Western Popularity in the Musical Instrument Market in China Gives Overseas Producers the Advantage

Lucrative Musical Instrument Market in China. But is there a real Quality Focus?

Musical instrument market in China is booming and in the process of transformation. We are talking about a 7-billion-USD industry, which had grown at a rate of 10% in the past five years. It used to be all about exporting musical instruments abroad, but times are changing. Export revenue accounted for only 22.4% in 2017, down from almost 70% in 2005. Western instruments are becoming more popular than traditional Chinese ones, according to Daxue Consulting research.

Based on our research, more and more Chinese consumers are asking for higher quality instruments and brand awareness. Imports of instruments grew by 10% in 2016. The increasing popularity of the annual “Music China” (国际乐器展览会) fair at the New International Expo Center (上海新国际博览中心) in Shanghai further highlights the industry’s gradual shift toward better quality products to compete on the world stage. This year’s event, hosted between October 11th and October 14th, should exceed last year’s attendance data of 90,000 visitors from 86 countries.

The local musical instruments market is indeed significant. Not only because of its unique business characteristics and trends, but also because of some special instruments that are used exclusively in China. These traditional instruments are virtually unheard of in the West, such as the guzheng (古筝), a plucked, usually 21-string instrument with an over 2,500-year-long history, or the guqin (古琴), another ancient seven-string instrument which is gaining popularity in recent years.

For more specific insights, read our previous article here about the panpipe (排箫), an ancient flute-like instrument.

China’s growing economy in the tech era has positively affected their music industry through quality manufacturing and e-commerce. This article presents the main findings of one of our recent studies focusing on the musical instrument market in China.

Playing Musical Instruments is Popular Among Children and Young Adults

One of many music schools in Jiuting (九亭), a suburban area of Shanghai (上海). Music education is very important for Chinese parents. There are over 2,700 music schools in Shanghai alone, according to Daxue Consulting research. Photo credit: Daxue Consulting.

The Chinese are hungry for music. From Ultra to Strawberry to Midi to Budweiser Storm, we can see the attendance numbers of live music events skyrocketing. To put this into perspective, the Strawberry festival achieved a growth rate of 200% between 2013 and 2015, while Budweiser Storm experienced an astonishing growth of over 650% between 2013 and 2016.

Christina Ding, senior project manager at Daxue Consulting, commented for CNBC’s Cheang Ming on the prospects of this industry and the reasons for its growth: “The growing number of reality TV programs, such as the ‘Rap of China’ (中国有嘻哈), is one of the reasons that young people attend concerts.”

[ctt template=”2″ link=”aysNU” via=”yes” ]Musical instrument market in China is a 7-billion-USD industry which had grown at a rate of 10% in the past five years.[/ctt]Of course, it is not all about live events. When you walk down the streets of Shanghai’s suburbs or any other big city’s residential area in China for that matter, you will certainly notice a surprisingly high number of music schools offering lessons. Daxue Consulting estimates that there are over 2,700 places like that in Shanghai alone. Though classes are mainly for children, there are some adult classes too. As such, in the recent years, the Chinese are being introduced to music at a very early age. Therefore, the music industry in China is getting a lot of support at the grass-roots level, propelling it to the path of success.

Though the industry remains somewhat underdeveloped compared to other countries—for instance, China’s live and recorded music market value was only around 110 million in 2014 according to the International Federation of the Phonographic Industry, compared to the U.S.’s 4.9 billion—we can see this improving with every passing year.

Currently, underprivileged Chinese consumers spend only 118 RMB (about 18 USD) per year on music, such as live music, CDs, or musical instruments, while their more affluent compatriots are willing to dish out as much as 914 RMB (about 137 USD) per year on average based on our market research. This may still not seem like much, but China is a country with 1.3 billion people and a rapidly growing middle class.

Folk music is the most popular genre. The line between folk and classical music in China is quite blurred. However, pop and rock are gaining ground every year.

[ctt template=”2″ link=”e7Afb” via=”yes” ]Underprivileged Chinese consumers spend only 118 RMB (about 18 USD) per year on music, such as live music, CDs, or musical instruments. [/ctt]Growing popularity of live music and increased spending habits make the Chinese music industry more interesting for foreign companies than ever before.

An Industry in Transformation: Exports Fall by 47% over 10 years, Imports Rising

China produces 80% of pianos in the world. Many foreign brands, such as Japan’s Kawai (卡瓦依), a mid-level brand in terms of price, set up their production bases in the country to benefit from skilled labor, low costs, and a big domestic market. Photo credit: Daxue Consulting.

