The dating industry in China: Meet the APPs bringing China’s singles together

With a high pace of modern life, Chinese people are finding it more and more difficult to balance work and personal life. This leaves a lot of singles without life partners, especially in big cities. With the high levels of stress from work, they have no time to cultivate relationships with friends nearby but only keep themselves immersed in work everyday. This gives a lot of new opportunities in the dating industry in China. According to statistics, in 2019 the amount of singles reached over 15% in China. Among them, 48.5% thought it was due to having narrow social circles, while 42.7% attributed it to a lack of time and high pressure. The pursuit of efficiency and quickness in Chinese society today makes dating seem almost like a trip to the supermarket.

Specifics of dating in China

Because of China’s rigorous college entrance examination, dating is not common among high school students. They simply have too much work to do, in addition to dating being looked down upon by family members. In general, Chinese students leave high school with a lot less romantic experience than their Western counterparts. For a lot of Chinese people, serious dating starts after they’ve finished school.

More so than Westerners, many Chinese view dating as a pragmatic affair. It’s not always about finding love so much as it is about finding a potential marriage partner. In general, Chinese parents expect to be more involved in their children’s relationships.

The goal of most relationships in China is marriage. Young Chinese adults are often under pressure to find a good husband or wife and get married relatively early. This pressure is particularly acute for women, if they pass the age of 26-27 without finding a husband. Men can find themselves similarly ‘left-over’ if they wait too long to get married.

Gender imbalance in Chinese dating

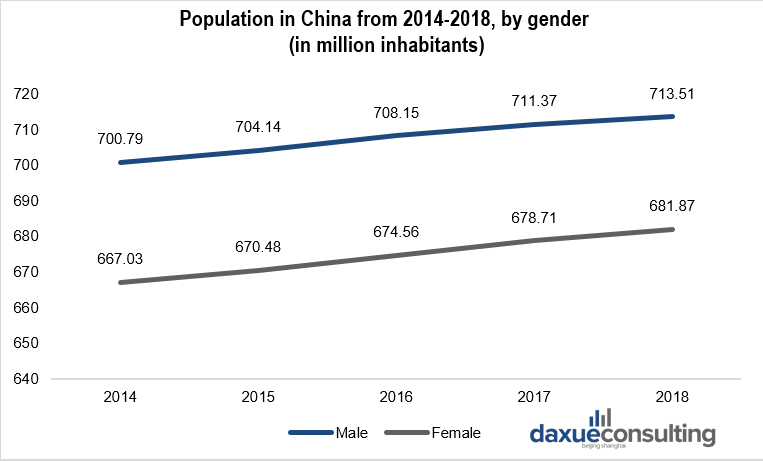

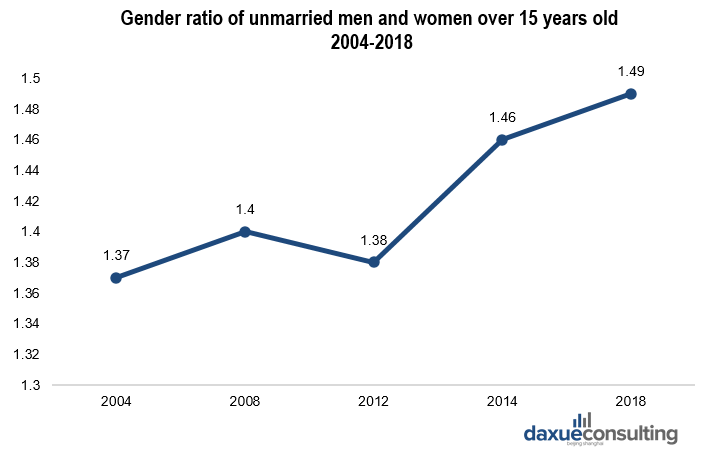

Demography is a major source of worry for China’s policymakers: the country’s population is ageing and has more men than women. China has many millions more men than women, a hangover of the country’s one-child policy.

[Data Source: Statista, ‘Population in China from 2014-2018, by gender’]

The gender imbalance is making it hard for many men to find a partner – and the gap will widen. The race to find a suitable partner has led men to go to great lengths to find a wife. Longstanding tradition of meeting a potential partner has given way to modernity. Online dating is growing fast, giving impetus to the development of the dating industry in China.

Late marriages are getting more common

The statistics of Chinese local civil affairs departments show a rise in the age of marriage among Chinese urbanites. For example, in 2018, the number of newly registered marriages in Hangzhou reached over 65,000. The average age of men and women at first marriage was around 29 and 27 respectively. The trend is same in other developed coastal cities. In east China’s Jiangsu Province, the average age of residents at first marriage was around 26 in 2017, an increase for the third consecutive year. Chinese people now date longer before marriage, and dating industry in China makes the use of this fact. Additionally, China’s divorce rate is also on the rise, opening a new market for dating.

Dating websites

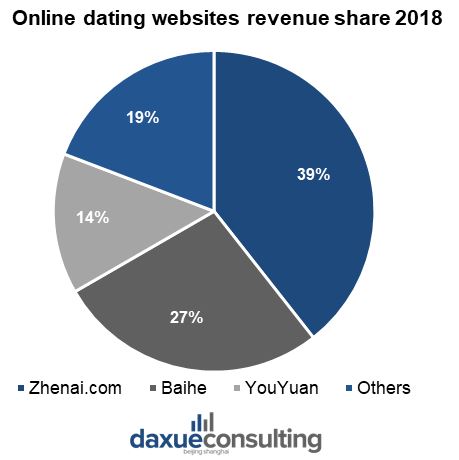

Dating websites quickly saw this market opportunity and have already acquired a large customer base. At present, Zhenai.com and Baihe jointly occupy nearly 70% of the market. Zhenai.com revenue share in the first quarter of 2018 reached 39%, ranking first in the dating market in China. Baihe continued to pose competitive pressure on Zhenai.com with 27% of revenue share. Zhenai.com occupies the first place among dating websites ranking with more than 30% of the user’s time.

[Data Source: Analysis, ‘Online dating websites revenue share 2018’]

Chinese Dating TV shows

Besides dating websites, dating TV shows are becoming more and more popular in mainland China. The most successful of these shows is Fei Cheng Wu Rao (非诚勿扰), a dating show broadcasted on Jiangsu TV. Its audience rate always ranks first among all entertainment shows with a viewing audience of up to 50 million per episode.

The program takes advantage of its stage effects and high profiles of both male and female guests and successfully attracts a large audience. A lot of the show’s viewers even become fans of the dating guests. This interesting phenomenon suggests that more and more people regard dating as a kind of entertainment as someone might find their true love on the stage under the focus of millions of viewers. It also suggests that more and more Chinese consumers are looking to get involved in dating, but cannot do so because of time restrictions. They are looking to entertainment to experience something that they themselves cannot experience.

Finding love in the age of technology

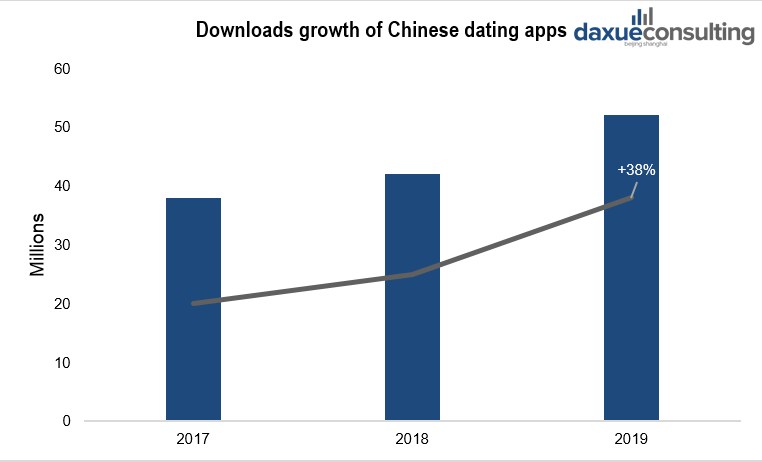

Download volume of dating apps in China has been increasing year by year

As dating apps have become more effective around the world, online dating has gradually evolved into a global phenomenon. Deeper understanding of users and enhancing of user interaction will help apps to achieve a huge success in the dating industry in China.

From 2017 to 2019, the download volume of dating apps in China has an increase of nearly 40%. This means that more and more people are trying to use the apps to find true love.

[Data Source: App Annie, ‘Growth of downloads of Chinese dating apps’]

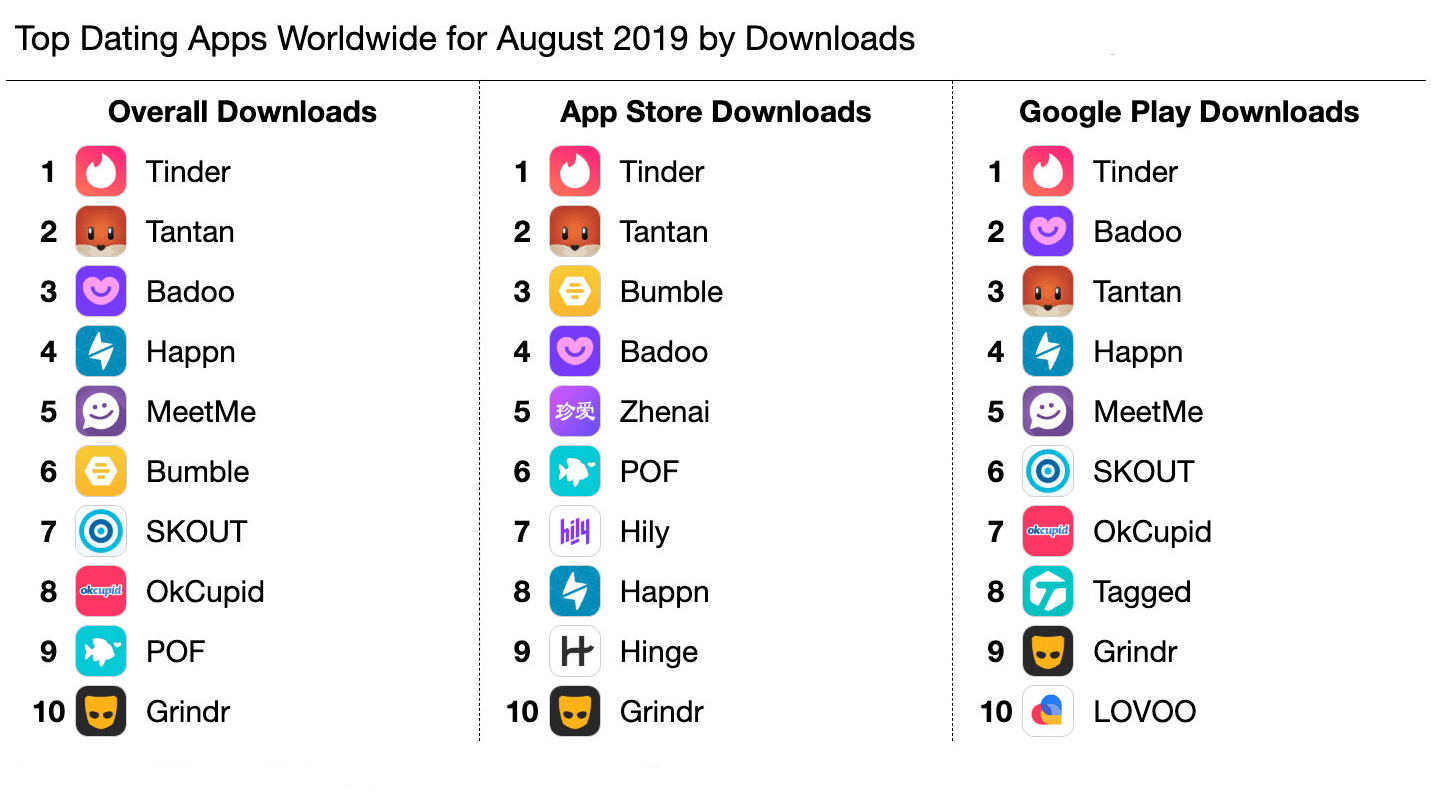

Tantan which ranks sixth among all social apps in China, and has about 70% increase from 2017 to 2019. Dating apps in China focus on creating experiences adapted to the emotional needs and cultural characteristics of Asian users. In 2019 Tantan was the second most installed dating app worldwide with more than 4.2 million installs. It represented a 34 percent increase from August 2018.

[Source: Sensortower, ‘Top dating apps worldwide for August 2019 by downloads’]

Focusing on the dating industry in China, Tantan and Momo are firmly on the top of the dating app downloads and income rankings.

[Source: Sensortower, ‘Top of the dating app downloads in China’]

Different dating apps in China for different generations

Zhenai app covers a wide range of users, mainly adopting the traditional offline blind date model. The target audience is middle-aged and high-income white-collar workers in China. Zhenai app has relatively early development time and strong penetration in the dating market in China.

Such dating apps as Momo and Tantan targeting users of Generation Z in the dating industry in China. They focus on innovative features such as trend tags and cultural communities. Cloud dating platforms adopt the online live blind date method, adding matchmaker elements. Their user group is mainly young people.

Dating apps are getting bigger in China

Rivalry between Baihe and Tantan

Baihe

Baihe is the service, founded in 2005, claims to have over 100 million users. It also operates as an online-to-offline (O2O) service where users make use of its physical stores for matchmaking purposes. Baihe-owned Jiayuan app (世纪佳缘) also focuses on marriage-related services. It claims to have over 170 million users and operates offline stores in 71 cities. A primary part of Baihe’s business is covering the process from matching to marriage. In the future, Baihe also plans to extend to consulting, consumer services, financial services, and media offerings in the dating industry in China.

While other online services take a more “casual “approach, Baihe website provides a platform for finding a potential spouse. Baihe collects user data that panders to the more traditional aspects of courtship in China. Users should supply their real names, information relating to property and car ownership, educational qualifications, employment details, household registration (户口 hùkǒu) information and credit scores (芝麻信用 zhīmaxìnyòng).

[Source: technode, ‘The types of information Baihe verifies includes education level, assets, Sesame Credit scores, and real names’]

Tantan

The biggest difference between Tantan and Baihe is the goal. People who use Tantan only want to have a boyfriend or girlfriend, but people who use Baihe want to get married. Chinese dating app Tantan is almost a replica of its American counterpart, Tinder. Like Tinder, Tantan is a location-based dating app, alerting users about possible matches nearby. It also features Tinder’s signature “swipe right” and “swipe left” gestures to indicate interest or the lack of it. In 2019, Tantan had more than 100 million registered users with 6 million using it daily.

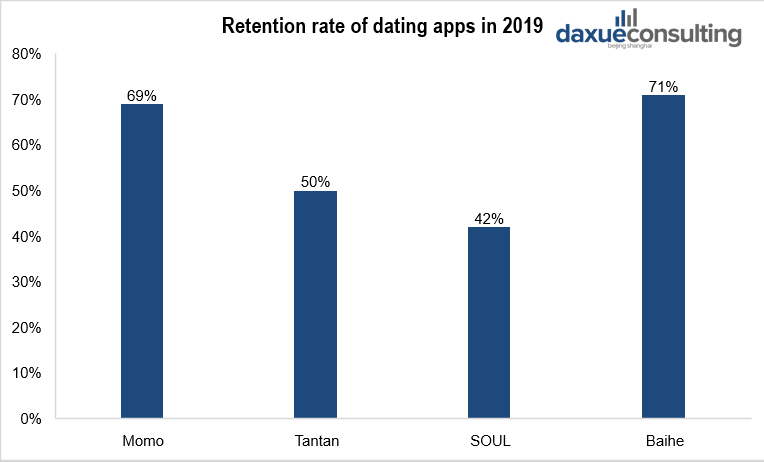

[Chyxx.com, ‘Daily retention rate of dating apps in China in 2019’]

It doesn’t have special features like Baihe, which encourages users to list their assets. That’s why Tantan is so popular in China – almost anyone can use it without restrictions. It’s a platform for arranging casual dates, not necessarily for meeting your future spouse.

Dating app Momo plans to become “Tinder of China”

Tencent rules China’s mobile messaging market with WeChat, which serves 1.15 billion monthly active users. Its ecosystem of “mini programs” enables users to shop, order food, play games, hail rides and make payments. Tencent recently launched three functions at Momo: an anonymous video dating app called Maohu (“Catcall”), a Tinder-like app called Qingliao (“Light Chat”), and a reboot of its Pengyou (“Friends”) app.

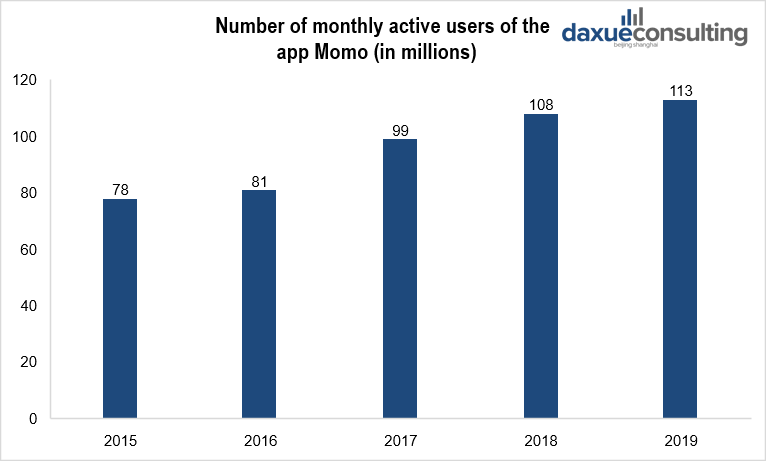

Simply put, Tencent needs new ways to reach younger users. Momo’s streak of double-digit revenue growth suggests that online dating industry in China is still a fertile market.

[Data Source: Statista, ‘Number of monthly active users of Chinese dating app Momo’]

Maohu, Qingliao and Pengyou

Maohu lets users chat anonymously with strangers while donning digital masks. Male users wear the mask for a maximum of five minutes, while female users wear a mask indefinitely. Once a user removes his or her mask, beauty filters apply automatically to the live video.

Qingliao resembles Momo’s Tantan and Match’s Tinder, but doesn’t adopt the swiping mechanic of those two apps. It simply offers two choices – one to “like” it, and another to dismiss it. Users can scroll down to view additional information like a user’s occupation, education, hobbies, location, and social media postings.

Pengyou is an updated version of an older social networking app. The new app resembles Instagram. It splits its feed into three categories – friends, colleagues, and people who live in the same city. Users need to verify their identities with personal credentials, and they can opt-in for dating matches. This subtle approach is similar to Facebook’s opt-in strategy with Facebook Dating.

Increased popularity of Tantan and Zhenai during COVID-19 outbreak

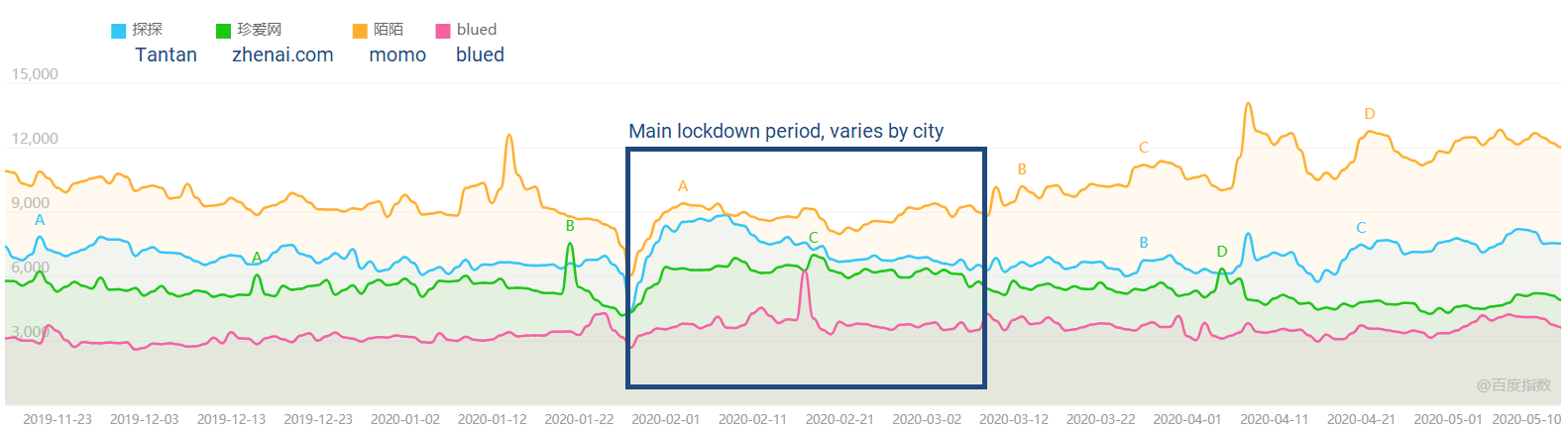

The below image from Baidu index shows how Chinese interests faired during the COVID-19 outbreak. While there were more searches for Momo before and after the outbreak, both Tantan and Zhenai experienced a small uprise in searches.

[Source: Baidu Index, searches for Chinese dating apps and websites during the COVID-19 outbreak]

Online dating apps have seen a significant increase in usage due to the COVID-19 outbreak in China. A report released by mobile dating app Tantan said the average time people spent on the app in early and mid-February increased over 30 percent compared with the usage during normal times.

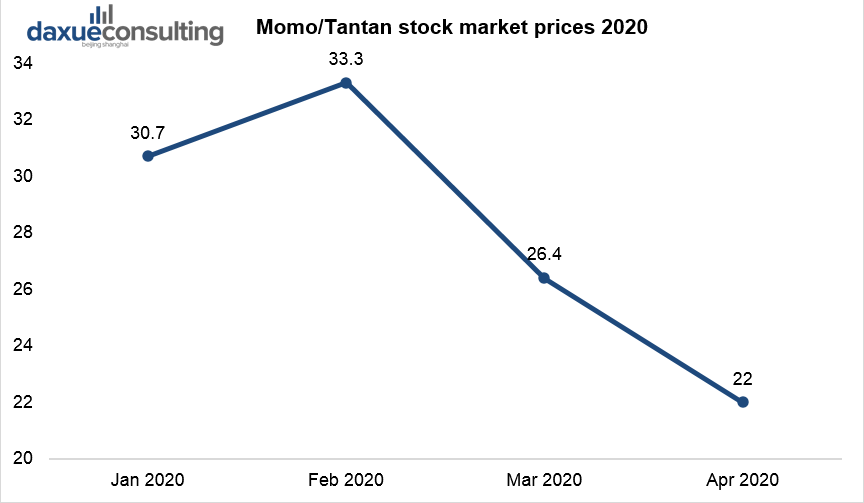

Stock prices of dating APPs rose during the peak of COVID-19 and fell afterward

[Data source: Yahoo finance, stock prices of Momo and Tantan during COVID-19]

During the Spring Festival this year, the number of active users of Zhenai APP reached 10 million, a year-on-year increase of 39.3%.

In February, the per capita usage time of Tantan App has increased by more than 30%, and the number of users during peak hours (12 am-1pm) has increased by 60%.

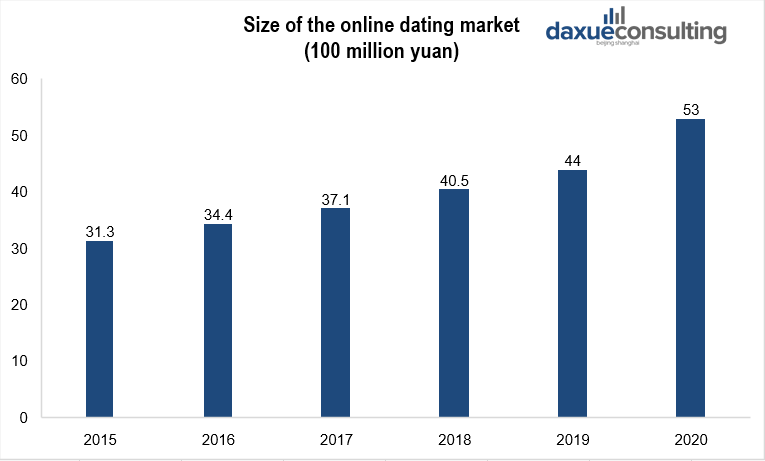

During the outbreak, those born around 1995 and after 2000 have become the top users of Tantan. They recorded a more than 20 percent increase in messages sent and daily matches. Another notable fact is that the number of older users who came back rose by 25.9 percent. The market size of online dating industry in China will increase from 4 billion yuan ($567 million) in 2018 to 5.3 billion yuan in 2020.

[Data Source: iResearch, ‘Online dating industry in China market size’]

Zhenai.com said its active users reached 10 million during the Lunar New Year holiday, an increase of 39.3 percent. 50 percent of single men and 33 percent of single women were lonely as they could not go out during the outbreak. Surfing the internet has become a major way to help ease their anxiety. About 30 percent of men and 41 percent of women have switched from attending offline activities to online dating.

Huge potential of dating industry in China: large population with demand for dating and marriage

Just under half of China’s 1.4 billion people fall between the ages of 25 and 54 years old and ost are men. Within this total, 200 million are unmarried, according to government records. 54 million people made use of online dating services in 2016. This number will increase by 24 million, or 45%, by 2022. Online dating companies have even more optimistic statistics, with each firm asserting they have 100 million users. The generation born between 1982 and 1997 is driving this growth. Making up 20% of China’s population, this group is just reaching the legal marriage age—22 years old for men and 20 years old for women.

[Data Source: chyxx.com, ‘Proportion of unmarried men and women over 15 years old, 2004-2018’. In 2018, for every 100 unmarried women over 15, there are 149 men]

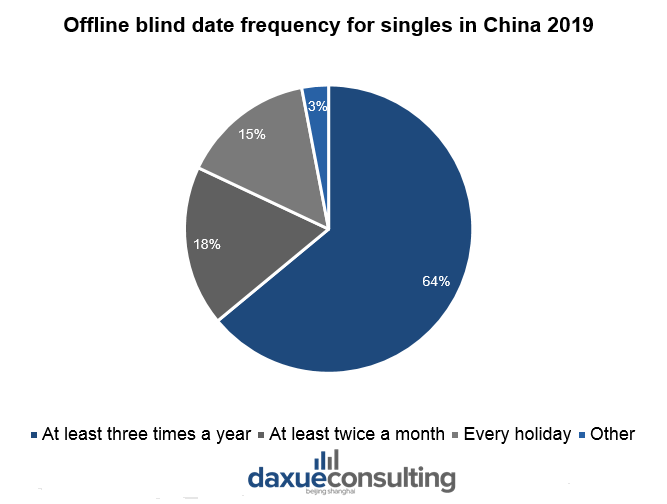

With the development of dating apps in China, more and more people are having blind dates. Statistics show that the percentage of people with blind dates has exceeded 60%. 62% of them said that the number of blind dates was not less than three times in a year. This fact gives dating industry in China a huge opportunity to flourish.

[Data Source: chyxx.com, ‘Offline blind date frequency for singles in China 2019’]

Another factor contributing to the frequency of blind dates is that it is custom to introduce single friends and family to potential partners.

What direction is Chinese dating culture shifting?

In traditional Chinese culture, marriages were often arranged and made for familial partnerships. While a part of this culture still exists through parents introducing single children to single’s that they approve of, or through phenomena like Shanghai’s dating market, where grandparents and parents gather to show off the impressive dating resumes of their children, the dating culture is going digital, and marriage is happening later and later.

Author: Valeriia Mikhailova

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast