The condiment and sauce market in China | daxue consulting

The demand for condiments and sauces is rapidly growing in China. The market is versatile, international brand provides both western and Chinese products. Drivers of the condiment and sauce market in China include; increasing acceptance of western sauces and condiments, increasing income, and diversification of the restaurant industry. Additionally, the condiment market in China has not been dominated by local brands. E-ecommerce is an important purchasing channel for condiments and sauces in China, and has also enabled foreign brands to easily access the market. KOL marketing has also proven to be affective in marketing condiments in China. This article covers everything a condiment or sauce brand needs to know to enter the condiment market in China.

Consumption analysis of the condiment market in China

The main products of the sauce and condiment market in China

Among all kind of sauce and condiments in China, soy sauces, vinegar, salt, monosodium glutamate (MSG), cooking wine and sugar are the most frequently used. However, sauces and condiments can also be categorised into; Table sauces which includes (mayonnaise, Soy sauces, Vinegar, ketchup, Mustard, Salad dressing, Chilli sauces, Soybean paste, etc.) while Cooking ingredients includes (Herbs and spices, Pepper, Salt, Sugar, Monosodium glutamate, Soy sauces, Ginger, Onions, etc.)

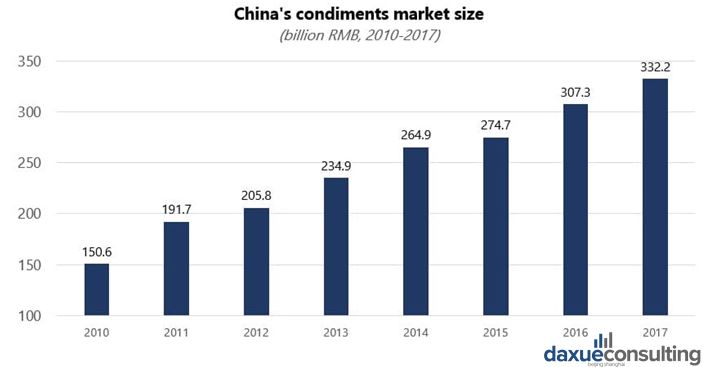

From 2010 to 2017, the compound annual growth rate of sales revenue in the condiment market in China exceeded 11%. In 2017, the market size reached 332.2 billion RMB, which recorded an increase in 8.1%. By 2020, it is expected that the condiment market size will exceed 400 billion RMB.

Consumer analysis: Chinese flavour preferences

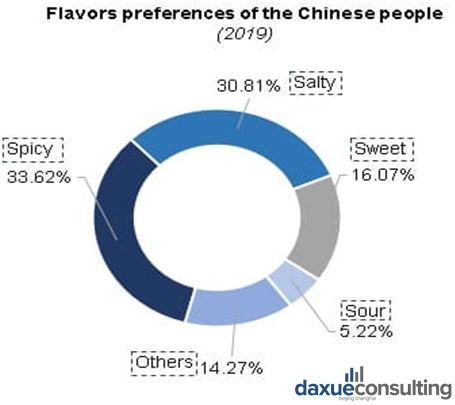

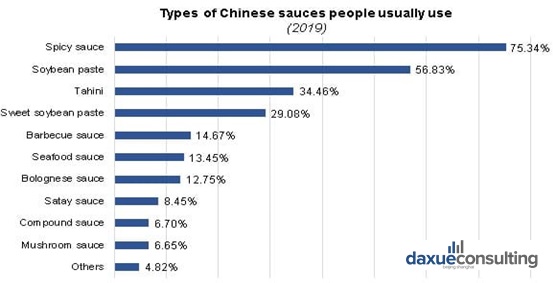

Spice is the favourite flavour of the Chinese people accounting for 33.62% of their flavour preferences. Salty and Sweet have a huge potential market potential of 30.81% and 16.07 % respectively, while only 5% of the people like sour. Although China is known for being one of the countries with the highest salt intake, spicy sauce is the most popular Chinese condiment. Families with babies usually prefer soybean pastes and tahini instead of spicy sauce. The most popular foreign condiments in China are ketchup, salad dressings, and black pepper.

Spicy is the most popular Chinese sauce. Families with babies usually prefer sweet soybean pastes and tahini instead of spicy sauces. The most popular foreign condiments are ketchup, salad dressings and black pepper.

Consumer analysis: The purchasing channels and sizes of the condiment and sauce market in China

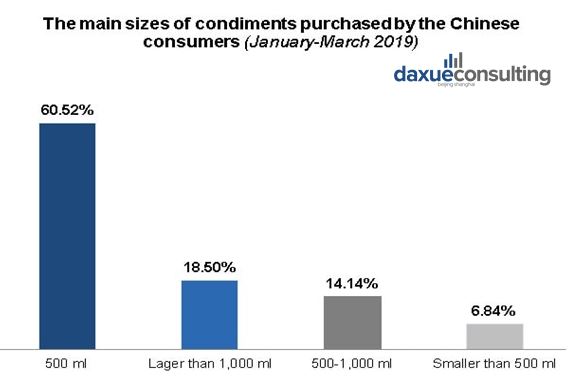

The main purchasing channels of condiments in China supermarkets account for 69% of the total purchasing channels, in other words, the Chinese still prefer supermarket channel to buy their condiments. In offline and online shops, the most common size of condiments’ container or bottle are 500ml.

