Video Games Market in China: Mobile and client games take the largest share

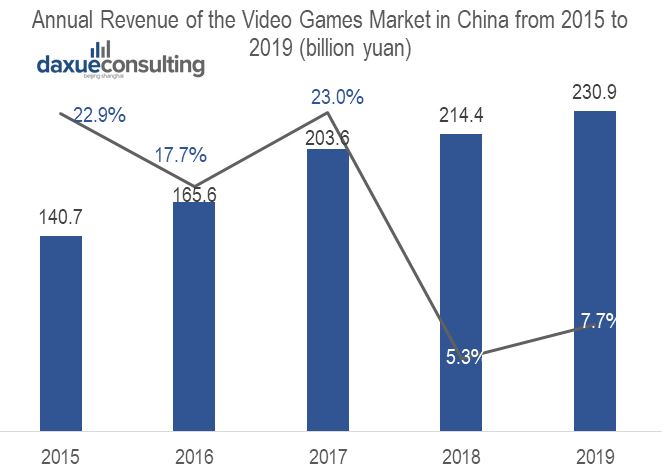

The video games market in China used to lead the international market. However, Newzoo predicted that the U.S would like to surpass China as the No. 1 video games market because of the temporary free policy in China. However, China still accounted for 30 percent of the international market in 2019. According to the 2019 China Gaming Industry Report, the revenue of the video games market in China continuously climbed in recent years. Meanwhile, the revenue’s growth rate returned to rise since 2015’s fall, indicating the industry was recovering. Thus, the video games market in China is expected to increase stably. Tencent and Net ease lead the development of the video game market in China.

Since the issue of Honor of Kings by Tencent in 2015, the game always occupies the throne in the domestic mobile games market. At the same time, video games live-streams became a new trend, and Tencent owned over 88 percent of the video games live-stream market. Net ease also launched many popular video games like Onmyoji. Its long-term operation strategy allowed it to provide refined service for existing games, driving its increase.

Data Source: GPC, IDC, Annual Revenue of the Video Games Market in China from 2015 to 2019

Video Games Market in China: Mobile Games Outperform

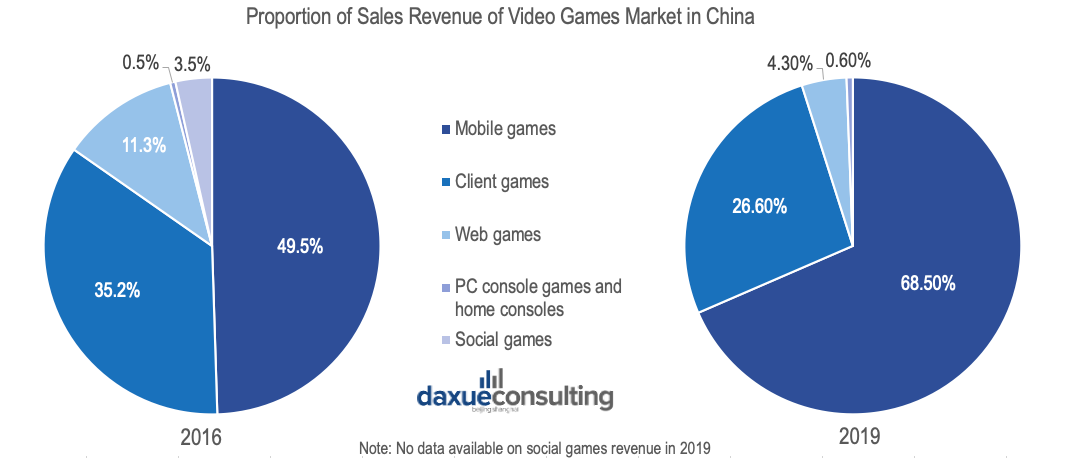

According to the classification of the CNG Games Research Center (CNG中新游戏研究), there are three main categories of video games in the Chinese market: mobile games (68.5%), PC client games (26.6%), and online games (PC browser games) (4.3%). Client games include games whose client software must be installed onto gamers’ PCs, such as Multiplayer Online Role-Playing Games (MMORPG). The revenue of client games-player games in 2019 did not have tremendous growth compared to its income in 2015.

Thus, the Chinese market for multi-player games reached a stable condition. Mobile games are growing slower in the past five years. Elimination and parkour games (parkour involves movements such as running, jumping, swinging, climbing, vaulting, and rolling while navigating obstacles) were particularly popular on mobile devices in 2016, when, for the first time, mobile gaming took a larger share than PC gaming and accounted for over half of the online gaming market. The number of mobile players has increased over the past five years, while the number of PC client gamers started to decrease.

Data Source: GPC, IDC Proportion of Sales Revenue of Video Games Market in China in 2019

The mobile gaming boom has so far produced a number of highly reputed games, enticing more players by day. Thanks to the large PC game user-base and the fast-growing mobile games sector, the video games market in China is still on the rise. However, iResearch holds that the gaming industry urgently needs product innovation, industry integration, and international development to maintain its competitive edge.

Government Policies Regulate the Market Development

Since 2005, the government has continually published laws and regulations to regulate the Chinese video game market. The video games industry is one of the most indispensable parts of modern Chinese culture, explaining for the Chinese government’s recent surge of interest in gaming. The government has invested a great deal in social construction and set up incentives for innovation within the video games industry so as to bolster the companies’ competitiveness. Despite former government policies to support the video games market in China, in recent years, the Chinese government attempts to regulate the fast-growing market.

To protect youth from indulging in video games, the government issued a series of laws to ask video game companies to regulate their games. Those companies need to ensure that the games’ contents are healthy and may forbid youth from using certain functions.

To quash the production of low-quality and illegal games, for instance, the government references its approval processes and requirements. (Chartboost) According to China’s Ministry of Culture, the pilot reform program begun in 2014 has been a boon for the industry, even if the manufacturers must still comply with strict regulations and ensure that the game won’t promote anything that would harm national unity.

Regulatory reform offered foreign companies a great opportunity to build their business in China, as it gave them access to the Chinese video game console market, where products like XBox, Nintendo, and Playstation were quickly injected. However, Pokémon Go, launched in Hong Kong in July 2016, was not granted the same level of access. Therefore, in order to adapt to the Chinese market, it is important to stick to their customs, laws, and regulations.

New Trends in the Video Games Market in China

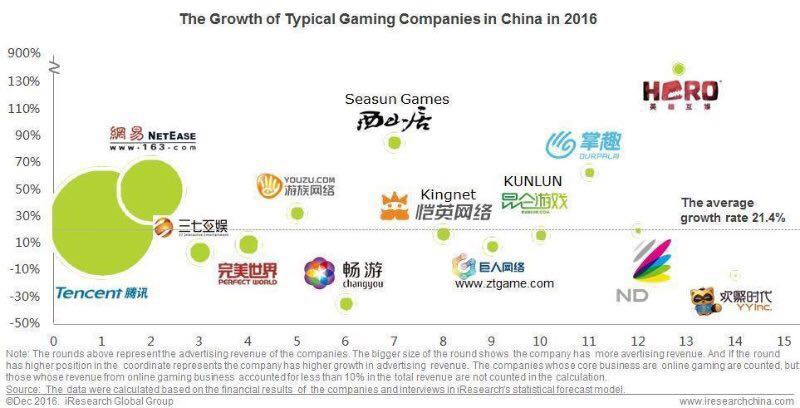

Source: iResearch Global Group, 2016

In 2016, the Chinese Internet giant Tencent bought Supercell, the Finnish maker of the popular mobile game “Clash of Clans” for $10.2 billion from the Japanese group SoftBank. The deal is believed to be the first that values a European digital company at more than $10bn, surpassing both the old-guard video-calling service Skype and music streaming giant Spotify, according to The Telegraph. Tencent also owns Riot Games Inc., the American firm behind the massively popular multiplayer online battle arena (MOBA) game “League of Legends.” Riot games is the organizer of the League of Legends World Championship, which was seen in autumn 2016 by 43 million people, according to the company.

With Tencent dominating the Chinese market, numerous small and medium-sized companies with creative gaming concepts are contending for coveted niches–proof that innovation is key to success in this market. Therefore, it is crucial to stay up-to-date with the latest industry news. According to Johnny Zou, an analyst at IDC Research, “China’s gaming industry will see further growth. While remaining closely involved with the traditional PC and mobile industries, the gaming industry will draw from artificial intelligence, wearables, virtual reality, big data, cloud service and other emerging technologies and use animation, literature, movie & TV, live broadcasting, themed amusement park and other traditional entertainment industries to create more disruptive value.”

High-quality mobile games

Japanese-style playing cards of the roleplaying game Onmyoji (阴阳师), which became a hit in 2016

Zheng Shuang (郑爽), the lead actress in LOVE O2O (微微一笑很倾城) TV series, playing A Chinese Ghost Story (新倩女幽魂) online game.

Of the revenue from top-up cards (cash cards netizens use to pay for online games), which generated more than $1.45 million in China every month of 2016, role-playing games (RPG) accounted for 66.8%, followed by trading card games (TCG, also called collectible card games) with 13.5%, as reported by the CNG Games Research Center.

Compared with the other types of mobile games, role-playing games are still the major market-driving force. A new mobile role-playing game, Onmyoji (阴阳师) launched in September 2016 by NetEase, became an instant hit, thanks to the unique design of the cards and the game’s traditional Japanese characters. Onmyoji features exquisite graphics and 3D animations set in ancient Japan, location-based services (LBS), allowing players to socialize with nearby users, and popular Japanese voice actors to create an immersive gaming experience. NetEase’s RPG game was extremely successful with young people last year. Onmyoji was one of Facebook’s Top 3 best mobile games of 2016.

