China on track to becoming world’s largest amusement park industry by 2020 | Daxue Consulting

Exceeding 40 billion RMB in domestic market size in 2016, China’s amusement park industry is a booming sector of the Chinese economy. With rapid projected growth in the next 5 years, the amusement park industry has been in the midst of a robust age of development, with both domestic and foreign companies participating in an effort to mature this entertainment sector in high demand from Chinese consumers. In 2015, 21 theme parks opened across China, and 20 more are in the process of construction. In 2016, 65 more were undergoing planning. Since then, major Amusement parks such as Disneyland, Universal Studios, Fantawild Parks, and Wanda Parks have opened its doors, and many more are on track to open within the next 5 years. Yet the hyper-growth of Chinese Amusement Parks has caught the attention of the Chinese government, issuing new regulations surrounding the development of parks in an attempt to stifle the negative effects of a theme park boom. Nonetheless, the competition for China’s Amusement Park industry continues to be fierce, fueled by a booming middle-class population in demand of high-quality entertainment.

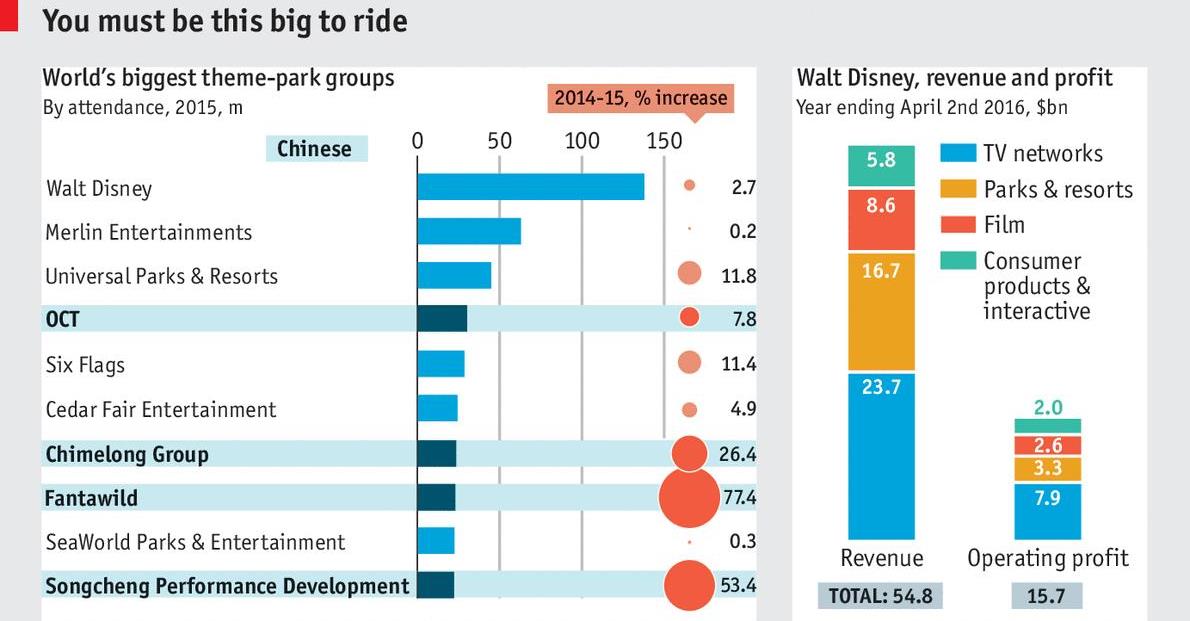

World’s biggest theme-park groups

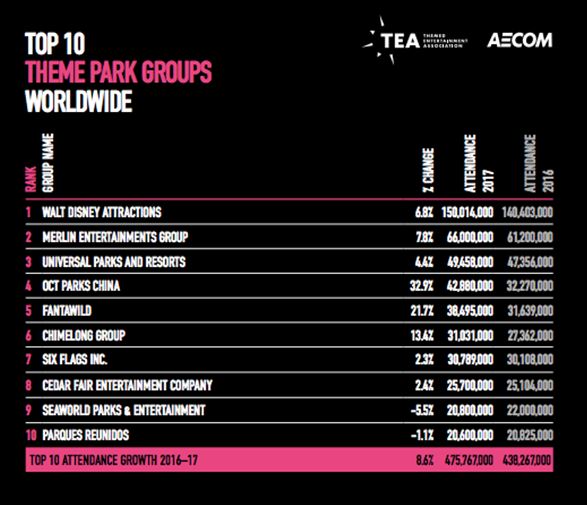

China’s Amusement Parks among the most attended in the world

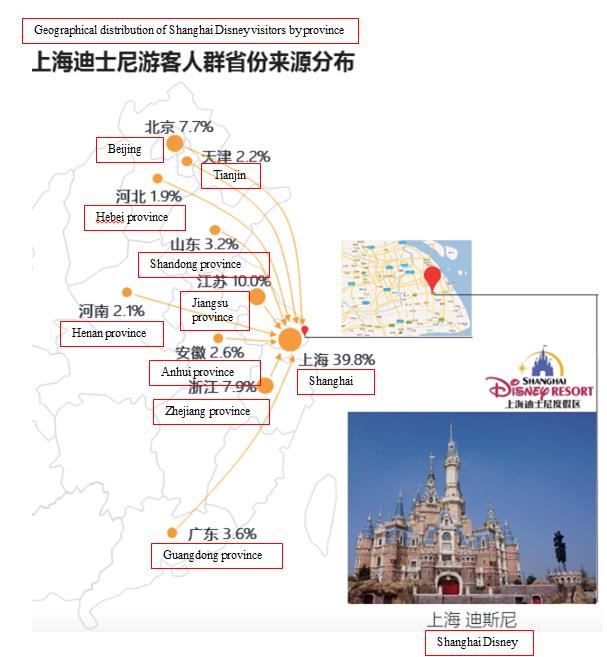

In 2017, over half a billion Chinese people visited an amusement park site. China’s Amusement park spending is marked to pass $6 billion by 2019, making it the fastest growing market in the area. Disneyland Shanghai saw over 11 million visitors in its first year of opening, exceeding its expectations. Since Disneyland’s coming to Shanghai in 2016, a number of other major Western projects are planned for development, including a Universal Studios, Six Flags, and Legoland in Beijing, Tianjin, and Shanghai respectively. Four of the leading Chinese theme park operators – Overseas Chinese Town, Chimelong, Fantawild, and Songcheng – have all topped the list for most visited parks.

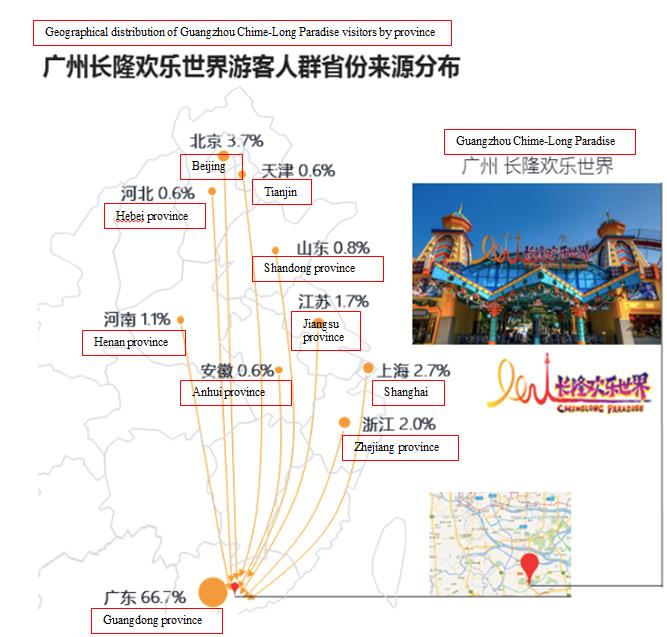

The categories of amusement parks can be roughly classified into the following: Comprehensive Parks, Adventure Parks, Culture Parks, Cartoon Icon Parks, Film Parks, and Water/Ocean parks. Many parks are not exclusive to just one category, but the Chinese have brought more specific themes to parks. Simulating a Song Dynasty setting, Songcheng in Hangzhou is the most popular cultural park opened, and have continuously topped the records of highest attendance since its opening in 2014. China has opened unique film parks, such as Changchun Film Group Corporation’s Changying Century City, and “mainland box office king” Feng Xiao Gang’s Film Town. With new water/ocean parks opening monthly, China is also developing a lucrative marine park industry. Chimelong Water Park in Guangzhou currently stands as the most visited water park in the world. Haichang Ocean Park Holdings China’s largest marine park operator is planning to open multiple new destinations along the silk route.