Consumer analysis: The main influence factors

There are many influencing factors that always motivate consumers towards some particular brands. The Chinese consumers pay most attention to taste, brand reputation and production dates. KOL’s opinions can affect consumers purchase decisions but mainly focus on high-income families

The main consumption considerations of sauce and condiments in China

Baidu index analysis- Interest trends

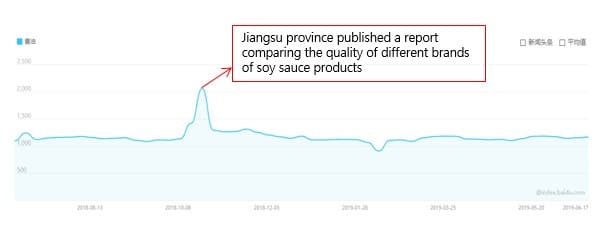

Baidu index of Soy sauce in China

The number of searches of soy sauce peaked on October 15, 2018, when Jiangsu province published a report comparing the quality of different brands of soy sauce products. When people search soy sauce on Baidu, they usually browse soy sauce products and the way of using soy sauce.

Data from 2018.6 – 2019.6

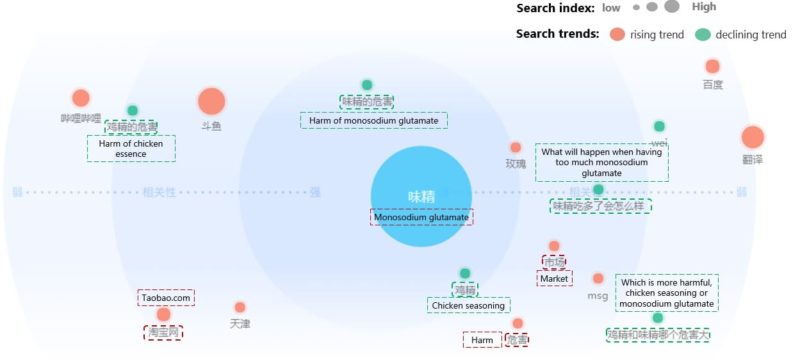

Baidu index of MSG in China

The number of searches of monosodium glutamate (MSG) fluctuated around the average index, and the search number reached the highest point in November 2018 when CCTV released the news that MSG is not harmful to the human body. When people search MSG on Baidu, they usually browse benefits and harm of MSG.

Data from 2018.6 – 2019.6

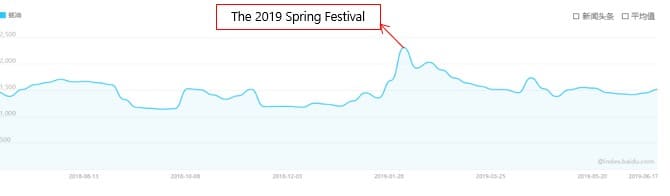

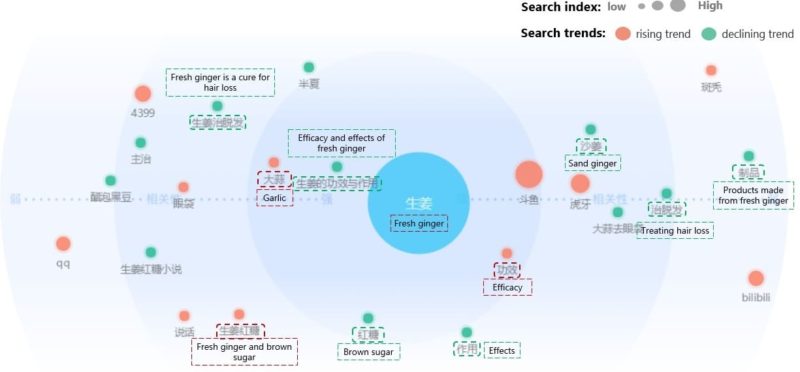

Baidu index of ginger in China

The number of searches of ginger remained high from June to October in 2018, but in January 2019 the search number declined and reached its the lowest point during the 2019 Spring Festival. When people search ginger on Baidu, they usually browse the efficacy and possible uses of ginger.

Data from 2018.6 – 2019.6

Baidu index of oyster sauce in China

The number of searches of oyster sauce remained high from Jan to Feb in 2019, reaching the highest point during the Spring Festival. When people search for oyster sauce on Baidu, they usually browse oyster sauce products and the way of using oyster sauces to make tasty dishes.