Video game-film relationship

Another growing trend in China is the videogame-film connection. Video games based on movies and TV series are becoming more popular in China. As reported by the CNG Games Research Center, the video game adaptations generated $1.29 billion dollars last year, or 10.9% of total global mobile games revenues. This trend involves the concept of IP (Intellectual Property), which companies use to adapt original PC games into mobile games. In the cross–platform game industry, the IP of a lot of original PC games were used by companies to adapt them into mobile games, such as the mobile game A Chinese Ghost Story (新倩女幽魂), adapted from an online game of the same name launched in 2012 by NetEase.

In 2016, this mobile game also achieved fame especially among young girls thanks to its product placement in the drama and the movie LOVE O2O (微微一笑很倾城), featuring the young actor Yang Yang(杨洋)and the actress ZhengShuang (郑爽). The campaign drew the attention of new and old gamers to this 4-year-old MMORPG ( the acronym for Massive Multiplayer Online Role-Playing Game). Another example is the American action-fantasy movie Warcraft: The Beginning, based on the Warcraft video games series and novels, which succeeded tremendously in China. The film grossed $433 million worldwide and is the highest-grossing video game adaptation of all time. Warcraft made over $220 million in China alone, representing more than half of its global total box office. After the movie had been released, many gamers in Mainland China started to play this old PC client game again.

Enhanced gameplay

“Social gaming” commonly refers to playing online games that allow or require social interaction between players. Social games can be operated on mobile devices and PC. Because of the 14-year-old ban on gaming consoles (2000-2014) in China, players particularly enjoy free social games. In China, traditional social games like card and chess games, allowing users to play with their friends and strangers online, were once very popular but are now on the wane.

Chinese social game Happy Farm (开心农场), called FarmVille in the West, was one of these games. The goal was to grow virtual vegetables in a farm and steal vegetables from others. More than social activities, now most players prefer good mobile games with an enhanced gameplay experience, like Clash of Clans. Released in China in 2013 by Supercell, the combat strategy mobile game Clash of Clans (部落战争) was a massive hit. Clash of Clans makes $1,847.31 per minute compared to Candy Crush Saga, also released in 2012, which earns $1,847.01 a minute.

The Video game market in China under Coronavirus

While at home during the COVID-19 pandemic, many Chinesechose to play video games to fill their time. In April 2020, Gamma data issued a report talking about the video games market in China under the epidemic. The growth rate spiked from January to March in 2020 over the same period last year, triggering the market consumption.

Video games attracted more attention during the pandemic

Since people had to stay at home, video games became an excellent tool to satisfy their social needs. Not only popular games gained more downloads, but outdated games also had increasing downloads over the same period last year. The revenue of the video games market in China kept rising, and home quarantine stimulated people to spend more time playing video games. Therefore, that aroused the payment on video games. Particularly, TechWeb pointed out that the Daily activate unites of Honor of King in China reached over 95 million, and its daily transactions were over 2 billion yuan.

Responding to the government’s call, many video games companies did not fire employees during this period

Many companies stopped their work during the pandemic, thus, numerous people lost their jobs. Also, many new graduates were unable to find jobs because limited positions were available. Gamma Data’s statistics showed that most video game companies did not fire their employees and even provided a Spring Fair to hire new employees. Tencent offered 3,000 summer internships and new graduates positions and 5,000 community recruitment positions. The number of positions this year increased 25 percent from last year. Sanqi Interactive Entertainment even set a new branch in Chengdu to hire more talents to improve their product qualities.

Video Games Market in China: What about consoles?

The console gaming market has suffered severe losses over the past few years, continuously bleeding its market share from 91.71% in 2008 to 0.3% in 2019. While mobile gaming is dominant in China, the console segment has the potential to grow higher and is “a largely untapped source of potential consumers,” according to The Verge. Not only Sony, Microsoft, and Nintendo would benefit from the lift of the 14-year-old ban on gaming consoles; Chinese indie game developers could, too.

Niko predicted that the revenue of the console gaming market in China would surpass 1.5 billion USD by 2023. Microsoft, Nintendo, and Sony all launched devices in China in the past few years. Notably, Nintendo united Tencent to release the Switch. According to Niko’s statistics, the number of Chinese users on Steam surpassed 10 million in 2016. The evolving video games market in China is also engendering development and innovation. China’s private developer pool is deepened as the country’s economy grows, and the Chinese government can no longer ignore indie game developers. This issue was a major focus during the 2016 China Game Industry Annual Conference (2016年度中国游戏产业年会) IDC forecasts that game exports, especially to the U.S., will continue to rise, as Google finally opened its Developers Platform to Chinese developers on December 8, 2016.