Apple in China is facing more and more difficulties, even after the launch of the iPhone 7

For the first time in thirteen years, Apple’s turnover in China decreased during two consecutive quarters in 2016. Within one year, its sales dropped by 30 %. The Californian company was expecting the launch of the iPhone 7 to boost its sales in this market, but things did not happen as planned. A few days after its commercialisation in China on the 16th of September, the new smartphone had already disappointed a majority of Chinese people. For Apple in China, this is a call to more efforts to get back to the heart of these consumers, on a strategic market that represents 48.5 billion dollars turnover, or the company’s third.

Apple in China: Poor results for the iPhone 7 on the Chinese market

Even before the launch of the new iPhone, forecasts were pessimistic. On Chinese social networks, there were fifteen times fewer comments related to this event than during the launch of the iPhone 6 two years earlier. Some web users were quite mean with Apple: “I will never buy an iPhone again. [The brand] lacks innovation and vision. Anyway, local smartphones are good enough”, an ex-user identified by Tech In Asia says after the presentation of the new model on September the 7th. His/her comment received 4 330 likes from other web users.

Moreover, several polls confirm the general feeling expressed on social networks. According to Netease, an Internet leader who owns the popular web portal 163.com, only 26 % of 40 000 people interviewed after the presentation of the 7th of September planned to buy an iPhone 7 at the official price of 808 dollars in China. Indeed, many consumers rather wanted to wait for a price drop before thinking about buying.

Another poll lead by Penguin Intelligence confirms the previous one. It shows that around 40 % of people polled were interested in buying the new model. When to choose between the 7 and the 7 Plus, the premium model was the most often selected because of its large screen, its camera, and its more resisting battery. Precisely, those characteristics can also be found in other Chinese smartphone makers’ models.

Finally, according to a study from UBS published in November, China iPhone 7 sales figures are decreasing about U.S. sales figures. Sales intentions are between 10 and 20 percentage points lower to those of the iPhone 6 and 6s.

Apple is facing increasing competition on quality from Chinese manufacturers

Indeed, the lack of innovation perceived by Chinese consumers in recent iPhones is moving them away from the brand. The iPhone 6 seduced them in 2014 with its large screen leading to a 71 % growth of Apple’s income in China. But the iPhone 6s launched the following year was not as successful. For many, the two models were too similar. With a design alike and functionalities that already existed on local competitors’ models – especially the double camera system present on Huawei’s P9 launched in April 2016 – the iPhone 7 is making the same mistake again. In total, among seven innovations announced by Apple on this model, Business Insider identified only four that are innovative for China’s technophiles.

In this context, Chinese consumers rather choose to buy local brands. According to the same study from Penguin Intelligence, 38.3 % of people interviewed intended to chose Huawei for their next smartphone acquisition. The iPhone 8 comes second, but far away, quoted by 18 % of people interviewed only.

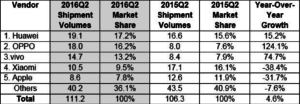

Globally, Apple in China is currently losing market shares. According to International Data Corporation (IDC), the volume of iPhone delivered in China in the second 2016 quarter dropped by almost a third compared to the second 2015 quarter. At the end of June 2016, Apple owned 7.8 % of Chinese smartphones’ market only, behind local groups like Huawei, OPPO, Vivo and Xiaomi (see beyond). These brands offer smartphones with similar functions to those of Apple at a far more affordable price for Chinese consumers. Also, being local manufacturers enable them to better understand consumers’ expectations. With its global position, Apple can not always adapt its products to the market specificities.

Source: IDC Asia/Pacific Quarterly Mobile Phone Tracker, August 2016 http://www.idc.com/getdoc.jsp?containerId=prCHE41676816

The various problems that iPhone 6 users faced (for instance the failing batteries of the 6s that happened to be more common than it seemed) are also contributing to influence users to buy other smartphone brands, and especially the ones quoted above.

Tensions between Apple and the Chinese government are another reason for the company’s declining incomes in China

In addition to competition issues, the Californian firm is in conflict with the Chinese government on several matters. This lead to the closure of iBooks and iTunes services in April 2016 and the order to block iPhone 6 and 6 Plus sales in May for intellectual property matters.

This is how at the end of its third fiscal quarter in June, Apple was already announcing a China, Honk Kong, Macau and Taiwan turnover of 8.8 billion dollars, which is a drop from 33 % compared to the same period of 2015. The company’s analysts knew that Apple had difficulties to sell its products in China: during the second quarter, the group already recorded a drop of 26 % year-to-year. But this time, the slowdown is stronger, and the quite weak enthusiasm of Chinese people for the iPhone 7 could even worsen the results of the group in China – even though Apple’s executive hope better sales figures for the December quarter.

iPhone sales in China may suffer from Donald Trump’s policy

The election of Donald Trump at the head of the United-States on November the 9th of 2016 is likely to make Apple and the Chinese government’s relations even more difficult: indeed, during its electoral campaign, the new president made the promise of taxing at 45 % the Chinese products imported to the United-States. This could trigger a “commercial war” between the two countries, which could negatively impact “a high number of American industries,” criticized and among which Apple, says an editorial published by the national daily newspaper Global Times, close from the Communist Party. Trump also suggested that he would like to repatriate the production of iPhones in the United-States; however, 90 % of iPhone components are currently made in China. This could potentially further increase the price of Apple’s products, which arcriticized for their high price by Chinese consumers.

From iPhone new functionalities to corporate investments, Apple’s executive is struggling to win back its rank on the Chinese market

Apple’s executive team is, therefore, making efforts to recover its brand image for Chinese consumers. For instance, the iPhone’s vocal assistant Siri now works with WeChat, a chat application broadly used in China. The anti-fraudulent calls system that will be included in the next iPhone models is also tailored to answer the specific needs of Chinese consumers, Les Echos explains.

Expect to see more effort on Apple’s part to win back consumers in China. In addition to product innovations, Apple is trying to consolidate its presence in China thanks to investments. For instance, a research and development center could soon be operational near Beijing. The unexpected investment of one billion dollars in the ride-hailing company Didi Chuxing in May 2016 can also be understood as an additional gesture to show Apple’s will to keep going on the Chinese market. The recent recruitment of the 18 years experienced Wall Street Journal journalist Wei Gu as chief of public relations for Apple China is also confirming Apple’s will to intensify its presence in the country after all the problems faced by local authorities.

Given the little enthusiasm for the iPhone 7 in China, everything tends to show that Apple in China will keep making all efforts to remain on good terms with the Chinese government and consumers.