Data from 2018.6 – 2019.6

Baidu Index – Semantic analysis of sauces in China

The semantic analysis show the most related keywords to “Soy sauce” are “Haitian” (a Chinese soy sauce brand), “Soy sauce brand” and “Fried rice”.

The semantic analysis show the most related keywords to “Monosodium glutamate” are “Chicken seasoning”, “Rose’’ and “Harmful effects of Monosodium glutamate”.

The semantic analysis show the most related keywords to “ginger” are “Efficacy and effect of fresh ginger”, “Efficacy” and “Fresh ginger is a cure for hair loss”.

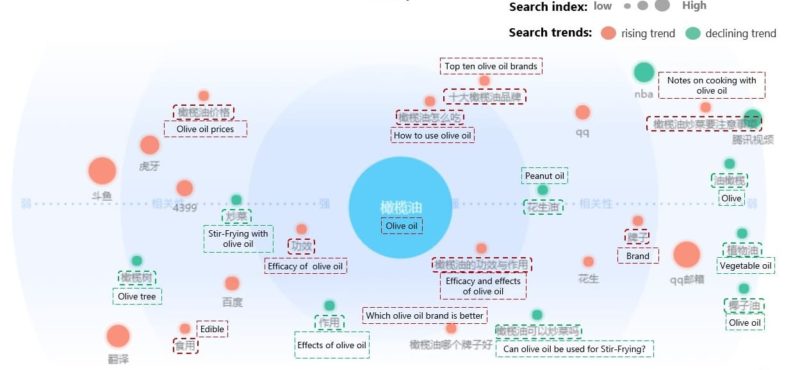

The semantic analysis show the most related keywords to “Olive oil” are “The efficacy and effect of olive oil”, “How to use olive oil” and “Efficacy”.

Consumer perception analysis of sauce market in China

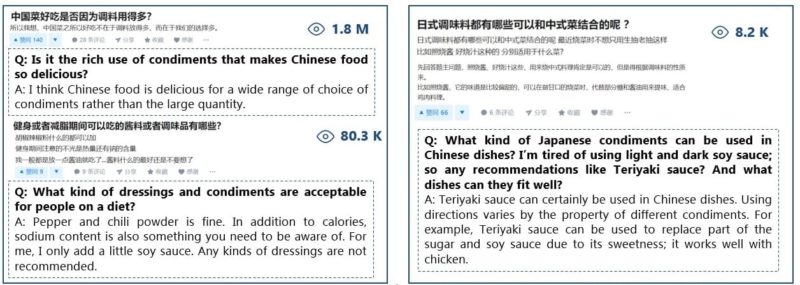

Zhihu is the first question and answer website in china and has transitioned to a social media sharing platform gathering more than 100m answers on various topics. The platform is especially relevant to reach higher and well-educated social classes. On, Zhihu, the most common question and posts about condiments consist of the following:

- Chinese citizens are curious about the importance of condiments in Chinese food and its effects.

- What kinds of condiments are healthy (e.g.: containing low calories)?

- What other cultures sauce or condiments can be good to mix with Chinese food?

Positive consumer perceptions of the condiment and sauce market in China

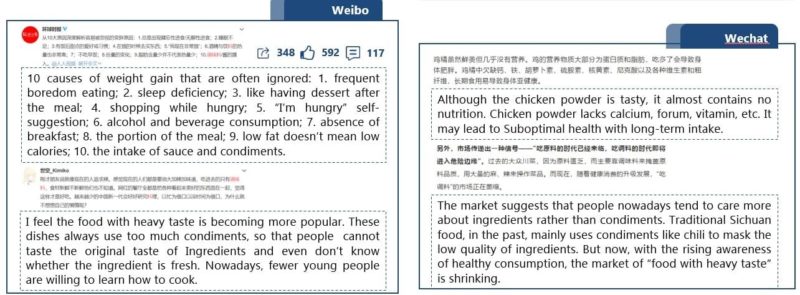

WeChat and Weibo are the most effective social media platform for which Chinese customers express their perception and commendation on certain brand. WeChat is the most used messaging application in China and an absolute must have for a market entry promotion. It accounts for over one billion active users. While, Weibo is china’s biggest social media network that was launched in 2009. Over the recent years, it has been transformed from a Chinese equivalent of twitter to a comprehensive platform. Some positive perceptions Chinese customers about condiments and sauces on Weibo & WeChat are; Most Chinese people love the taste of condiments and sauces, some condiments are good for health and are appreciated by Chinese people and condiments can help beginners to make tasty dishes more easily.

Consumers’ negative perceptions of condiments and sauces in China

On other hand, some negative perceptions of Chinese customers about condiments and sauce on Weibo and WeChat are; most sauces and condiments contain high calories that may increase consumers weight, too much intake of some condiments may lead to health problems and the excessive use of condiments.

Consumption context of sauces in China

Consumption is the one of the key drivers of product success and based on information from Weibo, WeChat and other Chinese social media platform, the most common purposes of buying condiments and sauce among Chinese customers are:

- Use them directly during cooking

- Making new flavours by mixing condiments.

