They have been able to leverage the Chinese intrigue and trust of Western brands, in turn, to rebrand themselves completely.

Repositioned Muji & Uniqlo: never stop learning about Chinese consumers

Uniqlo never stops adapting to the fashion industry and brand positioning in the Chinese market. As clear reposition by offering on-trend style and cost-effective products, Uniqlo has reached great achievement among Chinese, especially the millennial generation.

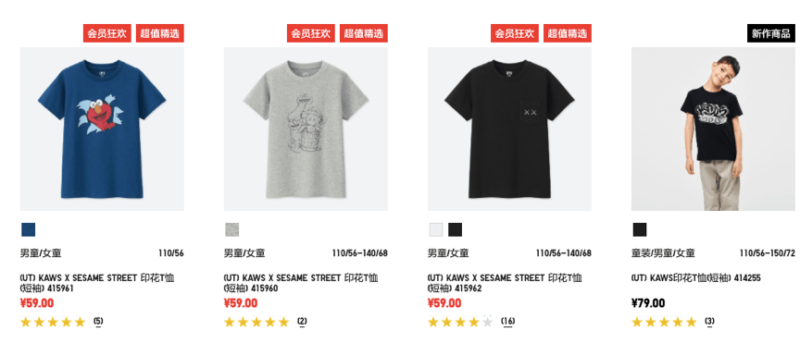

In line with being a fast-fashion brand in China, Uniqlo started to co-brand with many IPs,, including movies, television literature, game animations, etc. The recent collaboration between Uniqlo and KAWS has achieved huge success. The flagship store in Tmall was sold out in three seconds.

[Source: Uniqlo.cn. “Co-branding with KAWS in Tmall”]

On the contrary, Muji in China is currently facing a downfall. In the past, Muji was very successful in presenting a Japanese viewpoint of design and lifestyle to Chinese consumers.

Muji repositioned itself as “affordable luxury” when entered the Chinese market, compared with its “reasonably cheap” in Japan. It aimed to target the middle-class population. The previous pricing strategy of Muji caused the prices in China to be double of the price in Japan. But now, to adapt current changes in the retail market, Muji has reduced the price of different products 11 times in China, with an average of 20% each time. Such a price reduction strategy directly leads to consumers’ confusion about Muji’s brand positioning. Therefore, the middle-class consumers are reluctant to pay for it, while the low-end consumers are not loyal to this brand. Constant price reduction cannot revive the regression of sales, as it is also not a long-term solution for a brand.

[Source: Muji.com.cn., “Muji in China: new products, new pricing strategy, and new lifestyle”]

A business with unclear brand positioning faces difficulty when making an impression on customers and standing out among other brands. Uniqlo has positioned the brand at affordable clothing, when customers want to buy cost-effective clothes, Uniqlo will often be considered the first option. Although the product design from Muji is unique, customers have many other different options of brands available, even with lower pricing but similar quality.

Unlike Uniqlo, it seems Muji is losing its grasp on understanding what Chinese consumers want.

Discover better practices of market research in China

Here are some suggestions for conducting better market research in China:

Design a holistic approach to China market research

Given the large size of China, as well as the regional breadth and diversity, it often requires a multi-stage design to achieve the most accurate results as possible. The discrepancy among regions and the differences among city tiers are equally important in terms of the sampling consideration. Market researchers in China should avoid wasting efforts in unfit areas or making the survey too fragmented.

Besides, Chinese consumers are becoming more sophisticated. To collect deep insights about how they think and behave, a combination of qualitative and quantitative data is always necessary for achieving China market research goals. So, the research methodologies should be associated with the lifestyles of the target audience to identify consumer behavior and trends.

Cooperate with a China market research agency

Market research in China is different from the west. One element that is too often overlooked is culture. The diverse nature of socio-cultural inclinations of people across the Asia-Pacific Region makes research in China demanding and rigorous. Research agencies with professional experience can help tailor research instruments to address the specific cultural differences of localities in each market segments.

Furthermore, understanding various local dialects is also an issue. The use of a talented Chinese research intermediary is crucial in this case as they can correctly translate languages. In addition, it can provide insights into the best ways to contact local subjects and business associates.

Look beyond the data

Data interpretation needs to be based on a deep understanding of culture. For example, Chinese people tend to rate positively, even for the products they don’t like. “So-so” is likely to be the lowest they will present. It’s significant to pay attention to the rating scale in the middle, rather than the top or bottom box that many researchers will do in the West. Robust data analysis, coupling with a deep understanding of the Chinese market, will guide the marketing initiatives for the business to succeed in China.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes