The Chinese music education industry’s main driver: grades and certifications

Music education is a growing market in China

With a market size of 75.7 billion RMB in 2016, China is a rising market for music education. This can be attributed to government support, China’s booming economy, and the upgrading of citizens’ consumption. Another factor not to be overlooked is the importance of music certifications to Chinese families.

Western instruments account for more than half the musical instrument market in China

Musical instrument education is one of the major segments of the music education industry. Since the economic openness from the late 1990s, China has gradually been influenced by western culture, as a result, western musical instruments now account for more than 59% of the market in China. This also coincidences with the fact that three of the top four musical instruments in the music education market are western: piano, guitar and ukulele.

Obtaining certification is the key driver for music education

The key driver for Chinese parents to encourage their children to learn to play a musical instrument is passing the music certification tests. According to the industry report, more than 90% of the market output comes from the training for graded tests. Although most Chinese parents do not support their kids to apply for art colleges, they still wish their kids could learn some artistic skills, for example, music instruments. The grading test certification is proof of their kids’ success and a test of the teacher’s capability. Having high-level certification is also a stepping stone for entering better schools or universities. For junior/senior high schools, students with music instrument certification could get extra marks to compete. For the entrance examination for college (高考), universities provide a special channel for these students with high-level artistic skills. This is the reason why music instrument education is so popular and those instruments in the test list (the certification will only be available for those music instruments listed in the test system) are more favored by the market. For the long-term, people with the certification and the skill can find jobs in music education.

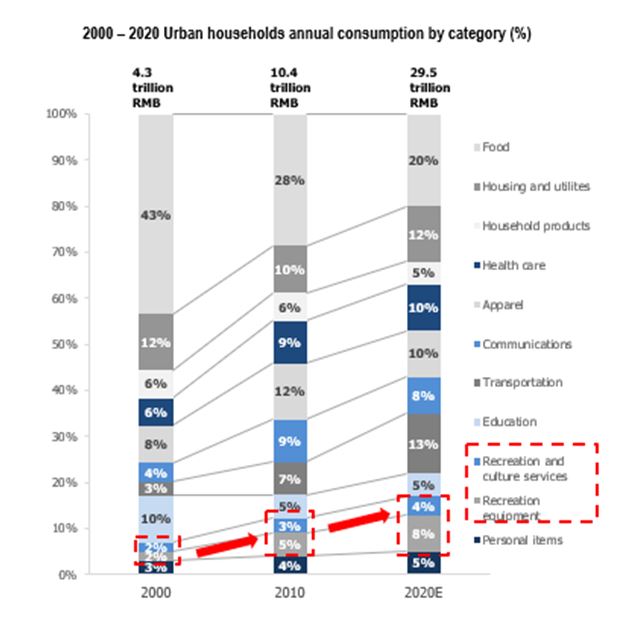

Consumption upgrading: Chinese households are willing to pay more for musical instruments

By looking at the urban households’ annual consumption by category, Chinese citizens are spending more on recreation and cultural services and equipment (including musical instruments). The amount has already reached 832 billion RMB in 2010 and is estimated to reach 3.54 trillion RMB in 2020. This indicates that people are more willing to pay for their music-related entertainment. Combining with the consumption upgrade, there is a trend that Chinese people would consume higher-end products.

Source: National Statistics Bureau

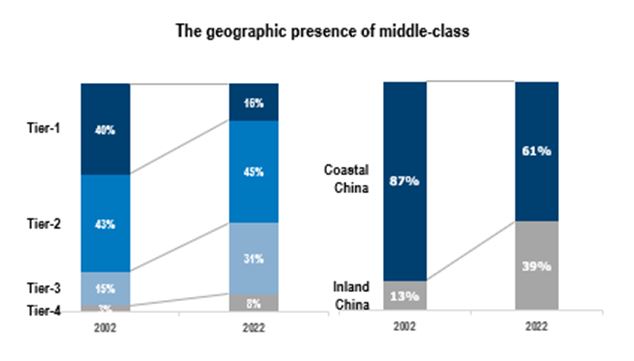

The future market potential is in tier-2 and tier-3 cities

Apart from the increase in expenditure of music-related products, the expansion of the middle class also shows new market development is in tier-2, 3 cities, and is moving from the coastal regions to inland China. This doesn’t mean that there is no potential in the most developed areas, but rather these markets are becoming saturated with high-level competition. For now, Beijing, Shanghai and Guangdong are the three key regions for sales of music instruments, the number of music instrument schools and their economic factors. However, for music education or instrument sales, the market has already shown the trend towards inland China. For example, in recent years, more kids from more remote provinces have participated in the Shanghai International Youth Piano Competition. And their performance is as good as the ones from developed provinces.

Source: McKinsey Quarterly

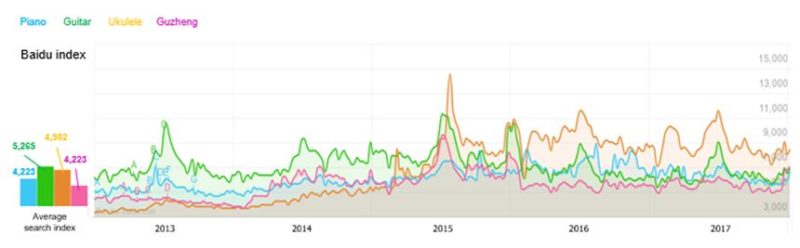

The four most popular musical instruments in China: piano, guzheng, guitar and ukulele

Piano, guzheng, guitar and ukulele are the four most popular musical instruments based off the frequency of searches on Baidu. The standardized test for piano started in 1993, and it is the western instrument with the longest history in China. There are currently more than 30 million children in China are learning to play piano, and with an annual growth rate of around 10%. In Chinese parents’ mind, playing the piano is a symbol of elegance and dignity. Guzheng, which is a type of zither, is the most popular traditional Chinese music instrument for education. The first reason is that guzheng is easier to learn than other traditional instruments, the other reason is that guzheng, with more than 2,000 years of history, is a typical representation of Chinese music culture. By 2018, there are more than 5 million people learning guzheng. As for guitar and ukulele, their targeting older students, mostly adults. The lack of a standardized certification is the main reason that fewer parents would pay for their kids’ guitar/ukulele class. However, because the guitar and ukulele are easy to learn and portable, these 2 instruments have an even larger market size than guzheng.

Guitar and ukulele are gaining more attention in recent years due to the popularity of music TV shows

Baidu index is a figure which shows the popularity of certain searches on Baidu. The graph below illustrates that generally, all four instruments are gaining more attention in the market. Although guzheng is the top Chinese traditional instrument, its index is the lowest compared to the other three western ones. China is getting more open to western culture and meanwhile is integrating the music culture. For example, Zhang Chao, a Chinese composer, has added Beijing opera element into a piano score. Or on the contrary, Wang Zhongshan, guzheng artist, has played pop music with guzheng. Among the 4 indexes, ukulele’s is the highest since 2015. Ukulele is a new instrument for the China market and has only been receiving the public’s attention for a few years. However, thanks to music TV shows like “the Voice of China”, people have become familiar with the ukulele. The guitar is also gaining popularity due to the popularity of music TV shows and festivals.

Baidu index of keywords: piano, guitar, ukulele and guzheng

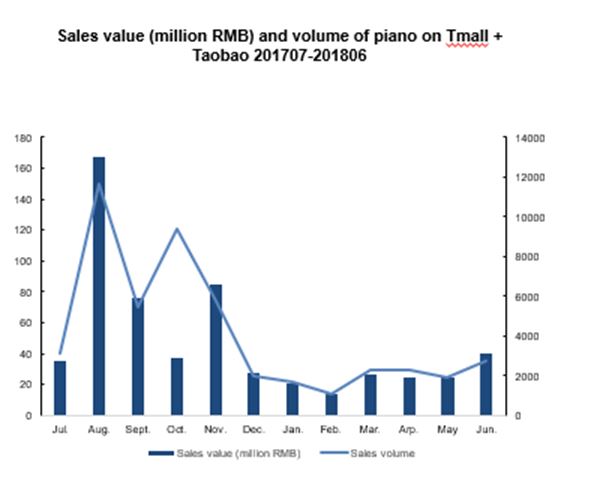

Piano market is mature: demand is for high-end brands

For the piano market, the best-selling brands online are YAMAHA, Bruno & Sons, Carod, Zhujiang (珠江) and KAWAI. All these brands are middle- or high-end, 4/5 are foreign brands. According to the sales data for the last 12 months, the average price of piano sold is around 12,000 RMB/unit, which shows that the piano market is already a mature market for high-end products. There is a sales peak in August because students start their summer vacation then and have more time for lessons. The sales volume is extremely high in October 2017, which is caused by a company called Yun Fei piano’s renting business. They have successfully rented around 6,500 pianos within one month. However, this renting business also met some difficulties. For example, some consumers refuse to return the piano, which has led to many lawsuits. This phenomenon demonstrates that there is a huge market for renting service while the relevant regulations are not settled to protect the benefits of leaseholders.

Source: taosj.com

From the summary of people who mentioned the keyword “piano” in Baidu searches, notable inland regions such as Henan, Hubei and Sichuan are highlighted on the map. Classic music is these people’s common interest, meaning the mainstream music style for piano playing is still classic music. “#piano score#” is the most popular topic among them, they are looking for and discussing scores. This implies a market potential for online music scores.

The most famous pianists in China: Lang Lang (朗朗), Li Yundi (李云迪)

Lang Lang and Li Yundi are the two most famous pianists in China. People like to compare the achievements of them. The most relevant topics people search on Baidu when searching “Lang Lang” are Li Yundi, piano, score and many video playing platforms. The last one might imply that video playing platform is one of the key information sources for people interested in piano. This could be considered as a marketing channel for music education or instrument sales.

Lang Lang, one of the most Chinese famous pianists, messager de la paix. He was also awarded Bernstein art achievement award in 2002.

Li Yundi, a talented pianist, has been awarded the golden prize in the International Chopin Piano Competition when he was 18 years old. Before then, it had been 15 years that no one got the prize. He is the “benchmark” or the “idol” for kids learning piano. Because of this, people are stricter about his mistakes, so many related topics in 2018 are still about his mistake in one concert in 2015.

Li Yundi, one of the most Chinese famous pianists. He was the champion of the 14th International Chopin Piano Competition in 2000.

Guzheng is a market solely for domestic brands, while foreign companies can export raw materials to these brands

For the guzheng market, like this a traditional Chinese instrument, all the vendors are domestic brands. Yangzhou is the base for guzheng manufacture. This would be a market difficult for foreign companies to enter. From the social listening of guzheng on Weibo, it can be concluded that TV dramas have a strong influence on people’s interests and preferences. Brands could sponsor or partner with some TV dramas with musical elements.

China Conservatory of music is one of the centers of guzheng culture, also is the center for other kinds of music studies. Normally, those music instruments stores and schools are located near these conservatories of music, where the key offline distribution locations are. For example, the famous music street, Fenyang Road (汾阳路), in Shanghai is on the street where Shanghai Conservatory of music is. There are 39 music instrument schools and around 30 stores.

Guzheng is listed separately from other traditional Chinese instruments in Chinese Golden Bell Award for Music, which shows its importance and a large base of learners. The Chinese government is also encouraging the development of traditional culture. This would influence the trend for future courses set up in schools. This might be a negative influence on western music education’s business in China. However, there are still other business opportunities. For example, exporting the steel wire of guzheng strings or the paint for those traditional instruments.

Famous guzheng artists in China

Wang Zhongshan (王中山), professor of China Conservatory of Music, president of guzheng association under Chinese Musician’s Association. He has created many new skills to play guzheng, contributing to the development of the modern guzheng playing system. |

Yuan Sha (袁莎), professional guzheng supervisor of China Conservatory of Music, head of Zhong Zheng Art Troupe. She has traveled to more than 30 countries for culture exchange performance and has recorded a one-year-long guzheng educational lectures for CCTV. |

Most guitars sold online are low-end, an opportunity for high-end brands is in offline distribution

For the guitar market, most of the guitars sold online are low-end. There are basically 2 reasons behind this. First, beginners would prefer to buy cheap guitars, and they usually do so online. Second, for those intermediate and expert players, they would like to collect limited edition on second-hand e-commerce platforms or in offline channels. Offline distribution is still the key for music instruments especially for high-end brands, although e-commerce is expanding fast these years in China. Meanwhile, domestic brands have already taken low- and part of the middle-end market in the guitar industry, the opportunity for foreign brands is not to compete with the price but the quality and user experience.

Based on social listening on Weibo, rock and heavy metal music are the main music styles for those people interested in guitar topics. Although classic guitar is listed in the grading test system, this is still not the mainstream for guitar culture, also because it’s difficult to learn. Besides those KOLs within the guitar industry, young idols who play guitar have a strong impact on a wider range of potential/existing learners. Sichuan province with the fourth largest population and fast developing economy is the inland province with the highest potential for music education. The starting point could be Chengdu, the capital city of Sichuan.

Famous guitarists in China

Liu Yijun, used to be the guitarist in the band “Tang Chao (唐朝)”, is recognized as the greatest guitarist in North China of his era. He is also the first Chinese guitar player who can press the keyboard from the back of the neck. Li Yanliang (guitarist of Chao Zai Dynasty Band), another famous guitarist in China, who has been awarded Best Music Arrangement Award in China original music award. People care a lot about their daily movements, their performance. Besides these guitarists and bands, there is another important KOL in the guitar industry, Jiang Wei. He is the CEO of GuitarChina, the largest BBS platform in the guitar market. Along with BBS, Guitar China also has its own online and offline distribution channels. They also have official accounts on all key social media platforms for marketing. GuitarChina has developed a partnership with most of the brands in the guitar industry and hundreds of music education schools in China. This company would be the touchpoint for marketing in this niche market.

Liu Yijun (刘义军), the first metal rock guitar player in China, the first Chinese guitar player who can press the keyboard from the back of the neck. |

Li Yanliang (李延亮), has been playing guitar for more than 30 years, been awarded Best Music Arrangement Award in China original music award. |

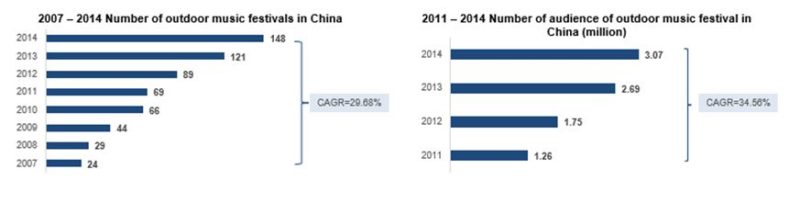

Besides music TV shows, music festivals are also the stimulator for guitar culture

As mentioned before, music festivals have brought popularity to guitar and pop music. The number of outdoor music festivals in China has dramatically increased from 24 in 2007 to 148 in 2014. And the number of audiences has doubled from 2011 to 2014. The most successful music festivals in China are Strawberry music festival (草莓音乐节) and Midi music festival (迷笛音乐节). This is where people are inspired by new trends in the music industry. Besides sponsoring, brands can also rent a booth in the inside bazar to display and sell products.

Source: Daxue Consulting

Ukulele is new to China, although with high popularity, still a market for low-end products

For the ukulele market, most of the products in China are low-end. This is because for China market, the ukulele is an instrument even younger than guitar, meaning a majority of the players are beginners. Besides, the ukulele is not regarded as a formal music instrument, firstly because that it is not in the grading test system, secondly, because that ukulele is more like “little guitar” for the Chinese market. Although ukulele is new to the China market, China is already the main producer of this instrument and is estimated to produce around 90% of ukuleles in 2022. Middle- and high-end brands have already entered China’s market, the next step is to educate consumers to accept higher-end products.

The screenshot shows the related topics people searching for then search the keyword “ukulele”. Half of the most related topics are learning material/skills for beginners, implying that most people tend to learn ukulele by themselves. Two reasons behind this: firstly, the ukulele is easy to learn, especially for those who already play the guitar; secondly, people play the ukulele more for music initiation or entertainment, they are not willing to invest heavily on this. The other popular topic is about the difference between ukulele and guitar. For the very beginning, it’s a marketing strategy to sell ukulele as “little guitar”, but for a long-term strategy, brands need to marketing ukulele as an independent product.

The existing market for ukulele is still the coastal region and people who are interested in ukulele don’t have a clear preference for the music style. The domestic brand, Tian Lai Cun (天籁村), has conducted the business model of “sales + education”, which is the common model for music instrument education in the current market. The ukulele summer camp organized by them is the most popular topic among those people. The “bundle sale” of musical instrument and education is an effective marketing strategy to increase consumer stickiness.

Famous ukulele players in China

Liu Zongli is one of the most famous ukulele artists in China. He is the spokesman of an aNueNue ukulele. This brand covers middle- to high-end products. They also provide educational classes on a live-streaming platform: Meipai (美拍). Liu Zongli has also provided teaching material to CCTV, which assists the spread of ukulele culture. The actual boom of ukulele started from the rising of music TV shows like “the Voice of China”. Liu Weinan, a participant in this show, introduced ukulele to the public by playing “lemon tree”.

Liu Zongli (刘宗立), one of the most famous ukulele artists in China, spokesman of aNueNue Ukulele. He has more than 4,000 students and has provided teaching materials to CCTV. |

Liu Weinan (刘伟男), has participated in the Voice of China Season 4. He was famous for his performance in this show by playing a ukulele. This also increases the exposure and recognition rate of ukulele in China. |

A new opportunity in the music education market: intelligent instruments

Intelligent music instruments are the trend in the industry. First, this follows the government’s guide of “Artificial Intelligence + education”, which encourages to the conversion of AI technology to the education industry to compensate for the limits of teachers in the current system. Secondly, intelligent musical instruments could ease the stress of high expenditure on instrument consumption and classes. For example, one high-end intelligent piano costs 7,000 RMB, which could teach you the entry-level knowledge about playing the piano. If you buy a middle-end traditional piano (5,000 RMB), attend training class (200 RMB/class) and have a personal tutor to monitor your practice (50 RMB/hour), in total that is more than 10,000 RMB. Thirdly, intelligent instruments could guarantee a systemic and standard training process. This avoids the problem brought by changing teachers. The final benefit of an intelligent instrument is that it could monitor your daily practice at any time, which saves the money for hiring a personal tutor.

Popular intelligent instruments in the market: piano, guitar, ukulele

There are three popular intelligent music instruments in the market already: piano, guitar, and ukulele, coincidently are the three top instruments in the education industry. The main principle of this kind of instruments is that the LED lights on it are linked to an APP on tablets and mobile phones. Students can follow the movement of those lights to play. The ONE is the most mature brand for intelligent piano, whose spokesman is Lang Lang. “Learning piano with your family” is also their selling point. Popular and Populele are designed by a technology company based in Beijing and were awarded the iF Industrie Forum Design in 2017. The target market for intelligent music instrument is still limited for entry-level education, while this is already a huge market for development.

The ONE intelligent piano |

Populele by Popular Inc |

Popular by Popular Inc |

“Side-products” of music instrument education: instrument maintenance, second-hand sales, electric teaching material, personal tutor, music competition

There is also great potential for those “side-products” of music instrument education: product maintenance, second-hand sales, teaching material, personal tutor and music competition. Maintenance service is a long-term business for musical instrument sales and education. For example, for the guitar market, even the in-store staff is not professional about the maintenance knowledge of strings. As for the second-hand market, from the Baidu index, it can tell that this market has expanded dramatically since 2015. This indicates a huge market for imported second-hand pianos, especially for high-end ones. Along with the development of intelligent music instruments, electric teaching materials is also the trend in the education market. Tier-1 cities have already started programs for testing the performance of electric teaching material. For those kids who use traditional pianos, they would still hire personal tutors to monitor their daily practice if the budget allows. This market is at least twice larger than a formal teacher. For example, a kid will only attend piano class 1-2 times/week, but he/she needs to practice 3-4 times/week. The music competition is getting popular and paid more attention to the market in recent years, including local ones and national wide ones. This is a chance for kids/players to present their skills, to prove their talent or add experience on their CV. This is a marketing channel for more exposure rates and high-level reputation. Brands could sponsor the competitions financially and provide free products as gifts.

Daxue Consulting has done thorough research on instrument markets in China

Daxue Consulting is ready to help you understand the musical instrument market in China and give you all the data you need to be prepared to make critical decisions—regardless of whether it is the actual market entry or the potential success of your products on e-commerce websites. We are also able to get opinions from a large number of respondents so that you really know what the people are thinking and feeling. Sensory research, in particular, is one of our strengths.

We have already conducted research projects for our customers on very specific parts of the musical instrument market in China, involving the following points:

- An overview of the specific market segment, with market drivers and market trends as well as opportunities and challenges;

- Competition mapping, including five case studies focusing on similar companies in the industry;

- Online analyses using the Baidu Index and most popular e-commerce websites;

- Geographical areas analysis, highlighting good places to start a business, and;

- A detailed customer analysis.

We used various methods to collect data and reach our conclusions. In-depth interviews with brand managers and retailers as well as distributors were one important part. Focus groups with customers and online surveys proved useful too. Other methods included desk research, in-depth interviews with retail consultants, benchmarking, and a corporate financial reporting evaluation.

Contact our project manager who worked on the musical instrument market in China by dropping an email to dx@daxueconsulting.com.