- Sterilizing food (salt and vinegar)

However, Chinese customers do use social media not only on expressing their mind, perceptions, but also videos and pictures of the concern discussion topic. The Fig(a), was taken from a consumer’s kitchen and shared on Weibo. In the picture, the consumer is using salt to cook. While figure (b) was taken from a video that shows people how to make delicious sauce by mixing different condiments.

Fig(a)[Source: sample of posts on WeChat/Weibo ]

Fig(b) [Source: sample of posts on WeChat/Weibo]

Online trends: consumer perception of sauces in China

This section give an intuitive both analytical and theoretical summary, overview of brand marketability by providing an avenue to customers to express their perception. On Tmall/Taobao and JD, besides good tastes, other positive feedback includes high quality, extensive use, satisfied free gifts, fresh production date, good packages, reasonable price and fast delivery. Negative feedback focuses more on bad taste, small size, broken packages, expired products and high price.

Competition analysis of the condiment and sauce market in China

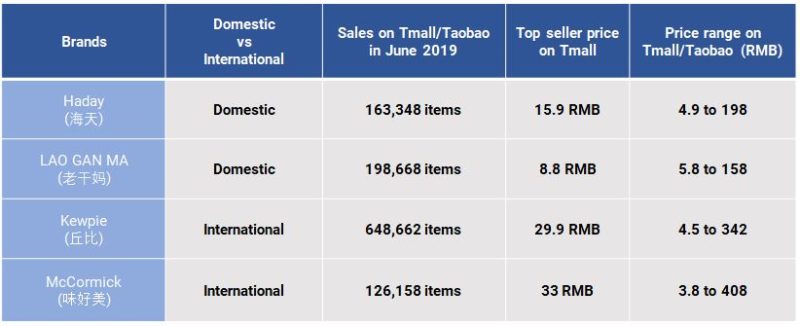

Competition analysis: Table sauce brands in China

On Taobao/Tmall, domestic and international brands both have high sales, some international brands even more popular than Chinese ones. As we can see, the Kewpie brand has the highest sales on Taobao, with the total sales of 648,662 items. The main reasons are some International brands localized their products by catering to the popular taste in China and more Chinese people accepted foreign dishes/tastes

Competition analysis: Cooking condiment brands in China

Chinese cooking condiment brands have much more sales than international brands on Taobao/Tmall since their products better fit Chinese people’s flavour preferences. From the above table, we can see that Totole has the highest sales on Taobao, with the total sales of 290,982 items. International brands offer both Chinese and foreign condiments to attract more local consumers, thus their competitiveness is increasing.

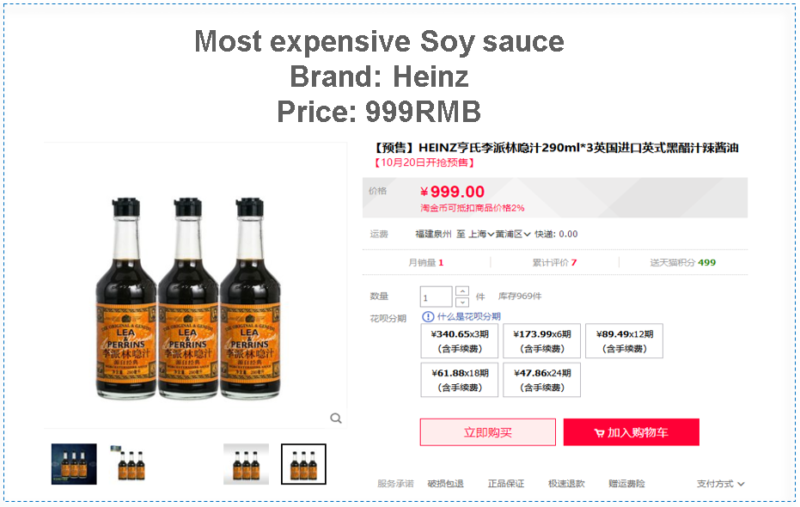

E-commerce landscape of Soy sauce in China

On the Tmall, the price range of soy sauce which weighs around 800ml is huge (more than 900 RMB). Popular products are usually priced at about 49 RMB. Foreign brands of soy sauce products online are usually more expensive. In order to attract consumers, these products can be purchase on installments.

[Source: Tmall.com “Haidi soy sauce”]

[Source: Tmall.com “Qianhe soy sauce”]

[Source: Tmall.com “ Heinz soy sauce”]

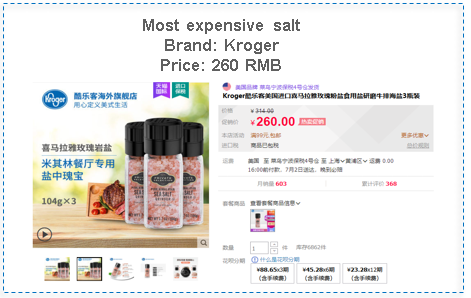

E-commerce landscape of table salt in China

On the Tmall, the price range of edible salt which weights around 300g varies widely. The top seller and cheapest goods are the same product at 2.7 RMB. Many consumers like cheapest edible salt. Wether containing iodine or not is an important criteria for purchasing edible salt online. Now, people prefer to buy edible salt without iodine.

[Source: Tmall.com “Kroger salt”]

[Source: Tmall.com “CNSIC salt”]

[Source: Tmall.com “ Cheapest salt”]

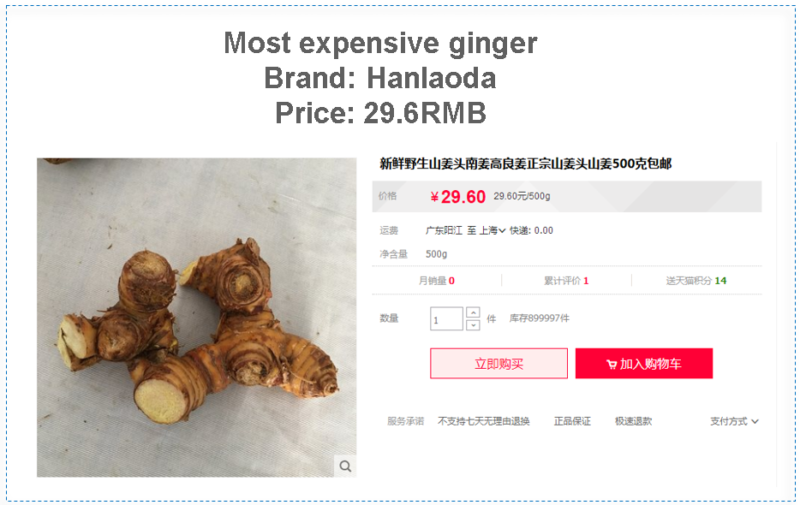

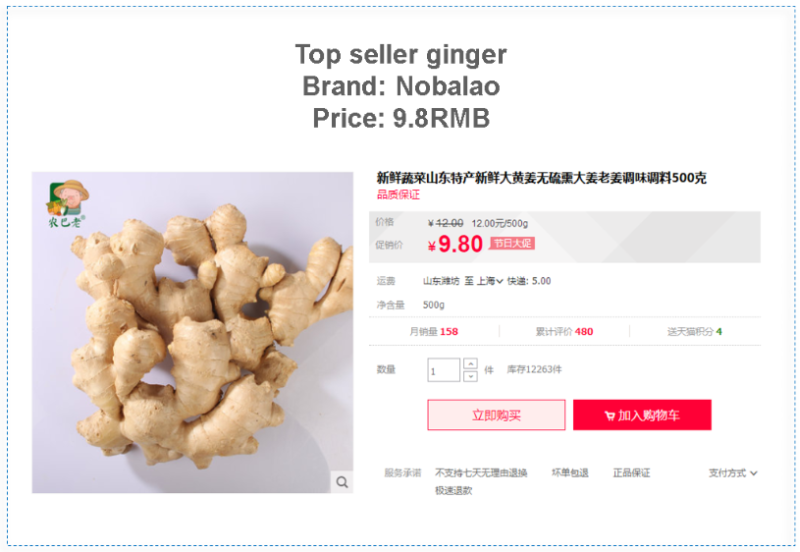

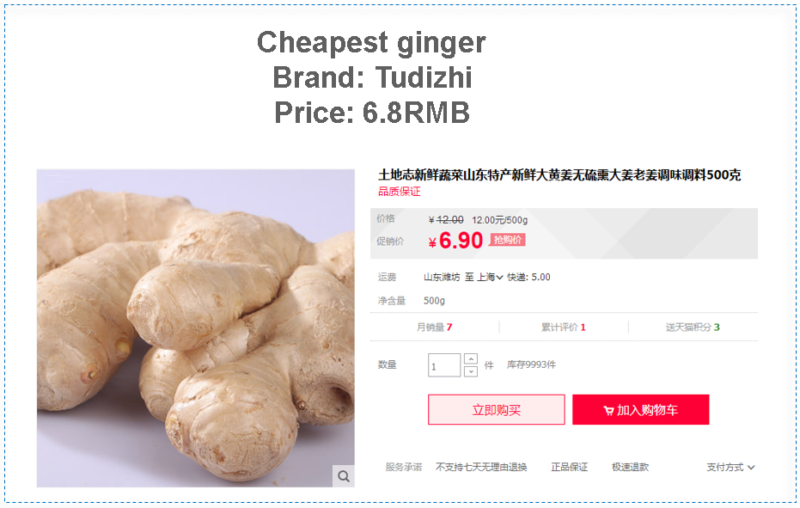

E-commerce landscape of ginger in China

On the Tmall, the price range of fresh ginger with the same weight (such as 500g) is small (around 22 RMB). Popular products are usually about 10 RMB, Freshness is an important criteria for purchasing ginger online. There are no important ginger product on the market.

[Source: Tmall.com “Hanlaoda”]

[Source: Tmall.com “Nobalao”]

[Source: Tmall.com “Tudizhi”]

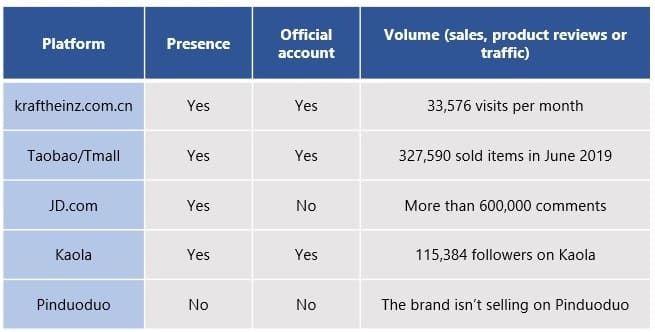

Business cases – Kraft Heinz (卡夫亨氏) Digital activity of Kraft Heinz in China

Kraft Heinz is a famous F&B brand from the USA and officially entered China’s condiments and sauces market in 2010 by merging a Chinese condiment company. Then the brand-built factories in China to increase output and expand market share.

In order to adapt to the Chinese market, the brand provides traditional Chinese soy sauces and also sells Western sauces (such as tomato ketchup) to attract young consumers who prefer western cuisine such as fast food.

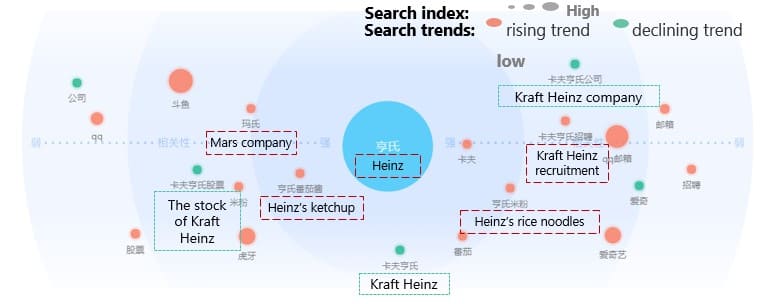

E-reputation of Krafy Heinz in China

The most related keywords of “Heinz” are “Heinz’s tomato ketchup”, “Heinz’s rice noodles”, “Kraft Heinz recruitment”, “Kraft Heinz company” and “The stock of Kraft Heinz”. On social media, Kraft Heinz usually posts info about new arrivals and important events. Recently, the brand started to use Ed Sheeran as new spokesman and he made a video ads to promote the tomato ketchup of the brand, he is a famous singer from England and also has many fans in China. The musician is on Chinese social media platforms, at has many followers.

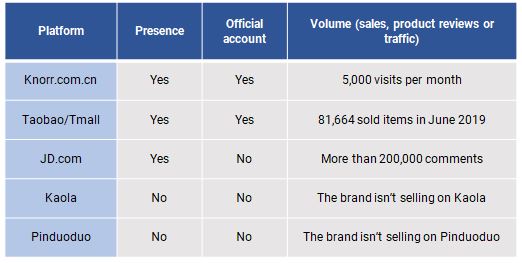

Business cases – Knorr (家乐) Digital activity of Knorr in China

Knorr is an international brand created in Germany and bought by the Unilever Group. The brand entered China’s market in 1993. Knorr’s main products are chicken essence, soup bases and other compound condiments for cooking. In order to attract local consumers, the taste and package design of those products adapt to the Chinese people’s needs. Knorr’s official website mainly displays products, cooking tips, and healthy recipes.

E-reputation of Knorr in China

On e-commerce platforms (Taobao/Tmall), the positive feedback consists of “cheap price”, “good quality”, “nice taste”, “nice package” and “long expiry date”. Negative feedback focuses on bad taste. On social media platforms, Knorr mainly publishes video ads, new arrivals and promotion activities, such as lucky draw and discount. The brand also works with some of China’s food KOLs to expand brand awareness.

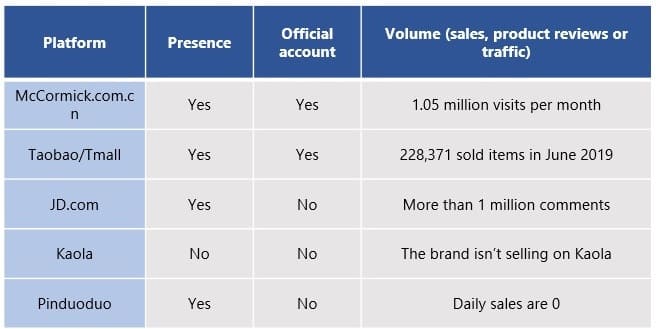

Business cases – McCormick (味好美) Digital activity of McCormick in China

McCormick is an American brand and entered China in 1989 by opening a factory in Shanghai. McCormick mainly provides both western sauces and cooking ingredients such as pepper products, tomato paste and salad dressing. Health is a primary selling point of McCormick’s goods. The brand’s condiments and sauces are all made by pure natural raw materials, which match the increasing awareness of health among China’s consumers.

E-reputation of McCormick in China

On e-commerce platforms (Taobao/Tmall), the positive feedback consists of “fast delivery”, “good quality”, “reasonable price”, “nice taste” and “long expiry date”. McCormick launched new arrivals in June 2019, it’s a type of cumin powder for cooking meat. Negative feedback focuses on bad taste. McCormick generally posts important activities, cooking knowledge and videos with the brand’s condiments & sauces. The brand also recommends some dishes from other countries to attract more attention from consumers.

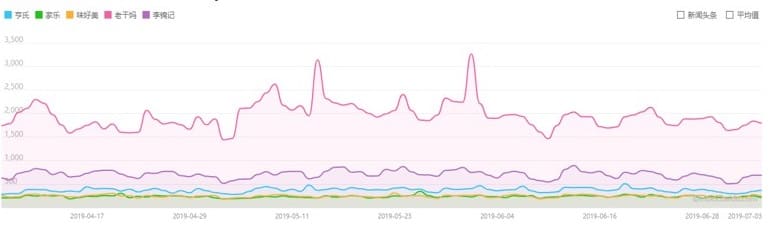

Comparing online interest for leading sauce brands in China

From the Baidu index, we can see that Lao Gan Ma showed the highest search frequency with average of 2000 and LeeKumKee had the second highest search with of 500 search frequency index during the past 90 days. On WeChat index, Kraft Heinz showed a significant high search frequency in June 2019 when the brand used the famous English singer Ed Sheeran as its new spokesman. This show the effectiveness of their promotion strategy of using celebrity in promoting their product.

Brand advertising case study-Lee Kum Kee (李锦记)

By visualizing the high-grade raw ingredients, the ad successfully undermines consumers’ attention regarding additive use in condiments and gains much credibility for the brand. The ad is quite strategic, it started with a lady bringing dishes while other family members are happily chatting. Then follows a close shot of soybeans with seemingly premium qualities. The ads then showed when and how consumers can add the product in different dishes. In the end, the video displayed diverse dishes placed around the bottle.

Brand naming – case studies of sauce and condiment brands in China

The Chinese names of condiments and sauces brands can make consumers easily associate with their products and they generally contain two meanings. The first meaning refers to their products have wonderful tastes or can help consumers make delicious dishes. While the second meaning refers to consumers’ family will enjoy the dishes made by their condiments and sauces. Below are some examples:

味事达(Master, Kraft Heinz) : “味” means “flavor / taste”, “事” means “matters / things” and “达” means “reach”. The Chinese name implies consumers can quickly make delicious dishes by using the brand’s condiments.

家乐(Knorr): “家” means “family” and “乐” means “happy”. The Chinese name implies consumers’ family will feel happy after using its condiments to cook.

味好美(McCormick): “味” means “flavor/taste” and “好美” means “very good/delicious”. The Chinese name highlights the products (condiments and sauces) of the brand have wonderful tastes.

Distribution & Promotion of sauce and condiment brands in China

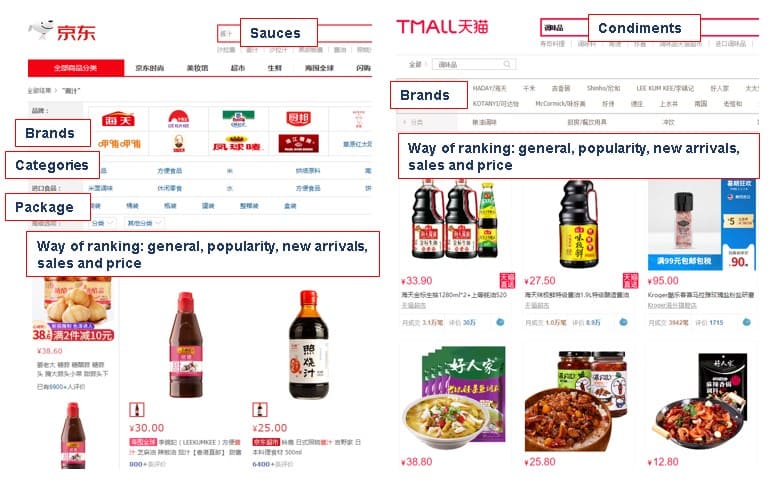

Restaurants and supermarket are the most important distribution channels for condiment and sauce brands for offline distribution channel, because restaurants usually purchase a large number of products and supermarket is the most popular channel for personal buyers. However, specialized condiment shops and wholesale market have shown a significant impacts towards the distribution of condiments and sauce in China. E-commerce platforms (third-party e-commerce such as Tmall/Taobao and JD) are also necessary channels for most brands since they are effective ways of promoting new arrivals and increase sales.

