Business development and prospect for SNS in China

Development of SNS in China

SNS (Social Networking Services) industry in China began later than in Western countries. SNS first grabbed public attention in 2005 when Qzone, 51.com and xiaonei.com (now under the name of renren.com) were established. Since then, many SNS websites were founded. By the end of 2008, the number of users of SNS websites in China had already tripled. According to the statistics of Global Web Index, a US market research company on online consumer behaviors covering 31 key global markets and 87% of the world’s internet population, the number of SNS users in China amounted to 0.43 billion in the first quarter of 2013. It is expected that this number will grow to 0.51 billion in 2014.

Major Competitors in China

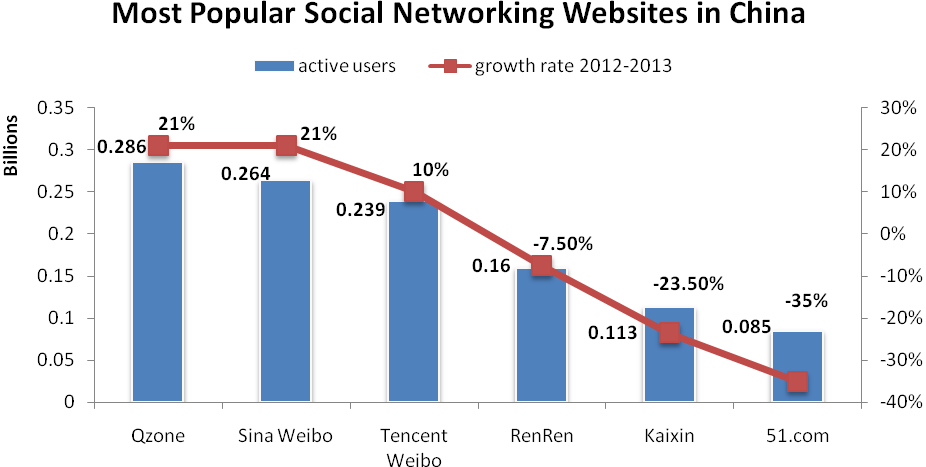

According to the data of Global Web Index, 66% of Chinese Internet users were active on Qzone (286million users), 61% on Sina Weibo (264million users) and 56% on Tencent Weibo (239 million users). Two out of three SNS products of Tencent are ranked in top 3, making Tencent the largest social networking company in China.

The users of Qzone are mainly teens. Because of the dominance of younger age users, Qzone is more entertainment-oriented. Users can post articles about their personal life and share pictures and music with their friends.

Sina Weibo and Tencent Weibo are micro blogs. While Tencent Weibo has similar users and functions to Qzone, Sina Weibo mainly focuses on middle-aged white-collars in first- and second-tier cities. By using celebrity to create topics, Sina Weibo succeeds in enabling large numbers of Internet users to participate in discussions on hot topics in the current Chinese society.

While the top three are winners in the industry, with 21%, 21% and 10% of growth seperately in the number of active users from 2012 to 2013, the following three are losers. RenRen (160 million users), Kaixin (113million users) and 51.com (85 million users) decreased by 7.5%, 23.5% and 35% separately in the number of active users.

Major users on RenRen are students and white-collars in first- and second-tier cities. As the first several generations of student users entered working age, white-collars became as important a group as students. Kaixin mainly targets at white-collars (especially those in first-tier cities). Certain games such as Parking Wars and House Purchasing which are similar to their urban life are meant for them to relax after work. 51.com has a mixed user group in which the majority are from lower-tier cities.

How they develop the business in China

The most direct and simple way for SNS to profit is advertisement revenues. For about 80% of Chinese social networks, advertisement revenues take the largest proportion of their total revenues. Advertisements include traditional ones using pictures and slogans and plant-in advertisements in games.

Membership fees are another revenue source of SNS focusing on high-end people in business. A famous example is the professional networking space TIANJI.com. Added values are realized by selling virtual items. Young people tend to be more wiling to purchase virtual items to decorate their personal homepages. People also purchase virtual gifts for friends on their birthdays or during festivals. The added value revenue of Qzone reached a billion yuan in 2008. Finally, other revenue sources include third-party plug-ins and online questionnaires.

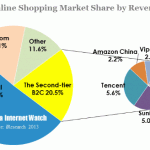

According to the statistics of CNNIC, in 2009, 80% of the total revenues for Chinese SNS comes from advertisement, 15% comes from membership fees and added value services while 5% comes from other ways.

Obstacles and Prospect

Currently, the SNS industry in China has been facing many problems. First, most SNS have similar functions and lack innovation. Social networks that started by cloning foreign websites gradually lost their competitiveness as users got tired of similar games and services. A representative of these websites is Kaixin which cloned Facebook to a large extent. Secondly, domestic SNS industry is lack of investment and the advertising mechanism is immature. Both factors led to the shutdown of many social networks because their revenue models could not continue. Thirdly, the piracy phenomenon in China weakens the software industry and very few people are willing to develop apps for SNS.

To walk out of the dilemma, Chinese social networks have to do include brand differentiation, joint venture and combination with e-commerce.

Source :