It is very different than it used to be. Comparing what the industry looked like 20 years ago to today, reveals striking developments that took place both in the musical instrument market and the Chinese economy in general.

Trending: Less Exports, More Concentration… Same Low Price

- Export Specialization to Wane

Following the liberalization of the Chinese economy in the early 1990s, most Chinese music instrument producers aimed at taking advantage of the suddenly large world market. They had the advantage of a cheap labor force, good logistical support, and the government’s desire to bring in foreign revenue. As such, most of all instruments were intended for exports. Many new producers popped up in cities across the country, but mainly along the coastal provinces, which generally featured better logistical support for international trade as well as a large pool of skilled workers. Even today, there are still producers which manufacture instruments only for overseas customers, such as Afanti Music Co., Ltd. (阿凡提乐器有限公司) or Eursound (宁波讴声音响有限公司).

- Industry Concentration to Increase

We can still see the remnants of the past in the music instrument market in China. The industry remains highly fragmented; according to IBISWorld’s report. There are around 250 manufacturers present in the market, employing a total of 79,000 workers, with the top four manufacturers accounting for only 12.7% of the total industry revenue.

As there are fewer and fewer export opportunities abroad, it is expected that the industry will be more concentrated in the following years, because small manufacturers will leave the market as the labor costs increases. Therefore, a fiercer competition with foreign manufacturers takes place in both overseas and domestic markets.

- Local Market is More Important Than Ever

Another interesting development is the share of exports revenue rapidly decreasing. In 2005, nearly 70% of revenue came from exports while this figure for 2017 is being estimated at only 22.4%. Further, analysts expect that the exports revenue share will continue to decrease by 2% every year in the foreseeable future, both highlighting the importance that the domestic manufacturers pay to the local market as well as the fiercer competition overseas.

- Low price = success?

The Chinese manufacturers mostly produce low cost instruments in large quantities. An example of such a brand is Weibo (威伯), which sells the ukulele for prices between 319 and 429 RMB (about 48-65 USD).

This concept has not changed so much from the past. But it allowed the country to capture a massive world market share in certain countries. For instance, piano manufacturers in China, which we wrote about in another article, control about 80% of the world’s market share.

A fruitful cooperation with foreign producers, mostly on the basis of joint ventures, allowed the Chinese industry to acquire the necessary know-how as well as expertise to compete on the world stage and achieve such a big success even though the piano in China is a relative novelty, with the first manufacturing place being open in Shanghai in 1895.

The times are slowly changing, however; we can already observe a number of instruments producers focusing on high-quality products, such as Nanjing Schumann Piano Manufacturing Co., Ltd. (舒曼钢琴公司), Shanghai Dunhuang Musical Instruments Co. Ltd. (上海敦煌乐器有限公司), or Guangzhou Pearl River Piano Group Co., Ltd. (广州珠江钢琴集团股份有限公司), which incidentally happens to be one of the top 50 brands in China.

Traditional Instruments not Popular, but Quality Matters More and More

- Western Instruments Lead the Way

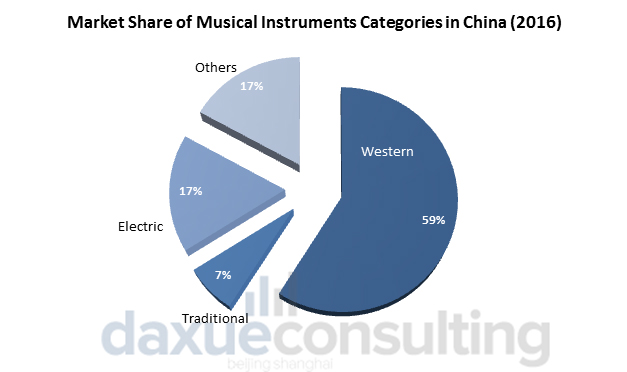

The Chinese market is special due to its unique blend of both Western and Traditional Chinese instruments. Instruments originally invented in the West, such as the piano or the guitar, are the most popular among the Chinese (59%), especially children and young adults, who together make up a large share of those who actually play music instruments. The reason that so many children pick up foreign instruments is that they are generally easier to master—reducing the workload on children during their primary school years. While it is not compulsory to play an instrument well, having mastered one does make it easier for children to be admitted to more prestigious middle schools and high schools.

Electrical instruments are also particularly popular (17% market share). Their popularity is in part also reflected in the large number of people who turn up for festivals and concerts focusing on the electric music genre, such as the Electric Zoo or the MIDI festival.

