Strategies of China online group buying websites

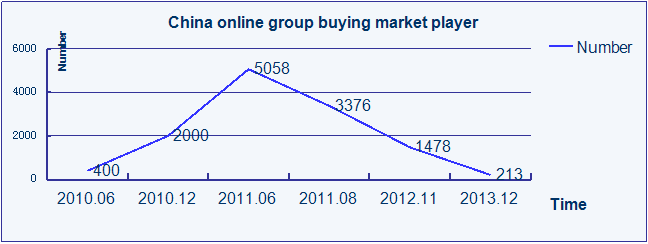

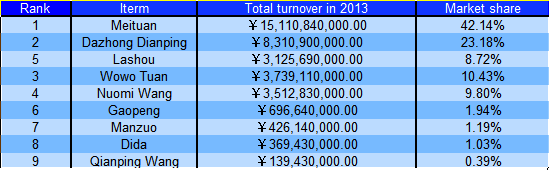

Past four years from 2010 to 2013 have witnessed tremendous changes happening in China online group buying industry. Market player number shrinks from above 5000 to 213 from 2011 to 2013. Previous market leader Lashou significantly lost its competitive edge within one year. Contrarily, Meituan stood out in the race, with 42.6% market share ranked No.1 in 2013. By far, the market is forecast to reach a relative mature status. However, the fierce movements within the industry still concern the market players.

China online group buying industry development

According to the industry life cycle model, China online group buying industry used 5 years to finish the discovery phase, innovation phase, cost or shakeout stage, and now finally comes to the relative mature phase.

Considering the above evolving process, the rapidness is stunning. However, to understand the market better, let’s move on to the market analysis.

Market definition

The online group buying refers to a group of people who want to buy the same products or service gather together via using group buying websites to achieve certain discounts in goods or service.

Independent third party group buying websites are a major market player in this business scope.They act as the middle men between companies and customers. However, traditional B2C platforms such as Taobao.com also seize the opportunity, they promote their tailor made group buying subsites to compete with the independent group buying websites.

The major subject of this case article is the third party group buying websites in China, such as Meituan, Lashou etc.

Market size

The third party independent group buying industry(which excludes Juhuasuan,58.com etc) grew 67.8% to reach 35,858,000,000 RMB in 2013.

The compound annual growth rate of the market in the period 2011-2013 was 79.89% (Source: Tuan 800.com).

|

China online group buying market size |

||

|

Year |

Total turnover |

% Growth |

|

2011 |

¥11,080,000,000.00 |

– |

|

2012 |

¥21,368,000,000.00 |

48.14% |

|

2013 |

¥35,858,000,000.00 |

67.81% |

Market product segmentation

Food and beverage is the largest segmentation of the online group buying industry in China, accounting for 52.4% of the total market turnover.

Leisure and entertainment segment account for a further 24.1%, which includes film tickets and KTV.

|

2013 China online group buying product portfolio |

||

| Segment | Total turnover | % |

| Food and beverage | ¥18,680,000,000.00 |

52.4% |

|

Leisure and entertainment |

¥8,640,000,000.00 |

24.1% |

| Hotel and Tourism | ¥3,590,000,000.00 |

10% |

| Life service | ¥3,210,000,000.00 |

8.9% |

| Goods | ¥1,660,000,000.00 |

4.6% |

| Total | ¥35,858,000,000.00 |

100% |

Geographic segmentation

Tier 3 and 4 cities accounts for 53.5% of total market share.

Tier 2 accounts for a further 22.67% of the national total market.

|

2013 China online group buying geography segmentation |

||

| Geography | Total turnover | % |

| Tier 3 and 4 cities | ¥19,160,000,000.00 |

53.5% |

| Tier 2 cities | ¥8,130,000,000.00 |

22.67% |

| Tier 1 cities | ¥7,250,000,000.00 |

20.2% |

| National (products like goods) | ¥1,340,000,000.00 |

3.7% |

| Total | ¥35,858,000,000.00 |

100% |

Source: Tuan 800.com

Market player

In December, 2013, there are 213 group buying websites in total.

Meituan is the top 1 market player with 42.14% market share. The market is well centralized, with top 9 companies accounting for above 98% of the total market share.

Market trend

The group buying industry is expecting to develop in below fields:

1. Tier 3 and 4 cities will still be the hot spot for all group buying websites.

2. More Merger and acquisition will happen in this industry.

3. Mobility end user business market share will increase

4. Face the competition from other integrated sites in niche markets, such as film tickets markets.

5. More group buying websites will be involved in offline business.

http://blog.sina.com.cn/u/2885774287

http://www.tuan800.com/homepage