How COVID-19 will impact commercial real estate in China

As the globe grapples with economic conditions caused by COVID-19, the commercial real estate industry has been among the hardest-hit. Stay-at-home orders and social distancing have become standard protocol worldwide, so procedures like in-person home showings and construction have been suspended. China’s property sector — which makes up around a quarter of the nation’s GDP — is no exception to this rule. Here’s how the virus has affected commercial real estate in China.

Real Estate in China is in a Downward Spiral

Chinese real estate investors have struggled with unfavorable market conditions long before the outbreak of COVID-19.

COVID-19 is only “hastening widespread structural changes” to the real estate market, as expert and journalist Mark Cooper observes.

Chinese policymakers, foreseeing dangers in the country’s financial system, have cracked down on corporate borrowing. In an effort to bolster China’s slowing economic ascent, Beijing regulators have introduced ‘de-risking’ initiatives to curb risky lending practices.

This long-term campaign has effectively reined in investors who are now limited in their borrowing and financing powers.

COVID-19 marks a compounding of pressures on the already-slowing commercial property market in China.

COVID-19 Pushes Changes in Consumer Behavior

While the Chinese commercial real estate sector is subject to nationwide regulation, it relies heavily on consumer behavior.

It comes as no surprise that consumers are acting differently amidst a global pandemic. Shopping center footfall has decreased by as much as 90%, and hotel occupancy has similarly plummeted.

Wakeman and Cushfield data reveals downward trajectories in office rentals and prices as office workers across the country are working from home.

Additionally, Real estate transactions for new construction homes in Shanghai between February and March decreased by 56% compared to last year.

Home sales, in particular, have been adversely affected. The Wall Street Journal cites a sales decrease of around 90% from the same period in 2019. Buyers and renters have been unable or unwilling to view properties, which has driven the closure of showrooms. Consumers are more likely to tighten their purse strings, further depressing the demand for new homes.

COVID-19 and its surrounding conditions have ultimately discouraged consumers from pursuing property rentals and home purchases.

Companies Adopt Reactionary Tactics

To respond to the decline in interest, real estate developers have adopted incentivization tactics to convert reluctant customers.

Forbes reports that developers have implemented drastic pricing measures to entice hesitant home buyers during this time.

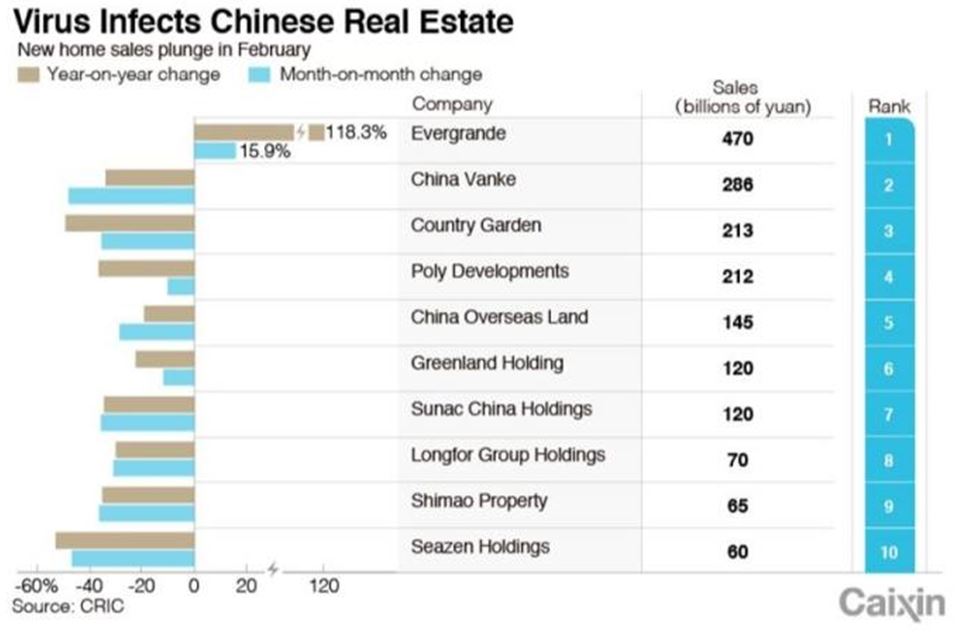

Evergrande Group, the third largest Chinese developer by sales, slashed its home prices by 25% in February and 22% in March. The company successfully bucked the trend of plunging home sales.

Image Source: Caixin, Data source: CRIC, COVID-19 impact on the Chinese real estate market

Other industry leaders are extending their terms of service to entice customers. Real estate giants like Country Garden and Sinic Holdings have begun offering 30-day cancellation periods to provide a risk-free incentive for buyers.

Caixin Global also reports that property developers are stepping up their borrowing through bond sales. By issuing bonds, companies are taking advantage of lowered rates and increased liquidity to endure the housing slump.

According to Reuters, local governments are selling prime real estate to buttress their revenues. Smaller property firms are similarly liquidating their assets by selling their land.

In a show of optimism, some larger developers are shrugging off their sales decline as a short-term predicament and purchasing these freed-up properties.

As such, large development companies are either reacting to the crisis or leveraging its effects for future benefit.

Commercial Real Estate Industry Could Recover Despite COVID-19 Setbacks

A sense of optimism seems to be a common thread among commercial real estate companies and investors.

Major developers like Evergrande are undeterred by their performance in the first quarter, continuing to set their goals as high as 30% more than last year.

Analysts are also remaining hopeful about the Chinese commercial property sector. Guangzhou-based GF Securities speculates that “the outbreak has merely postponed demand in the market, demand that will return.”

The market had already seen some recovery by March, when the sales of the top 100 developers had surged 136% from February. Stay-at-home restrictions are being increasingly relaxed, and the rate of infection in China has rapidly slowed and the economy recovers. Many see this as a sign that market normalization is on the horizon.

However, China’s real estate market is one that continues to fight an uphill battle. As policymakers have committed to “prudence in the property sector,” and as COVID-19 rages on as not only a nationwide but global crisis, it may be wise to remain cautious about growth in commercial real estate.

Author: Emily Landkamer

Emily Landkamer is an Editorial Associate for Clutch, a B2B research, ratings, and reviews platform in Washington, D.C. She writes content on the accounting sector to help businesses make an informed decision about accounting and properly budget for their operations.

Learn more about COVID-19 impact on the economy

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast

![[Podcast] China paradigm #2: How to reach 6 million USD sales without initial investment in the real estate industry in China](../wp-content/uploads/2018/05/501527244041_.pic_hd-150x150.png)