Why to Focus on Specialty Chemicals in the Chinese Chemicals Market

Drawing on our last market report about the chemical industry in China, this article shows the results of our recently conducted market research in the Chinese chemicals market. We found that China is importing less and less organic chemicals. However, the import from Germany remains steady. At Daxue Consulting, we expect the overall market share and value of the Chinese chemicals market to continue growing at an impressive 40% ($2 trillion) and expose how can western brands get a piece of cake of the largest chemicals market in the world.

How to explain that imports of organic chemicals in general dropped by one-third but imports from Germany remains steady?

In 2016, China became Germany’s largest trade partner for the first time, overtaking the United States and France. According to our calculation using United Nations database, compared to 2015, the overall trade balance between Germany and China increased from $182.8 billion to $190.6 billion, while those between Germany and France and the US dropped (France: $188.1 billion to $186.6 billion; US: $195 billion to $184.4 billion).

With this new supremacy of China for the German trade, it becomes even more necessary to have a closer look at the Chinese-German relationships. While it is obvious that China’s top imports from Germany are vehicles, machinery or electronic equipment, there are other industries that don’t get that much attention and yet, are of great importance. For example, organic chemicals. It is an important market because organic chemicals are in both German exports and Chinese imports in the top 10. Given the interesting development of the trade data, Daxue Consulting decided to take a closer look.

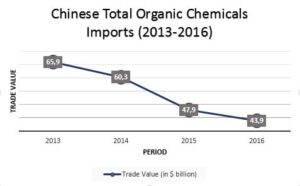

First of all, one can see that Chinese firms import less and less organic chemicals in general:

Reproduced by Daxue Consulting from UN Comtrade Database

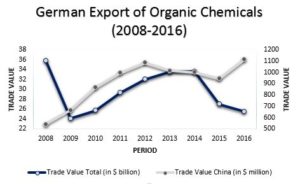

However, the more interesting pattern is that Germany, although having declining exports, was able to export to China at a fairly steady growing rate:

Reproduced by Daxue Consulting from UN Comtrade Database

One can see that, first, after the financial crisis in 2008, German exports in total dropped drastically. Yet, exports to China kept on growing constantly. Also, when German exports in total fell again after 2014, the exports to China reached even an all-time high last year with $1.1 billion.

First, we started with analyzing the Chinese chemicals market in general to get a better understanding.

Development and Paradigms of the Chinese Chemicals Market

Chinese chemicals market value increased more than tenfold with a CAGR of 25% – to only grow further until 2020

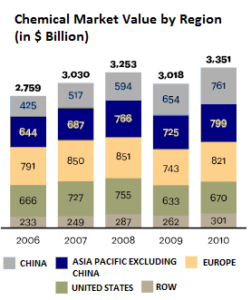

Over the past decade, the Chinese chemicals market was by far the fastest and greatest growing chemicals market, compared to the rest of the world. Despite different foreign forecasts in the early 2000s saying the market will ‘only’ grow by 10% a year, in fact, the Chinese chemicals market performed much better. We were assigned with a Chinese chemicals market analysis in China, where we investigated the market in terms of market size and key drivers of growth, for instance. We found out that between 2003 and 2013, China could increase its market value from $128 billion to $1361 billion. The annual growth rate during this time showed an incredible 25%, compared to only 4% and 3% in the NAFTA region or Europe, respectively. That is, why it is not surprising to see that China has surpassed the US already in 2009 as the country with the highest market value:

Reproduced by Daxue Consulting from Datamonitor; A.T. Kearney

In doing so, China today represents over one-third of the market share.

At Daxue Consulting, we expect the growth to be continuing – however, not at the same tremendous rate. We expect the annual growth rate for the years until 2020 to be at 8% with China having obtained up to 40% of the market share by then. The expected market value for 2020 is an incredible $2.06 trillion, compared to the global market value of $5.16 trillion and thus underlining the dominant position as the world’s largest chemicals market.

“Climbing the ladder”: seeking self-sufficiency for commodities and the rise of specialty chemicals in China

Although China’s GDP growth rate reached its lowest point since 1990 in 2016 (according to China’s 13th five-year plan) and although the imports of, e.g. organic chemicals steadily decreased, China still shows increasing domestic demand. Especially the automotive, manufacturing, electronics but also the energy, cosmetics and the food industry in China are thriving. All of these segments are in need of chemicals which increases the demand for them, too.

With increasing demand for chemicals in general, how can the decreasing imports of organic chemicals be explained? The Chinese government is seeking self-sufficiency in terms of serving the demand for commodities, and thus, domestic investments in basic chemicals increased over the last years.

However, the past five-year plans show the direction into which China is headed. China changed its imitation to an innovation paradigm and wants ‘to climb the ladder’. China is thriving for upgrading its industrial value chains which, for instance, led to an upward trend of the sophistication of manufacturing in China. Also, rising standards of living as well as the fact that the government shows increased environmental consciousness are increasing the demand of innovative products. Beneficiaries of these paradigms are producers of specialty chemicals. An example is the rising demand for innovative, lightweight chemicals such as polymers and specialty coatings which are needed, e.g. for cost-effective car manufacturing. A first result of this growing importance of specialty chemicals in China was contributed revenue of this segment of $189.3 billion in 2010. Furthermore, at Daxue Consulting, we expect the rise of the specialty chemicals to be continuing and forecast the annual growth rate of the specialty chemicals market to be up to 9% through 2020.

