4 successful Chinese companies overseas

Which are the truly successful Chinese companies overseas?

Therewith, telecommunication giant Huawei and computer market leader Lenovo are clearly the most famous Chinese success stories overseas. However, other companies went successfully abroad as well, such as the manufacturer for consumer electronics and home appliances Haier or the automotive components manufacturer Wanxiang.

This question of which Chinese companies are successful overseas is particularly interesting as it is common that Western companies go to China and it is also known that China more and more actively seeks to make deals and business in the West. For instance, according to a leading consulting firm for financial services, Chinese outbound M&A expenses increased by an incredible 246% in 2016, resulting in a total value of US$ 221 billion. At Daxue Consulting, we found certain patterns of successful Chinese companies overseas:

- Leading in domestic market

- Acquisition of assets

- Search for substantial opportunities (many acquisitions in the region of US$ billion)

- North America as favorite target of acquisitions

- Manufacturers of consumer electronics, home appliances, and automotive sector

- Chinese absence in entertainment, advertisement, corporate services and Chinese apps are also not successful overseas (most famous example is WeChat)

- Targeting a mid-level consumer segment in the beginning and then aiming higher

A List of 4 exemplary successful Chinese companies overseas

Lenovo Group

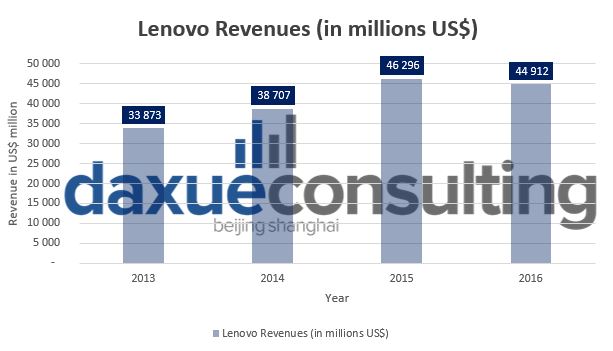

Lenovo Group Ltd. (联想), the leading computer manufacturer in China and globally,is probably the Chinese company that got famous overseas the first because of its acquisition of IBM’s PC business in 2005 for US$ 1.75 billion. Nowadays, this deal is considered as a win-win. Why? Because Lenovo got armed with a big PC business including the iconic ThinkPad brand, which they could leverage becoming No. 1.On the other hand, IBM could focus on its hardware, software and services business. After the acquisition, Lenovo’s strategy was to defend the positions in the mature markets US and Europe and expand the share in emerging markets.

In the first quarter of 2017, Lenovo consolidated its position as #1 in the PC market with a 21% market share, which is held since 2013 already. It has consolidated its position in North America as well, as #3, only behind Apple (苹果) and Dell (戴尔).

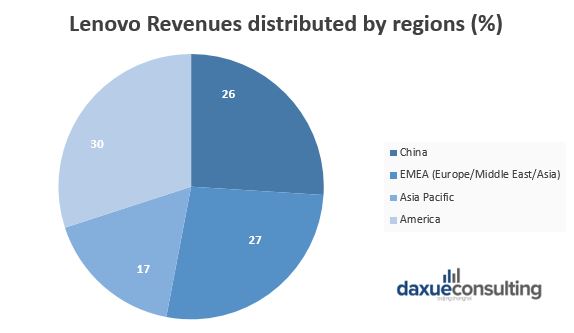

As of the end of Q4 in 2016, while still being the market leader in China, that 74% of its revenues came from outside of China, thanks to a growing change in the perception of “Made in China” products.

Huawei Technologies

Huawei Technologies Co. Ltd. (华为), a telecommunications equipment and services company best known for manufacturing its own smartphones, started as a B2B company and has started to launch its first own phone in the late 2000’s. In China, it is already leading the lucrative smartphone market, thinking of the Chinese being smartphone addicted. As of 2016, Huawei led the fragmented market in front of domestic competitors Oppo (欧珀) and Vivo (维沃) with a market share of 16%, according to a leading technology market analyst firm. Internationally, despite facing huge competition from Samsung (三星) and Apple, Huawei has slowly gained momentum. As of now, it has partnered with 80% of the telecommunications giants (e.g. T-mobile or Vodafone (沃达丰))and has started to sponsor sports teams to increase brand awareness: e.g. the successful football clubs Arsenal F.C. and Paris Saint Germain among them. That has allowed Huawei to become the third largest provider of smartphones in the world, standing behind Samsung and Apple.

CONTACT US TO LEARN MORE ABOUT THE SMARTPHONE MARKET IN CHINA

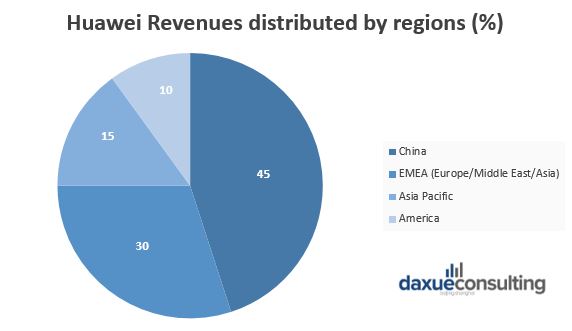

For 2016, the group reached US$ 75.1 billion, which was a 32% growth from the year before. As the future of smartphones and their features means a lot to the company, US$ 11 billion were reinvested in R&D, to stay ahead of the competitors. Most of the group’s revenue came from outside China: 55% came from the overseas market, according to the latest annual report of Huawei.

As its competitors aim for the most expensive phones, Huawei has always tried to keep its prices down. However, as the large investments into R&D show, the Chinese firm now has plans to start hunting on the grounds of high-end smartphones, to keep the pressure on the main companies in the market.

As a provider of telecommunications networks, Huawei has also been developing its 5G technology, allowing its smartphones to be better with the technology than its competitors. The R&D service is what keeps Huawei’s growth, and allows its market share to go upwards.

As the company keeps expanding outside of China, its two main targets are the US market, where it still has some image issues, and Africa, where all telecom companies have started to invest to be the first to reach a largely unconquered market. However, Huawei is getting more and more successful overseas as it increased its revenues generated outside of China to 62% in the first quarter of 2017.

[ctt template=”2″ link=”Qa25j” via=”no” ]Tweet about Huawei success overseas.[/ctt]

Haier Group Corporation

Haier Group Corporation (海尔), a leading manufacturer of consumer electronics and home appliances in China, manufactures many products which end up in all parts of the world: air conditioners, microwave ovens, refrigerators, television.However, it only started as a refrigerator manufacturer, until its current CEO, Zhang Ruimin (张瑞敏)in 1984 took over.

The company then started to transform itself. As responsible for the factory, Zhang Ruimin was once brought a faulty refrigerator by a customer. Upon checking the stock for an exchange, they discovered that around 20% of the stock was faulty. Zhang Ruimin had all the refrigerators lined up on the faculty floor, and ordered the workers to destroy them with sledgehammers. When they hesitated, he roused them by saying “Destroy them! If we pass these 76 refrigerators for sale, we’ll be continuing a mistake that has all but bankrupted our company.” One of the sledgehammers is still on display at headquarters.

After this incident, Zhang Ruimin focused on quality control, leading the company to its current glory: not only leading the domestic refrigerator market since 1999, Haier is also market leading in China in the whole “white goods” market, the market for home appliances. As of 2016, the company held a market share of 29.8 %. Moreover, Haier Group’s global revenues of 2016, excluding the GE (通用电气). Appliances, were US$28 billion, which accounted for a year-on-year growth of 6.8%.

[ctt template=”2″ link=”HV0te” via=”no” ]As of 2016, Haier held a market share of 29.8 % in the house appliances market in China.[/ctt]When expanding outside of China, it targeted six key regional markets: North America, Europe, Middle East/Africa, Asia-Pacific, ASEAN, and South Asia. The company now sells in over 160 countries.Haier’s biggest claim to fame is the acquisition of GE’s home appliance business in January 2016 for US$5.4 billion. This will help expand Haier’s U.S. and global presence.

Wanxiang Group Corporation

Wanxiang Group Corporation (万象) is the largest homegrown automotive components supplier in China, with a revenue of RMB 115.4 billion in 2015. The company had humble beginnings: at the origin, it was a truck repair shop. However, as China’s economy grew, so did the company. Because Chinese value those who own a car, the automobile market has known an unprecedented growth. As of now, Wanxiang has grown to become the largest auto-parts supplier in China and has spent the last few years expanding globally, buying failing competitors in the United States. For instance, A123 Systems for US$257 million and Fisker Automotive for US$ 149 million.

Internationally, Wanxiang owns as many as 30 overseas subsidiaries and is present in over ten countries, including Germany, the United States, and the United Kingdom. Wanxiang group’s main products have 12% of the market share in the international markets. As of now, it has even started to create and market its own cars in China. The company has decided to invest over 200 billion yuan (US$30 billion) within the next ten years to develop the production of new energy product components, battery, bus and passenger vehicles.

All these examples show how the paradigm of Chinese companies has changed to not only copying but developing high-quality products themselves, with which they want to be successful overseas. “Of course, there are many examples of companies failing abroad, too,” says Matthieu David, founder and CEO of Daxue Consulting, “such as Aigo (爱国者) or WeChat.” However, those successful Chinese companies overseas showed certain patterns: “from acquiring large assets preferably in the US to being all manufacturers for either consumer electronics, automobiles or home appliances,” continues David.

Matthieu David, founder and CEO of Daxue Consulting

At Daxue Consulting, we strive to be your ideal partner, no matter which industry you operate in. Through our many years of experience and large network, we have access to and can obtain key consumer and market insights. For example, the case of Huawei showed how fragmented the Chinese smartphone market is. Especially when you are in a market that fragmented, without a clear market leader, gaining first-hand consumer insights is even more crucial to gain competitive advantage. Using qualitative methods (e.g. focus groups) and quantitative methods (e.g. online surveys) we can not only spot your customers in the Chinese smartphone market but also provide most accurate and relevant information on them.

That the Chinese consumers differ from those in the West shows the fact that with Apple and Samsung, the two globally leading smartphone manufacturers, are only placed 5th (Apple) or below (Samsung) in the Chinese smartphone market. To provide you with a holistic understanding of the uniqueness of the Chinese market, we can also use our consumer panels in China to detect main consumption patterns and usage behavior. In doing so, we can predict specific requirements of smartphone consumers in China that lead to new market trends and technological requirements of your product, e.g.the design, camera resolution or a fingerprint sensor. With our consumer research in China, you can adjust your product accordingly and gain an extra share of the competitive Chinese smartphone market.

Our Shanghai office team

Contact us to discuss with our project managers how you can become successful in China in return, by sending an email to dx@daxueconsulting.com or clicking here.