Bright perspectives of China’s sporting goods industry: kids, millenials and elder people are most promising customers

Recently China’s sporting goods industry has showed surprising results, estimated to reach $ 30.6 billion in 2017 growing 9.8% annually.The Chinese government is taking measures to promote social sports and increase consumption of sporting goods and services, as the goal is quite ambitious – by 2020 the industry revenue should reach 3 trillion RMB (460 billion US dollars). But government efforts and support are not the only drivers of this market. Passion for sports, increasing number of sports addicts and better income will push the market even further.

Chinese millennials, aged 18 to 35 (around 380 million of people) are the most promising consumers, while retired people (males older than 55 y.o. and females older 50 y.o.) and kids between 5 and 18 years old are the audience with hidden potential in terms of sporting goods consumption. Chinese consumers still prefer foreign brands, but have high expectations about unique features and functionality of the products. Industry experts are positive about the future perspectives of the China’s sporting goods industry, which provides lots of opportunities for both foreign and local companies. Based on our findings, running is still the most popular sport in China, followed by badminton and basketball. While investors are interested in fitness, soccer, e-sports, outdoors and extreme sports, combat sports, cycling and square dancing.

[ctt template=”2″ link=”JD6BO” via=”yes” ]By the end of 2020, the revenue for #Chinese #sports industry will reach 3 trillion RMB, or 460 billion US dollars.[/ctt]Is China’s sporting goods industry the main part of the booming China sport market?

China has already become a sporting superpower, as its results and strive for gold at recent Olympic games speak for itself. In the report to the 19th National Congress, President Xi Jingping pointed out: “We must extensively carry out the nationwide fitness program, speed up the building of a nation that is strong in sports, and succeed in organizing 2022 Beijing Olympic Winter Games and 2022 Paralympic Games”.China is also investing resources into encouraging citizens to participate in sports as a lifestyle choice. Nowadays, almost 1/3 of the population (434 million of people) are playing sports on a regular basis in China.

According to China Daily, in 2013, sports and relevant sectors in China reached a total amount of 1.09 trillion RMB ($168.5 billion) and realized an added value of 356.4 billion RMB ($55 billion). Since then Sports industry in China has shown sustainable growth.

In 2016, China’s sports authorities announced the 13th Five-Year Plan for sports development, according to it by the end of 2020, the revenue for Chinese sports industry will reach 3 trillion RMB, or 460 billion US dollars, accounting for one percent in GDP with the added value of sports service taking up 30-percent in the overall sports industry.

Sporting goods, Sports Entertainment and services drives China’s Sports industry

The main factors driving industry performance have been higher consumption in China, large sporting events hosted by China, people’s increasing pursuit for a healthier lifestyle and the country’s active involvement in international trade within the World Trade Organization (WTO) framework. The market is estimated to reach $193.8 billion in 2020 and $ 470.3 billion in 2025

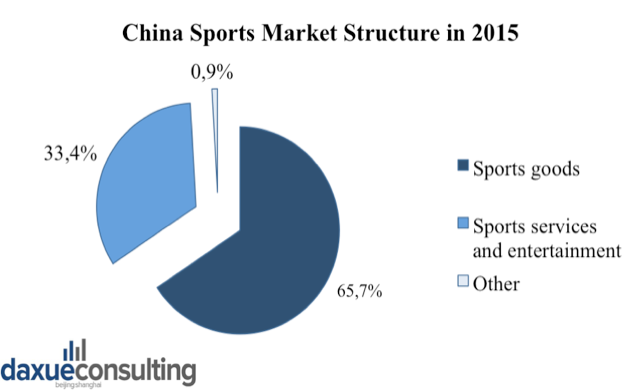

65.7% of China’s sports market is provided by the Sports manufacturing industry. Reproduced by Daxue Consulting with data from Chinadaily

As the market structure of 2015 shows, 65.7% was provided by the Sports manufacturing industry and 33.4% by the Sports services and entertainment. According to the “China Sports Industry Development White Paper“, the industry showed an annual growth rate of 13.38%, what proves its rapid development.

Sports equipment, gear, and apparel are main sources of revenue of Sports equipment manufacturers in China

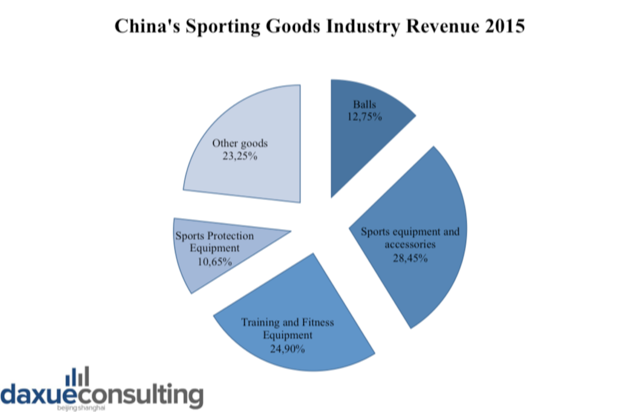

The main source of the revenue in China’s sporting goods industry in 2015 was sports equipment and accessories.Reproduced by Daxue Consulting with data from chyxx.com

There is nothing surprising that sports equipment and accessories (28,45%) is the main source of revenue in the industry. Chinese people are famous for their love for sports apparel and footwear. Second biggest source of revenue istraining & fitness equipment (24,90%), and the reason for this could be a rise of awareness for healthy lifestyle and growing number of fitness clubs in China. A significant share of Sports Protection Equipment can be explained by the increasing interest in China to contact sports like MMA, ice hockey and American football.

The Sporting Equipment Manufacturing industry in China is highly influenced by foreign demand and expected to generate revenue of $30.6 billion in 2017 (+ 6.1%). In the past five years, revenue has been growing 9.8%annually.

Sometimes it is hard to differ sporting goods from other goods (e.g. clothing and footwear). So many companies operate in all three sectors: wholesaling, manufacturing and retailing. These enterprises usually produce goods used for sports contests, workouts and leisure such as sporting equipment, gear and apparel.

Recently the entry to the high-end market has become more expensive as the cost of production increased due to the high prices of raw materials. Entry to the low-and mid-end markets still requires less capital. The government has built new barriers, publishing new industrial and environment protection standards for manufacturers to follow.

As China’s sports experts estimate, the next wave will happen in the sports entertainment and service sectors. It includes sports marketing, training, venue operation and sports tourism. The growth will be driven by the shift in urban consumption toward leisure and recreation in recent years.

Sportswear market in China

China is like a promised land for sportswear manufacturers, as it provides a perfect mix of several factors:

- 415 million millennials, sports lovers and “sneaker heads”;

- Middle class with growing interest in healthy lifetyle;

- Government support;

- Rapidly growing consumer appetite for sportswear—especially foreign brands.

Nike (耐克), Adidas(阿迪达斯), New Balance(新百伦), Under Armor(安德玛) and other foreign players focus on the Chinese market. The competition in the market is fierce, but everybody get revenue. For instance, Nike recorded growth of about 9.5% in the last quarter. In August 2017, Adidas reported 28% sales growth in China.

Big Chinese sports brands like Anta (安踏), Li Ning(李宁), Xtep(特步), 361Pand Peak(匹克) also improved their positions. As reported by Reuters, 2015 was a good year for Chinese brands, as some of them turned profitable or increased their revenues. For instance, China’s best-known home-grown sports brand Li Ning turned profitable in 2015 after three years of losses with e-commerce revenues increased by 95%.

Li Ning’s biggest rival ANTA Sports announced a 20 percent rise in 2015 net profit due to growth in children’s lines and e-commerce businesses.

Smaller rivals 361°and Xtep showed a 30 percent jump in profits in the same period when Peak Sports rose 22 percent.

The segment one should pay more attention to is China’s athleisure market. It is not slowing down in China due to Chinese consumers’ passion for fitness-inspired fashion. And it’s not only about consumer preferences. Chinese customers are very practical in terms of clothes, as many of them buy sports apparel designed for workouts and wear itat work, casual events or regular basis. As Daxue Consulting previously found out at leisure products can be a way to connect with China’s next generation. This healthy lifestyle trend coincided with the global athleisure fashion trend and rapidly took off among Chinese consumers both females and males, especially the young generation aged between 15 and 35 years old.

Nike and Addidas are chased by Anta and LiNing for the leadership in the Chinese sportswear market. Reproduced by Daxue Consulting with data from Financial Times.

A close look at Sports equipment Manufacturers in China

As China proved itself to be a world factory, there are many local companies working in this industry. Let’s take a closer look at Top-5 China’s sporting goods manufacturers of 2015, according to ASKCI (中国情报网).

- Taishan Sports Industry Group Co.Ltd, (泰山体育业集团有限公司) founded in 1978, it is currently one of the largest comprehensive sports industry groups in the world. It is both an internationally renowned brand and leading brand of China sports industry. Taishan manufactures a wide range of high-tech products involving sports equipment, fitness path, varied artificial turf, sports engineering, carbon fiber bicycles, sports & leisure mats, XPE foaming materials and online scientific fitness.

- Bestway (上海荣威塑胶工业有限公司) Shanghaibasedandfoundedin 1994 ,thecompanyisspecializedonR&Dandmanufacturingofoutdoorleisureproducts. Bestway produces inflatable stand up paddleboards, above ground pools, portable spas, flocked and fabric airbeds, as well as sports and leisure boats. One of the most famous partners of Bestway are Marvel and Disney.

- WeihaiGuangwei (Group) Co., Ltd. (威海光威集团有限任公司) The company is mainly engaged in production of fishing gear products such as fishing rods, fishing reels, baits and dip nets, composite materials such as carbon fiber prepreg and products of composite materials, chemical rubber products such as paint, resin and rubber mats, molds and various die-cast precision processing products. Over the past years, as the most important production base for producing fishing gears in China, Weihai has produced 80% of the fishing products in the country.

Ranked 4th and 5th areDoublefish (广州双鱼体育用品集团有限公司) and DHS-Sports (上海红双喜股份有限公司),which are big manufacturers related to national sports of China–table tennis (ping-pong)and badminton, 三大球(Big three): basketball, soccer, volleyball, and other sports.

How do Chinese consumers of sporting goods look like?

At a first glance, Chinese consumers seem not so sporty, as per-capita consumption of sportswear in China, while growth remains low. Earlier Daxue Consulting conducted a research, which showed that the majority of the people interested in sports are those with higher education, higher income, and higher social position. This consumer group is spending more money on sports. In 2015, the average household income of sports interested people reached 10,699 RMB, which is 35% more than non-sports interested households. 67% of them hold a bachelor degree or above and 28% are management level in their companies.As the standards of living for people get higher, they are willing to spend more on their wellbeing, i.e. invest more in exercising and buy necessary equipment for their training.

Perspective of sporting goods consumers in China

1) Post 80’s

According to Jing Dong Big Data platform, they are the main consumers of sports shoes, sportswear, sporting goods, cycling, fitness training, outdoor equipment, outdoor shoes and fishing supplies and other categories. This 26- 35-year-old population accounted for more than 51% of consumption. For instance, 68.97% of fishing consumers are born in 1980’s.The report predicts that by 2020, the post-80’s and post-90’s groups will account for 30% of China’s urban population and become the important force in sports consumption in the future.

2) 40 years +

Another group of consumers are people at their 40-s. The latest confirmed data (2015) shows that over all the population in China is still young, with a population of about 720 million under 40 years of age – about 10% more than the older population, while the latter is growing in number and in 2020, will exceed the former. This group has a great hidden potential in terms of consumption of sporting goods.

3) Women

In recent years, the female consumer market has been seen as a new driver of growth in the sports market. The Deutsche Bank comprehensive research report shows that yoga pants, quick-drying clothes, and other sportswear are gradually becoming the new favorite for consumers, especially in the female clothing market, with an increased sales volume. Even Chanel(香奈儿), H&M, ZARA(扎拉) and other luxury and fashion brands, have introduced sports products.

According to the data of Jingdong Big Data Platform, the proportion of male sports users is 18.29% higher than that of total male users, and the proportion of female sports users is 30.01% lower than that of female users of the whole station. This shows that in terms of sports consumption, men are still more active than women. However female sports consumer spending potential still has not been released.

Foreign big brands like Nike or Adidas have high expectations for the female sports market. They are trying to occupy it with integrated marketing communications, offline experience and digital platforms. Data show that as of October 14, 2015, Nike female product line revenues reached 5.7 billion US dollars. And Nike’s goal is to achieve annual revenue of 11 billion dollars for the female product line in fiscal year 2020, which will account for one-fifth of the total annual revenue.

4) Kids

With an increasingly urban population, rising disposable income and a growing demand for international cuisines, it is no wonder that China is home to a high number of fast-food brands.

The World Food Program indicated that 23% of boys and 14% of girls in China under 20 are overweight or obese. Inappropriate diet and unhealthy lifestyle will be common for about 28% of seven to 18-year-olds, almost 50 million children classified as obese or overweight by 2030, a new report from Peking University’s School of Public Health said.

These scaring figures can tell us about the opportunity, as parents will support any initiative to make their kids’ life better and healthier. In recent years, the amount of sports clubs for children have significantly increased. Many parents see sport as the best way for their kids to stay away from Coke and Xbox.

5 drivers of China’s sports industry

1. Sports as a lifestyle

Previous research conducted by Daxue Consulting showed an obvious consumer market trend in China of health awareness. Also, the Chinese middle class has been increasingly willing to pay more for higher quality, newness and lifestyle products.

2. Demographics

China had 415 million millennials, born in 80’s and 90’s. This generation is rapidly emerging as the country’s prime consumers and makesup 31% ofChina’stotalpopulation. In the next 10 years, Chinese Millennials’aggregate income is estimated to grow by US$3tn, as average annual incomes increase fromUS$5,900 to US$13,000. They are far more educated and globally aware than their parents, which is causing some significant changes in their product preference. For example, fun is equal to growth for them. 14% of their PCE is spent on personal beauty and getting sporty.

3. Digitalization

According to Techinasia, China has 731 million Internet users and 695 million mobile users (95 percent of total Internet users.Chinese consumers are willing to adopt new technologies, give a try for new wearables, interact with their peers via WeChat or other social networks, watch and stream sports events online,etc. In the near future digital platforms will increase its influence in the industry.

4. Sport as a status

According to Nielsen, sports and running, in particular, has acquired a position of status in China, and middle-class professionals with a level of higher education are more likely to take it up. The survey showed that running still remains the most sought-after sporting activity among Chinese, followed by badminton (China’s national sport) and basketball. This fact gives opportunities for local and foreign brands to get a piece of a pie.

5. Government support

The country is planning to invest heavily in nationwide fitness programs, with the aim improving health for its citizens. By 2020, it is expected there will be enough sports facilities that it would equate to 1.8 square meters per Chinese citizen.

What sports in China attract investors?

According to the General Administration of sports of China,中国体育总局)here are most attractive sports in terms of investment in the last 2 years:

Fitness

Results obtained by Daxue Consulting show that China’s fitness industry is facing a bright future. At present, the output value of China’s fitness and leisure industry is about 150-200 billion dollars, accounting for about 0.15%-0.20% of domestic GDP. According to the annual GDP growth rate at 7%, by 2020, the output value of Chinese fitness and leisure industry will exceed 190 billion RMB. While actually, a 0.7% of GDP is very little, consumer’s demand combined with the Chinese government effort, in 2020, the Chinese fitness market value is suggested to exceed 2000 billion RMB.

E-sports

“Fortune” is confident about China’s obsession about e-sports. Even though e-sports is still seen as a bad habit due to a traditional way of thinking, the audience, prizes, level of competition and amount of players are growing. Huge game developers like Tencent and NetEase, and others like Alibaba Group Holding are fighting for the local market. To benefit from the rise of e-sports others must adapt. Take a look at Wuhu – a city in China, which has targeted e-sports. In May 2017, Wuhu signed a deal with Tencent to build an e-sports university and a stadium for events. Or take Zhongxian in the municipality of Chongqing, it is also building facilities to profit from the e-sports boom.

Soccer

The main argument for the development of this sport in China is country’s leader Xi Jiping, who is a huge soccer fan. In 2015 in the interview to Reuters, Mr. XI shared his dreams about China becoming one of the world top soccer teams. He believed that a set of reforms including changes in youth and social sports would help to make this dream come true. Since then the World has been witnessing the development of soccer in China. Chinese Soccer League(CSL) clubs acquired super stars to play in China. Chinese entrepreneurs invested in European football clubs such as Atletico Madrid and Manchester City. Changes are also happening in the public sport.

As New York Times reported, Mr. Xi’s has further going plans:the number of soccer fields across the country will grow to over 70,000 by the end of 2020, from under 11,000. By then, 50 million Chinese, including 30 million students, will regularly play soccer.7

Basketball

Basketball can be called one of the most popular sports in China. The relationship began in the 1930s, when Chou En Lai, the first prime minister, endorsed the game for its contribution to fitness and promotion of teamwork. As NBA journalist Fran Blinebury points out, basketball survived the Cultural Revolution in China and was not only tolerated but also encouraged during the reign of Chairman Mao Zedong. Now it is literally a part of Chinese culture and you can see basketball courts everywhere. According to Forbes nowadays about 18% of athletically-engaged Chinese people play basketball.

China is the largest international market for NBA. Every year the League organizes NBA Global Games China and even celebrates Chinese Lunar New Year with special uniforms and Superstars greetings during the game days.

NBA celebrates Chinese Lunar New Year

According to the Bloomberg study, NBA is six times more popular in China than the three largest European soccer leagues combined. During the 2017 NBA Finals, more than 190 million Chinese streamed the games on their mobile devices.

NBA stars visit China every year. For instance, as Forbes reports, basketball superstars Stephen Curry (a face Under Armor) and Kyrie Irving, who represents Nike, had a trip to China this July as ambassadors of their brands.

Basketball superstars represent local brands as well.One of the most popular basketball athletes Dwayne Wade signed a contract with Chinese company Li Ning back in 2012. Since then he has a trip to China on his summer schedule to promote his brand Way of Wade. As CBSSports reports2017 NBA champion and Golden State Warriors shooting guard Klay Thompson signed a new 10-year deal worth up to $80 million with Anta.

Running

Running is the most popular sport in China. According to The Guardian from 2011 to 2015, the number of marathon events in China increased from 22 to 134 and the number of contestants increased from 400,000 to 1.5 million people. By 2020 the number of all kinds of marathon events in China to over 800 games, contestants to achieve the secondary goal of 10 million reports National Association of Field Association.Moreover, the marathon is gradually evolving into a lifestyle for the middle class. “2015 China Runners Survey Report” shows that in many runners, college degrees and above accounted for 70%; annual income of 5 to 150,000 groups account for about 50% of the income of more than 150,000 runners accounted for about 20%, Indicating that the characteristics of the high-income groups run by marathon runners.

Others sports

There are other sports with great potential for growth:outdoorsports, extremesports,wintersports (as 2022 Winter Olympic Games in Beijing are coming), cycling, combat sports and square dancing.The last one is a unique feature of Chinese society, and supposedly the easiest way to do sports. In the morning and in the evening you can see millions of people across the country dancing in the same uniform for about an hour in the parks or small squares. For middle-aged and elderly people it is not only a good way to stay in a good shape, but also socialize. In November 2017 China’s National Department of Sports published a report related to square dancing. Government is planning to support this activity and provide better infrastructure, as nowadays there are 80 to 100 million elderly people (almost all women) in the country who enjoy “square dance”. By the 2020 the number of people older than 65 years will reach 167 million.

There are 80-100 million of people who do “square dance” in China

The report shows that there are an estimated 80 to 100 million elderly people (almost all women) in the country who enjoy “square dance”. This form of exercise in common for Chinese elderly, and conceals huge business opportunities.

[ctt template=”2″ link=”8hP5T” via=”yes” ]Running, basketball and badminton are the most popular sports in China[/ctt]Case study

Previously Daxue Consulting provided marketing research servicesfor a fitness club group to support company’s China Market Entry project. Daxue Consulting services included a 360 overview of a market and a guideline for the group’s development plan in China. The research consisted of the following steps.

Step 1.Desk research. The purpose was to get a full understanding of the fitness industry in China by identifying market trends, consumer segments, their behavior, key market players and their strategies.

Step 2. In-depth interviews. It helps to confirm and complete previous desktop research. Daxue’steam conducted in-depth interviews with in the field. Interviews provided Daxue Consulting with some valuable insights. For instance, Clement Mougenot, Head of Research at Daxue Consulting, explains: “Tier-2 cities are more attractive for a basic offer in the fitness industry in China. A major challenge is the cost of real estate in cities like Shanghai or Beijing. Scarcely any fitness clubs are profitable. Their strategies consist of opening many stores to gain market share but disregarding quality aspects or targeting niche markets with high prices”.

Step 3. Store-checks. The purpose of gym-checks was to verify of prior information as well as to investigate different business models and key competitors’ strategies.Through on-site visits, Daxue Consulting could assess various aspects such as the location and equipment, type of customers, services, prices and payment methods.

Step 4.Feasibility Study. On the basis of the achieved results during previous steps Daxue Consulting was able analyze the overall environment of the fitness industry in China. By understanding national and local regulations, strength and weaknesses of competitors, potential opportunities, and risks in the market for the client’s operations, Daxue could finally assess the feasibility of the market entry project, thus announce a so-called Go/No-Go Recommendation.

Resume

In many sports gyms in China, you can see a slogan: “努力工作50年,每天锻炼一个小时,健康生活一辈子”. Basic translation will sound like “Work hard for 50 years, exercise one hour a day and stay healthy for life”. Fitness has already become a major national way of life. A huge generation of millenials with high incomes is willing to spend money on training and sports goods. Elder people also pay much attention to staying fit. China’s sports and sporting goods industry showed a rising trend in the last years and is supposed to continue it with solid government support. This market providesa lot of opportunities both for foreign and local brands. But the biggest challenge is to find your customer and improve your product, as customers pay more attention to unique features and functions.

Daxue Consulting has completed several projects in China’s sports market and sporting goods industry and continuously gathering new data related to this market. If you want to learn more please contact us or subscribe to our newsletter.

Follow us on Twitter to learn more:

How high-end #adventure may become the new face of #Chinese #tourism https://t.co/DHaZ71hKkN @Al_Humphreys @thenorthface pic.twitter.com/G9aLdnVoQB

— Daxue Consulting (@DaxueConsulting) September 26, 2017