Another paradigm that occurred during the last decade is the declining market share of foreign-owned companies in the Chinese chemicals market. According to the Independent Chemical Information Service ICIS, in the period between 2006 and 2012, they lost 4% of their market share, from 27% to 23%. Predominant are private domestic companies which could increase their share from 43% to 58% in the same time. This is to be explained by the goal of achieving self-sufficiency regarding serving commodities, which still represent the major part of the Chinese chemicals market.

High-Quality Organic Chemicals drive Import from Germany

With the knowledge of the trends in the Chinese chemicals market in general, it is even more interesting to examine the drivers for importing organic chemicals from Germany – as it seems to be not affected by the emerging power of specialty chemicals in the market, as shown by the steady growing import from Germany, despite the overall declining import of organic chemicals.

As above mentioned, basic or organic chemicals for producing commodities still constitute the major part of the Chinese chemicals market. However, the overall import of those chemicals dropped dramatically over the past years. That is because the government is attempting self-sufficiency. So what is it that the Germans were even able to export an all-time high of organic chemicals to China last year?

Our research resulted that, although China is seeking self-sufficiency, China is in need of world-class organic chemicals even more than ever. Because of the fact it is ‘climbing the ladder’, e.g. sophisticating its manufacturing or raising the standards of living in general, China needs organic chemicals of a quality which they aren’t capable of producing themselves yet. Therefore, it is only logic to import this type of chemicals from Germany as the leading chemicals firms such as BASF and Bayer are from Germany. Also, these companies are highly trusted as they also have operations in China since a long time, in the case of BASF even since 1885.

Another reason for importing organic chemicals from Germany is not only the fact that top-class chemicals are imported – but also, that in doing so, Chinese firms can increase their own technological knowledge. When importing and using these high-quality chemicals they can learn and adapt and thus, their own capacity of producing high-quality organic chemicals for the use of reaching self-sufficiency in producing commodities will be raised.

However, when you’re operating in China itself, you need to be aware of several other aspects as well.

Opportunities and Implications for Multinationals in China – why companies should focus on Specialty Chemicals

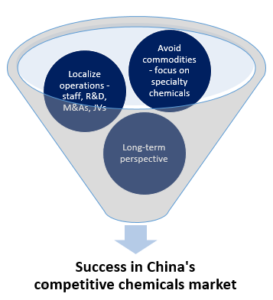

First of all, although foreign-owned companies lost market share during the past years and were facing declining sales, the worst decision businesses could take is to retreat from or to decide not to enter the Chinese market. As we expect the chemicals market to keep growing, it will remain the most important driver for global chemical demand growth, which is why global players like Dow and DuPont from the US or the Dutch companies Royal Dutch Shell and Akzo Nobel increase their commitment to the Chinese market, e.g. by extending R&D. However, it is crucial to be well positioned in order to get a piece of cake of the estimated 40% market share and $2 trillion market value of the Chinese chemicals market by 2020. The challenge is to adapt to the local market.

Nonetheless, the main opportunity and concurrently main implication are to focus on specialty chemicals. The market for commodities is saturated. Heavy investments of domestic chemical firms, private- as well as state-owned, in basic chemicals to secure self-sufficiency according to the goal of the government, have led to overcapacities. For instance, the coal-based chemical methanol shows a fierce cost competition and a very low margin due to overcapacity.

On the other hand, specialty chemicals still show attractive niches. Especially, chemicals used in the thriving industries like the automotive or electronics industry can be very attractive. An example for this could be polymer composites or specialty coatings in the automotive industry which allow reducing weight and therefore make the car more fuel-efficient which again is in high demand.

Further implication is to implement digitation strategies. While digitization is concerning all industries worldwide, chemical companies must put a special focus on it as they are clearly lagging behind other industries like the automotive industry. Several studies, among them the study of Roland Berger about digital readiness, illustrate that chemical companies only show an average digital readiness of 35% and even less than 20% of the companies are using novel techniques such as Scrum, an agile framework to complete complex projects by improving communications, for instance. This shows the great potential for chemical companies to create future competitive advantage if they only adopt to the digitization and implement digitation strategies in the organization now.

Referring to the Chinese chemicals market, the most important aspect of digitizing the company is the fact that it is becoming a prerequisite to obtain customer insights with the means of big data analyses. Applying these big data analytics, e.g. processing unstructured data from social media, enables the companies to forecast customer behavior and create accurate demand patterns. To give a precise example, leading chemical producers like BASF using big data methods could predict the rise of environment-consciousness in China. In return, this led to an increasing demand of innovative, lightweight chemicals such as polymers to increase fuel-efficiency. The companies which were aware of that could focus on developing and producing this kind of chemicals and are profiting from it now.

Finally, another implication would be to take up a long-term perspective. As many local players focus on short-term results, this is a way to avoid intense competition with local companies. This goes hand in hand with the implication of using M&As or joint ventures to increase market access as it is very crucial to make a thorough decision whom to target for the potential acquisition or joint venture. Also, the decision where to set up the R&D facilities affects your long-term success.

Research at Daxue Consulting

These insights represent only a little grasp of the ever-growing chemicals market in China. Especially, when foreign businesses are operating in or producing for one or more of the thriving industries in China such as the automotive, construction, or electronics industry they need to conduct research to find out which chemicals are attractive. In doing so, they can discover which chemicals should they be focusing on buying or producing as these chemicals are in demand, cost-effective, have a good margin, etc.

Contact us for further research or subscribe our newsletter to keep up to date with the Chinese chemicals market.

Take a look at Daxue Office: