Sony in China

Sony in China

Sony, the multinational conglomerate corporation has a huge commercial presence in electronics, game, and entertainment industries in China for the past thirty years. However, compared with its greatly strong market position ten years ago, Sony’s market share of PC, mobile phones, and televisions all shrunk to different extend due to its slow transformation process. Here is our analysis of Sony in China.

Sony’s television business in China

The CRT (cathode ray tube) technology made Sony once the most popular television brand global wide. Its stagnancy in adapting the new trend makes Sony rather slow in realizing what is going on around it. After the introduction of LCD (Liquid-crystal display) TV, Samsung, LG and Sharp quickly developed at a faster pace than Sony. Since 2010, the Chinese government launched a program called “electrical appliances go into the countryside” (家电下乡计划) where television manufacturers and distributors who participated in this program got huge subsidies. Unfortunately, Sony was absent. According to Daxue Consulting, China is the largest market for television industry; but as the demand is already full in urban areas the biggest potential remains in the countryside. Sony’s absence of getting into China’s vast countryside market would definitely affect its sales in China. As a consequence, Sony is forced to cooperate with Samsung, who became the world’s largest TV supplier in 2005. As for the cooperation, Sony played a role more like a distributor and a financial investor while the key technological patent remains in Samsung. Sony also launched 3D TV with lower price of 2999 RMB ($480) into the Chinese market in 2011, making its market share in China slightly rise from 3,42% to 4,6%. However, senior consultant at EZCapital, Luo Qingqi, said that the low price strategy won’t last long since it’s not as low as domestic brands and will compete with Samsung, LG in high-end market.

Sony’s smartphone business in China

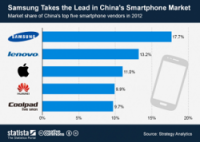

While its global market share are about 3,8%, Sony’s market share in China last year was not above 0,5%. Facing strong opponents such as Samsung (17,7%), Lenovo (13,2%) and Apple (11.0%), Sony recently launched its new model Sony Xperia T3. With many record-breaking technologies, the has a 720p HD display, depth of 7mm, 1.4 GHz quad-core processor; Sony are expecting than its Sony Xperia T3 will make a hit in the Chinese market.

While its global market share are about 3,8%, Sony’s market share in China last year was not above 0,5%. Facing strong opponents such as Samsung (17,7%), Lenovo (13,2%) and Apple (11.0%), Sony recently launched its new model Sony Xperia T3. With many record-breaking technologies, the has a 720p HD display, depth of 7mm, 1.4 GHz quad-core processor; Sony are expecting than its Sony Xperia T3 will make a hit in the Chinese market.

Sony’s playstation business in China

China recently ended its ban on foreign videogame consoles. Indeed, the international brand as Sony are allowed to develop their sales of consoles into the China domestic market because the government needs more foreign direct investment to keep the economy growing. Sony reacted quickly to this policy by setting up two joint ventures to produce and distribute its PlayStation in China. However, the task is not easy. As Chinese consumers are more likely to play games on PC and mobile phones than Japanese and European consumers, and the privacy and smuggling of PlayStation consoles is commonly seen. Unless the market in China is well regulated, the same business model will not be copied easily in China. Sony’s Chinese partner, the Shanghai Oriental Pearl Group emphasized their future strategy, that by adopting a “free to play” model, their main resources of getting the profit will be by selling extra lives and extra money in the games.

Sony in China

References : http://www.nytimes.com/2014/05/27/business/international/sony-forms-joint-venture-in-china-for-playstation.html?_r=0

Picture: http://www.statista.com/

![[Podcast] China paradigm #8: How can businesses keep up with China’s changing mobile scene?](../wp-content/uploads/2018/11/Thomas-Meyer-Youtube-Cover-150x150.jpg)