Feng Xiao Gang’s Film Town

Three Six Flags parks in Nanjing among many more to open soon

China expects a large number of major amusement parks to open around the next 5 years. Projects will take place in Tianjin (2018), Zhejiang (2019), Bishan (2019), and three parks in Nanjing (2021). A Universal Studios also expects to open in 2019, with double the budget as previous projects. Legoland Shanghai is also planned for 2022, building off of the 2019 Lego Land Discovery Center. Despite these foreign entrants, the theme park landscape in China is still dominated by Chinese companies. The future plans of these Chinese theme park operators are even more ambitious. Haichang Ocean Park expects 4 more parks by 2020. Wanda expressed a desire to open 15 more amusement parks and entertainment complexes by the same year. Overseas Chinese Town (OCT) currently has 3 parks under construction in Guangdong, Jiangsu, and Hunan, all are expected to open by 2019.

Chinese are spending more on the leisure industry than ever before

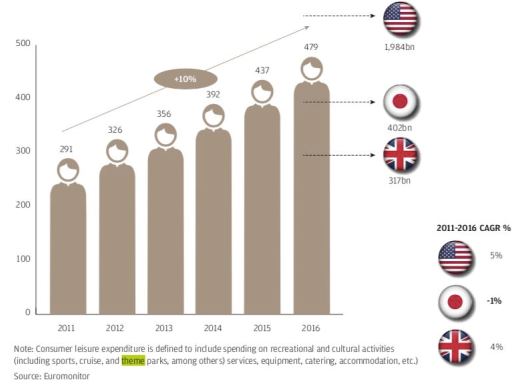

Behind the boom of China’s Amusement Park industry are Chinese consumers demanding quality and unique options from the entertainment industry. The Chinese are spending more money on the leisure industry than they have ever spent before, surpassing Japan to becoming the second leisure market in the world. Amongst the highest perceived activities are theme parks, as there is a pivot towards newer activities such as cruises and theme parks, which the Chinese perceive to be of higher value for its cost. As the consumption shifts from more traditional forms of entertainment such as Karaoke(KTV), the planned growth in the various types of theme parks in China is not only grown tremendously but only expected to grow even more.

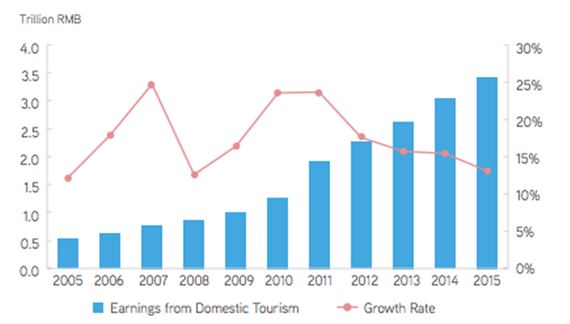

Earnings from domestic tourism from 2005 to 2015

Consumer leisure expenditure in China

Spending on theme park facilities remains high amongst Chinese Consumers

While the Chinese are now more selective about their spending, amusement parks are places where consumers are willing to spend more money. In terms of in-park spending, a consumer report by Mintel showed that around 81% of consumers of urban Chinese consumers aged 20 – 49 have made food and drink purchases at theme parks, 76% made ticket purchases, and 59% bought souvenirs or themed merchandise. To increase profits, theme parks often develop and/or operate facilities for food/dining, hotels, retails, and other recreational opportunities. Such comprehensive facilities generate higher consumption as it extends the total tourists’ stay-time and creates loyalty for customers for the park and its brand. Most successful theme parks across China provide hotels within their parks or hotels of their branded hotels surrounding the park area. As Chinese consumers are now looking for new, quality, holistic leisurely experiences, the development of amusement park facilities such as quality dining opportunities and living accommodations greatly suits this demand and actively increases; since such offerings would create a comprehensive experience that is very different from their everyday lives.

The theme park boom attracts Chinese government attention

The explosive growth of the amusement park industry over the past few years have ignited government concern over many areas surrounding its development. In April of 2018, the National Development and Reform Commission (NDRC) stated: “In the development of theme parks we’ve seen unclear concepts, blind construction, imitations and plagiarism, low-standard duplication and other issues.” The NDRC seems to have two primary areas of concern: housing and office projects disguised as theme parks, and the debt incurred by such projects on municipal and provincial governments that are often co-sponsors of these projects. Thus, the commission has ordered parks costing more than $235 million would be subject to “special scrutiny,” and mega-parks costing more than $790 million or occupying 330 acres must seek central and regional government approval. These regulations are more targeted towards large-scale projects, thus big international operators such as Disney and Universal are unlikely to be affected. However, low-tier cities that are already highly indebted will likely face more scrutiny even smaller scale construction.

A wealth of opportunities for foreign and domestic amusement park markets

In spite of new government directives, domestic tourism continues to become more popular in China, as domestic tourism has become a symbol of national urban development for many Chinese cities. In recent years, amusement parks in China have lessened tourist traffic in popular surrounding countries such as Japan and Korea. However according to the Theme Entertainment Association, the number of world-class theme parks per 100 million people in China is only 0.2, compared to 2.5 and 3.1 in the US and Japan respectively, thus demonstrating the substantial room for growth for foreign and domestic markets alike.

Disneyland Shanghai

The entry of international companies and increased investments made by both international and local players have accelerated overall leisure industry growth in the recent years of China’s booming theme park age. As the tremendous potential of the Chinese amusement park industry continues to be captured by big foreign players, growing domestic companies are also fueling the intense competition in the Chinese theme park market. Fantawild operates over 20 parks in China and is the second largest domestic theme park group and the fifth largest internationally. It plans to build another 20 parks both in China and abroad in the next 5 years. With many Chinese operators acting upon aggressive plans for expanding its theme park businesses, China is set to transform into a land of quality amusement parks and a hot spot for leisure tourism.

Western Markets: East-West IP Alliances show promising opportunities

Demonstrated by the recent IP infringement of Disney “Stormtroopers” in one of Dalian Wanda’s theme parks, it is evident that the booming amusement park age has also ushered in an age of IP battles. Chinese companies must compete against foreign companies with the highest IP, such as Walt Disney characters. Many companies have entered in IP Alliances, allowing collaboration between parks and its operators, enhancing the brand for both parties. There are three ways to access global IP access: acquiring the company of IP ownership, a joint venture, or signing an exclusive licensing deal. For instance, Disney has a joint venture with the Shanghai government, with licensing deal signed for use of Disney names, Characters, stories, etc. While IP alliances are a complicated process, as more foreign amusement park players looking to enter the China, more alliances are expected to be made, bridging the east-west leisure industry market through collaboration on amusement park expansion.

Stormtroopers at Wanda Movie Park

In addition, China is in the process of accumulating its own IP creations. Fantawild has created a series of cartoon characters of “Boonie Bears.” China Animation has invested a lot of money into its new character “Violet,” which has already added in the Shanghai Joypolis attractions. Changzhou Dinosaur Park has created a cartoon star “Baby Dinosaur.”

Boonie Bears Fantawild

Safety and customer experience should be top priorities when entering the Chinese Market

The desire for quality, new experiences from a wealthier generation of Chinese consumers is the main consumer drive for the booming theme park industry. This population is looking to expand their options for the leisure market, beyond traditional activities such as shopping and karaoke. The successful player should consider safety concerns as well, due to the issues with safety mechanisms in previous smaller local Chinese theme parks. Safety also plays heavily into the perception of a better customer experience a whole, along with an array of options for quality dining and concessions, hotels, and themed merchandise. Consumers are looking to experience the whole package at theme parks, from comprehensive facilities to innovative rides, to enticing theme park characters.

Author: Julia Qi

Daxue Consulting can help with the analysis of any market in China, including the amusement park industry

Daxue Consulting, as a market research company, provides the adapted data in one of the most challenging markets in the world, China. We have a wide range of services to deliver a competitive market research. To know more about the amusement park market in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.