Traditional music’s market share is only 7%. This is because of the large effort required to master them as well as the growing preference towards the Western culture.

Western instruments, such as the guitar, the piano, and the violin are among the most popular in China. Source: Daxue Consulting Research.

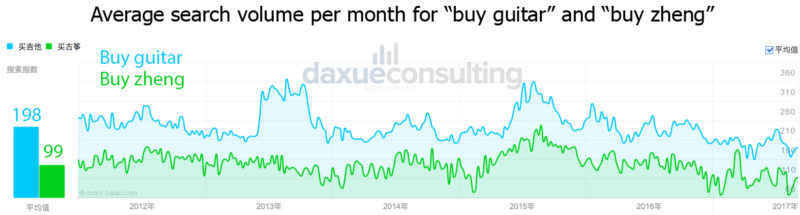

To further consider this issue, we can compare two online search queries: “buy zheng” and “buy guitar”. The zheng is a typical traditional Chinese musical instrument while the guitar is representative of the Western musical landscape.

The term “buy guitar” (买吉他) is much more often searched on the Chinese Internet than “buy zheng” (买古筝) is. Source: Baidu Index.

- “Trading Up”

We can observe the so-called trading up trend getting stronger across China, with the consumers demanding higher quality products from sellers. On one hand, forces the existing domestic producers to pay increasingly more attention to the quality of their wares. On the other hand, it creates opportunities for foreign-made musical instruments to be imported to China and sold in the local market.

The annual imports of musical instruments into China constantly reach double digits in recent years, though the baseline is still relatively small (the import volume was 300 million RMB in 2016).

“Cost-efficiency is still one of the most important factors that consumers consider, especially those picking up an instrument for the first time. But we see that more and more importance is attached to the brand name and the perceived quality associated with it,” adds Christina Ding, senior project manager at Daxue Consulting.

- Online Sales Surpass Walk-In Stores in China

While it is common for customers in the West to test-drive and purchase their instruments in brick and mortar stores, conversely, Chinese music stores are mostly available online.

Alibaba Group’s Taobao (淘宝) and Tmall (天猫) are extremely popular platforms for the Chinese people to purchase their instruments. One can buy anything from the ukulele to the guitar to the guzheng to the piano. An instrument one can imagine is sold online. Almost every seller offers either free or very cheap returns (costing no more than a few dozen RMBs for shipping) to their customers and therefore people can try their instruments in the comfort of their own home before fully committing to the purchase.

For instance, 3,500 to 6,000 electric guitars were sold on Taobao and Tmall every month during 2016. The quantity is relatively stable at 4,000 sold units. Although, sales peak in July because parents typically enroll their children in music schools.

Foreign brands wishing to do business in the music instrument market in China would do well to pay attention to the online side of their business to really take advantage of the size of the local market.

The market certainly presents challenges for foreign instrument producers, such as the need to invest heavily in having an online presence and competitors who are eager to compete on price.

But, at the same time, this is a dynamic market which continues to grow by over 10% every year. The customers give preference to western instruments where overseas manufacturers should have the competitive advantage in terms of design and quality. The quality itself is an increasingly important aspect for local consumers.

Daxue Consulting’s expertise

At any rate, Daxue Consulting is ready to help you understand the musical instrument market in China and give you all the data you need to be prepared to make critical decisions—regardless of whether it is the actual market entry or the potential success of your products on e-commerce websites. We are also able to get opinions from a large number of respondents so that you really know what the people are thinking and feeling. Sensory research, in particular, is one of our strengths.

We have already conducted research projects for our customers on very specific parts of the musical instrument market in China, involving the following points:

- An overview of the specific market segment, with market drivers and market trends as well as opportunities and challenges;

- Competition mapping, including five case studies focusing on similar companies in the industry;

- Online analyses using the Baidu Index and most popular ecommerce websites;

- Geographical areas analysis, highlighting good places to start business, and;

- A detailed customer analysis.

We used various methods to collect data and reach our conclusions. In-depth interviews with brand managers and retailers as well as distributors were one important part. Focus groups with customers and online surveys proved useful too. Other methods included desk research, in-depth interviews with retail consultants, benchmarking, and a corporate financial reporting evaluation.

Contact our project manager who worked on the musical instrument market in China by dropping an email to dx@daxueconsulting.com.

![[Podcast] China Paradigm #33: How to run a health food business in China](../wp-content/uploads/2019/05/Health-food-business-China-podcast-150x150.jpg)