Online retail coverage of sauce brands in China

The number of sauces & condiment brands on JD is far more than Tmall/Taobao, mainly due to the higher requirements and deposit from Tmall for those brands want to enter the platform. Most Chinese brands have built official stores on those e-commerce platforms (such as Taobao/Tmall and JD), which increased their sales in the market.

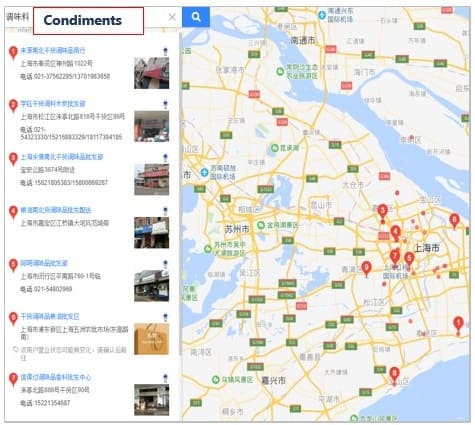

Offline retail of sauce and condiments in China: Coverage in Shanghai

Condiments and sauces in China are mainly sold in supermarkets, convenient stores, wholesale market and specialized condiments shops. We use them as examples of distribution channels for condiments and sauces in Shanghai

On-the-shelf: representation of sauce and condiments in Chinese stores

In China, supermarket is the most popular purchase channel of condiments and sauces for consumers. In those stores, different kinds of condiments and sauces are placed on different shelves or they share the same shelve but clearly separated by types. Table sauces often use smaller packages and cooking ingredients generally have larger packs. The main packages of condiments and sauces are bottles and small bags

[Source: pictures from stores in Shanghai]

[Source: pictures from stores in Shanghai]

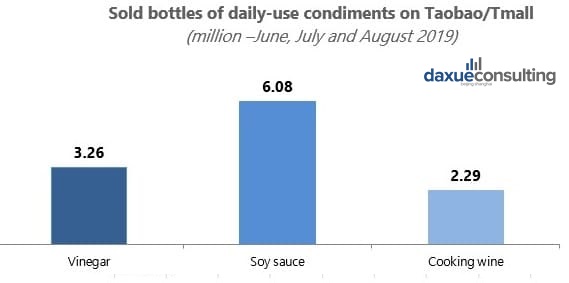

Online sales: Volume asseement of sauces in China

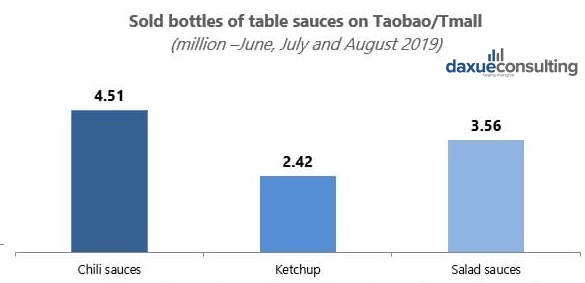

On Taobao/Tmall, soy sauces showed significant high sales in June, July and August 2019 as one of the most common condiments among the Chinese consumers. On other hand, among all kinds of table sauces on Taobao/Tmall, Chili sauces had the highest sales in June, July and August 2019. However, the spicy is the most favorite flavour of the Chinese people.

Promotion channels to leverage for international condiment brands in China

Considering the rapid development of the market, the promotion channels can be on websites/Apps which includes (tiaoliao.net,cntiaoliao.com and twzj.cn). Taioliao.net, is the dedicated condiments & sauces webside, it offers information about relevant distributors, sellers and conferences. Also, specialized magazines (such as China condiment, Chinese cusine, Home gourmet and ZGDC) are part of promotion channels in China. China condiment is a Chinese magazine that focuses on condiments, it mainly introduces different types of condiments and how to use them during the cooking.

KOLs related to condiment and sauces in China

For international brands, KOLs are a huge part of modern condiment and sauce promotions, and young consumers are influenced by KOL’s shared opinions and experiences. China’s KOLs, who usually post content related to condiment and sauce on Weibo, mostly are food KOLs. Foodvideo, is a KOL account on Weibo mainly posts video about cooking process and methods and it has over 4.4 million followers. Some KOLs focus on food recommendations, products testing and recipe sharing. Condiment and are frequently mention in those, and they are always important in every post.

Market trends of the condiment and sauce market in China

Health is becoming important to Chinese consumers: Due to the increasing health awareness among the Chinese people, many brands are trying to make products healthier with more natural sauces and condiments. The desire to consumer healthy and natural products certainly has an effect on the condiment market in China

Diversified flavors in food and cooking: Although many people still prefer traditional Chinese condiments and sauces, more young consumers are willing to buy compound and western condiments to try different tastes.

Social media and KOLs: In order to attract consumers in more effective ways, condiments & sauces brands are working with some KOLs to promote their goods on Chinese social media platforms. o

Author: Abdulhamid Sillah

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes