The new approach of Chinese investors in Africa

Since the development of the commercial and diplomatic relation between China and African countries, many Chinese companies are willing to extend their business to this continent. While the first Chinese aim in Africa was to harvest natural resources such as mining, there are more and more companies looking at these countries as a prospecting market for finished goods sales or finance investments.

Chinese investments in Africa are criticised

Indeed, since the beginning of the 21th century, trades between China and Africa have increased by a factor of ten. There are now more than two hundred Chinese companies investing in about 50 different countries in Africa. Their total turnover is nearly $35 billion. Driven by the needs of Africa for economic support and infrastructure development, this commercial relationship is expecting to keep rising in the nearly future. But this growing presence of China is perceived negatively by European countries and many African experts who claim that China is taking advantage of African resources and exploiting labor.

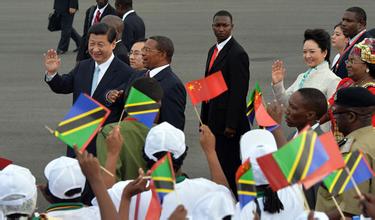

Chinese president Xi Jinping recently visited few African countries to support Chinese companies with the local governments. He especially mentioned that Chinese investments in Africa support the growth of local economies, create jobs and enable local people to access new technology and, generally speaking, new standard of living. As an answer to those who think this massive investment of China in Africa is a new form of colonization, it has been announced that 85 per cent of the jobs are allocated to Africans, even some of the top jobs. Indeed, recent surveys show that Chinese private companies made significant efforts in Africa and are now offering better working condition than European companies.

A good example of the new long-term vision of investors : MySimax

JX Paulin is one of these investors willing to extend his business into Africa, not to take advantage of the natural resources or the cheap labor but mainly to contribute to the development of emerging market economies. After studying in Harvard and having met the success in China for more than 20 years with a Shanghai based Architecture Company, he launched multitude of prosperous start-ups targeting emerging markets. He is now looking to develop a tablet specifically designed for education which will be launch on some African countries, called My Simax. His aim is to equip schools with high-quality tablet, specifically designed to bring educational benefits, at a reasonable price. The distribution of the tablets will be combined with the launch of a multitude of apps of interest for several sectors, such as medicine or army for instance.

He hopes in this way to contribute to the development of education in these countries, which will lead to the growth of a great potential market where he will be leading the way. For this reasons, My Simax is a good example of the new way Chinese investors are working in China.

Thus, after years of exploitation and accumulation of wealth, it seems that Chinese companies tend to focus on long term investment, by helping the economic development of these countries which will become markets with huge potential.

![[Podcast] China paradigm #2: How to reach 6 million USD sales without initial investment in the real estate industry in China](../wp-content/uploads/2018/05/501527244041_.pic_hd-150x150.png)