Nuclear Industry in China: From Humble Beginnings To World Leader

With a third of the world’s nuclear reactors currently under construction in China, this growing country may be the biggest believer in atomic energy. Growing energy needs and the necessity of finding alternatives to coal have indeed forced the Chinese government to emphasize its nuclear policy. The 13th Five Year Plan adopted in March of 2016 gives the State Council the responsibility of approving the construction of six to eight new nuclear reactors per year. If this pattern is respected, China’s nuclear power could reach 58 gigawatts (Gw) by 2020-2021 and surpass 150 Gw in 2030.

Nuclear Industry in China: This ‘catching up’ was mainly possible thanks to international nuclear leaders’ expertise

This situation is the result of a rapidly growing nuclear industry in China, which launched its civil nuclear industry in 1994, several decades after France and the United States. The technologies developed by the pioneers of nuclear energy are the ones which actually enabled China to build its first plants. Countries involved in China before 1994 were France with the groups Areva and EDF and the USA with Westinghouse, but also Russia with OKB Gido press and Canada with Atomic Energy of Canada Limited.

Thanks to this cooperation, China was able to develop36 reactors which are currently operational in sixteen sites on the Chinese coast. Between 2007 and 2014, the quantity of electricity generated by these plants more than doubled and in 2014, nuclear power represented around 2 % of Chinese energy.

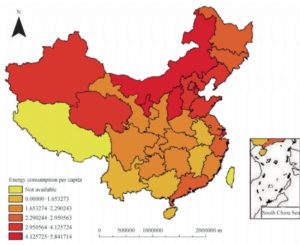

Geographic repartition of energy consumption per inhabitant (ton by habitant), by province in 2008

One of the challenges of the Chinese government today is to improve the geographic redistribution of energy according to consumption. Source: Characterizing China’s energy consumption with selective economic factors and energy resource endowment: a spatial econometric approach. Lei JIANG, Minhe JI, Ling BAI http://journal.hep.com.cn/fesci/EN/Y2015/V9/I2/355#FigureTableTab

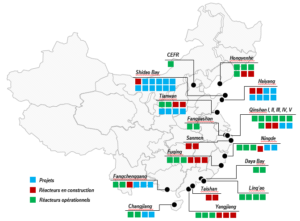

Map of Chinese nuclear reactors in operation, in construction and current projects

Source: Daxue Consulting

Since the 2000s, Chinese technology is advancing with more powerful and innovative projects

However, China consistently maintains its objective of becoming a leader itself in the domain of atomic energy: the two decades during which foreign groups exported their technology to China, and the thirty-six reactors that were built following their methods enabled Chinese teams to develop their own reactors.

The Hualong One, co-created by the China General Nuclear Corporation (CGN, 中国广核集团), and the China National Nuclear Corporation (CNNC, 中国核工业集团公司), is an example. Two units of this third-generation reactor are currently under construction in Fuqing (福清核电站). This reactor is partially based on a French technology used for years in China, but improved and redesigned by CGN.

This very company is also working on a project to create a floating power plant. The world’s first floating reactor would generate electricity starting in2020.

For 2020 or 2021, China has also planned to begin commercialising a fourth-generation reactor in Jiangxi (江西). The first Chinese reactor of this kind was activated in 2010, while the previous eleven power plants of China were still using second-generation reactors. This is called the Chinese Experimental Fast Reactor (中国实验快堆) and it is located near Beijing. Its particularity (the rate of use of uranium) is around 60 %, while those of second-generation only have a rate of 1 %. “The CEFR is safer, less harmful to the environment and more economic than its predecessors”, says Zhang Donghui, chairman of the CEFR project, according to the China Daily.

A technology developed by local leaders is now looking for foreign markets

Three key State companies, the CGN, the CNNC as well as the State Power Investment Cooperation (SPIC, 国家电力投资集团), were able to gain shares of their own national market and are today elaborating and developing their own technologies. Despite the competition from international groups and thanks to its financial clout, CGN (previously China Guangdong Nuclear Power Corporation) participated in the creation of sixteen reactors since its creation in 1994. Today, it is managing the construction of twelve others, among which, the Hualong One.

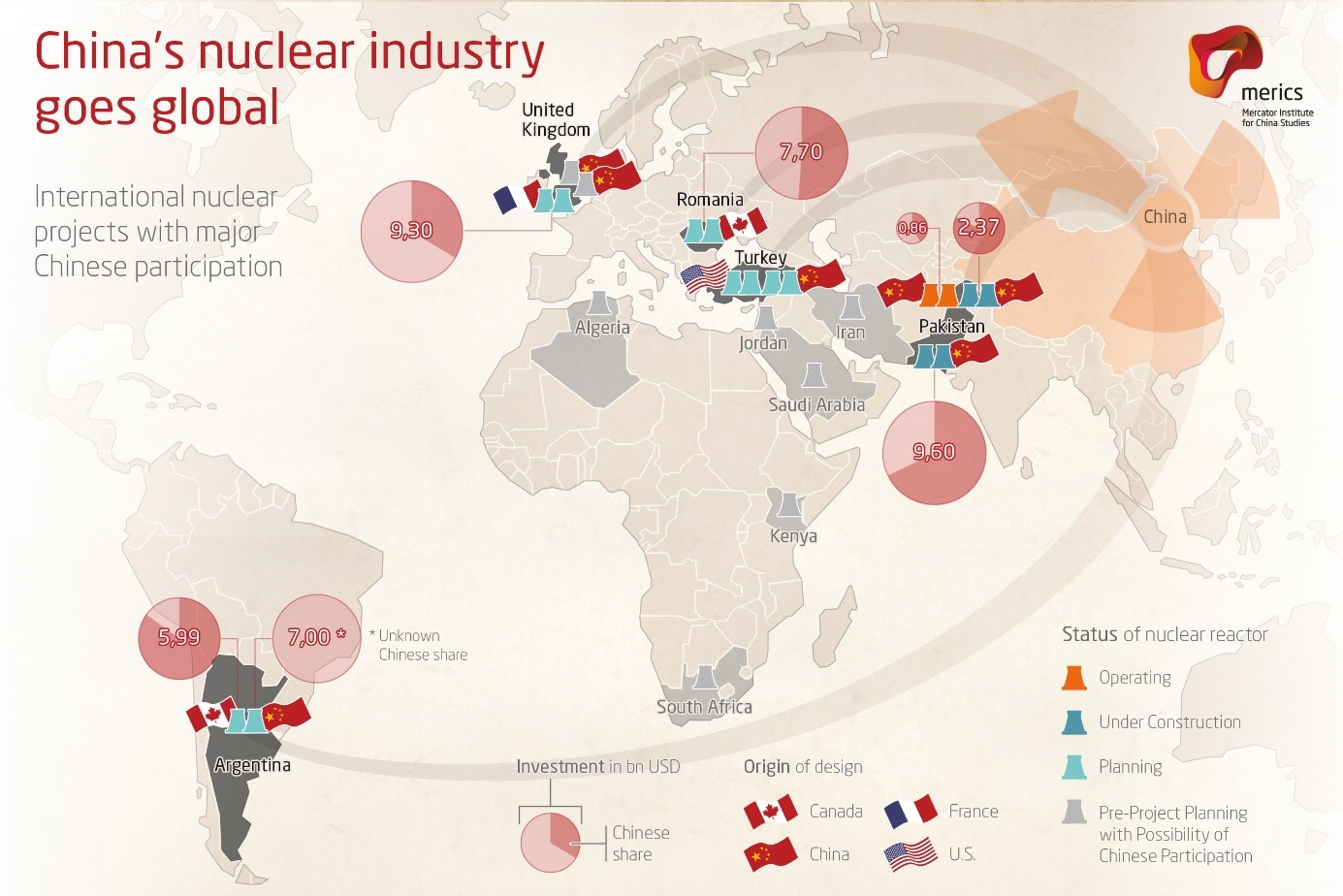

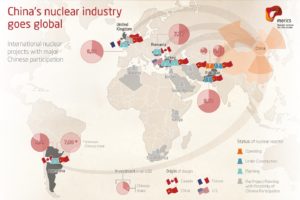

Even though CGN has cooperated with the CNNC for the realisation of this reactor, these two companies remain competitors for market shares within the Chinese market. “The later has been investing tremendously in the supplier chain and the development of the nuclear sector”, says Clément Mougenot, the Study Director at Daxue Consulting. While China begins to export its know-how, the competition of Chinese groups is also taking place in foreign markets and especially in Africa (South-Africa), in Latin America (Argentina) and Europe (United Kingdom).

Source: Mercator Institute for China Studies, via https://www.chinadialogue.net/article/show/single/en/8911-China-s-nuclear-exports-may-struggle-to-find-a-market

In addition, those companies still have numerous problems to solve within their national market. For instance, projects of new nuclear plants face growing concerns from the local population living in the places selected to build plants. This situation is even more problematic given that more powerful reactors require more space. Even though the Chinese population is, in general, more open to nuclear energy than most Europeans, numerous security questions have also been raised, to which the Chinese government promised an answer. Finally, the dozens of reactors currently operational in China, largely thanks to imports of foreign technology in the 1990’s and 2000’s, constitute a challenge for Chinese companies that manage the network, regarding integration and standardisation.

Nuclear industry in China: Daxue Consulting’s expertise

The nuclear industry in China has already proved its strong potential, and it will no doubt continue to pursue its expansion in the coming forty years. If you are a player in the nuclear sector, equipment manufacturer or supplier, Daxue Consulting can help you better understand and get closer to the Chinese market. Our research team can first assess and measure your offer’s potential in the Chinese market. Daxue can also assist in geographically mapping the sector’s actors (market competitors and potential clients and local partners) define the best possible strategy for your project to enter China. “Daxue can also assist in geographically mapping the sector’s actors…”

Stay Up to Date! Follow Daxue On Facebook: